Tickmill Review

Overall, Tickmill is considered low risk, with an overall Trust Score of 83 out of 100. Tickmill is licensed by one Tier-1 regulator (high trust), three Tier-2 Regulators (average trust), and two Tier-3 Regulators (low trust). Tickmill offers Ghanaians three retail trading accounts: a Pro Account, a Classic Account, and a VIP Account.

- Lesche Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

1 135 GHS or $100

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Tickmill is a reputable online brokerage firm that provides trading services in various financial instruments, including forex, commodities, and indices. Since its inception in 2014, the firm has built a reputation for offering a solid trading platform, competitive spreads, and a transparent fee structure.

Tickmill is an appealing option for Ghanaian traders due to its regulatory compliance with multiple jurisdictions, including the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

Tickmill also offers educational resources and customer support, especially useful for traders new to the financial markets. Webinars, tutorials, and market analysis are among the resources available to help Ghanaian traders make informed trading decisions.

Tickmill provides various account options to accommodate different trading styles and investment sizes. Classic, Pro, and VIP accounts are available, each with features and benefits.

Tickmill also offers a demo account that allows traders to practice their strategies without risking real money, which is especially useful for those new to trading.

Tickmill excels in another area: transaction costs. Tickmill provides tight spreads and low commissions, which can significantly reduce trading costs. This especially benefits Ghanaian traders on a tight budget and looking for cost-effective solutions.

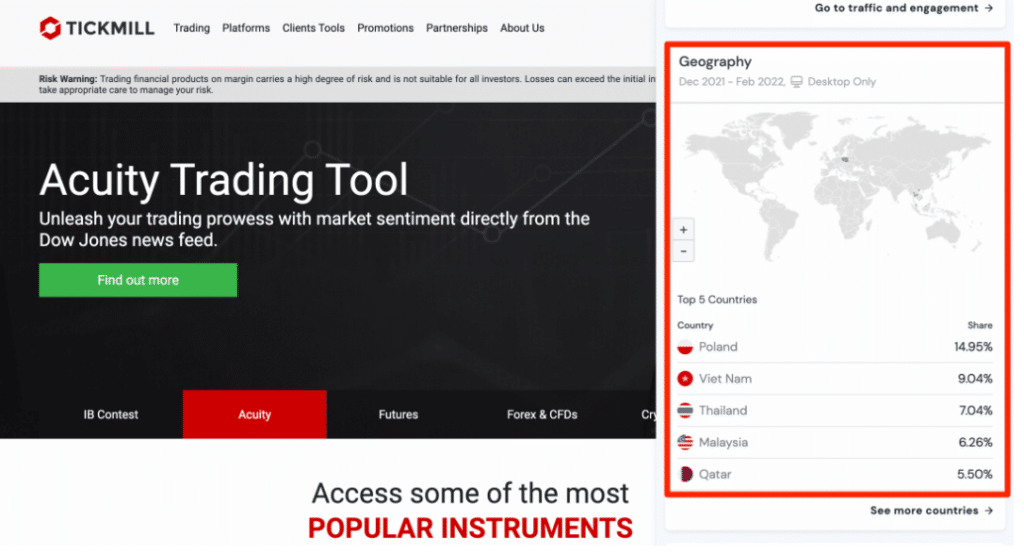

Distribution of Traders

currently has the largest market share in these countries

➡️ Poland – 14.9%

➡️ Vietnam – 9.04%

➡️ Thailand – 7.04%

➡️ Malaysia – 6.26%

➡️ Qatar – 5.50%

Popularity among traders

Tickmill is one of the Top 20 Forex and CFD brokers for traders in Ghana.

Tickmill At a Glance

| 🏛 Headquartered | London, United Kingdom |

| 🌎 Global Offices | Australia, Ireland, Cyprus, South Africa, Seychelles, Malaysia |

| 🏛 Local Market Regulators in Ghana | Bank of Ghana (BoG) |

| 💳 Foreign Direct Investment in Ghana | 524.3 million USD (2021) |

| 💰 Foreign Exchange Reserves in Ghana | 5.3 million USD (June 2024) |

| ✔️ Local office in Accra? | No |

| 👨⚖️ Governor of SEC in Ghana | Daniel Ogbarmey Tetteh (Director-General) |

| ✔️ Accepts Ghanaian traders? | Yes |

| 📊 Year Founded | 2015 |

| 📞 Ghana Office Contact Number | None |

| 📱 Social Media Platforms | Facebook YouTube Telegram |

| ⚖️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA |

| 1️⃣ Tier-1 Licenses | Financial Conduct Authority (FCA) |

| 2️⃣ Tier-2 Licenses | Cyprus Securities and Exchange Commission (CySEC) Financial Sector Conduct Authority (FSCA) Dubai Financial Services Authority (DFSA) |

| 3️⃣ Tier-3 Licenses | Financial Services Authority (FSA) Financial Services Authority Labuan (LFSA) |

| 🪪 License Number | Seychelles – SD008 United Kingdom – 71720 Cyprus – 278/15 Labuan – MB/18/0028 South Africa – FSP 49464 Dubai – F007663 |

| ⚖️ Regulation | No |

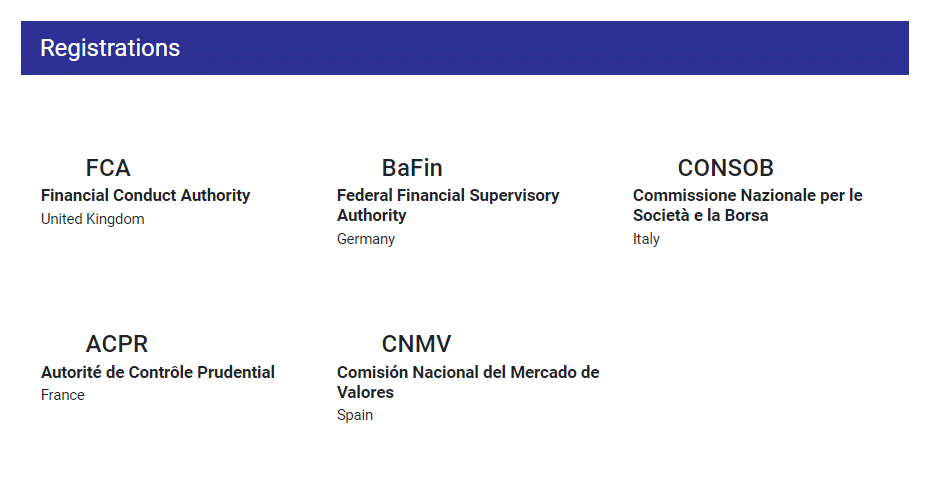

| ✔️ Regional Restrictions | Germany – BaFin ID 10146511 Spain – 4082 France – 75473 Italy – 4082 |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | MAM Accounts |

| 💻 Liquidity Providers | Barclays and other top-tier banks, as well as hedge funds |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | From 0.0 pips |

| 📉 Minimum Commission per Trade | $1 per side, per standard lot traded |

| 💰 Decimal Pricing | 5th Decimal after the comma |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 30% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a GHS Account? | No |

