HFM Review

HFM is a low-spread broker offering Ghanaians a lucrative revenue share affiliate program with a $5,000 additional bonus offer. HFM caters to Ghanaians by offering easy withdrawals and excellent copy and crypto trading opportunities.

- Lesche Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawals

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 0 / 0 GHS

Regulators

FSCA, CySEC, DFSA, FSA, CMA

Trading Desk

MT4, MT5, HFM Platform (Android & IOS)

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

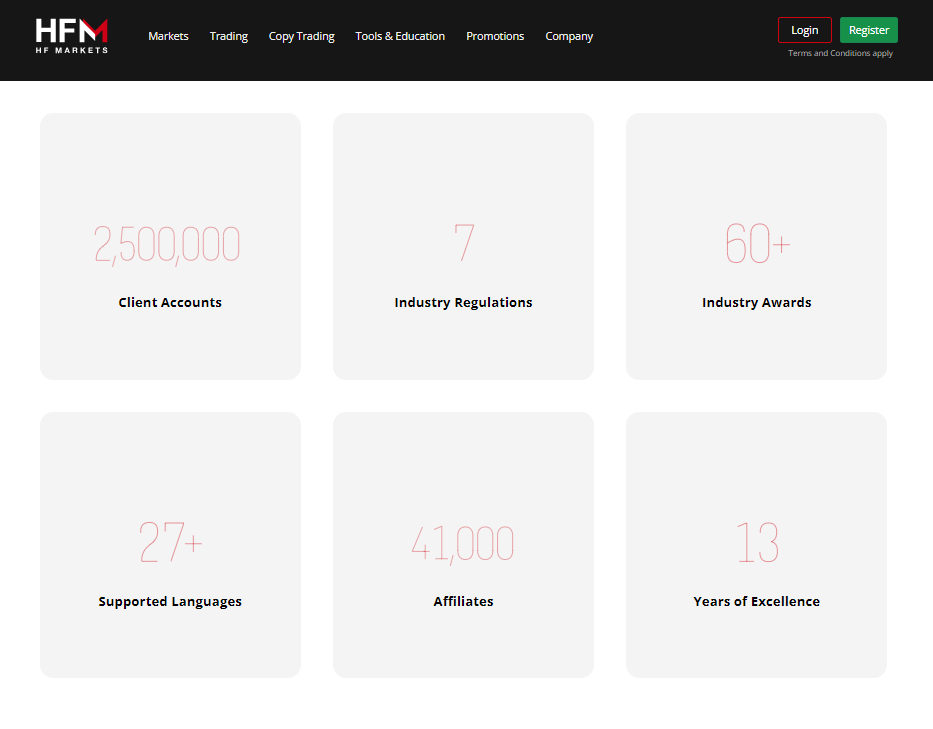

HFM was founded in 2010 to meet the demand for accessible forex and CFD trading platforms globally. HFM is a trusted broker in Ghana that offers low-risk investing choices.

In addition, according to our findings about HFM, it is popular among Ghanaian traders. It offers a user-friendly platform with excellent trading technologies and access to several financial markets where Ghanaians can benefit from price movements.

From its range of flexible account types, we found that HFM’s Cent to Pro Plus accounts suit traders of various risk tolerances and styles.

Our evaluation covers HFM’s journey and its Ghanaian trader-specific offerings. The broker follows worldwide regulatory requirements set by FSCA, CySEC, and FCA, giving traders confidence in preserving their capital.

HFM has done well in adapting and expanding its offerings for Ghanaian traders. This is clear considering that HFM has competitive trading conditions, multi-currency accounts, and dedicated customer support.

With over 2.5 million traders worldwide, HFM’s success shows its dedication to customer satisfaction. Ghanaian traders like HFM’s affiliate programs and competitive trading conditions, including spreads from 0.0 pips and leverage up to 1:2000.

HFM also offers training materials and a comprehensive, fair, and transparent trading environment, creating a worldwide market-savvy trading community.

HFM’s broker adventure began 14 years ago and the broker continues to grow, meeting and exceeding the expectations of its millions of clients, including Ghanaians.

HFM is a great alternative for financial traders seeking tradition, innovation, and specialized services with its present products and continuous developments.

How long has HFM served Ghanaian traders?

HFM has offered Ghanaian traders a secure and user-friendly trading environment since its inception in 2010.

Is HFM’s trading platform suitable for new and experienced Ghana traders?

Yes, HFM’s user-friendly platforms, like MetaTrader 4 and 5, cater to traders of all skill levels by offering comprehensive analytical tools and configurable interfaces.

