BDSwiss Review

BDSwiss is a well-regulated and reputable broker available in Ghana with a range of trading tools and technical indicators. BDSwiss offers Ghanaian forex and CFD traders a demo account and customer support in various languages.

- Lesche Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawals

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

119 GHS / $10

Regulators

FSC, FSA, FSCA

Trading Desk

MetaTrader 4

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

In our experience, BDSwiss is a renowned financial services company based in Limassol, Cyprus.

BDSwiss has grown significantly since its inception in 2012 and is known for its commitment to transparency and regulation compliance. On the website, we found and verified BDSwiss’ CySEC, FSC, FSA, and BaFin regulations on the respective regulatory entity’s websites.

This ensures a safe trading environment for Ghanaian traders, who prioritize the security of their investments and the reliability of their trading platform.

We also found that BDSwiss has won prestigious awards, including Best IB Program in 2024, Broker of the Year in 2023, and Best FX Education Broker in 2023. Furthermore, BDSwiss is also featured on Bloomberg, Yahoo! Finance, CNBC, and several other reputable websites.

Currently, BDSwiss offers Ghanaians over 250 financial instruments, including Forex, commodities, shares, indices, and cryptocurrencies.

Overall, when compared to other prominent brokers that accept Ghanaians, BDSwiss shows great potential in all aspects.

BDwiss’ journey from its inception to its current status in the global financial market reflects its unwavering pursuit of excellence and dedication to serving clients’ interests.

How does BDSwiss help its clients?

BDSwiss provides 24-hour customer assistance to help Ghanaian traders with their questions and problems.

Can BDSwiss help Ghanaian traders meet their financial goals?

Yes, BDSwiss offers a wide selection of financial products and account types to assist Ghanaian traders in reaching their investing goals.

BDSwiss at a Glance

| 📊 Year Founded | 2012 |

| ⚖️ Regulation | CySEC, FSC, FSA, BaFin, Mwali International Services Authority |

| 🏛 Ease of Use Rating | 4/5 |

| 💰 Bonuses | None |

| 🌎 Support Hours | 24/5 |

| 📱 Trading Platforms | MetaTrader 4, MetaTrader 5, BDSwiss Web, BDSwiss Mobile |

| 📈 Account Types | Cent, Classic, VIP, Zero Spread, Islamic, Demo |

| 💰 Base Currencies | ZAR, USD, EUR, GBP, VND, etc. |

| 📊 Starting spread | From 0.0 pips EUR/USD |

| 📊 Leverage | 1:2000 |

| ✔️ Currency Pairs | 53; Minor, Major, and Exotic Pairs |

| 💳 Minimum Deposit (GHS) | 133 GHS ($10) |

| 📉 Inactivity Fee | Yes, 10% after 3 months |

| 📱 Website Languages | English, Czech, German, Italian, Spanish, Korean, French, Norwegian, Polish, Danish, Arabic, Malaysian, Thai, Ghanaian, Filipino, Hindi, Indonesian, Chinese, Portuguese, Romanian, Turkish, Russian |

| 💰 Fees and Commissions | Spreads from 0.0 pips, commissions from $2 on Indices |

| ✔️ Affiliate Program | Yes |

| 🔎 Banned countries | The United States, Belgium, and other OFAC-sanctioned regions |

| 📉 Scalping | Yes |

| 📈 Hedging | Yes |

| 📉 Dedicated Ghana Account Manager? | No |

| 💻 Tradable Assets | Forex, Commodities, Shares, Indices, Cryptocurrencies |

| 👉 Open Account | 👉Open Account |

Regulation and Safety of Funds

Regulation in Ghana

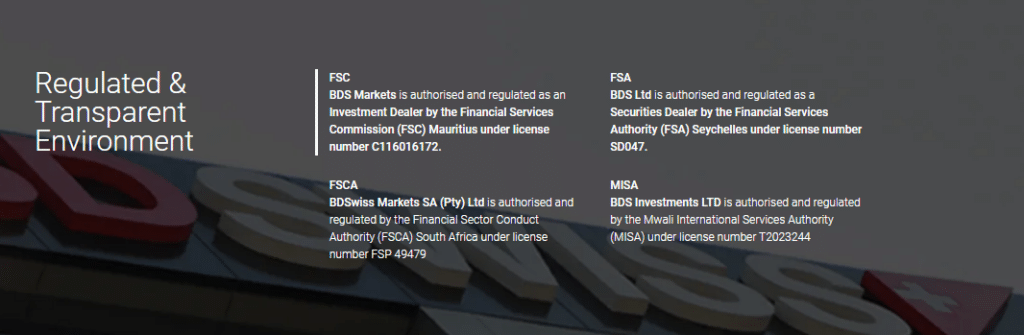

BDSwiss is not regulated by the Bank of Ghana (BoG). However, BDSwiss’ global regulations are listed in the table below.

BDSwiss Global Regulations

| 📱Registered Entity | 🌎Country of Registration | ✔️Registration Number | 🔎Regulatory Entity | 📊Tier | 💳License Number/Ref |

| BDS Markets | Mauritius | – | FSC | 3 | 199/13 |

| BDS Ltd | Cyprus Seychelles | – | FSA | 3 | C116016172 |

| BDSwiss GmbH | Germany | – | BaFin | 1 | 10134687 |

| BDS Holding PLC | Cyprus | – | CySEC | 2 | SD047 |

BDSwiss Protection of Client Funds

| 🔎Security Measure | 📱Information |

| Segregated Accounts | Yes |

| Compensation Fund Member | No |

| Compensation Amount | None |

| SSL Certificate | Yes |

| 2FA (Where Applicable) | Yes |

| Privacy Policy in Place | Yes |

| Risk Warning Provided | Yes |

| Negative Balance Protection | Yes |

| Guaranteed Stop-Loss Orders | Yes |

How does BDSwiss safeguard the privacy of its Ghanaian clients’ information?

To ensure the privacy of its Ghanaian clients, BDSwiss follows stringent data protection protocols according to industry-wide norms.

Are the BDSwiss trading platforms in Ghana secure?

Yes. Clients trading from Ghana may rest assured that their data is protected by BDSwiss’ robust trading platforms using industry-standard encryption.

Awards and Recognition

According to our findings, BDSwiss has received some of the following recent awards:

- The UF Awards honored BDSwiss as the top research and education provider in the LATAM region in 2024.

- Recognized for its innovation in the LATAM market, BDSwiss received the award for the Most Innovative Broker at the 2024 UF Awards.

- At the 2024 HQMena Awards, BDSwiss stood out by securing the award for the Best IB Program.

- The Mindanao Traders Expo in 2023 celebrated BDSwiss as the Broker of the Year.

- BDSwiss’ commitment to forex education was acknowledged in 2023 with the Best FX Educational Broker award at the HQMena Awards.

