5 Best Forex No-Deposit Bonus Brokers in Ghana

The 5 best forex no deposit bonuses in Ghana revealed. We have explored and tested several prominent forexes no deposit bonuses for forex trading in Ghana to identify the 5 bests.

This is a complete guide to the 5 best Forex no deposit bonuses in Ghana.

In this in-depth guide you’ll learn:

- Why brokers offer a Forex no deposit bonus

- Who are the 5 best Forex brokers that offer a no deposit bonus in Ghana

- How to choose a Forex no deposit bonus broker in Ghana

- Who the best Forex brokers are in Ghana

- How Forex no deposit bonuses work

- The advantages of using a Forex no deposit bonus

- The disadvantages of using a Forex no deposit bonus

And lots more…

So, if you’re ready to go “all in” with 5 best Forex no deposit bonuses in Ghana…

Let’s dive right in…

- Lesche Duvenage

Best Forex No-Deposit Brokers in Ghana

| 🏅 Broker or Provider | 👉 Open Account | 💻 Trading Platform | 💰 Minimum Deposit | 🎁 Additional Bonusses / Promotions |

| Admiral Markets | 👉 Open Account | MetaTrader 4 MetaTrader 5 Admirals Mobile App | USD 25 / 298 GHS | 100% bonus program 100% Welcome bonus |

| Windsor Brokers | 👉 Open Account | MetaTrader 4 MT4 Multiterminal MT4 WebTrader Windsor Brokers App Android | USD 50 / 597 GHS | Trading Challenge Deposit Bonus Loyalty Programme |

| XM | 👉 Open Account | Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform | USD 5 / 59 GHS | 50% Deposit Bonus 20% Deposit Bonus |

| HFM | 👉 Open Account | MT4, MT5, HFM Platform (Android & IOS) | USD 0 / 0 GHS | HFM 30% Rescue Bonus HFM 100% Credit Bonus |

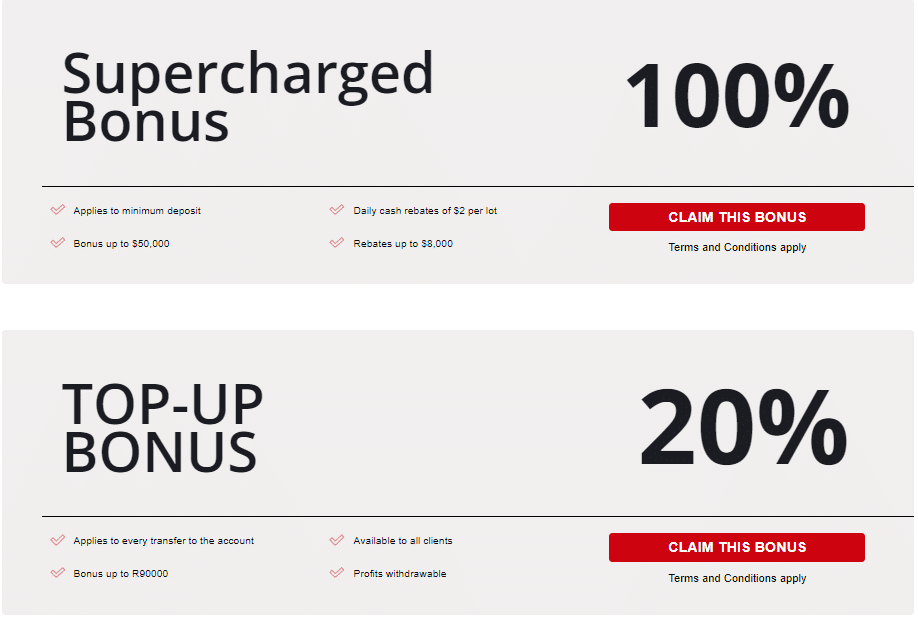

| Tickmill | 👉 Open Account | MetaTrader 4 MetaTrader 5 WebTraider Platform Mobile App | USD 100 / 1 195 GHS | Trader of the Month Intoducing Broker Contest |

10 Best Forex Brokers in Ghana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Why do brokers give Forex no deposit bonuses?