HFM at a Glance

| 📊 Year Founded | 2010 |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 🏛 Ease of Use Rating | 5/5 |

| 💰 Bonuses | Yes, deposit bonuses, top-up bonuses, giveaways, affiliate promotions, trader awards, loyalty programs, demo contests, merchandise |

| 🌎 Support Hours | 24/5 |

| 📱 Trading Platforms | MetaTrader 4, MetaTrader 5, HF App |

| 📈 Account Types | Cent, Premium, Zero, Pro, Pro Plus |

| 💰 Base Currencies | USD, NGN, ZAR |

| 📊 Starting spread | From 0.0 pips EUR/USD (Zero Account) |

| 📊 Leverage | 1:2000 |

| ✔️ Currency Pairs | Yes, 53+ |

| 💳 Minimum Deposit (GHS) | From 0 USD for Account Opening, 67 GHS ($5) when using a Credit/Debit Card or Skrill |

| 📉 Inactivity Fee | Yes, $5 after 6 months |

| 📱 Website Languages | English, Portuguese, Spanish |

| 💰 Fees and Commissions | Spreads from 0.0 pips, commissions from $6 per round |

| ✔️ Affiliate Program | Yes |

| 🔎 Banned countries | The United States, Canada, Sudan, North Korea, and Syria |

| 📉 Scalping | Yes |

| 📈 Hedging | Yes |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a GHS Account? | No |

| 📉 Dedicated Ghana Account Manager? | No |

| 💻 Tradable Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Crypto CFDs, Bonds, ETFs |

| 👉 Open Account | 👉Open Account |

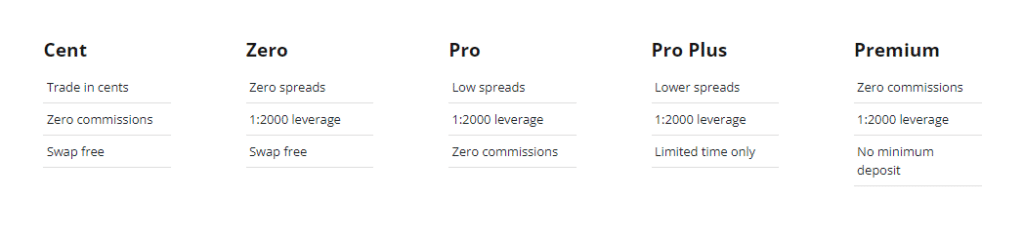

HFM Account Types

| 💻 Live Account | 👉 Open Account | 📉 Minimum Dep. | 💰 Commissions | 💸 Leverage |

| ➡️Cent Account | 👉Open Account | 0 GHS | None; only the spread is charged | 1:2000 |

| ➡️ Zero Account | 👉Open Account | 0 GHS | $0.03 per 1,000 units traded | 1:2000 |

| ➡️ Pro Account | 👉Open Account | 1,340 GHS | None; only the spread is charged | 1:2000 |

| ➡️ Pro Plus | 👉Open Account | 3,345 GHS | None; only the spread is charged | 1:2000 |

| ➡️ Premium Account | 👉Open Account | 0 GHS | None; only the spread is charged | 1:2000 |

Demo Account

Ghanaian traders can practice trading without risk with the HFM Demo Account. We found a realistic simulation of current market circumstances on this virtual trading platform, allowing users to try basic to expert trading methods.

This unique demo account lets traders test HFM’s trading environment and MetaTrader 4 and 5 platforms. The option for traders to modify demo account balances accurately simulates how different capital amounts would perform in real market situations.

Furthermore, this preparation is crucial for traders who want to make educated selections before actual trading.

Islamic Account

For Sharia-compliant traders, HFM provides an Islamic Account. We noticed that this account does not charge swap costs on overnight holdings, which benefits Muslim traders.

Carry Charges for prolonged positions ensure transparency and ethical trading. This account option lets Ghanaian Islamic finance traders trade the markets while sticking to their faith.

Cent Account

The HFM Cent Account has been created to make trading in Ghana easier for beginners. After careful examination, we identified no minimum deposit, which is wonderful news for beginners who might still be wary to start trading.

This Cent Account lets beginners trade with 0.01 lots, reducing risk. It works well with MetaTrader 4 and 5, and its versatility makes it a good choice for Ghanaian traders new to Forex and CFD markets.

Zero Account

The HFM Zero Account can be a great solution for Ghanaian scalpers and high-frequency traders. Furthermore, this account’s 0.0 pips spreads can help traders reduce costs while maximizing profit potential.

Trading micro-lots from 0.01 lots gives Ghanaians exact control over trade sizes, and high-volume traders benefit from the clear commission structure.

This account allows traders to capitalize on small spreads in fast-paced markets utilizing MetaTrader platforms.

Pro Account

The HFM Pro Account is for experienced Ghanaian traders. Not only is this account affordable with professional-grade features, but it also has a reasonable 1,340 GHS minimum deposit.

This account gives traders confidence to traverse markets with spreads from 0.5 pips and leverage up to 1:2000. Its interoperability with MetaTrader platforms allows complex trading methods, making it suitable for traders seeking professional conditions at low cost.

Pro Plus Account

Ghanaian traders seeking the best circumstances can consider the HFM Pro Plus Account. We found that this account provides spreads starting at 0.2 pips, meeting the standards of experienced traders.

Despite its higher minimum deposit, it targets serious, market-savvy traders. With improved trading conditions, leverage choices up to 1:2000, and full access to MetaTrader platforms, the HFM Pro Plus Account is the best option for professionals looking to perfect their HFM trading experience.

Premium Account

The HFM Premium Account is better for more experienced Ghanaians. Based on our trading experience, the premium account can benefit those with more complex strategies and higher risk tolerance.

The lack of a minimum deposit requirement is one of its best characteristics. It provides experienced traders with a good start where they can deposit any amount they are comfortable with, catering to their investment styles and risk management strategies.

The spreads on this account start at 1.2 pips, and there are no commission fees, making it cost-effective for casual traders.