- The UF Awards in 2023 recognized BDSwiss’ excellence in global partnerships, bestowing upon them the Best Global Partnership Program award.

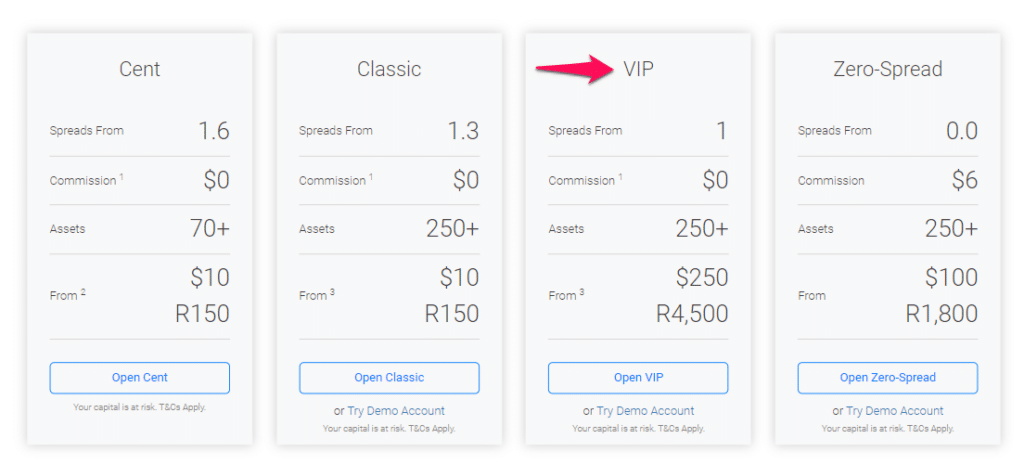

BDSwiss Account Types

| 💻 Live Account | 📉 Minimum Dep. | 👉 Open Account | 💻Platforms | 💸 Leverage |

| ➡️Cent | 133 GHS | 👉Open Account | MetaTrader, BDSwiss | 1:2000 |

| ➡️Classic | 133 GHS | 👉Open Account | MetaTrader, BDSwiss | 1:2000 |

| ➡️Zero Spread | 2,650 GHS | 👉Open Account | MetaTrader, BDSwiss | 1:2000 |

| ➡️VIP | 3,300 GHS | 👉Open Account | MetaTrader, BDSwiss | 1:2000 |

BDSwiss offers four flexible account types. We registered demo accounts with BDSwiss to discover what features and benefits they offer Ghanaians. In the table below, Ghanaians can view the basic features of these accounts, and further down, we detail each account type.

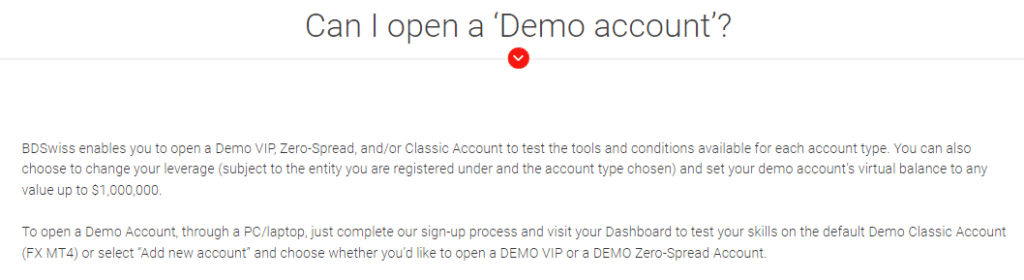

Demo Account

We signed up for a BDSwiss demo account to evaluate BDSwiss’ offer to Ghanaians. Furthermore, this account offers Ghanaians a realistic trading environment without real money risk.

With the BDSwiss demo account, Ghanaian traders can easily experiment with different strategies, familiarize themselves with BDSwiss platforms, and explore various financial instruments.

We can confidently recommend this demo account to beginners as it can help them build confidence and learn about market dynamics before they start trading in a live environment.

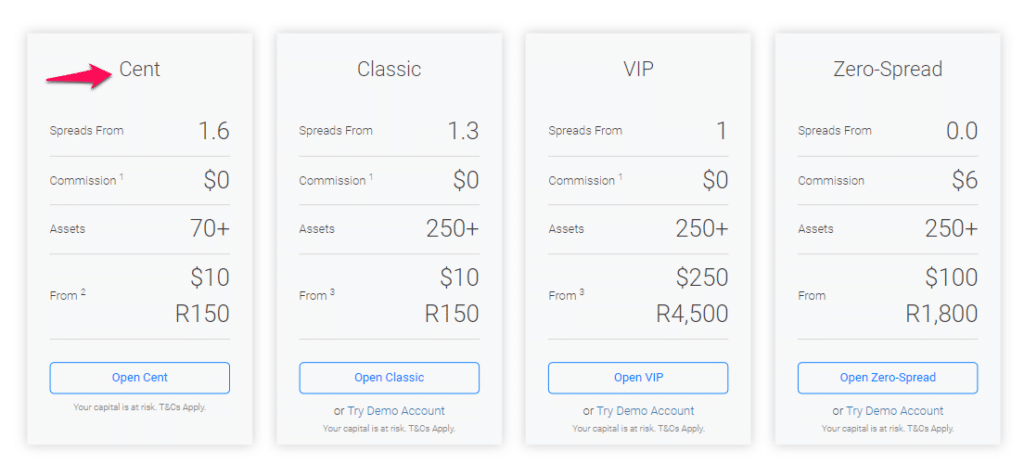

Cent Account

In our experience with Cent Accounts and compared to that of other brokers, the BDSwiss Cent Account is a great starting point for new Ghanaian traders. Beginners can expect micro-scale trading and a realistic trading experience without risking a large sum of funds.

The modest initial deposit requirement of 133 GHS (the equivalent of $10) makes it financially accessible to a wide range of traders, even experienced ones, who want to use it to test strategies in a live market arena without risking too much capital.