Many Forex brokers offer no-deposit incentives to encourage new customers. Traders can receive these benefits without making a down payment or meeting any volume requirements.

5 Best Forex No-Deposit Brokers in Ghana

- ✔️Admiral Markets – Overall, $100 No-Deposit Sign-Up Bonus Offer

- ✔️Windsor Brokers – Top Broker for Experienced Traders in Ghana

- ✔️XM – Best ECN Broker in Ghana

- ✔️HFM – Largest Credit Bonus Broker

- ✔️Tickmill – Top STP Broker

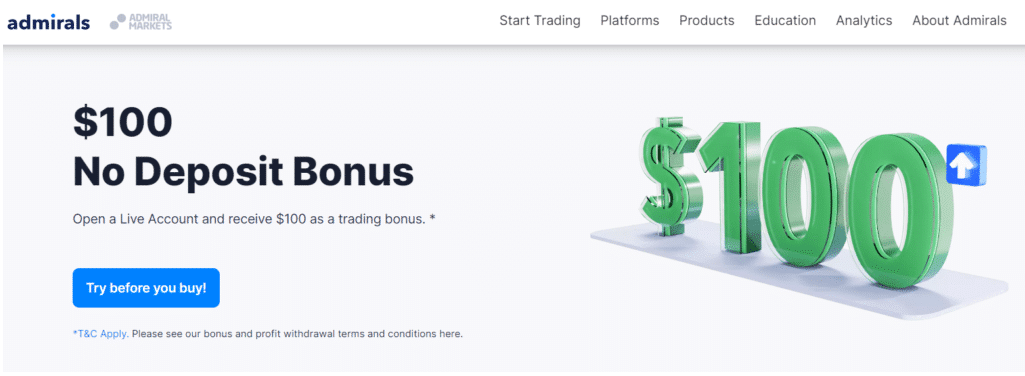

1. Admiral Markets

Overview

Admirals‘ “Exclusive Bonus” programmer gives Ghanaian traders a rare and lucrative opportunity.

Careful consideration went into designing this bonus to help members of Ghana’s trading community.

Min Deposit

USD 25 / 298 GHS

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

MetaTrader 4

MetaTrader 5

Admirals Mobile App

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

For trades made within 30 days (about 4 and a half weeks) after purchase, traders can take advantage of a higher margin thanks to the “Exclusive Bonus” feature. A wider margin allows traders to take on more high-risk positions, increasing the possibility of large profits.

The “Exclusive Bonus” is not intended to reduce trade deficits even though it does help increase dealers’ margin capacity. Traders need a deep familiarity with their trading techniques and the discipline to follow strict procedures to properly manage and minimize risks.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FCA, ASIC, CySEC, EFSA, JSC |

| ⚖️ BoG Regulation | No |

| ✔️ Accepts Ghana Traders? | No |

| 💳 Minimum deposit (GHS) | USD 100 / 1 195 GHS |

| 💻 Trading Accounts | MetaTrader 4 MetaTrader 5 Admirals Mobile App |

| 🔨 Trading Assets | • ESG Trading •Instruments • Forex • Cryptocurrency CFDs • Commodities • Indices • Stocks • ETFs • Bonds • Spread Betting |

| 📈 Average spread from | From 0.5 pips |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Admirals’ MetaTrader Supreme Edition trading platform allows you to trade in a variety of markets, instruments, and leveraged products with just an internet connection. | There is an inactivity fee charged. |

| Modern analytics are available to Ghanaian traders, and they have access to a wealth of learning resources, tools, and materials. | It costs money to convert currencies for Ghanaian traders. |

| There are user-friendly platforms available across devices | It costs money to administer Islamic accounts. |

| There is a wide range of tradable markets, complex instruments, and leveraged products | It costs money to deposit or withdraw money. |

2. Windsor Brokers

Overview

Due to its competitive spreads, comprehensive training resources, and regulatory oversight by the Cyprus Securities and Exchange Commission (CySEC), Windsor Brokers is a foreign exchange (forex) and contract for difference (CFD) brokerage firm that draws interest from both novice and experienced traders in Ghana.