Using leverage up to 1:2000 allows for aggressive trading techniques that more professional traders use. In addition, like the Cent Account, it’s compatible with MetaTrader platforms and provides a large selection of trading instruments, making it an excellent alternative for advanced traders.

What features set the Premium Account apart from other HFM account categories for Ghanaian traders?

The Premium Account provides attractive spreads, no minimum initial investment, access to various trading products, and dedicated account managers for customized help.

Does HFM provide specific accounts for Islamic traders in Ghana?

Yes, HFM offers an Islamic Account based on Sharia law principles, with swap-free trading and clear carry fee rules for Ghanaian traders.

How to open an HFM Account – A Step-by-Step Guide

To open an account, Ghanaians can follow these steps:

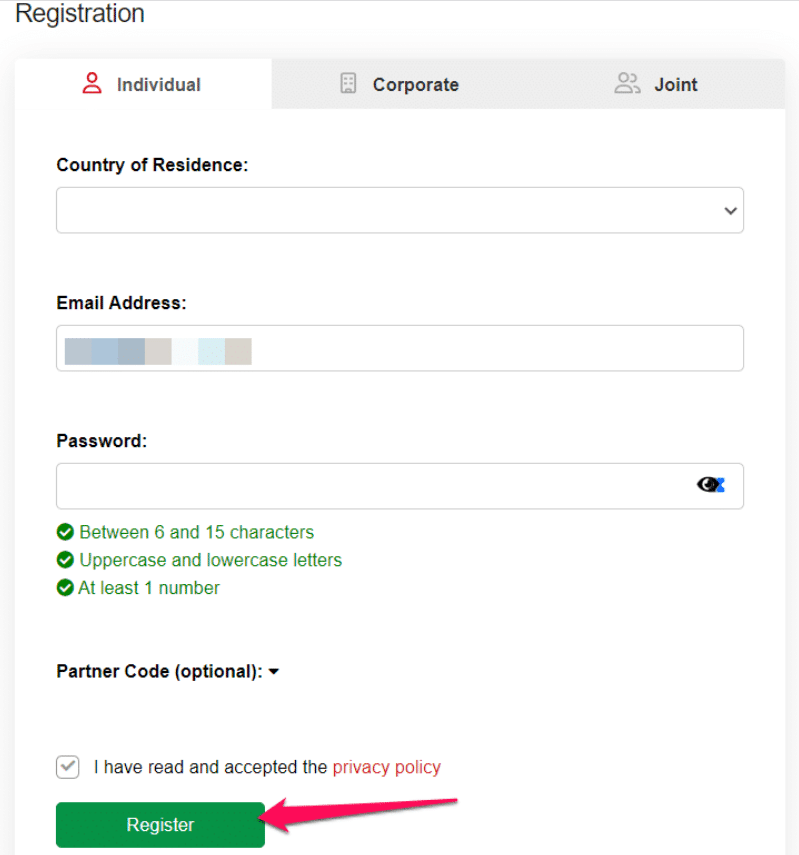

Step 1. Register

- Navigate to the official website and select the option to register from the homepage.

Step 2. Complete Application

- Complete the online application and include your complete Country of residence, email address, and password.

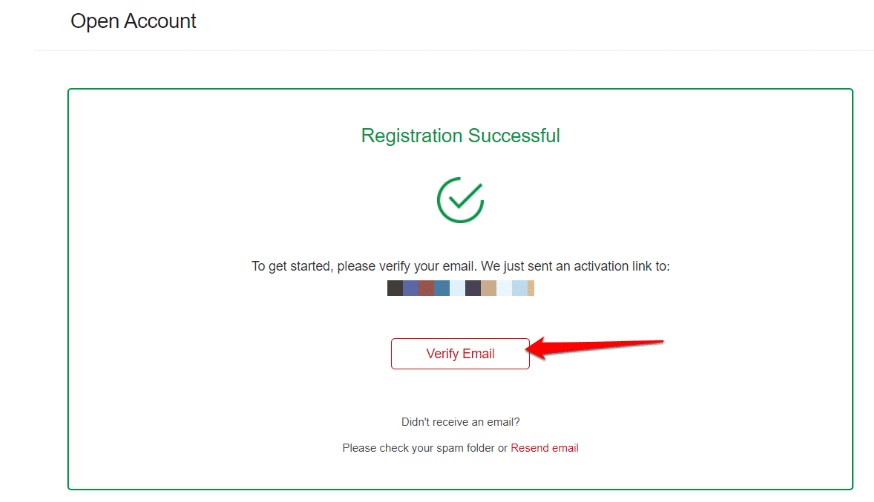

Step 3. Receive Email

- After registration, you will receive a link to your email.

- After completing this process, you will gain access to the MyHF dashboard. This is the administrative center for a demo, live, and other accounts.

- Select your account type from the available account options and upload all Know Your Customer (KYC) documents through the MyHF portal. To be accepted as a retail trader, required at least two documents namely proof of identity and proof of residence.

- Proof of Identification can be a colored scanned copy (in PDF or JPG format) of your current (not expired) passport. If a legitimate passport is not available, a picture identification card or driver’s license with a comparable design can suffice.

How long does it take Ghanaian traders to validate and activate their HFM accounts?

Account verification and activation dates can vary, but Ghanaian traders should anticipate their accounts to be validated within one to two business days of submitting the necessary papers.