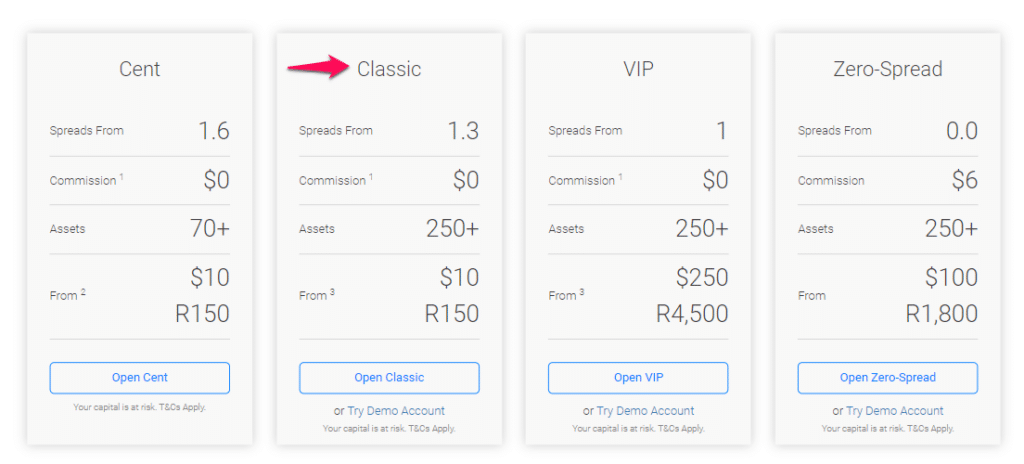

Classic Account

The BDSwiss Classic Account is a cost-efficient trading solution suitable for traders of all levels in Ghana. It offers low spreads and leverage ratios up to 1:2000, making it accessible to a wider audience.

BDSwiss does not charge any deposit or withdrawal fees on credit cards, showcasing BDSwiss’ commitment to providing cost-efficient trading solutions.

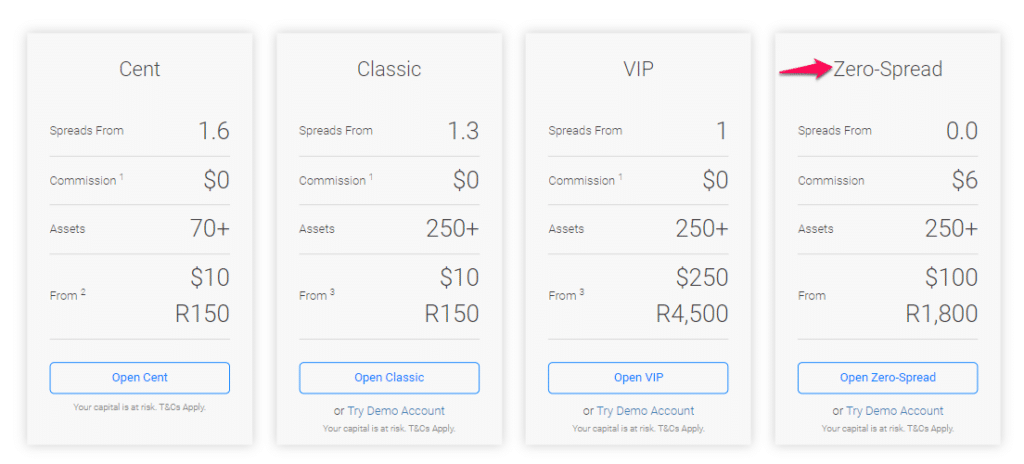

Zero Spread Account

The BDSwiss Zero Spread Account is designed for Ghanaian traders focusing on day trading and scalping.

It offers spreads as low as 0.0 pips on popular currency pairs like EUR/USD, making it ideal for high-volume traders.

Despite commission fees, we found that the near-zero spreads outweigh the cost, giving traders a competitive edge in fast-paced trading environments.

VIP Account

The BDSwiss VIP Account is a top-tier trading platform for Ghanaian traders, offering narrower spreads and advanced features like professional account managers and sophisticated trading tools.

BDSwiss offers maximum leverage of 1:2000 and a wide range of tradable assets, ensuring that this account provides a solid platform for traders to enhance their trading potential.

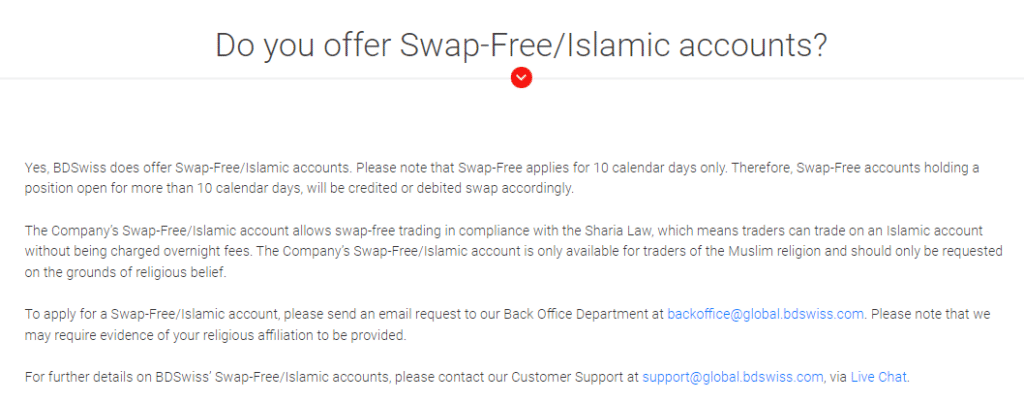

Islamic Account

We understand the dilemma that Muslim traders often face when evaluating brokers to find swap-free options. We’re impressed with the Islamic Account offered by BDSwiss because it promotes ethical and religious principles surrounding Islamic Finance.

Can traders alter account types?

Yes, traders can move between account types based on their changing trading needs and preferences.

Is there a commission linked with account types?

Yes, BDSwiss charges costs on specific account types, such as $2 for indices and 0.15% for shares.

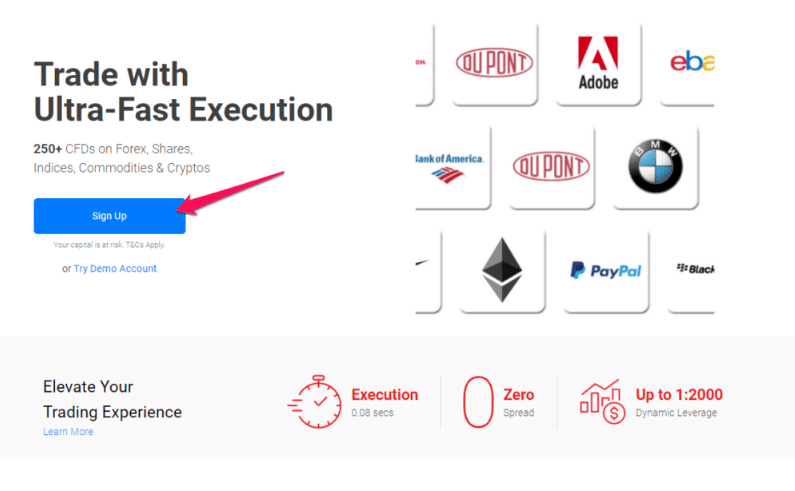

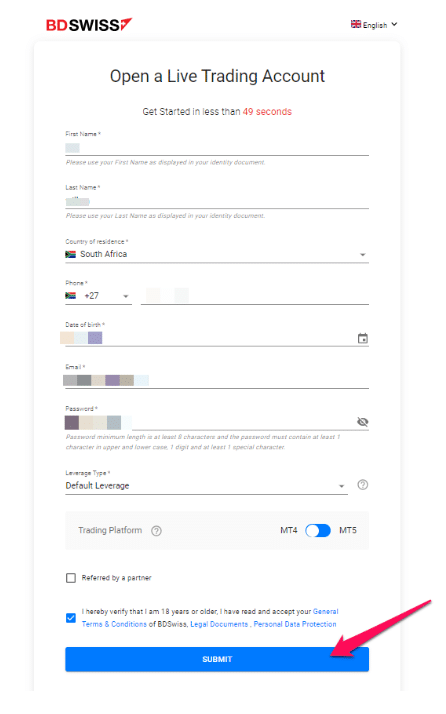

How to open a BDSwiss Account – Step by Step

To register and set up a live account.