Min Deposit

USD 50 / 597 GHS

Regulators

CYSEC

Trading Desk

MetaTrader 4

MT4 Multiterminal

MT4 WebTrader

Windsor Brokers App Android

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Across its range of account tiers, Windsor Brokers offers a variety of spreads. For those using Prime accounts, the spread on the Euro to US Dollar (EUR/USD) currency pair is 1.5 pip, whereas Ghanaian traders using Zero accounts can take advantage of spreads as low as zero.

Unique Features

| Feature | Information |

| ⚖️ Regulation | CMA, CySEC, FCA, FSC |

| ⚖️ BoG Regulation | No |

| ✔️ Accepts Ghana Traders? | No |

| 💳 Minimum deposit (GHS) | USD 50 / 597 GHS |

| 💻 Trading Accounts | MetaTrader 4 MT4 Multiterminal MT4 WebTrader Windsor Brokers App Android |

| 🔨 Trading Assets | Forex Metals Spot and CFD indices Spot and CFD energies Commodities Treasuries Shares |

| 📈 Average spread from | from 1.0 pips |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Ghanaian traders have access to commission-free trading with Windsor Brokers, which is regulated effectively across a few jurisdictions. | Fewer trading platforms available compared to other brokers |

| Up to four updates may be made to Technical Signals each day. | |

| With over 33 years of continuous market presence, the company has established a solid reputation. |