Are there any basic currency requirements for Ghanaian traders when starting an HFM account?

Yes, there are. Ghanaians cannot register a GHS-denominated account with HFM. Thus, traders must choose an account denominated in USD if they cannot use ZAR or NGN.

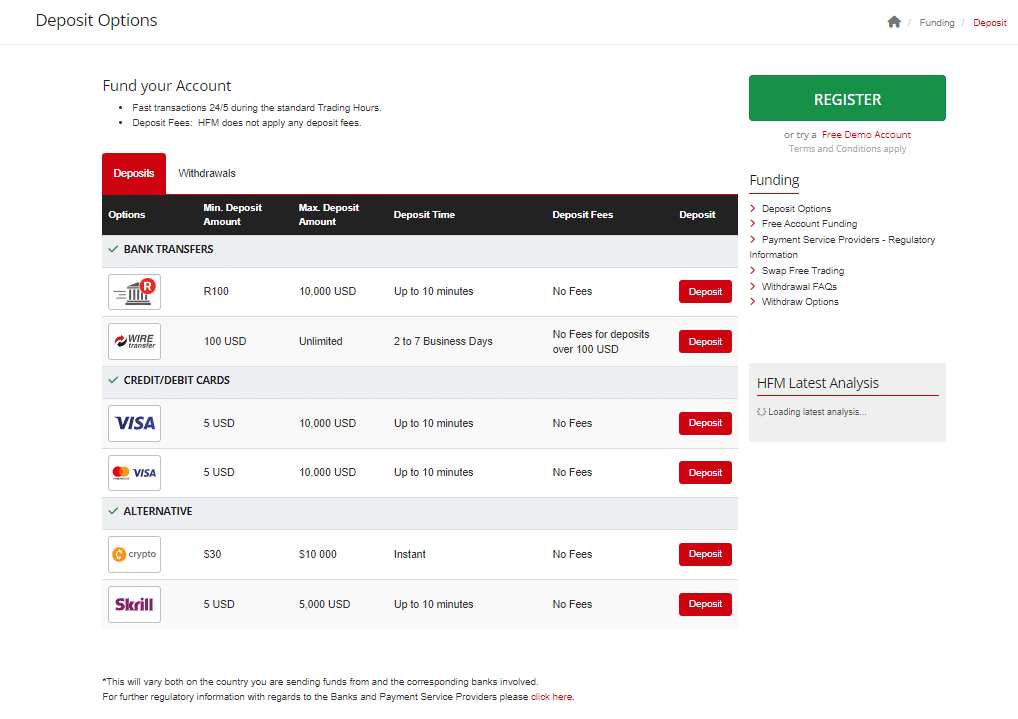

HFM Deposit & Withdrawal Options

| 💳 Payment Method | 🌎 Country | 💴Currencies Accepted | ⏱️Processing Time |

| 💰 Bank Wire Transfer | All | Depends on region | 2 – 10 days |

| 💳 Electronic Transfer | South Africa | Depends on region | 10 minutes – 2 days |

| 🪙 Credit Card | All | Depends on region | 10 minutes – 2 days |

| 💸 Debit Card | All | Depends on region | 10 minutes – 2 days |

| 🪙 Skrill | All | Depends on region | 10 minutes – 2 days |

Deposits

How to Deposit using Bank Wire Step by Step

➡️Access the HFM client portal and navigate the ‘Deposit Funds’ area.

➡️Select ‘Bank Wire Transfer’ as your desired deposit method.

➡️If available, select GHS as the transaction currency to simplify local currency transactions.

➡️Provide the deposit amount and submit your bank information, including the account number and SWIFT/BIC code.

➡️Confirm all details for accuracy to avoid delays or problems with the transaction.

➡️Submit the deposit request; the funds should be available in your HFM account within 2 to 10 days, depending on regional banking regulations.

How to Deposit using Credit or Debit Card Step by Step

➡️Navigate to the ‘Deposit Funds’ area of the HFM client portal.

➡️Select ‘Credit/Debit Card’ as your deposit method.

➡️If the option is available, select GHS as the transaction currency.

➡️Enter the amount you want to deposit.

➡️Enter your card information, including the number, expiration date, and CVV/CVC code.

➡️Check all of the entered information for accuracy to ensure a seamless transaction.

➡️Finalize the deposit request; the funds should show in your HFM account within minutes to a few hours of your bank’s authorization.

How to Deposit using Cryptocurrency Step by Step

➡️Log in to the HFM Client Portal.

➡️Go to ‘Deposit Funds’ and pick the cryptocurrency you want to use for the deposit.

➡️Enter the deposit amount and, if possible, select GHS as the currency for the transaction.

➡️HFM will offer a unique wallet address for the deposit.

➡️Use this address to send funds from your cryptocurrency wallet to the HFM account.

➡️Verify and confirm the transaction; the deposit should appear in your HFM account following the blockchain confirmation, which can take anywhere from a few minutes to an hour.

How to Deposit using e-Wallets or Payment Gateways Step by Step

➡️Log in to the HFM client portal and navigate the ‘Deposit Funds’ area.

➡️Choose your favorite e-wallet or payment gateway, such as Skrill or Neteller.

➡️If GHS is available, use it as the transaction currency to speed up the process.