Step 1 – Go to the website and select “Sign Up”.

“Sign Up” can be found under the blue sign-up button on the homepage.

Step 2 – Complete the online application and registration

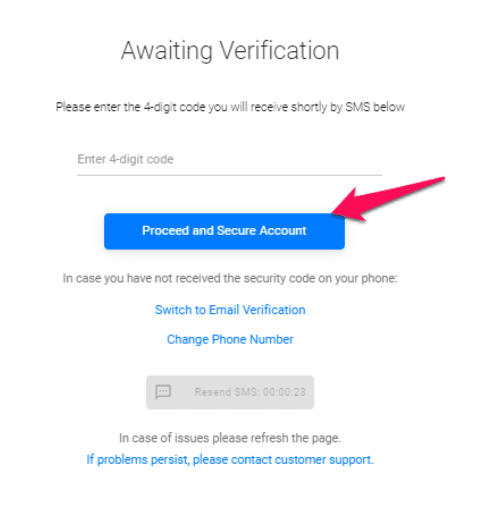

To complete the registration process provide the personal details as requested and verify your profile with the verification number sent to your phone.

Step 3 – Verify your account

This is a mandatory step. Submit all requested documents to BDSwiss for verification purposes.

Is there a minimum age to create a BDSwiss Account?

Yes, traders must be at least 18 to create an account with BDSwiss.

Are there any limits on creating accounts for specific nationalities?

Yes, there are. BDSwiss bans account opening to citizens of countries sanctioned by regulatory agencies, including the United States and Belgium.

Broker Comparison

| 🥇 BDSwiss | 🥈 FBS | 🥉 Plus500 | |

| ⚖️ Regulation | CySEC, FSC, BaFIN, FSA, Mwali International Services Authority | IFSC, CySEC, ASIC, FSCA | FSCA, IFSC, ASIC, CySEC, DFSA, FCA |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • BDSwiss Mobile • BDSwiss Web | • FBS Trader • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 • XM Mobile App |

| 💰 Withdrawal Fee | No | Yes | None |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 134 GHS ($10) | 67 GHS ($5) | 67 GHS ($5) |

| 📊 Leverage | Up to 1:2000 | Up to 1:3000 | 1:1000 |

| 📊 Spread | From 0.0 pips | From 0.7 pips | 0.7 pips |

| 💰 Commissions | From $2 | $0 | $1 to $9 |

| ✴️ Margin Call/Stop-Out | 50%/20% | 30%/ 10% | • 50%/20% • 100%/50% (EU) |

| 💻 Order Execution | Instant/Market | Market | Market, Instant |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | Yes | No | Yes, Micro |

| 📈 Account Types | • Cent Account • Classic Account • VIP Account • Zero Spread Account | Retail Account | • Micro Account • Standard Account • XM Ultra-Low Account • Shares Account |

| ⚖️ BoG Regulation | No | No | No |

| 💳 GHS Deposits | Yes | No | No |

| 📊 Ghana Cedi Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/7 |

| 📊 Retail Investor Accounts | 4 | 1 | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 50 lots | 500 lots | 100 lots |

| 💰 Minimum Withdrawal Time | Instant | 15 minutes | 1 working day |

| 📊 Maximum Estimated Withdrawal Time | Within 24 hours | Up to 7 days | 5 working days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes | Deposits | Yes, deposits |

BDSwiss Deposit & Withdrawal Options

| 💳 Payment Method | 🌎 Country | 💴Currencies Accepted | ⏱️Processing Time |

| 💰Credit/Debit Card | All | EUR, GBP, USD | Instant Deposits, Withdrawals in 24 hours |

| 🪙 Electronic Funds Transfer (EFT) | South Africa | ZAR | Instant Deposits, Withdrawals in 24 hours |

| 💳 Korapay | Nigeria | NGN | Instant Deposits, Withdrawals in 24 hours |

| 🪙 Mobile Solutions (OZOW, M-PESA, Vodafone, Airtel, TiGO, MTN, etc.) | South Africa, Kenya, Ghana, Tanzania, Uganda, Benin, Burkina Faso, Ivory Coast, Guinea-Bissau, Mali, Niger, Senegal, and Togo | ZAR, KES, GHS, TZS, XOF, UGX | Instant Deposits, Withdrawals in 24 hours |

| 💸 Electronic Wallets (GCash, Pay Maya, etc.) | Thailand, Indonesia, Philippines, Ghana, Malaysia | THB, IDR, PHP, GHS, MYR | Instant Deposits, Withdrawals in 24 hours |

| 🪙Pix | Brazil | BRL | Instant Deposits, Withdrawals in 24 hours |

| 💰Beeteller | Brazil, Chile, Colombia, Costa Rica, Mexico, Peru, Guatemala | BRL, CLP, COP, CRC, MXN, PEN, GTQ, USD | Instant Deposits, Withdrawals in 24 hours |

| 💳 Cryptocurrency Wallets | All | BTC, BCH, ETH, PAX, TUSD, USDT, USDC, LTC, XRP, DASH, ZCASH, ADA | Instant Deposits, Withdrawals in 24 hours |

Deposits

How to Deposit using Bank Wire Step by Step

➡️Proceed to the “Deposits” area after logging into your BDSwiss account.

➡️Click on “Bank Wire Transfer” to choose this option for making a deposit.

➡️Provide your banking information and the amount you would like to deposit.

➡️The BDSwiss bank information for the transfer will be shown on the screen. Make a note of them.

➡️Use the supplied BDSwiss banking information to initiate the wire transfer through your bank.

➡️Save a duplicate of the reference number or receipt for future reference.

How to Deposit using Credit or Debit Card Step by Step

➡️Find the “Deposit” option in your BDSwiss trading account.

➡️Select “Credit/Debit Card” as the deposit option.

➡️Payment information (card number, expiration date, CVV code, etc.) must be entered.