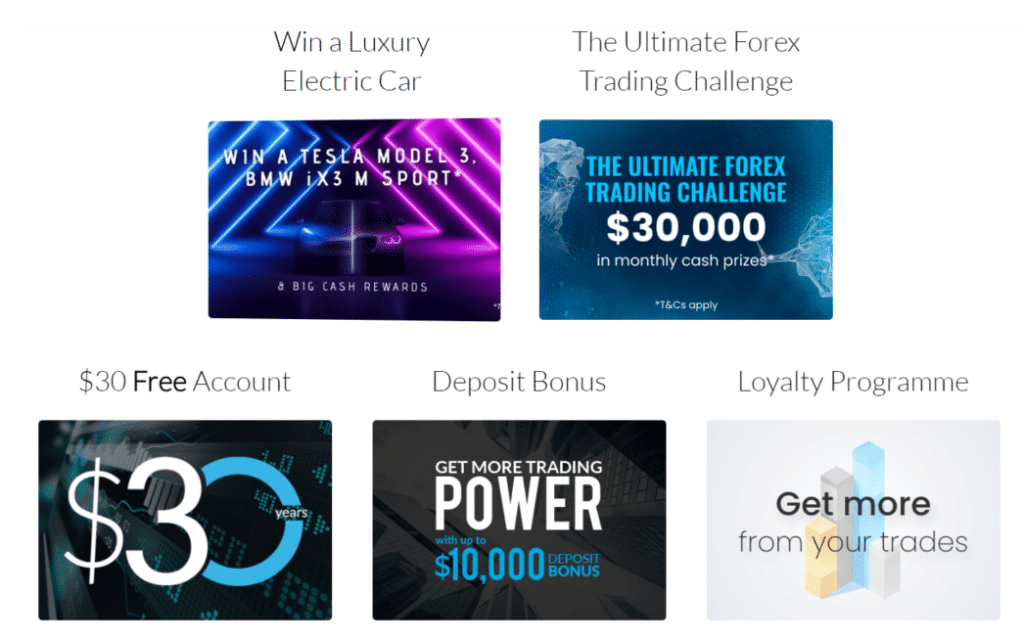

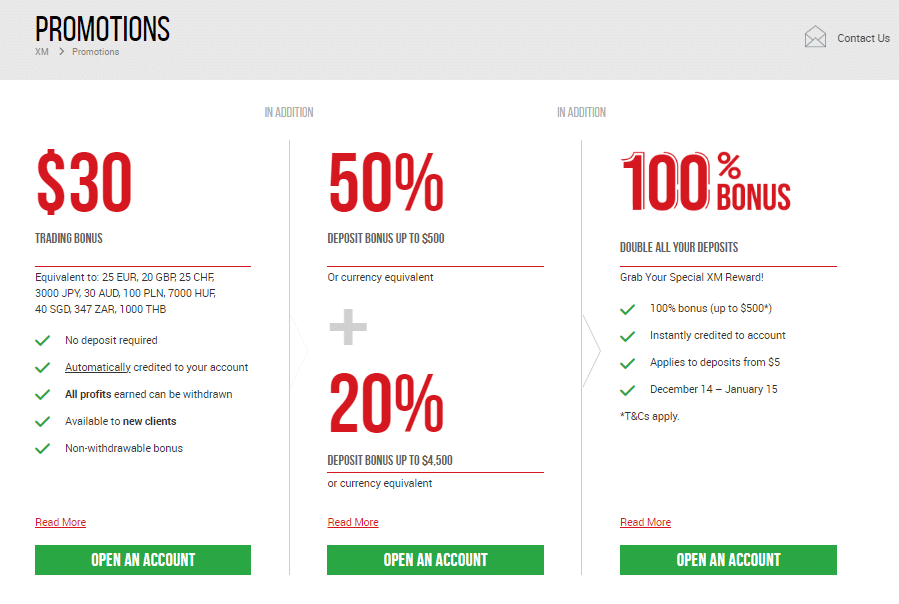

3. XM

Overview

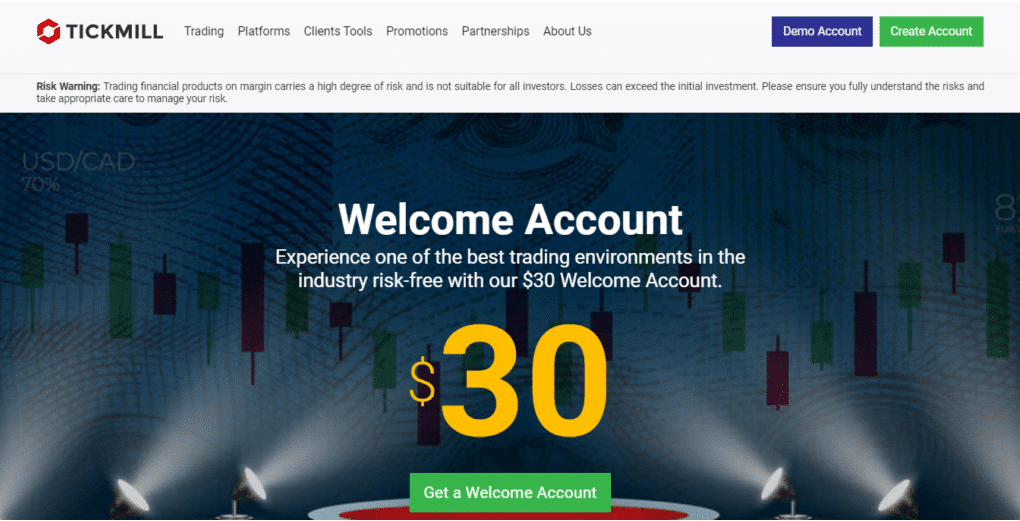

Customers who open a Real Account with XM will receive a $30 non-withdrawable credit. There is no deposit required for the $30 USD Welcome Bonus, and any winnings can be cashed out.