➡️Enter the deposit amount and give your e-wallet information.

➡️Confirm that all transaction details are correct.

➡️You will be rerouted to your e-wallet service to finish the transaction. The funds should be credited to your HFM account within minutes of validating the transaction.

Withdrawals

How to Withdraw using Bank Wire Step by Step

➡️Enter the HFM customer area and navigate to the ‘Withdrawal’ section.

➡️Select ‘Bank Wire Transfer’ as the withdrawal option.

➡️Input the amount you want to withdraw and, if available, select GHS as the transaction currency.

➡️Provide the right banking information, such as your account number and SWIFT/BIC code.

➡️Confirm all of the given information to confirm that it is correct.

➡️Submit the withdrawal request; processing times range from 2 to 10 business days, depending on your bank and location.

How to Withdraw using Credit or Debit Cards Step by Step

➡️Access the withdrawal area of the HFM client portal.

➡️Choose ‘Credit/Debit Card’ as your withdrawal method.

➡️Enter the withdrawal amount and select GHS as the currency if it is available.

➡️Verify your card information, including the last four numbers, expiration date, and withdrawal amount.

➡️To ensure a smooth withdrawal procedure, ensure all information is correct.

➡️Submit the withdrawal request; funds normally take 24 hours to 5 business days to appear on your card, depending on processing schedules.

How to Withdraw using Cryptocurrency Step by Step

➡️Login to your HFM account and navigate to the ‘Withdrawal’ area.

➡️Choose the ‘Cryptocurrency Wallet’ option for your withdrawal.

➡️Specify the withdrawal amount and, if available, choose GHS as the currency for the transaction.

➡️Before submitting the withdrawal request, make sure your crypto wallet address is correct.

➡️After confirmation, the funds should be transmitted to your crypto wallet at the appropriate blockchain confirmation times.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

➡️Log into the HFM client portal and navigate the ‘Withdrawals’ area.

➡️Choose your favorite e-wallet for withdrawals, such as Skrill or Neteller.

➡️Indicate the withdrawal amount and, if applicable, choose GHS as the transaction currency.

➡️Check that all e-wallet account information is correct to avoid any transfer difficulties.

➡️Submit your withdrawal request; funds are normally sent within minutes to a few hours, depending on the transaction’s verification.

Are there any deposit fees for Ghanaian traders on HFM?

No, HFM does not impose deposit fees for transactions beyond a particular threshold, usually $100, but Ghanaian traders should verify with their payment providers for any additional expenses.

Are there any minimum or maximum deposit limits for Ghanaian traders on HFM?

Yes, HFM imposes minimum deposit restrictions based on account type and payment method, which begin at 67 GHS ($5) for various payment methods, while maximum deposit limitations can differ.

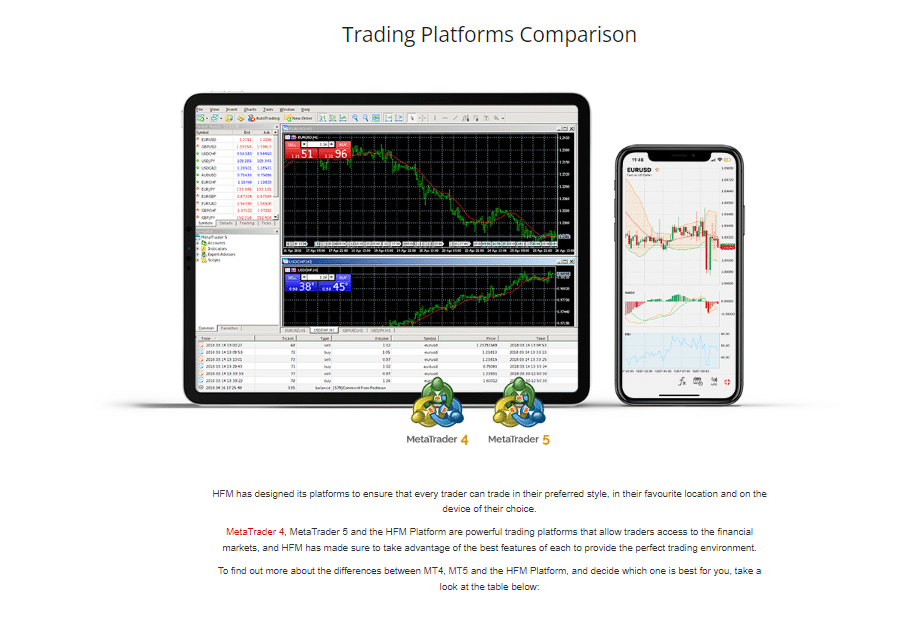

HFM Trading Platforms and Software

HF App

Of all the trading platforms HFM offers to traders in Ghana, we discovered that the HF App is the most responsive and easy to use.

Our testing showed that traders of all skill levels can quickly and easily navigate the app thanks to its user-friendly design. Keeping tabs on the markets, making transactions, and managing our accounts while on the move was a breeze.

For Ghanaians who need a powerful trading platform that can keep up with HFM’s ever-changing trading environment, the HF App’s ability to manage deposits and withdrawals straight from the app is a major plus.

MetaTrader 4

We were extremely impressed by what HFM offers regarding MetaTrader 4 and the integration of comprehensive trading features.