| 📉 Dedicated Ghana Account Manager? | No |

| 📈 Maximum Leverage | 1:500 |

| 📊 Leverage Restrictions for Ghana? | No |

| 💳 Minimum Deposit (GHS) | 1 135 Ghanaian Cedi or an equivalent to $100 |

| ✔️ GHS Deposits Allowed? | No |

| 📊 Active Ghana Trader Stats | 250,000+ |

| 👥 Active Ghanaian -based Tickmill customers | Unknown |

| 🔁 Ghana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | Bank Transfer Crypto Payments Debit Card Credit Card Skrill Neteller Dotpay PayPal Trustly Sticpay FasaPay UnionPay WebMoney Sofort Rapid (by Skrill) |

| 💻 Minimum Withdrawal Time | 1 Business Day |

| ⏰ Maximum Estimated Withdrawal Time | 2 to 7 Business Days |

| 💳 Instant Deposits and Instant Withdrawals? | Instant Deposits |

| 🏛 Segregated Accounts with Ghanaian Banks? | Yes |

| 📱 Trading Platforms | MetaTrader 4 MetaTrader 5 Tickmill Mobile App |

| 💻 Tradable Assets | Forex Stock Indices Energy Indices Precious Metals Bonds Cryptocurrencies Stocks |

| ✔️ Offers USD/GHS currency pair? | No |

| 📊 USD/GHS Average Spread | N/A |

| ✅ Offers Ghana Stocks and CFDs | No |

| 🔎 Banned countries | US, North Korea, New Zealand, Iran, Belgium |

| 💻 Languages supported on the Website | English, Chinese (Simplified), Chinese (Traditional), Turkish, Thai, Slovakian, Russian, Portuguese, Polish, German, Hungarian, French, and several others |

| 📈 Related lot sizes | Standard, Mini and Micro lots size |

| 👥 Sponsorship | Currently with Bolt |

| ✴️ Instruments offered | 800+ |

| ✴️ Instruments | Forex Stock Indices Energy Indices Precious Metals Bonds Cryptocurrencies Stocks |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes, Myfxbook |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Ghana-based customer support? | Yes |

| 💸 Bonuses and Promotions for Ghanaian? | Yes |

| 📚 Education for Ghanaian beginner traders | Yes |

| 📱 Proprietary trading software | Yes, App |

| 🤝 Most Successful Trader in Ghana | Louis Boah |

| ✔️ Is Tickmill a safe broker for Ghana Traders? | Yes |

| 🎖 Rating for Tickmill Ghana | 9/10 |

| 🥇 Trust score for Tickmill Ghana | 83% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Tickmill Regulation in Ghana

The broker is not currently regulated by the Bank of Ghana (BoG). However, Tickmill’s global regulations are listed in the table below.

Global Regulations

| Registered Entity | Country of Registration | Registration Number | Regulatory Entity | Tier | License Number/Ref |

| Tickmill UK Ltd. | United Kingdom | 09592225 | FCA | 1 | 71720 |

| Tickmill Europe Ltd | Cyprus | 340249 | CySEC | 2 | 278/15 |

| Tickmill South Africa (Pty) Ltd. | South Africa | 2017/531268/07 | FSCA | 2 | FSP 49464 |

| Tickmill Ltd. | Seychelles | – | FSA | 3 | SD008 |

| Tickmill Asia Ltd. | Labuan | – | LFSA | 3 | MB/18/0028 |

| Tickmill UK Ltd. | Dubai | – | LFSA | 2 | F007663 |

Protection of Client Funds

| Security Measure | Information |

| Segregated Accounts | Yes |

| Compensation Fund Member | Yes, FSCS and ICF |

| Compensation Amount | FSCS – £85,000 ICF – 20,000 EUR |

| SSL Certificate | No |

| 2FA (Where Applicable) | No |

| Privacy Policy in Place | Yes |

| Risk Warning Provided | Yes |

| Negative Balance Protection | Yes |

| Guaranteed Stop-Loss Orders | No |

Security while Trading

Tickmill is committed to transparency in its operations, ensuring clients can access transparent fee reports and thorough details about its trading terms.

This commitment to transparency is crucial for enabling traders to make informed decisions and comprehend the associated costs of their transactions.

In addition, Tickmill maintains a healthy level of capital sufficiency. This firm’s financial strength ensures the continuity of its operations and provides additional protection for client funds.

Moreover, Tickmill’s trading platforms are designed with an emphasis on user-friendliness. These platforms provide a vast array of advanced features for both novice and experienced traders.

The technology infrastructure of Tickmill is designed to facilitate rapid and reliable trade execution, thereby minimizing the risk of interruptions and delays.

What steps does Tickmill take to protect client funds?

To ensure the safety and security of client funds, the broker keeps them in segregated accounts with top-tier banks.

Is Tickmill compliant with anti-money laundering regulations?

Yes, to ensure the integrity of financial transactions, they follows strict anti-money laundering (AML) policies.

Awards and Recognition

received the following recent awards and recognition:

- Premier Broker for Fee Structure: Annual Forex Broker Review by ForexBrokers.com

- Top Affiliate Program in Africa: 2024 Finance Magnates Africa Summit

- Leading Forex Spreads in MEA: 2024 Ultimate Fintech Awards MEA

- Foremost Forex Broker: 2024 QualeBroker Awards

- Optimal Forex Trading Experience: 2022 Global Forex Awards

- Superior Forex Spreads for 2022: 2022 Ultimate Fintech Awards

- Exceptional Customer Service in Forex: 2022 Global Forex Awards

Has Tickmill received any notable awards for its services in the financial industry?

Yes, the broker has earned recognition through various notable awards within the financial industry. The platform has been honored across different categories, including trading services, customer support, and technological innovation.

How is Tickmill regarded in the financial industry, and what does its reputation suggest about the platform?

The broker enjoys a positive reputation within the financial industry, reflecting its dedication to providing a wide range of trading services and maintaining customer satisfaction. The receipt of various awards and positive reviews from traders further underscores Tickmill’s success in delivering a reliable and user-friendly trading experience.