➡️Choose the amount you would like to deposit.

➡️Ensure you finish all of the authentication stages specified by your bank.

➡️Your deposit will be finalized after you confirm the transaction.

How to Deposit using Cryptocurrency Step by Step

➡️After logging into your BDSwiss account, go to the “Deposit” menu and choose “Cryptocurrency Wallets.”

➡️Before you make the deposit, decide which cryptocurrency you will use.

➡️You must specify the account currency when entering the deposit amount.

➡️BDSwiss will give you a one-of-a-kind deposit address or QR code for each transaction.

➡️To deposit crypto, scan the QR code or use your cryptocurrency wallet.

➡️The final step in depositing is to confirm the transaction in your cryptocurrency wallet.

How to Deposit using e-Wallets or Payment Gateways Step by Step

➡️Access the “Deposit” area of your BDSwiss account after logging in.

➡️Choose “e-Wallets” or your payment gateway, and make sure it supports GHS.

➡️Select your e-wallet provider from the provided list (e.g., GCash, Pay Maya) and choose GHS from the list of deposit currencies.

➡️If asked, enter the amount you want to deposit into your electronic wallet account.

➡️Verify and finalize the transaction using the interface of your electronic wallet.

Withdrawals

How to Withdraw using Bank Wire Step by Step

➡️Head on over to your BDSwiss account’s “Withdrawal” section.

➡️Choose “Bank Wire Transfer” as your preferred mode of withdrawal.

➡️Your SWIFT or BIC, code and bank account number are mandatory pieces of information that must be provided.

➡️The amount you want to withdraw must be specified.

➡️Send in your request to withdraw funds and, if requested, any further documents to complete the transaction.

How to Withdraw using Credit or Debit Cards Step by Step

➡️In your BDSwiss account, go to the “Withdrawals” tab.

➡️After that, choose “Credit/Debit Card” as your withdrawal method.

➡️If applicable, choose the credit card you used to make deposits in the past.

➡️Indicate the amount you wish to withdraw.

➡️If there is one, finish the authentication process and submit the request.

How to Withdraw using Cryptocurrency Step by Step

➡️Select “Cryptocurrency Wallets” from the “Withdrawal” menu.

➡️Choose the cryptocurrency you want to withdraw funds in.

➡️This is where you may store your crypto.

➡️Within restrictions, provide the withdrawal amount.

➡️Kindly review and confirm the details of the withdrawal.

➡️Send in your request to withdraw funds.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

➡️Log in to access the “Withdrawal” section of your BDSwiss account.

➡️Select “e-Wallets” or your chosen payment processor that offers GHS withdrawals.

➡️Make sure your chosen e-wallet provider can process GHS transactions before you use it.

➡️Provide the email address or account number linked to your electronic wallet.

➡️Give the amount you wish to withdraw.

➡️Verify and send the request to withdraw the funds to your electronic wallet.

What payment options can I use to finance my BDSwiss account?

BDSwiss accepts various deposits, including credit/debit cards, bank wire transfers, electronic wallets, mobile solutions, and cryptocurrency wallets.

How long do deposits take to be reflected in my BDSwiss trading account?

Deposits made using most payment methods are received instantaneously, allowing traders to begin trading immediately.

BDSwiss Trading Platforms and Software

We tested and explored BDSwiss’ platforms and software using a demo account. Below we give Ghanaians a run-down on what they can expect when they trade using these innovative platforms.

MetaTrader 4

We tested the BDSwiss’ MetaTrader 4 platform using a demo account and discovered that it’s a reliable and user-friendly platform for Ghanaian traders. MT4 is known for its user-friendly interface and strong trading features, making it suitable for all experience levels.

It seamlessly integrates with various trading instruments, including forex, commodities, and indices, providing a smooth and efficient trading experience.

BDSwiss Web

BDSwiss Web is a user-friendly platform, and BDSwiss is designed to provide accessible trading solutions for Ghanaian traders.

We didn’t have to download the platform, and it gave us access to global financial markets regardless of whether we used web browsers or our phones.

The platform’s intuitive design complements BDSwiss’ extensive educational resources. This lets Ghanaian traders navigate, access trading information, and execute trades with just a few clicks.

BDSwiss Mobile

We have tested many proprietary apps from brokers and found that the BDSwiss Mobile app can give Ghanaians a competitive edge, especially because traders can use it from any mobile device anywhere in the world, given they have a stable internet connection, of course.

BDSwiss mobile app for Android and iOS prioritizes speed and efficiency, allowing quick access to trading accounts, real-time market analysis, and trade execution.

The app also provides customizable alerts and notifications, informing traders about potential trading opportunities.

Another benefit is that the app seamlessly integrates with BDSwiss’ trading conditions, allowing users to benefit from narrow spreads and leverage options directly from their mobile devices.

MetaTrader 5

MetaTrader 5 is one of our favorite platforms to test, and BDSwiss did not disappoint. BDSwiss’ MetaTrader 5 (MT5) is cutting-edge and offers advanced technology and functionalities to cater to the needs of traders.

The platform supports additional time frames and graphical objects, allowing traders to customize their analysis and trading strategies.

This sophisticated trading system, combined with BDSwiss’ competitive environment, makes it an attractive choice for Ghanaians who want efficiency and flexibility.

Which trading platforms are accessible on BDSwiss?

BDSwiss provides several trading platforms, including MetaTrader 4, MetaTrader 5, BDSwiss Web, and BDSwiss Mobile, to meet the unique demands of Ghanaian traders across several devices and preferences.

Can I use MetaTrader 5 to trade on BDSwiss?

Yes, BDSwiss offers MetaTrader 5, a comprehensive multi-asset platform with enhanced trading capabilities, updated graphical tools, and faster transaction execution to meet the changing demands of Ghanaian traders.

Trading Instruments & Products

We found that BDSwiss offers the following instruments and products:

➡️Cryptocurrencies – Ghanaian traders can access BDSwiss’ 27 cryptocurrency CFDs to enter the volatile digital currency market, including Bitcoin, Ethereum, and various altcoins. This selection is ideal for those seeking to diversify their financial products and join the growing crypto market.

➡️Shares – BDSwiss provides CFDs on 128 stocks, including renowned names in technology, banking, and medical sectors. It allows Ghanaian traders to diversify their investment portfolios and engage in the stock market without owning any underlying shares.

➡️Commodities – BDSwiss offers Ghanaian traders six commodities, including precious metals and energy resources, as an alternative to currency and equities, protecting against inflation and alternative investment options during currency fluctuations.

➡️Forex – BDSwiss is a market leader in the forex industry, offering Ghanaian traders 53 currency pairings, high liquidity, and 24/5 trading availability.