HFM’s MetaTrader 4 (MT4) is a reliable and versatile trading platform that offers a wide range of tools to suit its trading conditions.

Its advanced charting features enable thorough technical analysis, especially with competitive spreads. The platform’s extensive selection of indicators allows for personalized trading experiences, aligning with HFM’s account options.

MT4’s ability to manage multiple orders simultaneously is advantageous, especially with HFM’s high leverage of up to 1:2000. The platform’s stability and responsiveness complement HFM’s trading environment, ensuring swift execution and reliability.

Overall, MT4 is an ideal choice for traders seeking performance and ease of use, as it perfectly encapsulates HFM’s blend of advanced functionality and user-friendly interface.

MetaTrader 5

While testing MT5, we found that it has several features that improved our trading experience. The platform effortlessly connects with HFM’s extensive variety of tradable instruments, providing additional timeframes and graphical tools for market analysis.

MT5’s enhanced charting and capacity to handle additional pending orders can benefit Pro Plus account users seeking precise entry and exit locations, according to our testing.

The multi-threaded strategy tester, which back-tests several currency pairings simultaneously, was impressive, especially given HFM’s 53 currency pairs.

Due to its extensive market capabilities, MT5 improves trading transparency and market liquidity, crucial for HFM leveraged products.

The platform’s support for stocks, currency, and commodities makes it suitable for testing HFM’s diversified trading products. Overall, MT5 is a powerful instrument for Ghanaian professional traders, giving a complex and varied trading environment.

Does HFM provide a proprietary trading platform for Ghanaian traders?

Yes, HFM gives Ghanaian traders access to the HF App, a proprietary trading platform with a user-friendly interface and rapid trade execution on mobile devices.

Are there any limitations to the availability of trading platforms for Ghanaian traders based on their account type?

No, HFM offers all account kinds, from Cent to Pro Plus, access to the same trading platforms, assuring equitable chances for all Ghanaian traders.

Trading Instruments & Products

HFM offers the following trading instruments and products:

➡️Precious Metals – HFM provides Ghanaian traders with six precious metals, including Silver, Gold, Platinum, and Palladium, with spreads from 0.03 pips and maximum leverage up to 1:2000.

➡️Energies – For individuals interested in volatile markets, HFM offers the opportunity to trade energy commodities such as oil and natural gas, with spreads from 0.04 pips and margin requirements of 0.5% of the notional value.

➡️Cryptocurrencies – HFM offers a variety of 40 cryptocurrencies for trading, giving Ghanaian traders access to the developing digital currency market. Ghanaians can expect leverage of up to 1:50, negative balance protection, and the opportunity to trade rising and falling prices.

➡️Forex – More than 53 forex currency pairs are available on HFM MetaTrader 4 and 5. While HFM offers several exotic forex pairs, GHS is not included in any of them.

➡️Bonds – Ghanaian traders can broaden their portfolios with HFM by trading three distinct bond products, including Euro Bund, UK Gilt, and US 10-year Treasury Notes, with spreads from 0.05 pips and no swap fees.

➡️ETFs – HFM expands its product offering to 33 ETFs, providing Ghanaians with cost-effective solutions, profile diversification, and more.

➡️Spot Indices – HFM also has 11 spot indices that can be traded across account types and can indicate the performance of individual sectors or whole economies without directly participating in the stock market.

➡️Futures Indices – HFM provides 11 indices contracts, a strategic instrument for risk management and profiting on market trends.

➡️Stock CFDs – HFM offers 109 Stock CFDs, which allow traders to speculate on stock price changes on popular names like Apple, Netflix, Amazon, Bayer, Anglo-American, and more.

➡️Commodities – There are five tradeable commodities accessible, including precious metals, agricultural items, and raw minerals, allowing traders to broaden their strategy beyond typical financial instruments.

Does HFM provide bond trading opportunities to Ghanaian traders?

Yes, HFM allows Ghanaian traders to speculate on government debt instruments through bond trading

Are there any restrictions on the number of stock CFDs accessible to Ghanaian traders on HFM?

HFM provides Ghanaian traders with a wide range of 109 stock CFDs.

Spreads and Fees

Spreads

HFM’s Ghanaian spreads are suited to different trading techniques. Spreads are competitive from 0.0 pips for the Zero account, making them perfect for aggressive traders, especially scalpers who profit from little price swings.

We liked these narrow spreads because they let traders maximize earnings by lowering trading costs. Cent and Premium accounts with spreads from 1.2 pips are cost-effective for beginners and experienced traders.

HFM’s tiered spread structure meets Ghanaian traders’ varying demands by offering a variable pricing structure that matches market participation.

Commissions

The HFM commission structure is clear and competitive. Zero account fees are $0.03 per 1,000 units traded, making it perfect for high-frequency traders who want low-cost transactions.

This allows more transactions while controlling expenses with leverage up to 1:2000. HFM’s Cent and Premium accounts have no commissions, indicating its dedication to Ghanaian traders.

Overnight Fees

Overnight fees with HFM vary by instrument and liquidity provider rates, affecting long-term trading strategy cost-effectiveness.

Trading with leverage requires Ghanaian traders to understand swap rates since costs can accumulate and affect profitability. Furthermore, HFM charges triple exchange rates on Wednesdays to cover the weekend, which we know is an industry standard for many brokers.