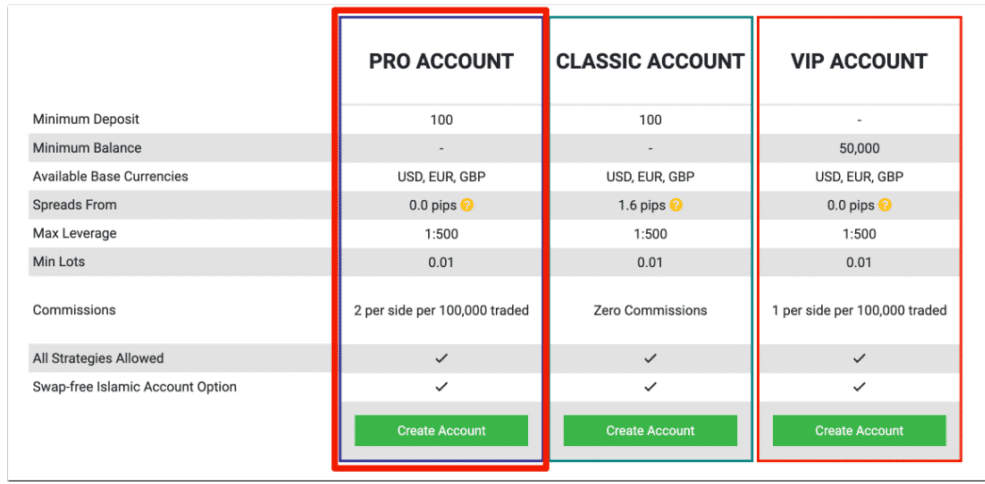

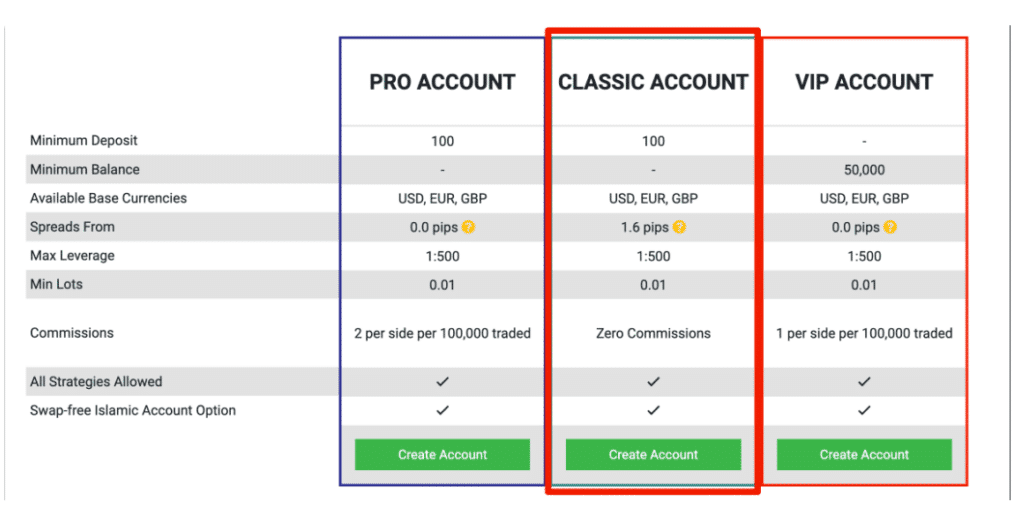

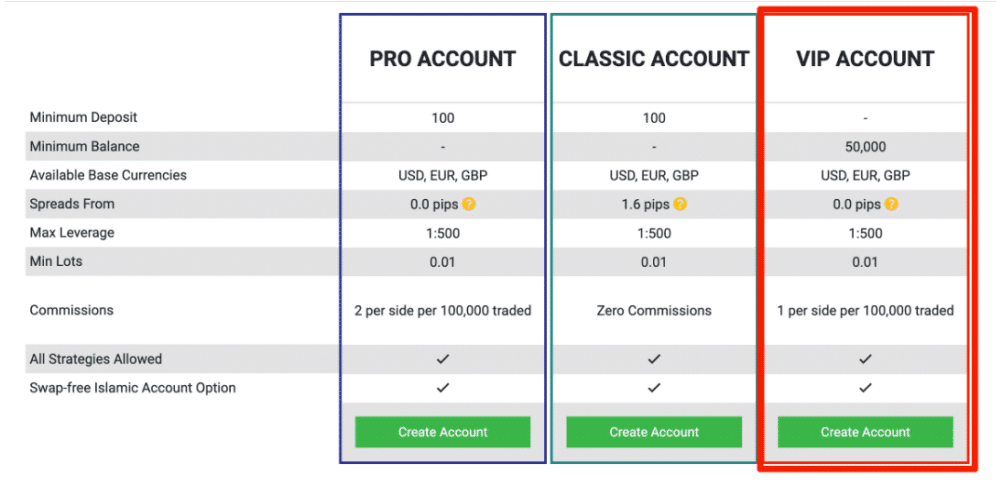

Tickmill Account Types and Features

The broker uses a no-dealing desk concept with ECN pricing to provide three different account types for trading FX and CFDs. The Pro, Classic and VIP accounts are all available. Each of these account kinds is appropriate for a particular level of experience in trading.

Each of the accounts is designed to meet the needs of both novice and experienced traders. There is also the option of swap-free Islamic accounts, which is a convenient addition that enables even more traders to make use of the company’s offerings.

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Average Trading Cost |

| ➡️ Pro Account | $100 / 1 135 GHS | 0.0 pips | $4 per lot | 4 USD |

| ➡️ Classic Account | $100 / 11 GHS | 1.6 pips | None | 16 USD |

| ➡️ VIP Account | $50 000 / 60 0088 GHS | 0.0 pips | $2 per lot | 2 USD |

Live Trading Account Details

Pro Account

The Pro Account is intended for traders who want more competitive spreads and are willing to pay a commission on each trade. Here is a breakdown of the Pro Account:

| Account Feature | Value |

| 💸 Account Base Currencies | USD EUR GBP PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.) |

| 📊 Minimum Deposit | 1 135 GHS / $100 |

| 🔧 Minimum Account Balance | None |

| 💵 Average spreads | 0.0 pips |

| 💻 Maximum Leverage Ratio | Seychelles: 1:500 UK: 1:30 (Retail), 1:500 (Pro) Cyprus: 1:30 (Retail), 1:300 (Pro) Ghana: 1:500 South Africa: 1:500 |

| 📈 Minimum Lots that can be traded | 0.01 lots |

| 📉 Commission charges | $2 per side per standard lot of 100,000 |

| 🔄 Strategies Allowed | Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc. |

| 📱 Swap-Free Islamic Account Option | Yes |

Classic Account

The Classic Account is ideal for new traders or those who prefer a simple, commission-free trading structure. It is also appropriate for traders who do not trade frequently and are less concerned with spread sizes. Below are the features of the Tickmill Classic Account:

| Account Feature | Value |

| 💸 Account Base Currencies | USD EUR GBP PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.) |

| 📊 Minimum Deposit | 1 135 GHS / $100 |

| 🔧 Minimum Account Balance | None |

| 💵 Average spreads | 1.6 pips |

| 💻 Maximum Leverage Ratio | Seychelles: 1:500 UK: 1:30 (Retail), 1:500 (Pro) Cyprus: 1:30 (Retail), 1:300 (Pro) Ghana: 1:500 South Africa: 1:500 |

| 📈 Minimum Lots that can be traded | 0.01 lots |

| 📉 Commission charges | None |

| 🔄 Strategies Allowed | Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc. |

| 📱 Swap-Free Islamic Account Option | Yes |

VIP Account

The VIP Account is ideal for professional traders, institutional investors, or high-net-worth individuals seeking premium trading conditions and a large account balance. The following table provides a comprehensive breakdown of the features of the VIP Account:

Account Feature Value

💸 Account Base Currencies USD

EUR

GBP

PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.)

📊 Minimum Deposit 600088 GHS / $50,000

🔧 Minimum Account Balance $50,000

💵 Average spreads 0.0 pips

💻 Maximum Leverage Ratio Seychelles: 1:500

UK: 1:30 (Retail), 1:500 (Pro)

Cyprus: 1:30 (Retail), 1:300 (Pro)

Ghana: 1:500

South Africa: 1:500

📈 Minimum Lots that can be traded 0.01 lots

📉 Commission charges None

🔄 Strategies Allowed Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc.

📱 Swap-Free Islamic Account Option Yes

Base Account Currencies

The broker does not provide a trading account in the Botswanan Pula (BWP). All five of Tickmill’s worldwide organizations accept just USD, GBP, and EUR as base currencies. Tickmill UK Ltd. and Tickmill Europe Ltd., on the other hand, accept PLN as an extra currency across all accounts.

This is a let-down for Botswanans with BWP bank accounts, given most other overseas brokers provide a more extensive set of services. Conversion fees can increase trading expenses and have a substantial influence on profitability.

Demo Account

Tickmill provides a comprehensive demo account that allows Ghanaian traders to trade risk-free while becoming acquainted with Tickmill’s platform and features.