➡️Indices – If you want to diversify your portfolio beyond individual equities but still want exposure to whole industries or the economy as a whole, BDSwiss lets you trade on 14 different indexes.

Which financial products can I trade on BDSwiss?

You can trade forex, commodities, stocks, indices, and cryptocurrencies, allowing you to diversify your investment and trading portfolio and spread the risk across markets

Which indexes can I trade on BDSwiss?

BDSwiss provides 14 indices, exposing Ghanaians to various sectors of the global economy or the larger market without trading individual stocks.

Spreads and Fees

We discovered that BDSwiss offers a transparent, flexible trading and non-trading fee schedule. In the sections below, we discuss some fees Ghanaians can expect when they start trading with BDSwiss.

Spreads

We compared the spreads that BDSwiss offers and found that BDSwiss’ variable spread methodology can impact Ghanaian traders’ trading strategies and outcomes.

The Zero Spread Account is designed for high-volume traders with minimal expenses, offering spreads as low as 0.0 pips on popular currency pairs.

The Classic Account and other basic accounts include all trading costs in one bundle, resulting in higher spreads. This transparent spread list lets Ghanaian traders understand the costs of FX and CFD trading, and they can then make more informed trading decisions.

Commissions

BDSwiss ensures transparency in commissions, with the Zero Spread Account charging a $6 fee on commodities and currency to maintain narrow spreads. In addition, BDSwiss’ market pricing access is reflected in the commission, applied to all equity CFD trades, regardless of account type.

Overnight Fees

Traders holding overnight positions rely heavily on overnight fees, we also refer to them as swap fees, which BDSwiss imposes to account for profit or loss from leveraged positions.

Therefore, Ghanaians trading long-term or short-term must be familiar with these expenses. Already previously covered, BDSwiss offers Muslims in Ghana the option of converting a live account into a Swap-Free account, exempting them from overnight fees in line with Sharia law.

Deposit and Withdrawal Fees

Due to its fee-free deposits, BDSwiss allows traders to fund their accounts without additional expenditures. However, Ghanaians should check conditions, as some preferred payment providers could charge fees or limit withdrawals.

Inactivity Fees

BDSwiss has introduced an inactivity fee for accounts that haven’t been used for three months or more, aiming to keep traders engaged and maximize resource utilization. The fee, equal to 10% of the total amount, is always communicated to traders.

Currency Conversion Fees

Unfortunately, while we found BDSwiss’ fees reasonable, trades in foreign currency incur currency conversion costs, despite BDSwiss’ reasonable fees. Ghanaians should be aware of these costs, especially when dealing with foreign currency.

BDSwiss offers several base currency options for accounts, but GHS might not be supported. This means that deposits and withdrawals to a BDSwiss account in GHS will be converted, and Ghanaians must pay the conversion fee.

Does BDSwiss charge a commission fee on trades?

Yes, BDSwiss runs on a commission-free approach for most trading accounts.

How do BDSwiss spreads compare to other brokers?

BDSwiss provides competitive spreads that are equivalent to industry norms.

Leverage and Margin

We researched BDSwiss leverage and margin using the client agreement and other sources on the broker’s website. BDSwiss has a significant policy on margin and leverage.

BDSwiss offers dynamic leverage ratios of up to 1:2000, which increases the likelihood of losses and the possibility of large profits from small initial inputs.

This range covers a wide range of traders, from cautious to aggressive. BDSwiss’ margin requirements ensure traders have enough funds to cover their open positions, with a margin being the collateral the broker holds to maintain open positions.

This allows Ghanaians to open larger positions with minimal cash despite the high leverage and low margin requirements.

However, in our experience with leveraged trading, these factors also increase the risk of quick losses, especially in unpredictable market situations.

Ghanaian traders will likely find that BDSwiss suits their needs in terms of leveraged trading, but it’s crucial to have risk management plans in place to protect against market swings.

Are there any margin restrictions while trading on BDSwiss?

Yes, BDSwiss enforces margin restrictions to guarantee that Ghanaian traders have enough equity in their accounts to cover any potential losses. The margin requirements vary depending on the financial instrument and leverage ratio chosen.

Are there any leverage limits on certain trading products on BDSwiss?

BDSwiss applies leverage limitations on some volatile or exotic trading products to reduce risk and safeguard Ghanaian traders from excessive market exposure.

10 Best Forex Brokers in Ghana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

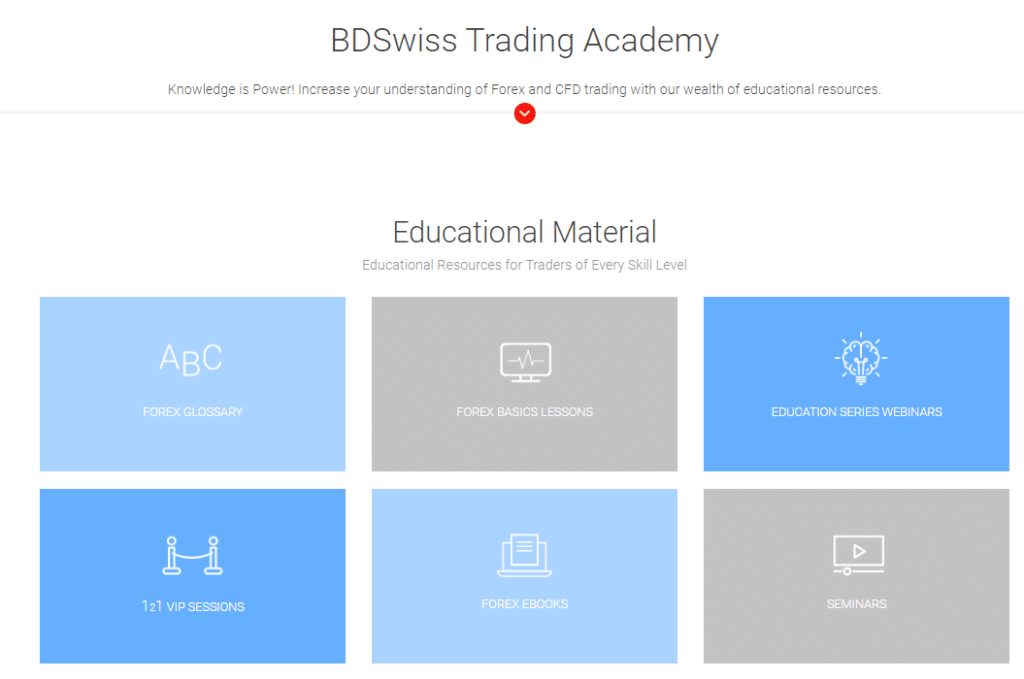

Educational Resources

We explored BDSwiss educational resources and found that the broker offers the following options to Ghanaian traders.

Seminars

BDSwiss offers seminars tailored to Ghanaian traders, providing hands-on instruction on financial market complexities.