Deposit and Withdrawal Fees

Deposit and withdrawal costs are usually free for transactions over $100. Therefore, smaller transactions and bank wire transfers can incur costs, therefore Ghanaians should be aware of transaction sizes.

Inactivity Fees

Inactive accounts for six months incur a $5 monthly fee from HFM. While not excessive, it underscores the significance of active account management for Ghanaian traders to minimize avoidable costs.

Currency Conversion Fees

HFM doesn’t provide GHS accounts; thus, Ghanaians must pay conversion costs when depositing or withdrawing funds. HFM has competitive conversion rates.

With lower capital to trade, conversion fees can significantly affect results. Therefore, Ghanaians should work these charges into their trading plan.

Does HFM charge fixed spreads on its trading accounts?

No, HFM does not charge set spreads for any of its account categories, instead offering traders variable spreads that can change depending on market circumstances.

Are there any fees or swaps for holding investments overnight on HFM?

Yes, Ghanaian traders can be charged overnight fees or swaps for holding holdings on HFM, which vary depending on the instrument transacted and the current market circumstances.

Leverage and Margin

We examined HFM’s leverage and margin requirements for Ghanaian traders, which are vital to their trading setup. HFM Cent to Pro Plus accounts have up to 1:2000 leverage, which is higher than many other brokers offer, with a typical 1:200 – 1:400 being the norm.

We know that appropriate use of this leverage can greatly expand a trader’s market exposure. It lets Ghanaian traders obtain greater market positions with a minimal initial commitment.

However, high leverage increases the danger of bigger losses; thus, it should be approached cautiously and with a risk management strategy.

We saw that HFM implemented margin rules to balance its excessive indebtedness. These regulations prevent over-leverage by requiring traders to hold a minimum amount of money in their accounts to start trades.

Does HFM offer various leverage choices for different trading instruments?

Yes, Ghanaians can expect leverage of up to 1:2000 on forex major pairs and a few other popular instruments.

Does HFM provide margin trading for cryptocurrency to Ghanaian traders?

Yes, HFM provides margin trading for cryptocurrencies to Ghanaian traders, allowing them to increase their exposure to digital assets and perhaps improve their trading profits.

10 Best Forex Brokers in Ghana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Educational Resources

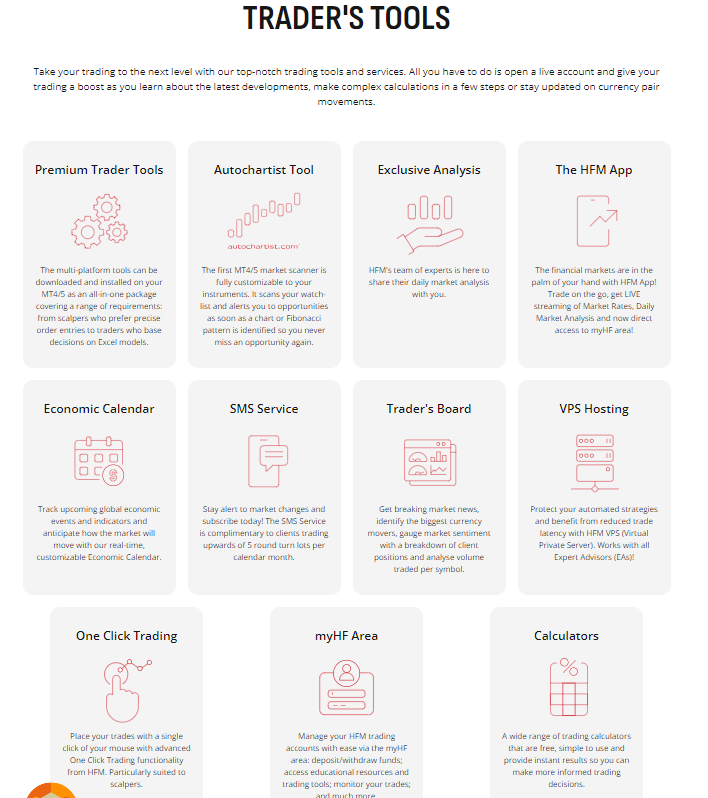

HFM offers the following educational resources:

➡️Trading Classes – HFM offers Trading Classes for Ghanaian traders, providing comprehensive learning on fundamentals and advanced tactics, allowing them to make educated trading decisions across various markets.

➡️Podcasts – The HFM podcasts provide a simple and enjoyable approach for Ghanaian traders to remain up-to-date on market trends and techniques.

➡️Forex Education – HFM offers extensive Forex education, covering everything from currency pair analysis to advanced market analysis techniques. Ghanaian traders will find this site invaluable for specialized material on currency trading in the context of global and African financial markets.

➡️HFM Educational Videos – The HFM Educational Videos provide a visual guide for Ghanaian traders, covering fundamental ideas and advanced procedures. Our assessment found these films well-produced, with clear explanations and demonstrations for visual learners.

➡️Training Course Videos – HFM offers organized learning routes for Ghanaian traders to improve their trading skills through training course videos.

➡️Live Webinars – HFM hosts live webinars that provide real-time market information and allow Ghanaian traders to ask questions and acquire insights from professionals.

➡️Events – HFM hosts events that provide learning and networking opportunities for Ghanaian traders. Industry professionals and thought leaders present deep dives into market dynamics, trading methods, and economic data essential for educated trading in Ghana’s lively financial market at these events.