The demo account closely resembles the conditions of live trading accounts, with the main difference being that virtual funds are used rather than real money.

Islamic Account

Tickmill provides an Islamic account, also known as a swap-free account, that is Sharia-compliant. This account type is designed to meet the needs of Muslim traders in Ghana who want to participate in financial markets while following their religious principles.

The following are some of the key features of the Islamic Account:

- Per Islamic financial principles, Tickmill’s Islamic account does not charge swaps or rollover interest on overnight positions. This feature enables Muslim traders to engage in trading without jeopardizing their faith.

- Tickmill’s Islamic accounts provide the same trading conditions as Tickmill’s regular accounts. This includes access to a diverse set of trading instruments and advanced trading platforms such as MetaTrader. The primary distinction is the lack of swap or rollover interest charges.

- Tickmill charges overnight fees on positions that remain open for more than three consecutive nights to compensate for the lack of swap charges. These fees apply to various trading instruments and are detailed in Tickmill’s overnight charges schedule.

Spread Betting Account

Tickmill does not offer spread betting to Ghanaian traders.

Base Account Currencies

Tickmill’s base currencies are USD, EUR, GBP, and PLN (for Tickmill UK Ltd. and Tickmill Europe Ltd.).

Basic Order Types

- Market Order – A market order can be either a buy or a sell order that executes at the current market price. This is the current price displayed on your price chart. If you place a market order, you will be immediately entered at the best available price.

- Market orders are most effective when a trading opportunity requires prompt action. Click buy/sell at market to enter the trade immediately.

- Stop Order – A stop order can be either a buy or sell stop, depending on whether you wish to purchase above or below the market.

- This is useful for trading breakouts or trend continuation strategies when you want the market to continue moving in the same direction.

- Limit Order – Alternatively, if you believe the price will reverse when it reaches a certain price, you can place a limit order.

- Limit orders can be either buy or sell limits, depending on the market’s direction before your anticipated reversal.

- A sell limit is used to sell above the market, while a buy limit is used to purchase below the market.

Does Tickmill offer an Islamic account?

Yes, the broker provides a Sharia-compliant swap-free Islamic Account.

What is unique about Tickmill’s VIP account?

Tickmill’s VIP account has lower commissions of $2 per lot and a $50,000 minimum deposit.

How to open a Tickmill Account step by step

Step 1: Create an Account

In order to start the process of opening a Live Account, the applicant can simply click on the green “Create Account” button located at the top right of the webpage.

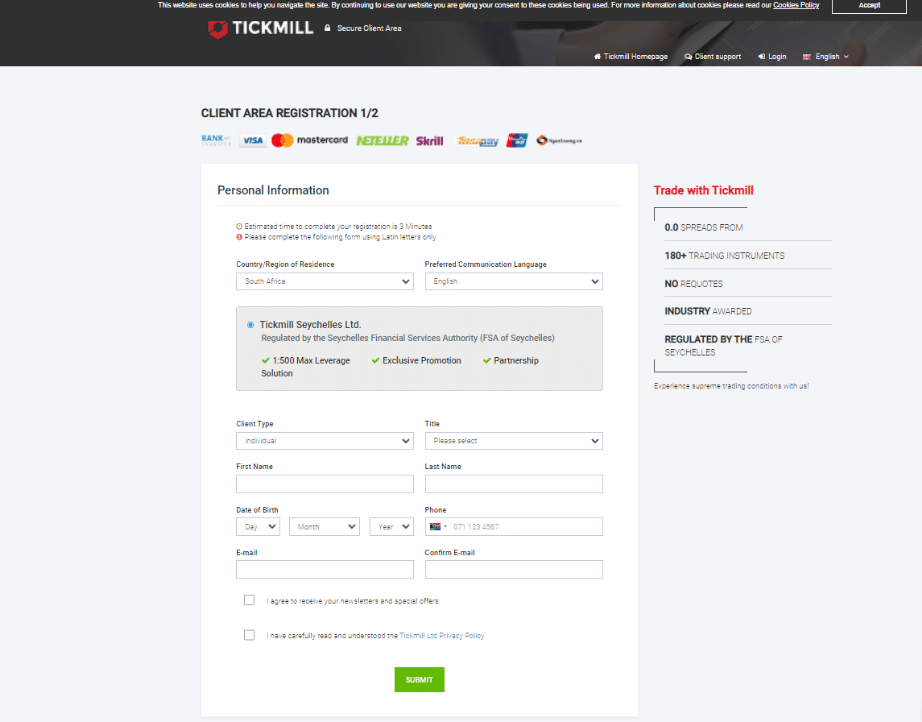

Step 2: Registration

The applicant will be required to complete a simple registration form which will include Country of Residence and client type.

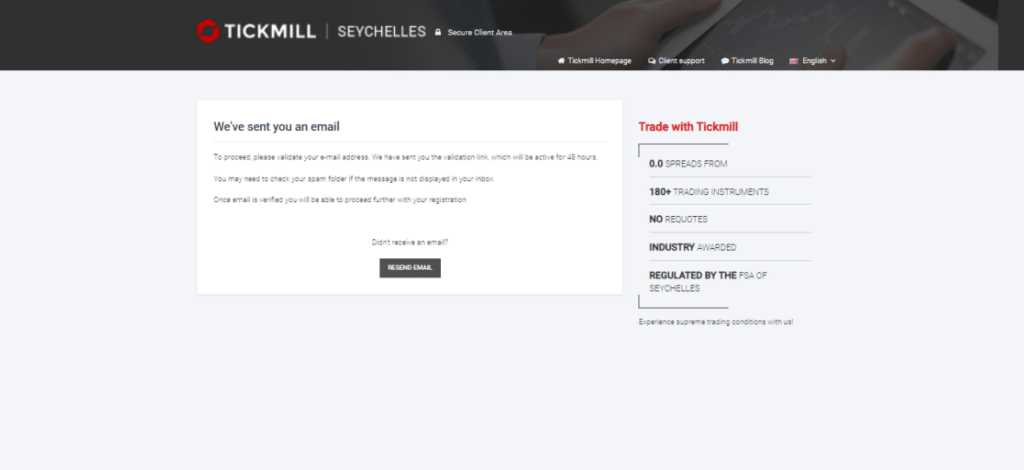

Step 3: Confirmation

Once the registration form has been completed and submitted, the applicant will receive an email in order to confirm their account creation.