Due to its outstanding platform, which serves both new and seasoned Ghanaian traders, XM is widely considered as a cutting-edge broker for online Forex trading.

Min Deposit

56,75 GHS or $5

Regulators

IFSC, CySec, ASIC, FCA

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

This platform stands out for its automated trading capabilities, clear pricing free of hidden fees or commissions, and astonishingly quick order executions, which have a remarkable success rate of 99.35 percent and are finished in a fraction of a second.

Along with a demo account that gives novice traders the chance to practice trading with a virtual cash balance of $100,000 USD, XM offers a wide variety of educational tools.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA |

| ⚖️ BoG Regulation | No |

| ✔️ Accepts Ghana Traders? | No |

| 💳 Minimum deposit (GHS) | 57 GHS or USD 5 |

| 💻 Trading Accounts | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| 🔨 Trading Assets | Forex, Cryptocurrencies, Stock CFDs, Commodities, Equity Indices, Precious Metals, Energies, Shares, |

| 📈 Average spread from | From 0.0 pips |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| XM has a sizable customer base of more than 5 million people from all around the world. | Inactivity fees are charged |

| XM offers investors safety and guarantees the security of client assets to traders from Ghana. | There are no fixed spreads |

| Since its launch in 2009, XM has received various plaudits from the business community. | |

| XM is regarded as a forex broker with competitive pricing and a commendable level of dependability. | |

| Neither deposits nor withdrawals are subject to commission fees. |

4. HFM

Overview

HFM offers eligible clients who meet the requirements a $30 USD Welcome Bonus. An HFM trading account must be opened to receive the $30 USD Welcome Bonus.

Min Deposit

USD 0 / 0 GHS

Regulators

FSCA, CySEC, DFSA, FSA, CMA

Trading Desk

MT4, MT5, HFM Platform (Android & IOS)

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

For both individual traders and institutional investors, HFM provides a wide variety of account types, trading tools, and products that make it easier to conduct online Forex and derivatives trading.

Using cutting-edge automated trading systems, Retail, Affiliate, and White Label clients have access to a wide variety of spreads and liquidity.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| ⚖️ BoG Regulation | Yes |

| ✔️ Accepts Ghana Traders? | No |

| 💳 Minimum deposit (GHS) | USD 0 / 0 GHS |

| 💻 Trading Accounts | Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account |

| 🔨 Trading Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| 📈 Average spread from | From 0.0 pips |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Ghanaian forex traders might benefit from the EUR/USD currency pair’s narrow spread of just 0.9 pip. | There aren’t many convenient local withdrawal and deposit options for Ghanaian HFM traders |

| Platforms for demo trading could be beneficial for traders of all experience levels. | |

| Thanks to HFM’s user-friendly MetaTrader 4 and 5 platforms, Ghanaian traders can trade a range of assets from any computer, smartphone, or tablet connected to the internet. |

5. Tickmill

Overview

Utilising Tickmill’s $30 Welcome Account, new traders from Ghana have the chance to obtain some basic experience in the exciting world of forex trading. This account’s main goal is to give new traders a platform to practise their trading skills without putting their own money at danger of potential financial losses.

The Welcome Account is simple to use and comes with a free $30 deposit. This account is always open for withdrawals.

Min Deposit

1 135 GHS or $100

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

It is essential to finish the Client Area registration process, supply the required verification documents, and keep a minimum Wallet balance of $100 to participate in trading operations.

It is also crucial to be aware of the limitations that must be met to enable the transfer of earnings from the Welcome Account to the Client’s Wallet, such as the requirement to meet minimum trading volume requirements.