How does HFM guarantee that Ghanaian traders understand leverage risks before trading?

HFM requires Ghanaian traders to go through risk disclosure and education throughout the account opening process, ensuring they fully grasp the consequences of leverage and margin trading before engaging in live trading operations.

Are there any special trading classes accessible for Ghanaian traders on HFM?

Yes, HFM provides trading classes targeted to Ghanaian traders’ needs, covering various trading styles, strategies, and market analysis methodologies and equipping them with practical skills to improve their trading success.

HFM Pros & Cons

| ✔️ Pros | ❌ Cons |

| HFM does not require a minimum deposit when Ghanaians register a trading account | HFM does not support GHS as an account currency |

| The initial deposit requirement per payment option is low, starting from 67 GHS on credit/debit cards | There are limited payment methods for deposits and withdrawals |

| HFM supports various strategies like automated trading with EAs, news trading, scalping, etc. | HFM is not locally regulated in Ghana |

| HFM offers several educational materials and tools for Ghanaians | HFM only offers free deposits for amounts over $100 |

| Ghanaians can use MetaTrader 4 and 5 to access over 500 financial instruments | |

| HFM offers flexible account types to Ghanaians, from Cent to Pro Plus, catering to all trading levels | |

| Ghanaians can use leverage up to 1:2000 with the benefit of negative balance protection and other risk management tools | |

| Ghanaians have several trading opportunities through leveraged trading, PAMM, copy trading, and more |

Security Measures

We also saw that HFM has a solid civil liability insurance package that covers €5,000,000. The broker’s protection is strengthened by market-leading coverage against mistakes, omissions, carelessness, fraud, and other financial damages.

Despite HFM’s strong security procedures, Ghanaian traders cannot access a local regulatory agency due to the lack of local legislation.

The multi-layered security system, which includes segregated accounts with major worldwide banks, protects customer assets from the company’s operational finances. In case the broker goes bankrupt, this segmentation protects traders’ capital.

What safeguards does HFM take to protect Ghanaian traders’ funds?

HFM prioritizes the safety of Ghanaian traders’ funds by isolating client funds from business assets, using accounts with reputed worldwide institutions, and providing negative balance protection, which protects customers from losses that exceed their account balance.

Does HFM regularly examine operational risks?

Yes, HFM takes a proactive approach to risk management, regularly identifying, analyzing, and monitoring operational risks to ensure the success of its rules and procedures for the safety of Ghanaian traders.

You might also like: AvaTrade Review

You might also like: IC Markets Review

You might also like: InstaForex Review

You might also like: Tickmill Review

You might also like: Exness Review

Conclusion

After our detailed assessment of HFM as a broker for Ghanaian traders, it stands out for its powerful trading platforms, including MetaTrader 4 and MetaTrader 5, which are suitable for novice and experienced traders.

Ghanaians can easily tailor their trading tactics and risk profiles with high leverage up to 1:2000 and a variety of account kinds from Cent to Pro Plus.

The availability of currencies, commodities, indices, cheap spreads, and clear commissions make HFM an attractive alternative. HFM’s trader education through comprehensive resources also benefits the rising Ghanaian market, which wants to improve its trading skills.

However, traders must know that there is a lack of local regulatory monitoring in Ghana and potential currency translation costs owing to the lack of a GHS-denominated account option. Furthermore, FM’s restricted withdrawal e-wallet alternatives can also make transactions harder.

Despite these drawbacks, we see a broker devoted to a secure, adaptable, and informative trading environment. Given HFM’s high leverage and the complexity and risk involved with trading, Ghanaian traders should use its services with appropriate caution and risk management.

Our Insight

I have found that HFM is one of the best brokers in the market with smooth interfaces for traders and partners. The broker’s Deposits and withdrawals occurred a lightning speed and never got any issues in the trading system.HFM is safe and 100% legit.

Our Recommendations on HFM

- Integrate more local payment methods for Ghanaians and other countries, especially e-wallets and mobile money solutions.

- Tailor education so that it can provide Ghanaians with more relevant local insights.

- Consider expanding the account currency options to include GHS and other currencies.

Frequently Asked Questions

Can I use HFM for mobile trading in Ghana?

Yes, HFM provides specialized mobile trading apps for Android and iOS, allowing you to trade on the move despite probable internet connectivity variations in Ghana.

Does HFM provide deposit/withdrawal options that are handy for Ghanaians?

Yes, HFM accepts popular payment options, such as bank transfers, Visa/Mastercard, Skrill, and Neteller, concerning the Ghanaian market.

Is there a local HFM office or assistance in Ghana?

No, HFM does not have a physical presence in Ghana, but they often provide online and phone assistance with time zone considerations for African clients.

Can I exchange Ghana Cedis (GHS) with HFM?

No, while HFM supports major currency pairs, direct GHS trading is impossible. However, you can use a USD account and convert currencies at competitive rates.

Is HFM compliant with Bank of Ghana regulations?

While HFM is globally regulated, local regulatory entities in Ghana do not oversee its operations.

Namibian Dollar Forex Trading Accounts

Namibian Dollar Forex Trading Accounts

Scam Forex Brokers in Ghana

Scam Forex Brokers in Ghana

HFM User Comments and Reviews