Tickmill Vs Exness Vs Pepperstone – Broker Comparison

| 🥇 Tickmill | 🥈 Exness | 🥉 Pepperstone | |

| ⚖️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 • Exness App • Exness Terminal | • MetaTrader 4 • MetaTrader 5 • cTrader • TradingView • Myfxbook • DupliTrade |

| 💰 Withdrawal Fee | No | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1 135 GHS | 119 GHS | 0 GHS |

| 📊 Leverage | 1:500 | Unlimited | 1:400 |

| 📊 Spread | Variable, from 0.0 pips | Variable, from 0.0 pips | Variable, from 0.0 pips |

| 💰 Commissions | $1 per side per 100,000 traded | From $0.1 per side, per lot | From AU$7 |

| ✴️ Margin Call/Stop-Out | 100%/30% | 60%/0% | 90%/20% |

| 💻 Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | Yes | No | No |

| 📊 Cent Accounts | No | Yes | No |

| 📈 Account Types | • Pro Account • Classic Account • VIP Account | • Standard Account • Standard Cent Account • Raw Spread Account • Zero Account • Pro Account | • Standard Account • Razor Account |

| ⚖️ BoG Regulation | No | No | No |

| 💳 GHS Deposits | No | No | No |

| 📊 Ghana Cedi Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/5 |

| 📊 Retail Investor Accounts | 3 | 5 | 2 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | Unlimited | 100 lots |

| 💰 Minimum Withdrawal Time | 1 business day | Instant | 1 business day |

| 📊 Maximum Estimated Withdrawal Time | 2 to 7 Business Days | Up to 72 hours | Up to 7 business days |

| 💸 Instant Deposits and Instant Withdrawals? | Instant Deposits | Yes | No |

Min Deposit

1 135 GHS or $100

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

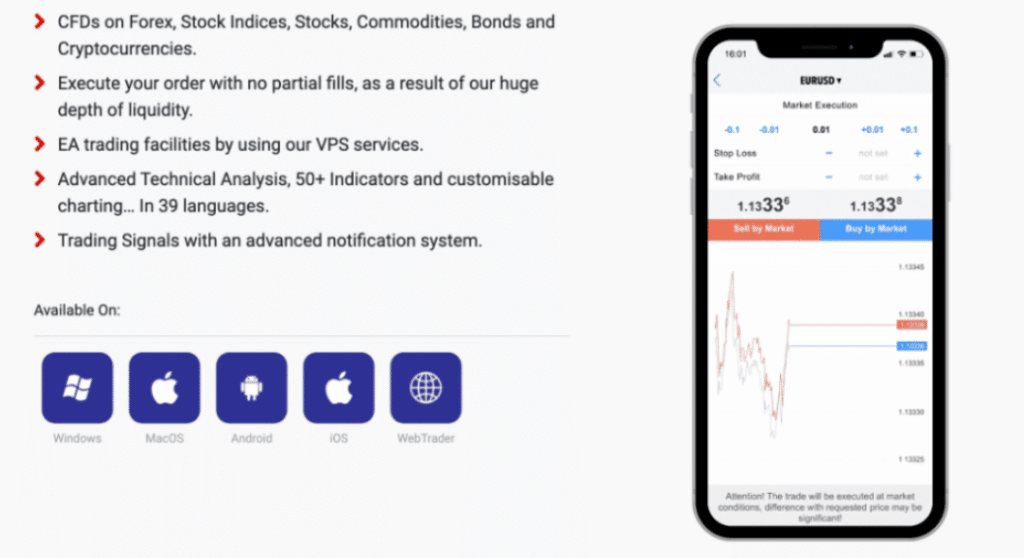

Tickmill Trading Platforms

Offers Ghanaian traders a choice between these trading platforms:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Tickmill App

MetaTrader 4

MetaTrader 4 is a trading platform that has earned the trust of traders worldwide, including Ghanaians. It has an easy-to-use interface suitable for novice and experienced traders.

MT4 provides various charting tools, multiple timeframes, and the ability to implement algorithmic trading strategies in addition to quick order execution. Tickmill provides the core MT4 platform and optional feature upgrades for an additional fee.

Some Ghanaian traders may consider the MT4 interface to be dated, and certain features may be difficult to use.

The platform accepts various orders, including Market, Limit, and Stop. It also has a unique Trailing Stop feature that adjusts stop-loss levels automatically to lock in profits.

MetaTrader 5

Tickmill’s MetaTrader 5 (MT5) is an improved version of MT4 designed for traders needing more comprehensive trading tools.

MT5 released a decade ago, is particularly well-known for its advanced back-testing capabilities, which are critical for traders using automated trading systems.

Unique features include one-click trading from charts, real-time news streams, market depth analysis, and an integrated economic calendar. Tickmill offers the standard MT5 platform, making it an excellent choice for Ghanaian traders seeking more advanced trading features.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

It is possible to trade the markets right from your web browser using MetaTrader 4 and 5. It is easier to trade using Tickmill’s WebTrader trading platform since it incorporates the MetaTrader system into your browser.

The WebTrader version includes all the same features as the desktop application, but it is more secure thanks to data encryption.

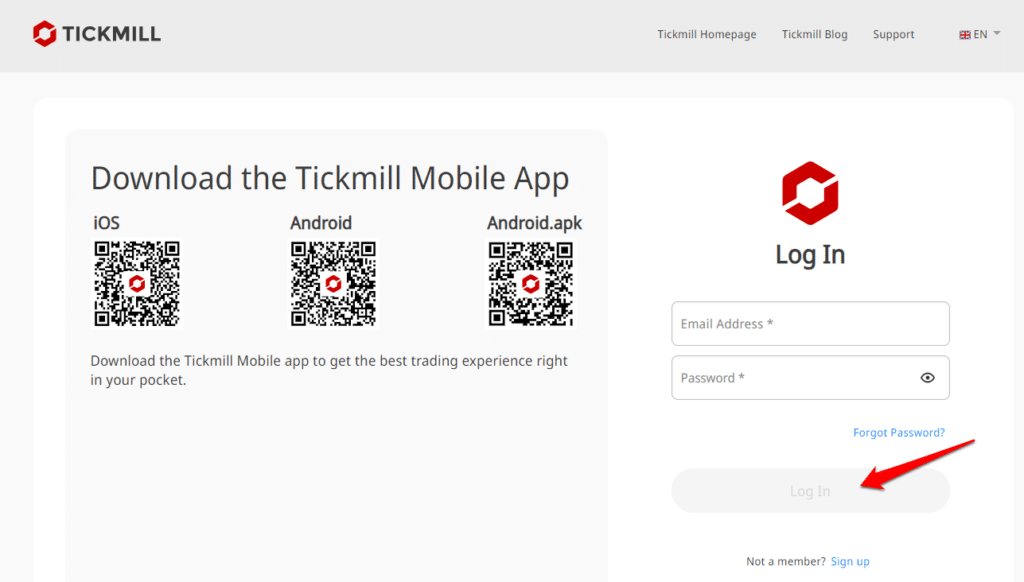

Trading App

The Tickmill Mobile App is intended to provide traders a simple way to manage their trading activities while on the go. The app simplifies account and fund management and includes novel features such as fingerprint and facial recognition for secure login.

Traders can do everything from depositing and withdrawing funds to monitoring account balances and open positions in real-time.

The app is also uniquely capable of handling document submissions for account verification and direct access to customer support via live chat, making it a comprehensive mobile trading tool for Ghanaian traders.

Is Tickmill’s MetaTrader 4 and platforms customizable?

Yes, you can tailor Tickmill’s MetaTrader 4 and 5 platforms to your specific trading requirements.

Is automated trading allowed on Tickmill’s platforms?

Yes, Tickmill’s MetaTrader 4 and MetaTrader 5 platforms support automated trading.

Range of Markets

Ghanaian traders can expect the following range of markets:

- Forex

- Stock Indices

- Energies

- Precious Metals

- Bonds

- Cryptocurrencies

Financial Instruments and Leverage

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 62 | FCA, CySEC: 1:30 FSA, LFSA, FSCA: 1:500 |

| ➡️ Precious Metals | 4 | FCA, CySEC: 1:20 FSA, LFSA, FSCA: 1:500 |

| ➡️ Indices | 23 | FCA, CySEC: 1:20 FSA, LFSA, FSCA: 1:100 |

| ➡️ Stocks | 98 | FCA, CySEC: 1:20 FSA, LFSA, FSCA: 1:20 |

| ➡️ Cryptocurrency | 8 | FCA, CySEC: 1:200 FSA, LFSA, FSCA: 1:200 |

| ➡️ Energies | 3 | FCA, CySEC: 1:10 FSA, LFSA, FSCA: 1:100 |

| ➡️ Bonds | 4 | FCA, CySEC: 1:5 FSA, LFSA, FSCA: 1:100 |

Does Tickmill offer trading in cryptocurrencies?

Yes, the broker allows you to trade several cryptocurrencies.

What types of Forex pairs does Tickmill offer?

The broker provides a diverse selection of Forex pairs, including major, minor, and exotic pairs.

Broker Comparison for Range of Markets

| 🥇 Tickmill | 🥈 Exness | 🥉 Pepperstone | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | No | No |

Trading and Non-Trading Fees

Spreads

Tickmill offers variable spreads depending on account type and financial instrument traded. For example, spreads on the Pro Account begin at 0.0 pips, while spreads on the Classic Account begin at 1.6 pips.

Spreads are competitive and should be considered as one of the primary trading costs by traders.

Commissions

The broker only charges commissions on Pro and VIP accounts. The commission for the Pro Account is $4 per lot, while the VIP Account is $2. The Classic Account, on the other hand, is commission-free but has slightly wider spreads to compensate.

Overnight Fees, Rollovers, or Swaps

These are charges for positions held overnight, also known as swap fees. Fees vary depending on the financial instrument and account type.

At midnight EST, swaps are executed with a standard lot size of 100,000 base currency units.

The swap rates for diverse instruments are as follows:

| Instrument | Long (Buy) Swap | Short (Sell) Swap |

| EUR/USD | -6.62 pips | 3.52 pips |

| USTEC | -0.52 pips | 0.26 pips |

| XAU/USD | -29.59 pips | 12.27 pips |

| XAG/USD | -4.05 pips | 2.9 pips |

| EURBOBL | -0.49 pips | -4.76 pips |

| BTC/USD | 0 pips | 0 pips |

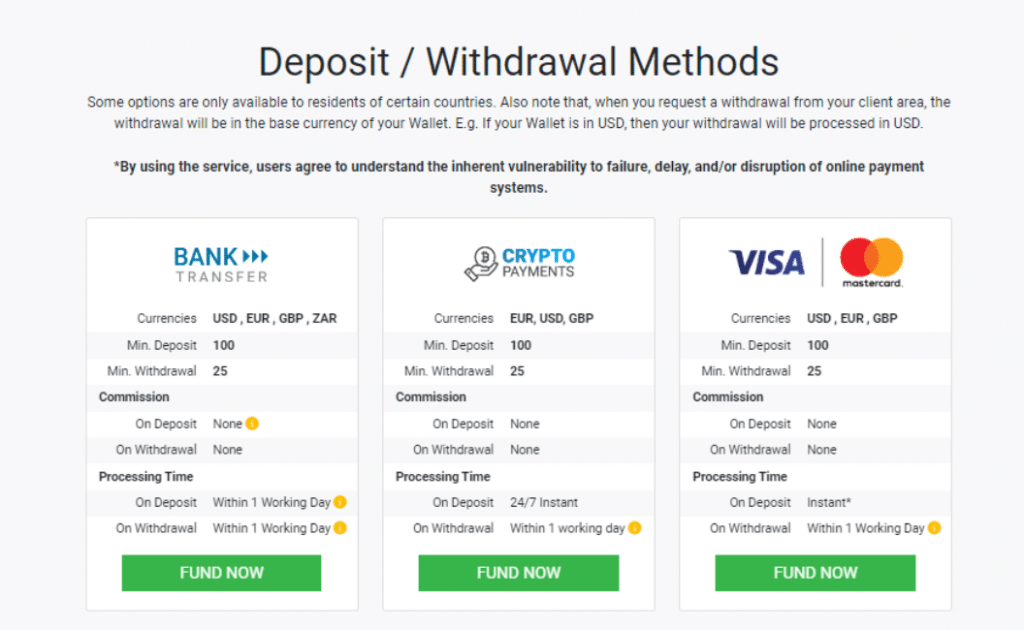

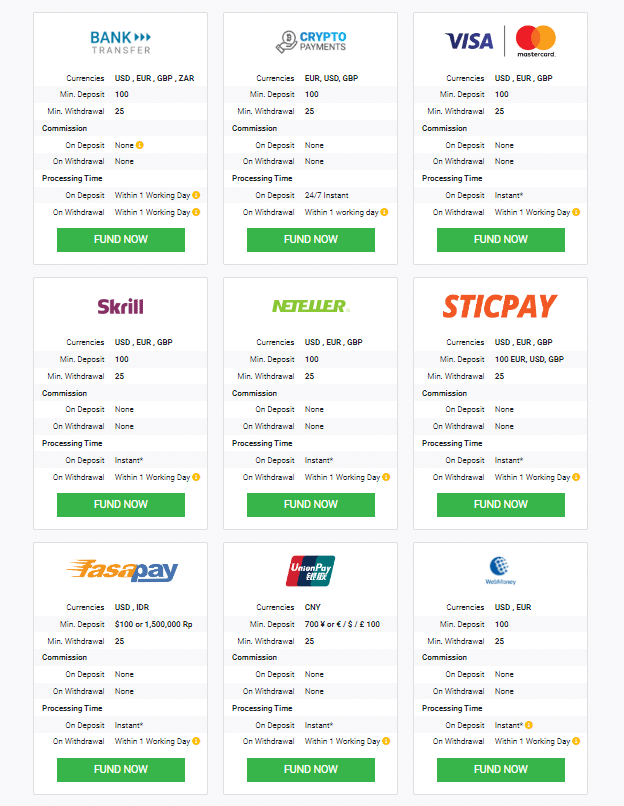

Deposit and Withdrawal Fees

Tickmill does not typically charge fees for deposits or withdrawals. However, it is important to note that third-party payment providers may charge their own fees, which Tickmill will not cover.

Inactivity Fees

Tickmill does not charge inactivity fees, allowing traders to maintain their accounts without penalties.

Currency Conversion Fees

Tickmill may charge a currency conversion fee if you trade in a currency other than the base currency of your account, for instance, GHS. This fee is not explicitly stated but is included in the conversion exchange rate.

Does Tickmill have inactivity fees?

No, the broker does not levy inactivity fees.

How much is the commission on Tickmill’s Pro Account?

Tickmill’s Pro Account commission is $4 per lot.

Tickmill Deposits and Withdrawals

Offers the following deposit and withdrawal methods:

- Bank Transfer

- Crypto Payments

- Debit Card

- Credit Card

- Skrill

- Neteller

- Dotpay

- PayPal

- Trustly

- Sticpay

- FasaPay

- UnionPay

- WebMoney

- Sofort

- Rapid (by Skrill)

Broker Comparison: Deposit and Withdrawals

| 🥇 Tickmill | 🥈 Exness | 🥉 Pepperstone | |

| Minimum Withdrawal Time | 1 Business Day | Instant | 1 business day |

| Maximum Estimated Withdrawal Time | 2 to 7 Business Days | Up to 72 hours | Up to 7 business days |

| Instant Deposits and Instant Withdrawals? | Instant Deposits | Yes | No |

Deposit Currencies, Processing Times, and Minimum Deposit/Withdrawal

| 💳 Payment Method | ⏰ Deposit Processing | ⏱️ Withdrawal Processing |

| 💰 Bank Wire Transfer | 1 working day | 1 working day |

| 💳 Credit/Debit Card | Instant | 1 working day |

| 🪙 PayPal | Instant | 1 working day |

| 💸 WebMoney | Instant | 1 working day |

| 💴 Neteller | Instant | 1 working day |

| 🪙 Skrill | Instant | 1 working day |

| 💰 Dotpay | Instant | 1 working day |

| 🪙 Trustly | Instant | 1 working day |

| 💳 Sticpay | Instant | 1 working day |

| 💸 FasaPay | Instant | 1 working day |

| 🪙 UnionPay | Instant | 1 working day |

| 💳 WebMoney | Instant | 1 working day |

| 🪙 Sofort | Instant | 1 working day |

| 💸 Rapid (by Skrill) | Instant | 1 working day |

Is there a minimum deposit requirement with Tickmill?

Yes, the brokers minimum deposit is usually $100, but this can vary depending on the account type.

Are there any fees for making deposits with Tickmill?

No, the broker does not charge any deposit fees, but third-party payment providers may charge their own.

How to Deposit Funds with Tickmill

To deposit funds to an account with Tickmill, Ghanaian traders can follow these steps:

Step 1: Log In

Log in to your trading account via the website or trading platform.

Step 2: Select ‘Deposit Funds’.

- After logging in, navigate to the ‘Funds Management’ or ‘Banking’ section and select ‘Deposit Funds’.

- Choose the best deposit method for you.

- Enter the amount you’d like to deposit. Check to see if it meets the minimum deposit requirements for your preferred payment method.

- Select the currency in which you want to deposit. Tickmill does not provide GHS-denominated accounts, so you may need to choose USD, EUR, or GBP.

- Examine all of the details and make the deposit.

- Follow any additional instructions, such as completing a verification process if necessary.

- Follow the prompts to complete the transaction.

- You may need to log into your online banking account to approve a bank transfer.

What are the available methods for depositing funds into my Tickmill account?

You can fund your account using various methods, including bank transfers, debit/credit cards, and e-wallets such as Skrill and Neteller.

Is there a maximum deposit limit with Tickmill?

No, the broker does not specify a maximum deposit limit, but following the deposit limits imposed by your preferred payment method is critical.

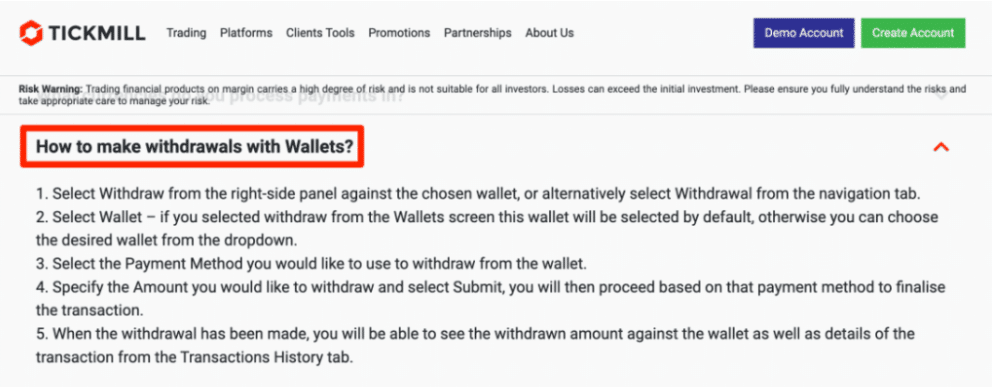

Tickmill Fund Withdrawal Process

To withdraw funds from an account with Tickmill, Ghanaian traders can follow these steps:

Step 1: Log in

Log in to your Tickmill trading account.

Step 2: Select ‘Withdraw Funds’

- Select ‘Withdraw Funds’ from the ‘Funds Management’ or ‘Banking’ section.

- Select your preferred withdrawal method. Using the same method you used to deposit funds is generally recommended.

- Enter the amount you want to withdraw, ensuring it meets the minimum withdrawal requirements.

- Go over all of the information and confirm the withdrawal. You may be required to provide additional documentation for verification.

- Once the withdrawal is processed, the funds will be transferred to the payment method of your choice.

Can I withdraw funds in a different currency than my account’s base currency?

Yes, you can withdraw funds in another currency; however, the broker may charge a currency conversion fee.

Can I withdraw my profits earned from trading with Tickmill?

Yes, you can withdraw profits from your Tickmill trading activities.

Education and Research

Education

Tickmill offers the following Educational Materials to Ghanaian traders:

- Webinars

- Seminars

- eBooks

- Video Tutorials

- Infographics

- Forex Glossary

- Fundamental Analysis

- Technical Analysis

- Educational Articles

- Market Insights

Research and Trading Tool Comparison

| 🥇 AvaTrade | 🥈 Exness | 🥉 Pepperstone | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | Yes, not free | No | Yes |

| ➡️ AutoChartist | Yes | No | Yes |

| ➡️ Trading View | No | Yes | Yes |

| ➡️ Trading Central | No | No | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

Tickmill also offers Ghanaian traders the following additional Research and Trading Tools:

- Access to AutoChartist

- Access to Myfxbook Copy Trading

- Economic Calendar

- Forex Calculators

- Tickmill VPS

- Pelican Trading

- Advanced Trading Toolkit

- Acuity Trading

Are Tickmill’s educational materials available for free?

Yes, the broker provides its educational resources for free, allowing traders to gain valuable knowledge without incurring additional costs.

Can I access Tickmill’s trading signals through the educational resources?

No, you cannot. The broker offers trading signals, but they are distinct from the educational resources. Tickmill Trading Signals are available to traders via the Acuity Trading Signal Centre.

10 Best Forex Brokers in Ghana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

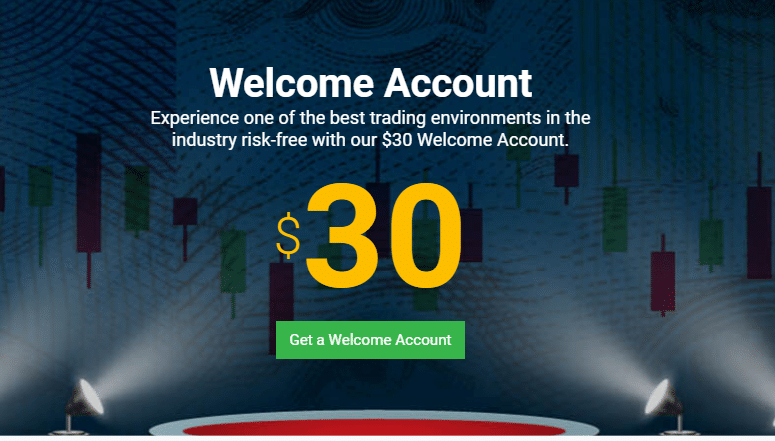

Bonuses and Promotions

offers Ghanaian traders the following bonuses and promotions:

- Welcome Bonus (No-Deposit Bonus)

- Trader of The Month

Welcome Account Bonus

The broker provides a Welcome Account Bonus to new customers. New traders are automatically credited with a trading bonus upon registration. It should be noted that this bonus is only available once per client.

The bonus is subject to certain conditions, including profit withdrawal limits ranging from $30 to $100. This promotion is intended to entice new traders to explore there trading environment while allowing them to profit.

Trader of the Month Bonus

Tickmill’s Trader of the Month bonus incentivizes and rewards top traders. Each month, the trader with exceptional profitability and risk management is automatically selected to receive a $1,000 prize.

This bonus recognizes trading skills and encourages traders to use effective risk management strategies.

How does the “Trader of the Month” bonus work, and how can I qualify for it?

The “Trader of the Month” bonus awards a $1,000 prize to the best-performing live account holder each month based on profitability and risk management criteria.

Does Tickmill offer any other ongoing promotions or bonuses?

Yes, the broker introduces new promotions and bonuses. For the most recent offers, traders should visit the official website or contact customer service.

How to open an Affiliate Account

To register an Affiliate Account, Ghanaian traders can follow these steps:

Step 1 – Click on the “Partnerships” tab at the top menu of the website.

On the website locate the “Partnerships” tab at the top menu bar then click on it then click on “Introducing broker”.

Step 2 – Click on the “Become a CPA Affiliate” button.

After clicking on the “Partnerships” tab you can click on the “Become a CPA Affiliate” button located close to the bottom of the page.

Step 3 – Fill in the form

Fill in all your required personal details to complete the form.

The affiliate account has been created.

Is there a minimum requirement or qualification for becoming a Tickmill affiliate?

No, the broker does not usually specify a minimum requirement for becoming an affiliate.

Once approved, how can I start promoting Tickmill as an affiliate?

You can guide them through the account opening process using your unique affiliate referral links and Tickmill marketing materials.

Affiliate Program Features

Tickmill’s Affiliate Account program in Ghana offers valuable opportunities for both new and experienced traders. It boasts a robust reporting system that provides real-time insights into referral performance, including commissions earned, aiding in fine-tuning marketing strategies.

The program also features a competitive commission structure, allowing affiliates to choose from CPA and revenue-sharing models. Transparent commission rates ensure fair compensation, and Tickmill provides marketing materials in multiple languages for effective promotion.

Affiliates earn commissions based on their referred clients’ trading volume, varying rates by account type. Monthly bonuses, potentially reaching up to $5,000, are available in addition to regular CPA pay-outs.

Furthermore, payments are typically made monthly, subject to partnership agreements’ minimum payment thresholds or withdrawal fees.

What commission structure does Tickmill offer for its Affiliate Program?

The Introducing Broker (IB) program offers specific commission rates for qualified trades, such as $10 per lot on a Classic account and $2 per lot on PRO and VIP accounts.

How often are commissions paid to Tickmill affiliates?

The broker affiliate commissions are typically paid out monthly.

Customer Support

With its headquarters in London, the United Kingdom, the broker offers broad trading services and client support. From 7 am to 4 pm GMT Monday to Friday, traders can contact them on any of the available communication channels.

The broker also has a help email with a 24-hour response time on business days. A live chat option is also accessible on the official website, with 14 different languages to pick from.

| Customer Support | Tickmill’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English, Malay, Polish, Indonesian, Arabic, Thai, Chinese, Vietnamese, Portuguese |

| 🗯 Live Chat | Yes |

| 📧 Email Address | [email protected] |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Ghana? | No |

| 🥇 Overall quality of Tickmill Support | 4.2/5 |

Corporate Social Responsibility

Tickmill’s commitment to Corporate Social Responsibility (CSR) aims to make a significant societal impact, particularly in improving social welfare and fostering sports development.

Furthermore, Tickmill works closely with the Gajusz Foundation for Terminally Ill Children to provide ongoing support and resources to these children and their families.

Tickmill also donates to the Bärenherz Children’s Hospice in Germany, demonstrating its unwavering commitment to providing compassionate care to children facing life-threatening illnesses.

These initiatives demonstrate Tickmill’s deep sense of social responsibility, extending its positive impact beyond its core business endeavours.

Our Verdict

In our experience, Tickmill is a solid trading platform that caters to both novice and experienced traders, according to our thorough analysis.

Its account types, including Classic, ECN Pro, and VIP, provide flexibility, while MetaTrader 4 and 5 trading platforms offer advanced functionality.

Furthermore, our findings show that the educational and research materials are extensive, allowing traders to make educated decisions. Tickmill’s customer service is responsive but could use more hours of support.

With transparent commission structures and real-time reporting, the affiliate program is profitable. However, the lack of a GHS-denominated account necessitates currency conversion fees for Ghanaian traders.

The Cashback Rebate and other promotional programs add value, but regional limitations exist. Overall, Tickmill provides a well-rounded trading experience, but it could improve customer support and currency options to appeal to a wider audience.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Tickmill offers dedicated, prompt customer support 24 hours a day, 5 days a week | There are only a few asset classes and financial instruments offered |

| There is a selection of funding and withdrawal options offered by Tickmill | There are no fixed spreads offered by Tickmill |

| Tickmill offers a no-deposit bonus to new traders | There are currency conversion fees when Ghanaian traders deposit or withdraw in GHS |

| There are low spread costs and high leverage ratios offered | Additional commissions are applied to the Islamic account when positions are held for longer than three days |

| Tickmill is well-regulated and has a good reputation | |

| There are several tools provided to advanced traders including AutoChartist, FIX API, and more | |

| MetaTrader 4 and MetaTrader 5 are both offered by Tickmill | |

| There is a commission-free trading account offered to Ghanaian traders |

You might also like: InstaForex Review

You might also like: AvaTrade Review

You might also like: Exness Review

You might also like: BDSwiss Review

You might also like: HFM Review

Conclusion

For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker.

Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements.

Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Now it is your turn to participate:

- Do you have any prior experience with Tickmill?

- What was the determining factor in your decision to engage with Tickmill?

- Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

- Have you experienced issues with Tickmill, such as difficulty withdrawing funds, inability to verify regulations, unresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

What are the account types offered by Tickmill?

Tickmill has three account types: Classic, ECN Pro, and VIP, each with features and benefits to meet various trading needs.

Is Tickmill Safe or a Scam?

Yes, Tickmill is verified as a reliable and legitimate platform due to its regulation by esteemed financial authorities and a commendable reputation among traders.

Is Tickmill regulated?

Yes, Tickmill is subject to regulation by various financial authorities, such as the Seychelles Financial Services Authority (FSA) and the United Kingdom’s Financial Conduct Authority (FCA), among others.

What are the deposit and withdrawal methods available on Tickmill?

To ensure convenient and secure transactions for its clients, Tickmill offers a variety of deposit and withdrawal options, including bank wire transfers, credit/debit cards, and e-wallets.

How long does it take to withdraw from Tickmill?

Tickmill withdrawals usually require one business day for processing.

Does Tickmill have Nasdaq 100?

Yes, Tickmill offers trading for Nasdaq 100, which is also referred to as ‘USTEC’ through their platform.

What are the trading tools and resources offered by Tickmill?

Tickmill offers a variety of trading tools and resources, such as market analysis, economic calendars, and educational materials, to assist traders in making informed decisions and improving their trading skills.

Does Tickmill have VIX 75?

No, the Volatility 75 Index is not part of Tickmill’s financial instrument portfolio.

What are the customer support options available on Tickmill?

Tickmill provides 24/5 customer support via live chat, email, and phone, ensuring clients can get help whenever needed.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all Ghanaian investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Namibian Dollar Forex Trading Accounts

Namibian Dollar Forex Trading Accounts

Scam Forex Brokers in Ghana

Scam Forex Brokers in Ghana