The $30 initial payment is not refundable, but any collected revenue may be withdrawn at any time, which is an important feature of this agreement.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA |

| ⚖️ BoG Regulation | No |

| ✔️ Accepts Ghana Traders? | No |

| 💳 Minimum deposit (GHS) | USD 100 / 1 195 GHS |

| 💻 Trading Accounts | Pro Account, Classic Account, VIP Account |

| 🔨 Trading Assets | Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies |

| 📈 Average spread from | From 0.0 pips |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Tickmill is a popular trading platform in Ghana due to its low trading fees, high client satisfaction, and accessibility of a wide range of useful payment options, including Skrill and Neteller. | Fixed spreads are not available |

| Tickmill’s features, such as the FIX API, AutoChartist, and virtual private servers, are a great match for the specific needs of professional traders in Ghana. |

How to Choose the Right Forex Broker in Ghana

Ghanaian traders must evaluate the following components of a forex no deposit bonus broker to decide whether the broker is suited to their unique trading objectives and/or needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Ghanaian traders must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Ghanaian traders must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments that the broker offers. Ghanaian traders must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Ghanaian traders must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Ghanaian trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

- eBooks

- Trading guides

- Trading knowledge on leveraged products

- A risk warning on complex instruments

- Educational videos

Research can include some of the following:

- Trading tools

- Commentary

- Status of International Markets

- Price movements

- Market sentiments

- Whether there is a volatile market

- Exchange Rates

- Expert opinions and several other resources can help experienced traders make informed trading decisions.

A closer look at how the Forex no deposit bonus works

New traders can benefit from a “no deposit bonus” by opening a Forex no deposit account, which provides them with access to a predetermined amount of bonus funds with which to practice trading.

Before making a real-money deposit, a trader can practice with bonus money thanks to a no-deposit bonus. This is a great opportunity for traders in Ghana to test out the broker’s trading conditions in a live market environment without having to risk their own funds. It also gives beginner traders the same chance to test their trading skills in a risk-free way.

That said, it is always advised that beginner traders first start practice trading in a demo account. These account types simulate live market conditions and are funded with virtual currency and allow you to practice trading without risking your own funds. They are also popular with experience traders looking for a way to test out their strategies.

The most asked question is “should I use a no deposit bonus or not?”. A player should research all a no deposit bonus’ conditions, rules, limitations, advantages, and disadvantages before accepting it.

Forex brokers frequently provide no-deposit bonuses to new traders these days to win their business. Some brokerages give traders no-deposit bonuses to set themselves apart from the competitors. Financial sector newcomers can always rely on the enormous popularity of no-deposit bonuses.

A “no deposit bonus” is an incentive that new traders may be eligible for when they open accounts with a particular brokerage. With the help of this bonus, novice traders can test the market without having to invest any real money.

No-deposit bonuses aren’t exactly lavish. These advantages are frequently minor and barely perceptible. However, the incentive might be utilized to test out a new brokerage’s services.

How to claim a no deposit bonus

A Forex no deposit bonus can only be used by customers with confirmed active accounts. A novice trader is not required to immediately fund his account with real money. Some brokers demand that customers open accounts using specific base currencies to be eligible for a no-deposit bonus.

Some brokers may have a cap on the highest leverage that can be used when trading using a no-deposit incentive.

As part of the verification process, the brokers will request copies or scans of identifying documents. You’ll also need to confirm your payment method and home address for a no-deposit bonus account.

Advantages of using a Forex no deposit bonus

Novice traders can test the trading waters with little risk by using a no deposit incentive. Beginning traders almost seldom have any problems. You simply need to locate a broker you can believe in. The advantages and disadvantages of no-deposit accounts are described below.

- It’s a terrific way to get familiar with a trading platform before investing your own money because you can get free money to trade with and avoid putting your own money at risk.

- With a no deposit bonus, you may experiment with different trading strategies and currency pairs without worrying about the possibility of loss.

- No deposit bonuses are the best way to test out new brokers without risking any of your own money.

Disadvantages of using a Forex no deposit bonus

- Some brokers may provide discounts that seem too good to be true to attract clients. You should be aware that there is a sizable no-deposit bonus available.

- Tiny no-deposit bonuses give traders on any platform little opportunity to maneuver. Since traders must first complete several trades before they can withdraw their funds, this is not an option.

- If the no-deposit incentive is particularly low, you may need to spend your own money to finance your trading account. For instance, you might occasionally need to trade $1,000 for a single dollar in bonus money.

- You can end up having a plethora of accounts but no actual expertise in the sector if you constantly switch brokers in search of a no-deposit incentive.

- There’s a chance the no-deposit bonus isn’t always what it looks. You’ll discover you must make a real-money trade first to qualify for a no-deposit bonus.

The Best Forex Brokers in Ghana

In this article, we have listed the best brokers that offer no deposit bonuses to Ghanaian traders. We have further identified the brokers that offer additional services and solutions to Ghanaian traders.

Best MetaTrader 4 / MT4 Forex Broker

Min Deposit

56,75 GHS or $5

Regulators

FSC

Trading Desk

MetaTrader 4

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Alpari is the best MT4 Forex broker in Ghana. Financial experts hold Alpari in high esteem as a reliable market maker due to its stellar track record. Alpari promises a trading latency of less than one millisecond. Currently, more than 2 million people use Alpari.

Best MetaTrader 5 / MT5 Forex Broker

Min Deposit 1 135,04 GHS or $100 Regulators ASIC, FSA Trading Desk MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central Crypto Yes Islamic Account Yes Trading Fees Low Account Activation Time 24 Hours

Overall, AvaTrade is the best MT5 Forex broker in Ghana. AvaTrade has built a solid reputation as a reliable CFD and FX broker. AvaTrade has established a strong reputation since it only employs the most prestigious institutions in each regulatory jurisdiction to handle its customers’ funds independently.

Best Forex Broker for beginners

Min Deposit

113,50 GHS or USD10

Regulators

CySec, FCA

Trading Desk

No Trading Desk

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Forex broker for beginners in Ghana. The eToro Academy, eToro Plus paid membership plan, practice trading accounts, and other resources are available to users who want to learn more about the platform.

Best Low Minimum Deposit Forex Broker

Min Deposit

USD 0 / 0 GHS

Regulators

ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, NFA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Oanda is the best low minimum deposit Forex broker for traders in Ghana. The state-of-the-art trading platform from Oanda is useful for FX traders of all experience levels.

Best ECN Forex Broker

Min Deposit

56,75 GHS or $5

Regulators

IFSC, CySec, ASIC, FCA

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XM is the best ECN forex broker in Ghana. XM places the highest importance on cost, customer satisfaction, cash flow, and security.

Best Islamic / Swap-Free Forex Broker

Min Deposit

1 135 GHS or $100

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Tickmill is the best Islamic / Swap-Free forex broker in Ghana. Tickmill is a reliable and trustworthy brokerage. This broker is ideal for a wide range of investors due to the flexibility it offers with accounts, the low rates associated with those accounts, and the affordable spreads. Tickmill is currently accessible in a range of languages and can be used in a variety of scenarios.

Best Forex Trading App

Min Deposit

$10 / 119 GHS

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness offers the best trading app for traders in Ghana. The Exness Trader app’s numerous useful features and functionalities make it a wonderful asset for Ghanaian traders. Candlestick charts, technical indicators, and quantitative strategies are all tools that help new traders.

Best Forex Rebates Broker

Min Deposit

1 135,04 GHS or $100

Regulators

FCA, CySEC, FSCA, SCB

Trading Desk

MT4

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FxPro is the Best Forex Rebates Broker in Ghana. The trading platform FxPro offers STP and ECN connection to its users. Retail traders can receive monthly cash returns of 30% in the foreign exchange market.

Best Lowest Spread Forex Broker

Min Deposit

0 GHS or $0

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Pepperstone is the best lowest spread forex broker in Ghana. For trading the US dollar against the euro, Pepperstone’s spreads begin at 0.0 pip. One of the best brokerages is Pepperstone Markets, which has a long history of success.