These seminars cover fundamentals to complex market analysis methods, addressing all skill levels. Traders can improve their practical trading expertise in a context they can easily relate to, as these seminars are locally relevant and cover unique trading circumstances and possibilities.

This helps traders in Ghana improve their trading skills and gain a better understanding of the financial markets.

Learning centres

The BDSwiss Learning Centres offer a comprehensive curriculum and an extensive library of trade materials for traders in Ghana.

These hubs provide in-depth articles, tutorials, and guides for all skill levels, helping Ghanaian traders understand trading strategies, risk management, market analysis, and more, helping them successfully navigate the financial markets.

Forex Basic Lessons

BDSwiss’ Forex Basic Lessons are valuable for Ghanaian forex traders. These introductory classes comprehensively understand forex trading, market research, and currency pairs.

The lectures are designed to be accessible to even the most naïve traders, ensuring a smooth start in the forex market.

Forex eBooks

BDSwiss’ Forex eBooks cover basic principles of foreign exchange trading and complex technical and fundamental analysis methods.

These eBooks not only educate Ghanaians but also offer practical strategies and insights for trading, making them an invaluable resource for those looking to improve their knowledge and skills in the forex market.

Forex Glossary

With the help of the BDSwiss Forex Glossary, traders can easily understand the language and terminology of foreign exchange.

Furthermore, traders and economists can use the glossary to understand various financial market terms better.

Educational Videos

BDSwiss has created instructional videos for Ghanaian traders, covering fundamental trading, complex strategies, and market analysis.

We watched a few of these videos and could see that they’re designed to help traders absorb and remember knowledge better due to their visual and aural components, allowing them to learn at their own pace in an interesting and educational manner.

Live Education

The Live Education programs on BDSwiss’ website cover live market analysis, question and answer periods, and detailed explanations of trading methods. The live format encourages engagement, allowing traders to ask questions and receive expert answers.

This real-world learning experience is ideal for traders seeking to enhance their skills in a real-world market setting.

Does BDSwiss provide tailored training sessions for Ghanaian traders?

Yes, BDSwiss offers individual training sessions led by skilled traders and analysts. It provides Ghanaian traders with specific instructions and insights to help them create efficient trading strategies and accomplish their financial objectives.

Can complete beginners use BDSwiss’ educational resources?

Yes, BDSwiss’ instructional tools cater to traders of all skill levels, with beginner-friendly information covering fundamental topics like market analysis, risk management, and platform navigation, allowing Ghanaian traders to begin their trading experience with confidence.

Bonuses and Promotions

From what we can see on the official website, BDSwiss does not offer any active bonuses or promotions. However, there is a lucrative forex cashback rebate program for Introducing Brokers.

BDSwiss is introducing an attractive incentive program tailored to Introducing Brokers (IBs) in Ghana, taking advantage of the country’s expanding forex trading business. Moreover, to promote a win-win relationship, this program attends to the requirements of both IBs and their clients.

Regardless of the client’s account type, the program allows IBs to earn up to $4.20 for each lot traded in Forex.

We’ve found that this streamlines the compensation plan, freeing up IBs to concentrate on expanding their clientele rather than navigating convoluted commission structures.

Furthermore, our evaluation revealed that being open and accommodating to its partners is important to BDSwiss. To determine the rebates, BDSwiss painstakingly records all transactions that occur when an IB promotes a new trader using a special referral link.

This rebate is a cut of the spreads or commissions the trader pays and splits with the IB. Therefore, this open method guarantees the program’s success for the IB and the trader.

In addition, we also found that BDSwiss has a customizable payment plan that lets IBs get their money when they need it. For IBs in Ghana, this is just one more perk that makes the program great.

Are there any cashback perks for BDSwiss customers in Ghana?

Yes. BDSwiss’ incentives include cashback rebates for IBs up to $4.20 per lot traded in the Forex market.

Do BDSwiss promotions in Ghana have a trading volume requirement?

Yes. The terms and conditions of each given BDSwiss campaign will specify any necessary trading volume to qualify for the promotion, such as cashback rebates.

How to Register an Affiliate Account with BDSwiss Step-by-Step

Step 1: Look for the “Partners” area

Open your web browser and navigate to the official BDSwiss website by searching for “BDSwiss.” Once on the homepage, look for the “Partners” area. This part is often found within the main navigation bar at the top of the page.

Step 2: Clicking on the “Start Now”

Clicking on the “Start Now” banner will take you to the registration page. Alternatively, you can click “Register” under the Affiliate or the Introducing Broker option on this page.

Step 3: Click “Register”

You can click “Register” under the Affiliate or the Introducing Broker option on this page.

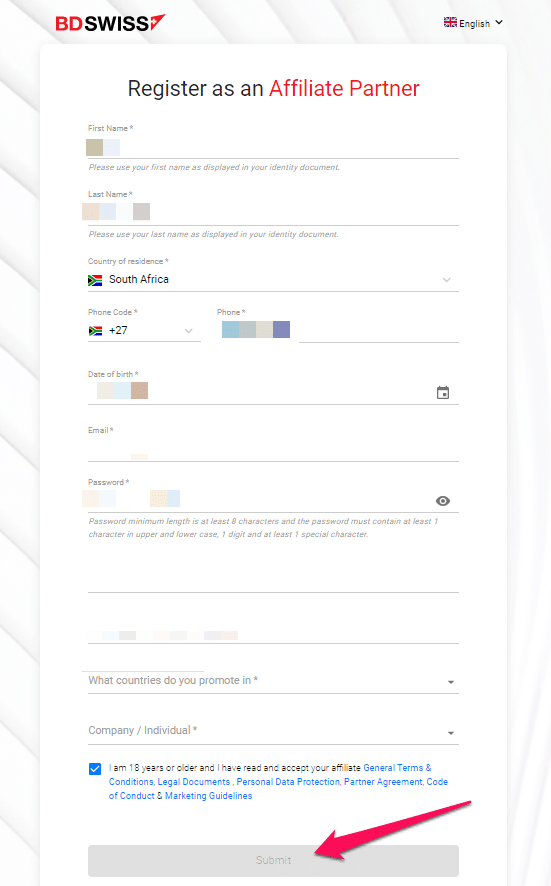

Step 4: Fill in Sign Up Form

A signup form will load, requiring personal and contact information. Make sure that you fill out all the fields correctly, including:

Your full name and a valid email address.

Vietnamese Mobile Phone Number with Country Code (+84)

URL of your website or social media platform to track referrals.

A brief description of how you intend to promote BDSwiss helps BDSwiss understand your strategy for targeting the Vietnamese market.

After completing the form, review it to verify there are no mistakes. Complete your registration by clicking the “Submit” button.