Best Nasdaq 100 Forex Broker

Min Deposit

2987 GHS or $250

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is the best Nasdaq 100 forex broker in Ghana. Modern trading tools, a large product assortment, and favorable market conditions have all helped IG rise to the top 20 platforms in the city. Since it is subject to tight regulations and gives clients access to a wide choice of assets, IG stands out among the numerous reliable online brokers serving the Ghanaian market.

Best Volatility 75 / VIX 75 Forex Broker

Min Deposit

2390 GHS or $200

Regulators

ASIC, CySEC, FSA, SCB

Trading Desk

MetaTrader 4

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IC Markets is the best Volatility 75 / VIX 75 forex broker in Ghana. Thanks to the cutting-edge trading tools provided by IC Markets, Ghanaian traders can now take part in transactions on global financial markets.

Best NDD Forex Broker

Min Deposit

119 GHS / $10

Regulators

FSC, FSA, FSCA

Trading Desk

MetaTrader 4

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, BDSwiss is the best NDD forex broker in Ghana. When it comes to CFD and forex services, BDSwiss is a prominent player on the global stage. Over 16,000 affiliate accounts are used, and up to €20 billion in foreign exchange transactions are handled each month.

Best STP Forex Broker

Min Deposit

298 GHS / $ 25

Regulators

FCA UK

Trading Desk

None

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best STP forex broker in Ghana. Over 28 awards in the industry have been won by OctaFX. By using ECN (Electronic Communication Network) and STP (Straight Through Processing), OctaFX has practically halved its trade costs.

Best Sign-up Bonus Broker

Min Deposit

USD 0 / 0 GHS

Regulators

FSCA, CySEC, DFSA, FSA, CMA

Trading Desk

MT4, MT5, HFM Platform (Android & IOS)

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, HFM is the best sign-up bonus broker in Ghana. Investors appreciate HFM’s trading platform because of its high caliber and affordable rates. The HFM website offers access to a wide range of account types and asset markets to accommodate customers with varied levels of experience in foreign currency trading.

Conclusion

Overall, due to the availability of no-deposit bonus brokers, the forex market in Ghana is busy and has a lot of promise. By removing the financial risk involved in testing the market, these bonuses have evolved into a crucial tool for brokers to draw in new clients.

You might also like: Best Forex Trading Apps in Ghana

You might also like:

You might also like:

You might also like:

You might also like:

Frequently Asked Questions

How do I get a Forex no deposit bonus?

To get a Forex no deposit bonus you should sign up with a no deposit bonus Forex broker by opening an account. These are the steps:

- Select a broker from our list.

- To create a live account, complete the registration form.

- Authenticate your account by submitting the required identity papers.

- Risk-free trading on a real account can be started.

How do you get Forex trading signals for free?

Typically, you can find traders discussing free FX signals on a variety of forums, with Forex Factory being the most well-liked. By conducting their own analysis and sharing precisely the same data that they are utilizing in their own transactions, traders attempt to deliver trustworthy signals.

How do I use my Forex bonus?

The trader must meet specific trading requirements to receive a forex deposit bonus. These specifications can include a minimal trading volume, a set quantity of trades, or a set amount of time. To understand the trading criteria, traders must carefully study the bonus’s terms and conditions.

Is a bonus good for Forex trading?

Forex bonuses can help you make more if you use them wisely. A welcome bonus, for instance, will help raise money and, as a result, the return from successful trades. No deposit bonus is a fantastic chance to have your first taste of dealing with a broker risk-free.

Can I withdraw my Forex bonus?

The bonus must first be traded for actual money before you can withdraw it. The conversion bonus will be added to your trading account once you’ve traded the required amount and can be withdrawn just like any other funds.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Namibian Dollar Forex Trading Accounts

Namibian Dollar Forex Trading Accounts

Scam Forex Brokers in Ghana

Scam Forex Brokers in Ghana