BDSwiss will thoroughly evaluate your application. During this time, you should get a confirmation email from the broker. This email will let you know if your registration has been authorized or if they need any more information.

Once approved, you will get a welcome email with login information for your personal Affiliate Dashboard. This dashboard acts as your affiliate hub, where you can:

View unique referral links to monitor the effectiveness of your advertising initiatives.

Monitor your earnings in real time.

To attract new clients, access a wealth of marketing resources designed exclusively for your audience, and contact BDSwiss’ experienced support team if you have any questions.

BDSwiss Affiliate Programs

According to our research, the BDSwiss Affiliate Program would thrive in Ghana due to the country’s large and active internet community, with individual traders and organizations with a strong web presence as the target audience.

Rewarded with excellent conversion rates and lucrative compensation structures, BDSwiss is a well-known player in the forex industry. It allows Ghanaians to make money by driving visitors to their website.

Whether it’s social media or websites that teach forex, affiliates can maximize the potential of their digital platforms thanks to the high average conversion rate of 36%.

The program offers a variety of tools and services to help affiliates, including payment options that meet both international and local regulations. This adaptability is vital in a country like Ghana, where people’s access to money fluctuates widely.

Furthermore, BDSwiss functions inside a regulatory framework that guarantees trust and security, which is especially attractive in Ghana.

What type of affiliate programs does BDSwiss provide to Ghanaians?

Ghanaians can take advantage of BDSwiss’ partnership options like Introducing Brokers and CPA affiliates.

How can Ghanaian affiliates withdraw their profits from BDSwiss?

Per the affiliate agreement, affiliates based in Ghana can withdraw their profits using any payment options BDSwiss offers. However, traders must note that there might be certain terms and conditions they must adhere to first.

BDSwiss Customer Support

| ☎️ Telephonic Support | Yes |

| 🗺️ Operating Hours 24/5 | 24/5 |

| 👛 Support Languages | Multilingual |

| 📙 Live Chat | Yes |

| 🎓Email Address | Yes |

| 📍 The overall quality of BDSwiss Support | 4/5 |

Social Responsibility

BDSwiss exhibits a robust dedication to social responsibility globally. Furthermore, they advocate for healthy lifestyles and assist local charities, among other initiatives.

Firstly, BDSwiss partially accomplished this by competing in events like the Limassol Marathon. BDSwiss actively participates in this significant athletic occasion that benefits multiple charitable organizations by fielding a team in the 5km Corporate Race.

This initiative encourages employees to adopt a healthier lifestyle and grows awareness for deserving causes.

Additionally, we also discovered that BDSwiss recognizes the value of education. Their collaboration with the non-profit organization “Fundraising” serves as an explicit illustration.

Furthermore, BDSwiss’ contribution to computer stations ensures that children have the necessary academic resources. This educational investment possesses the capacity to generate an enduring beneficial influence on the lives of young individuals.

Beyond individual initiatives, BDSwiss also cultivates an organization-wide culture of social responsibility. This is demonstrated through their sponsorship of the “365 Charity Run Walk.”

According to the research we did on BDSwiss’ CSR initiatives, this occasion facilitates the restoration of a nearby pediatric clinic and fosters community service and social accountability.

BDSwiss Pros & Cons

While BDSwiss has a comprehensive offering for Ghanaian traders, traders must consider both the pros and the cons. In the table below, we give unbiased points highlighting the positives and the drawbacks we experienced with BDSwiss.

| ✔️ Pros | ❌ Cons |

| BDSwiss’ spreads are competitive compared to other brokers, starting from 0.0 pips on major currency pairs | BDSwiss does not have any local offices in Ghana |

| Ghanaians can access leverage of up to 1:2000 when they trade forex majors | There are limited local payment methods for Ghanaians |

| There are robust trading platforms, including MT4, MT5, and BDSwiss own software | There are currency conversion fees applied on trades, deposits, and withdrawals |

| Ghanaians can deposit and withdraw in GHS using electronic wallets and mobile money solutions | There might be some withdrawal restrictions |

| BDSwiss is regulated by top entities in several regions globally | BDSwiss charges inactivity fees when accounts remain dormant after three months, affecting long-term strategies |

| The educational materials offered are comprehensive | |

| There are no deposit fees charged | |

| BDSwiss’ customer support is often praised for its quick responses and friendliness |

Our Recommendations on BDSwiss

While BDSwiss has amazed us with its transparency, competitive trading conditions, and several other benefits it offers Ghanaians; we can provide some feedback on recommendations to allow BDSwiss to cater to Ghanaians even more.

- Provide more localized payment options for Ghanaians and consider adding GHS for accounts.

- Consider offering customer support in more African languages.

- Consider offering CFDs on domestic instruments, including GHS.

You might also like: AvaTrade Review

You might also like: IC Markets Review

You might also like: InstaForex Review

You might also like: Tickmill Review

You might also like: Exness Review

Conclusion

After exploring BDSwiss and what they offer, we can confidently say that BDSwiss is a forex and CFD broker that caters to the unique needs of all traders, even those in Ghana

Despite not being regulated locally in Ghana, BDSwiss follows international standards set by top entities and fosters trust and assurance in the unpredictable world of forex and CFD trading.

According to our research, BDSwiss also provides educational resources, diverse account types, and a variety of trading instruments, catering to Ghanaian traders at different skill levels.

However, factors like the absence of local regulation, potential commission fees, and currency conversion fees should be considered.

Despite these, we can conclude that BDSwiss is a commendable option for traders in Ghana, offering extensive features and a robust security framework.

Our Insight

According to my findings, BDSwiss offers a good balance with easy-to-use platforms, strong support, and various trading options, making it a great choice for new and existing users. BDSWISS is fantastic, their support team gets back to you with any questions answered quickly.

Frequently Asked Questions

Does BDSwiss have a physical office in Ghana?

No, BDSwiss does not have local representation in Ghana.

Is it easy to use mobile money services in Ghana to fund my BDSwiss account?

Yes, the process involved with depositing funds using options like Vodafone, MTN, and others is extremely easy.

What is the time difference between BDSwiss support hours and Ghana Standard Time?

The time difference between BDSwiss support hours and Ghana Standard Time is usually between 1 and 3 hours, depending on whether it’s Standard Time or Daylight Saving Time in Europe.

How long does it take for BDSwiss to process my withdrawal request?

Withdrawal requests are processed as they’re received and mobile money services and e-wallets are processed within a few minutes up to 24 hours.

Namibian Dollar Forex Trading Accounts

Namibian Dollar Forex Trading Accounts

Scam Forex Brokers in Ghana

Scam Forex Brokers in Ghana

BDSwiss User Comments and Reviews

We visited several reputable review websites where BDSwiss clients left reviews and comments on BDSwiss. Here’s what people have to say about this broker: