AvaTrade Review

Overall, AvaTrade is considered low risk, with an overall Trust Score of 93 out of 100. AvaTrade is licensed by five Tier-1 Regulators (high trust), five Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). AvaTrade offers Ghanaian traders a single live trading account with the option between Retail and Professional.

- Lesche Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

1 135,04 GHS or $100

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Overall, AvaTrade is a well-known online broker that provides forex and CFD trading services to Ghanaian traders. It caters to both novice and experienced investors, offering a variety of trading tools, competitive spreads, and a variety of user interfaces.

Furthermore, AvaTrade provides a variety of account types, leverage options, and unique features to Ghanaian traders. Ghanaian traders can open a live trading account with AvaTrade by depositing at least $100 in their local currency.

The broker recommends a deposit of $1,000 to $2,000 for effective trading. Because of the low minimum deposit requirement, it is accessible to traders of all budget sizes.

Leverage options at AvaTrade range from 1:25 to 1:400, depending on the regulator and asset. Leverage is a useful tool that allows traders to control larger positions with less capital. However, it is critical to understand the risks of leverage and use it responsibly and fully.

The broker provides a wide range of trading instruments, such as forex, CFDs, and cryptocurrencies, giving Ghanaian traders access to over 1,250 financial instruments.

AvaTrade also has competitive spreads, with minimum spreads ranging from 0.9 pips to 5.2 pips, depending on the account type selected. While the broker offers commission-free trading, raw spreads are subject to internal markups.

AvaTrade offers a variety of trading features, including algorithmic trading, copy trading, and mobile trading, which allows traders to access markets and manage their positions while on the go.

Furthermore, the broker provides social trading, which allows traders to follow and replicate successful traders’ trades.

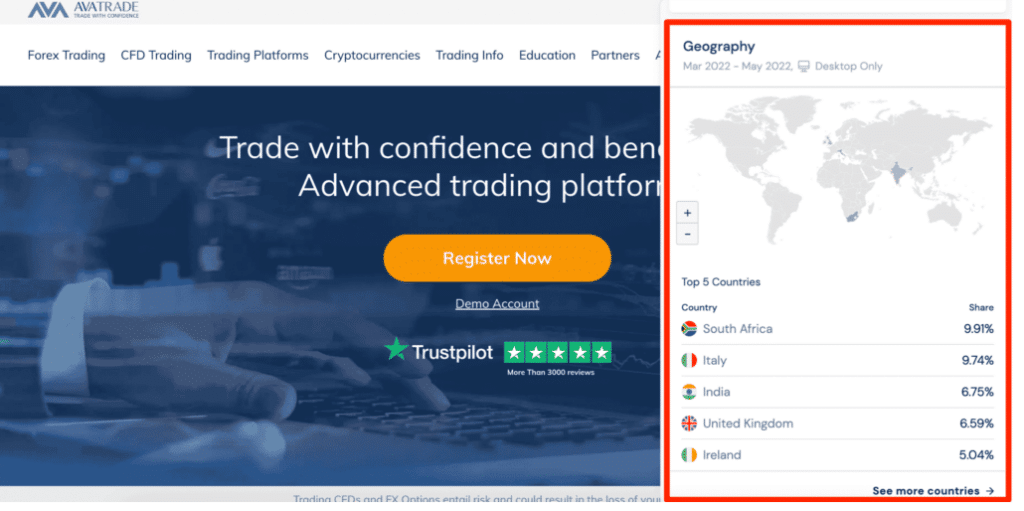

Distribution of Traders

Currently has the largest market share in these countries:

- South Africa – 9.9%

- Italy – 9.7%

- India – 6.7%

- United Kingdom – 6.5%

- Ireland – 5.04%

Popularity among traders

AvaTrade does not grab a substantial market share in Ghana, yet the broker not only welcomes Ghanaian traders but accommodates all traders whatever their trading styles and aims, putting this broker in the Top 20 forex and CFD brokers for Ghanaian traders.

AvaTrade at a Glance

| 🏛 Headquartered | Dublin, Ireland |

| 🌎 Global Offices | Australia, Ireland, South Africa, Japan, British Virgin Islands, UAE |

| 🏛 Local Market Regulators in Ghana | Bank of Ghana (BoG) |

| 💳 Foreign Direct Investment in Ghana | 524.3 million USD (2021) |

| 💰 Foreign Exchange Reserves in Ghana | 5.3 million USD (June 2024) |

| ✔️ Local office in Accra? | No |

| 👨⚖️ Governor of SEC in Ghana | Daniel Ogbarmey Tetteh (Director-General) |

| ✔️ Accepts Ghanaian traders? | Yes |

| 📊 Year Founded | 2006 |

| 📞 Ghana Office Contact Number | None |

| 📱 Social Media Platforms | Twitter YouTube |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 1️⃣ Tier-1 Licenses | Central Bank of Ireland (CBI) Australian Securities and Investment Commission (ASIC) Japanese Financial Services Authority (JFSA) Financial Futures Association of Japan (FFAJ) Investment Industry Regulatory Organization of Canada (IIROC) through Friedberg Mercantile |

| 2️⃣ Tier-2 Licenses | Cyprus Securities and Exchange Commission (CySEC) Financial Sector Conduct Authority (FSCA) Israel Securities Authority (ISA) Abu Dhabi Global Market Financial Services Regulatory Authority (ADGM FRSA) Polish Financial Supervision Authority (KNF) |

| 3️⃣ Tier-3 Licenses | British Virgin Islands Financial Service Commission (BVI FSC) |

| 🪪 License Number | Ireland (C53877) Australia (406684) South Africa (45984) British Virgin Islands (SIBA/L/13/1049) Japan (JFSA 1662, FFAJ 1574) Abu Dhabi (190018) Cyprus (247/17) Israel (514666577) Poland (693023) Canada (Friedberg Mercantile) |

| ⚖️ Regulation | No |

| ✔️ Regional Restrictions | Iran, Belgium, and the United States |

| ☪️ Islamic Account | No |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 1 (Retail and Professional Option) |

| ✔️ PAMM Accounts | No, MAM |

| 💻 Liquidity Providers | Currenex, and other bank and non-bank entities |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Instant |

| 📊 Starting spread | From 0.9 pips |

| 📉 Minimum Commission per Trade | No Commission Charges |

| 💰 Decimal Pricing | 5 points after the comma |

| 📞 Margin Call | 50% on Retail, 25% on AvaOptions Accounts |

| 🛑 Stop-Out | 10% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a GHS Account? | No |

| 📉 Dedicated Ghana Account Manager? | No |

| 📈 Maximum Leverage | 1:30 (Retail) 1:400 (Pro) |

| 📊 Leverage Restrictions for Ghana? | No |

| 💳 Minimum Deposit (GHS) | 1195 Ghanaian Cedi or an equivalent to $100 |

| ✔️ GHS Deposits Allowed? | No |

| 📊 Active Ghana Trader Stats | 250,000+ |

| 👥 Active Ghanaian -based AvaTrade customers | Unknown |

| 🔁 Ghana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | Wire Transfer Electronic Payment Gateways Credit Cards Debit Cards |

| 💻 Minimum Withdrawal Time | 24 to 48 Hours |

| ⏰ Maximum Estimated Withdrawal Time | Up to 10 days |

| 💳 Instant Deposits and Instant Withdrawals? | No |

| 🏛 Segregated Accounts with Ghanaian Banks? | No |

| 📱 Trading Platforms | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 💻 Tradable Assets | Forex Stocks Commodities Cryptocurrencies Treasuries Bonds Indices Exchange-Traded Funds (ETFs) Options Contracts for • Difference (CFDs) Precious Metals |

| ✔️ Offers USD/GHS currency pair? | No |

| 🚀Service description | financial instruments and multiple trading platforms, operating since 2006. |

| 💰 Bonus 20% | welcome bonus accordengly to regulation |

| 📊 USD/GHS Average Spread | N/A |

| ✅ Offers Ghana Stocks and CFDs | No |

| 📊 Average deposit/withdraw processing time | Depends on the method used. – CC and e-payments is immediate. Bank wire can take up to 7 business days depending on the banking institution |

| 🔎 Banned countries | US, North Korea, New Zealand, Iran, Belgium |

| 💻 Languages supported on the Website | English, Chinese (Simplified), Chinese (Traditional), Turkish, Thai, Slovakian, Russian, Portuguese, Polish, German, Hungarian, French, and several others |

| 📈 Related lot sizes | Standard, Mini and Micro lots size |

| 👥 Sponsorship | Currently with Bolt |

| ✴️ Instruments offered | 800+ |

| ✴️ Instruments | Metals, Commodities, Stocks, FX Options, Oil, ETFs, Options, Crypto currencies, CFDs, Indexes, Shares, Spread Betting, Indices, Forex, Bonds |

| ✴️ Total offered per instrument | CFD – Agricultural =7 CFD – Crypto = 20 CFD – EFTs = 60 CFD – Energies = 5 CFD – Indices = 32 CFD – Metals = 7 CFD – Shares = 623 Forex = 55 GRAND Total = 809 |

| ☎️ Customer Support Languages | Multilingual |

| 📈 Account Types | Real Account, Demo Account, Islamic Account. Options Account |

| 📈 Demo Account Description | Free Demo Accounts with $100,000. No limitations on the number of demo accounts. 21 days limitation |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Ghana-based customer support? | No |

| 💸 Bonuses and Promotions for Ghanaian? | Yes |

| 📚 Education for Ghanaian beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Ghana | Unknown |

| ✔️ Is AvaTrade a safe broker for Ghana Traders? | Yes |

| 🎖 Rating for AvaTrade Ghana | 9/10 |

| 🥇 Trust score for AvaTrade Ghana | 93% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

AvaTrade is not currently regulated by the Bank of Ghana (BoG). However, AvaTrade global regulations are listed in the table below.

Global Regulations

AvaTrade is a licensed foreign exchange broker operating in the European Union, Japan, Australia, South Africa, and the British Virgin Islands. This implies they must adhere to stringent regulatory compliance requirements.

This includes the way they manage client money (segregated accounts), as well as the security and reporting of financial information. Trading with a broker licensed in many countries assures customers that they are dealing with a respectable and reliable trading broker.

Following regulations and authorizations:

- The Central Bank of Ireland (CBI) regulates AVA Trade EU Ltd.

- Cyprus Securities and Exchange Commission (CySEC) controls DT Direct Investment Hub Ltd., one of the group’s subsidiaries. Investment Hub Ltd. is a regulated investment business operating according to the Markets in Financial Instruments Directive (MiFID). MiFID governs financial services in the European Union. It contributes to enhanced consumer investment protection while maintaining efficiency and openness.

- AVA Trade EU Ltd operates a branch in Poland according to an AvaTrade EU license issued by the Polish Financial Supervision Authority (KNF).

- AVA Trade Ltd is regulated by the Financial Services Commission of the British Virgin Islands (BVI). The BVI issues licenses to firms that conduct financial services operations inside the territory.

- The Australian Securities and Investments Commission (ASIC) regulates Ava Capital Markets Australia Pty Ltd. This is an Australian regulator that regulates clients in Australia. It contributes to the fair and transparent operation of financial services.

- The South African Financial Sector Conduct Authority (FSCA) regulates Ava Capital Markets Pty.

- Ava Trade Japan K.K. is regulated in Japan by the Financial Services Agency (FSA) and the Japan Association of Financial Futures Brokers (FFAJ).

- Ava Trade Middle East Ltd is supervised by the Financial Regulatory Services Authority (FRSA) of Abu Dhabi Global Markets (ADGM).

- AvaTrade operates under the name ATrade Ltd, a company that is well-regulated and overseen in Israel by the Israel Securities Authority (ISA).

- Accounts in Canada are established and maintained by Friedberg Direct, which executes transactions through a subsidiary of the AvaTrade group of enterprises. Friedberg Direct is a division of Friedberg Mercantile Group Ltd., which is a member of the Investment Industry Regulatory Organization of Canada (IIROC), the Canadian Investor Protection Fund (CIPF), and most Canadian exchanges.

Client Fund Security and Safety Features

AvaTrade takes a multifaceted approach to ensuring a safe trading environment, instilling trust in its diverse clientele. The robust regulatory framework is one of the most important aspects of its security measures.

AvaTrade is governed by five tier-1 and five tier-2 jurisdictions, which include some of the world’s most stringent financial regulatory bodies. This regulatory oversight ensures that the platform meets the highest levels of transparency, ethical behaviour, and financial stability.

AvaTrade uses advanced encryption technologies to protect traders’ personal and financial information and regulatory compliance. This includes employing SSL encryption for data transmission and strong firewalls to prevent unauthorized access.

The platform also employs segregated accounts to separate clients’ funds from AvaTrade’s operational funds, ensuring that traders’ investments are not misappropriated.

AvaTrade further enhances its secure trading environment with proprietary features such as AvaProtect.

This feature protects traders from potential losses during volatile market conditions, adding an extra layer of financial security. The platform is also regularly subjected to third-party audits to ensure its security measures are up-to-date and effective against emerging threats.

Furthermore, AvaTrade offers extensive educational resources on risk management and trading strategies, allowing traders to make well-informed decisions.

This educational emphasis helps traders improve their skills and provides them with the knowledge they need to navigate the markets safely.

Does AvaTrade offer protection against market losses?

Yes, AvaProtect™ provides loss protection when markets turn against you.

What kind of encryption does AvaTrade use?

Although specific encryption details are not made public, regulated brokers such as AvaTrade typically use high-level encryption for data security.

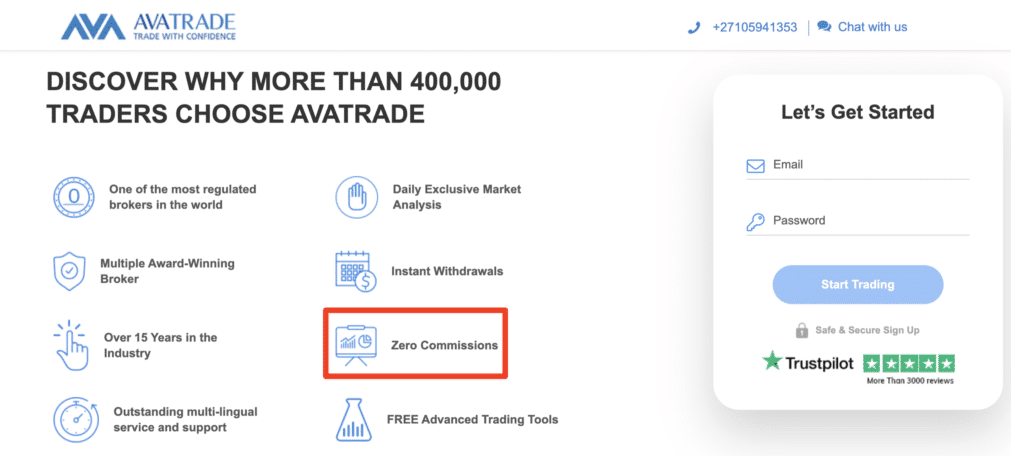

Awards and Recognition

Received the following recent awards and recognition:

- Best Affiliate Program UAE in 2024 – awarded by the Global Business Review Magazine

- Best Mobile Trading Platform in Spain (2023) – Finance Derivative.

- Top 10 Hot Brand of the Year (2023) – The Ceoviews.

- Most Trusted Broker (2023) – International Investor.

- Best Mobile Trading Platform in UAE (2022) – Global Business Review Magazine.

- Most Innovative CFD Broker in UAE (20220 – Global Business Review Magazine.

Has AvaTrade received any awards for its services?

Yes, These awards often acknowledge AvaTrade’s excellence in areas such as customer service, trading platforms, educational resources, and overall broker performance.

Which awards has AvaTrade won recently?

The broker dedication to excellence has been consistently recognized by industry peers.

AvaTrade Account Types and Features

| 🔎 Live Account | 💳 Minimum Deposit | 📈 Average Spread | 📉 Commissions | 📊 Average Trading Cost |

| Standard Account | $100 / 1195 GHS | 0.9 pips | None | 9 USD |

| Islamic Account | $100 / 1195 GHS | 0.9 pips | None | 9 USD |

| Professional Account | $100 / 1195 GHS | 0.6 pips | None | 12 USD |

Live Trading Accounts

Retail Investor Account

Retail Investor Account

AvaTrade provides a unique retail account tailored to a wide range of traders, from beginners to professionals. This account provides access to many trading instruments, including 44 forex options and more than 1,200 CFDs.

The account also has competitive spreads close to the industry average, making it a cost-effective option for traders.

Traders can also choose from various trading platforms, including AvaTrade’s proprietary platforms, AvaTrade WebTrader and AvaTradeGO, and third-party platforms like MetaTrader.

Each platform includes its own set of innovative features, such as risk management tools such as AvaProtect. Furthermore, the retail account offered has the following features:

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | 1 195 Ghana Cedi or an equivalent to 100 units in ZAR, USD, GBP, or AUD |

| 💳 Base Account Currency Options | ZAR, USD, GBP, or AUD |

| 📈 Maximum Leverage | 1:30 |

| 📉 Range of Markets offered | More than 1,250 tradable instruments |

| 💻 Trading Platforms | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade |

| 💵 Commissions on trades | None |

| 📈 Average spreads | From 0.9 pips EUR/USD |

| 📊 Margin Requirements | From 0.25% when using leverage of 1:400 |

| 📞 Customer Support Channels | Social Platforms, Email Request, Telephone, WhatsApp, Live Chat |

| 📚 Educational Materials offered | Trading Videos, Trading For Beginners, Trading Rules, Technical Analysis Indicators and Strategies, Economic Indicators, Market Terms, Order Types, Blog, Online Trading Strategies |

| 🔨 Trading tools offered | AvaProtect, Trading Central, CFD Rollover, Economic Calendar, Trading Calculator, Earnings Releases, Analysis |

| ✔️ Trading Strategies Allowed | All – scalping, swing trading, momentum trading, expert advisors, algorithmic trading, auto trading, etc. |

Professional Account

AvaTrade’s Professional Account is meticulously designed to meet the specialized needs of accredited investors, and it offers several benefits that set it apart from the standard retail account.

The Pro account’s average EUR/USD spread is 0.6 pips, while the Standard account’s average spread is 0.9 pips. This tighter spread structure makes the Professional Account especially appealing for traders seeking cost-effective trading.

In addition to competitive spreads, the Pro account has no trading fees, enhancing its attractiveness. Account holders can also connect their real accounts to social trading platforms such as DupliTrade and ZuluTrade, expanding their trading capabilities and strategies.

To qualify for an AvaTrade Professional Account, traders must meet stringent criteria to ensure that only traders with substantial market experience and financial resources can access the account.

The eligibility requirements consist of a minimum of twelve months of continuous market activity in relevant financial markets and an average of at least ten trades in CFD, forex, or spread betting over the previous four quarters.

In addition, applicants must have at least one year of experience in the financial services industry and a minimum investment portfolio of €500,000 or its foreign currency equivalent.

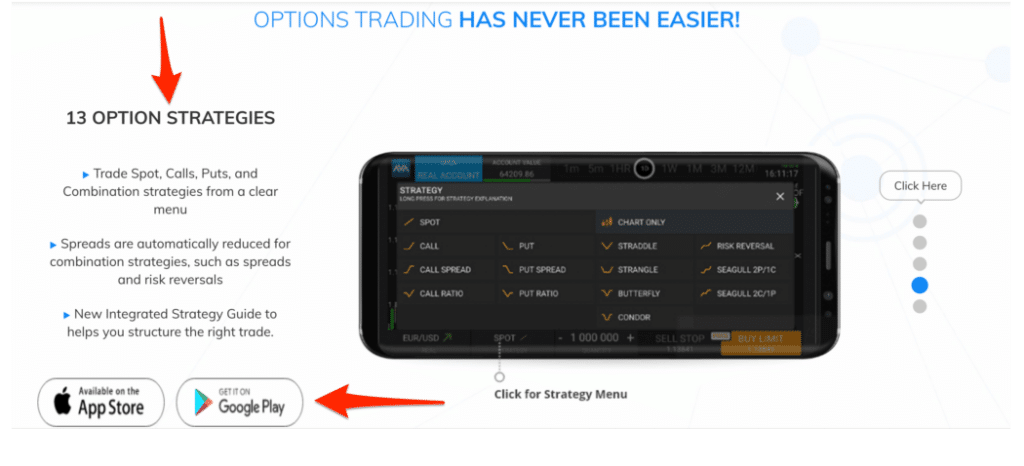

Options Trading

AvaTrade provides a robust platform for options trading, enabling traders to buy or sell a predetermined quantity of an asset at a predetermined price and time.

This type of trading gives retail traders full control over their investment decisions, including the products they trade, the capital they allocate, and the ability to set their own prices and trading times.

Options trading on AvaTrade is highly versatile, accommodating various trading strategies and objectives. Options contracts can be executed on various timescales, ranging from a single trading day to longer durations such as a week, month, or even a year.

The platform provides Call and Put options to accommodate various market perspectives. As these options grant the right to purchase an asset at a predetermined price, call options are especially popular among investors with a bullish outlook who anticipate an upward market trend.

Spread Betting (UK Clients Only)

AvaTrade does not offer spread betting to Ghanaian traders.

Base Account Currencies

The base account currencies available to Ghanaians include the following:

- ZAR

- USD

- GBP

- AUD

Basic Order Types

- Market Order – A market order can be either a buy or a sell order that executes at the current market price. This is the current price displayed on your price chart. If you place a market order, you will be immediately entered at the best available price.

- Market orders are most effective when a trading opportunity requires prompt action. Click buy/sell at market to enter the trade immediately.

- Stop Order – A stop order can be either a buy or sell stop, depending on whether you wish to purchase above or below the market.

- This is useful for trading breakouts or trend continuation strategies when you want the market to continue moving in the same direction.

- Limit Order – Alternatively, if you believe the price will reverse when it reaches a certain price, you can place a limit order.

- Limit orders can be either buy or sell limits, depending on the market’s direction before your anticipated reversal.

- A sell limit is used to sell above the market, while a buy limit is used to purchase below the market.

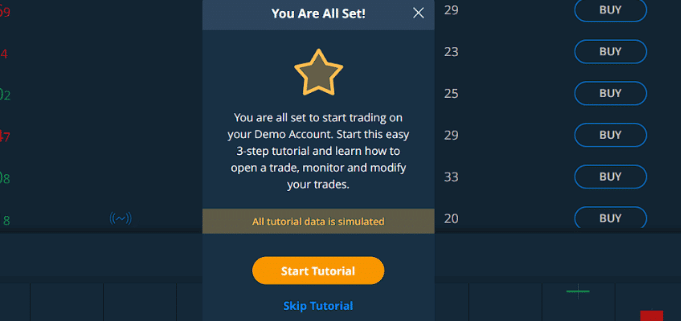

Demo Account

AvaTrade provides a comprehensive demo account, allowing traders to practice strategies and become acquainted with the platform’s features and tools without risking real money. The demo account simulates real-world trading, making it an excellent learning tool for novice and experienced traders.

The following are key features of AvaTrade’s demo account:

- AvaTrade’s demo account provides educational resources, such as tutorials and guides, to help traders understand the platform’s features and improve their trading skills.

- No Time Limit: Because the demo account has no time limit, traders can practice and fine-tune their strategies for as long as they need before moving on to live trading.

- Real-time Support: Traders can access AvaTrade’s customer service team in real-time, ensuring that any questions or issues are addressed as soon as possible.

- $100,000 Virtual Funds: Traders are given $100,000 (or equivalent currency) to simulate real trading conditions and test various strategies.

- Diverse Asset Selection: The demo account includes a diverse set of trading instruments, such as forex, stocks, commodities, and cryptocurrencies, allowing traders to experiment with different markets and asset classes.

- Real-time Market Conditions: Because the demo account reflects real-time market conditions, traders can experience the same price movements and order execution as they would in live trading.

- Access to Multiple Trading Platforms: Traders can practice their trading skills and explore different tools and features using AvaTrade’s various trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Islamic Account

The Islamic Account from AvaTrade is a solution for Muslim traders who follow Sharia law principles and want to trade per their religious beliefs.

This account type does not require the payment of swap fees or interest charges, which are prohibited by Riba principles. Positions in Islamic accounts can be held open for up to 5 days without incurring rollover fees.

Traders must verify their account, fund it, and then apply for an Islamic account, which is reviewed and approved within 1-2 business days. AvaTrade also provides halal trading options for gold, silver, oil, and stock indices on the Islamic account.

What is the AvaTrade standard account best suited for?

The Standard account is ideal for inexperienced traders.

Can the AvaTrade accounts be used as Islamic accounts?

Yes, all AvaTrade account types are suitable for use as Islamic accounts.

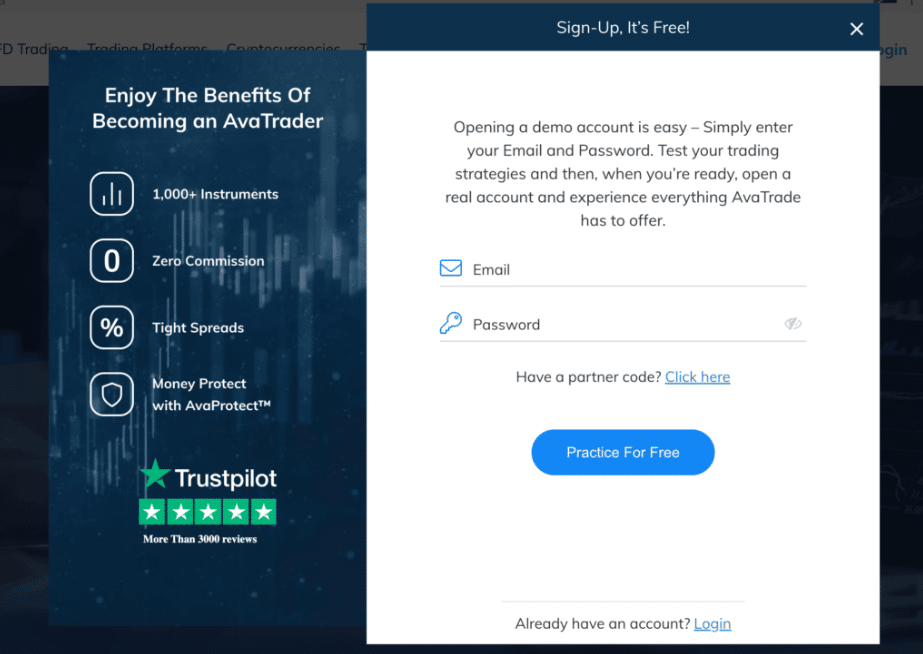

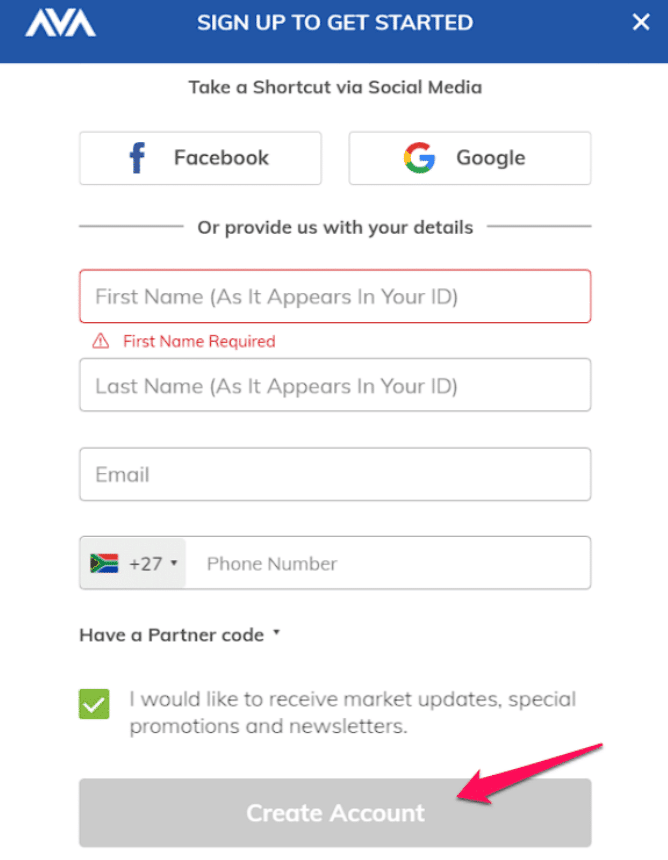

How to open an AvaTrade Account – A Step-by-Step Guide

To open an account, Ghanaians can follow these steps:

Step 1 – Open up the Avatrade Website.

navigate to the website and select the “Demo Account” option

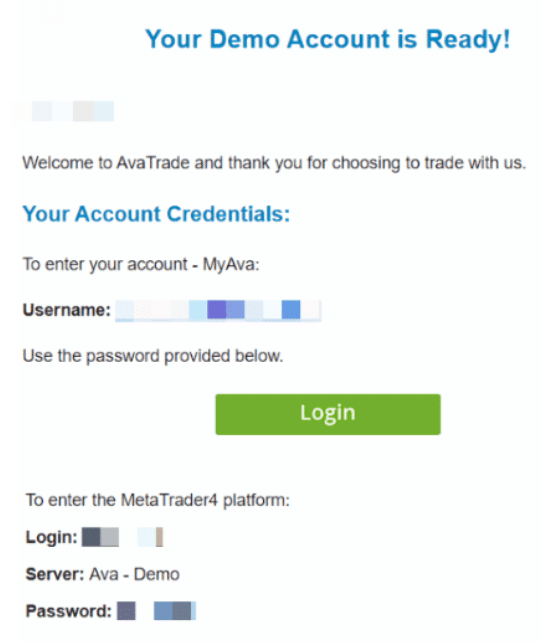

Step 2 – Insert your credentials.

This will redirect the trader to a registration page where the trader can register using their Facebook or Google credentials, or they can register by providing their First and Last name, email address, and mobile number.

Step 3 – Click on one of the options to proceed.

Once this has been completed, the trader can select to proceed, and registration on the AvaTrade website will have been successful.

Step 4 – Verify and log into your account.

Traders will receive an email to the address that they provided with confirmation that their demo account registration has been successful. The email address will also contain the trader’s login details and relevant links to the AvaTrade website where they can start using their demo account.

When it comes to signing up, the procedure is simple. Traders may join by going to the website and selecting the appropriate option. Before their account can be validated, they must complete an online form, verify their email address, and submit supporting evidence.

With only a few clicks of the mouse, traders may fund their trading accounts and begin trading immediately. Traders may also count on AvaTrade’s helpful customer care for assistance.

Is there a video guide for opening an AvaTrade account?

Yes, AvaTrade offers a video tutorial on how to open a trading account.

Is there a minimum deposit required to open an AvaTrade account?

Yes, a minimum deposit of $100 is required.

AvaTrade Vs NAGA Vs Plus500 – Broker Comparison

| 🥇 AvaTrade | 🥈 NAGA | 🥉 Plus500 | |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | CySEC, BaFin | ASIC, FMA, FSCA, FCA, CySEC, FSA, MAS |

| 📱 Trading Platform | AvaTrade WebTrader AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade | NAGA Trading Platform MetaTrader 4 MetaTrader 5 | Plus500 mobile and web-based trading platform |

| 💰 Withdrawal Fee | No | Yes | None |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1 195 GHC | 2 988 GHC | 1 195 GHC |

| 📊 Leverage | 1:30 (Retail) 1:400 (Pro) | 1:1000 | 1:30 |

| 📊 Spread | Fixed, from 0.9 pips | 0.7 pips | 0.8 pips |

| 💰 Commissions | None | None | None |

| ✴️ Margin Call/Stop-Out | 25% – 50% (M) 10% (S/O) | 100%/50% | None |

| 💻 Order Execution | Instant | Market | None |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | • Standard Live Account • Professional Account Option | • Iron Account • Bronze Account • Silver Account • Gold Account • Diamond Account • Crystal Account | • Standard Live Account |

| ⚖️ BoG Regulation | No | No | No |

| 💳 GHS Deposits | No | No | No |

| 📊 Ghana Cedi Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 1 | 6 | 1 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited | 10,000 | 100 lots |

| 💰 Minimum Withdrawal Time | 24 to 48 Hours | Instant | 1 working day |

| 📊 Maximum Estimated Withdrawal Time | Up to 10 days | Up to 5 working days | 5 working Up to 7 working days |

| 💸 Instant Deposits and Instant Withdrawals? | No | No | No |

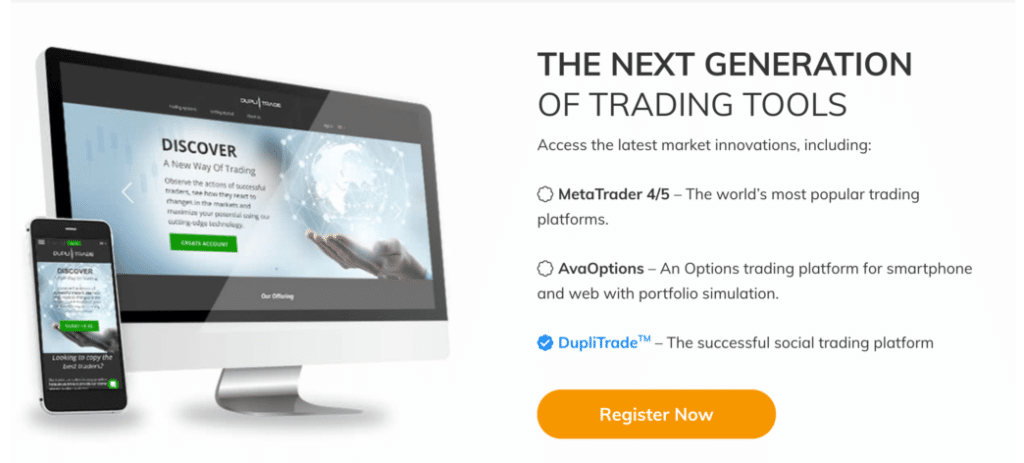

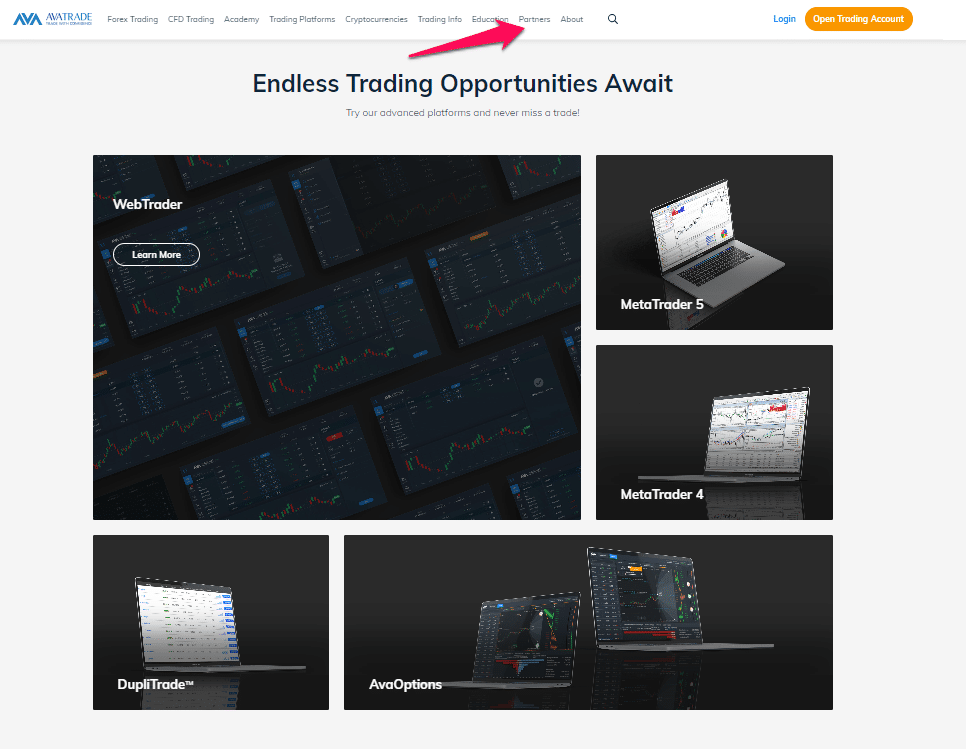

Trading Platforms

Offers Ghanaian traders a choice between these trading platforms:

AvaTrade WebTrader

AvaTradeGO

AvaOptions

AvaSocial

MetaTrader 4

MetaTrader 5

DupliTrade

ZuluTrade

WebTrader

WebTrader is an excellent choice for Ghanaian traders looking for a user-friendly yet powerful trading experience. This proprietary platform includes novel features such as AvaProtect, which offers risk management solutions.

The platform is accessible through web browsers, removing the need for software downloads, and is suitable for both novice and experienced traders.

AvaTradeGO

AvaTradeGO is AvaTrade’s mobile trading platform, designed for traders on the go who want to manage their portfolios. The app includes various features, such as advanced charting tools and real-time market updates, making it a complete solution for mobile trading in Ghana.

AvaOptions

Sentry Derivatives powers AvaOptions, a specialized platform for trading forex options. This platform is designed for professional traders and provides an excellent mobile trading experience. It offers a variety of forex trading options and is ideal for traders seeking more complex trading instruments.

AvaSocial

AvaSocial is a social trading app for mobile devices. It enables Ghanaian traders to follow, interact with, and copy expert traders’ trades. The platform has an easy-to-use interface and is ideal for those seeking community wisdom.

MetaTrader 4

MetaTrader 4 (MT4) is a popular trading platform available to AvaTrade customers in Ghana. It provides advanced charting tools, multiple timeframes, and various indicators, making it appropriate for traders of all experience levels.

MetaTrader 5

MetaTrader 5 (MT5) is the successor to MT4 and includes new features such as more timeframes and chart types. It also supports trading in a wider range of markets, with 1,260 symbols available. This platform is ideal for traders who want to expand their trading capabilities.

DupliTrade

DupliTrade is a trading platform that allows you to copy expert traders’ trades directly into your AvaTrade account. It is MT4 compatible and especially useful for traders who prefer a hands-off approach while benefiting from expert strategies.

ZuluTrade

ZuluTrade is a well-known social trading platform that allows you to follow and copy the trades of experienced traders automatically.

Furthermore, ZuluTrade provides a commission-based model in which the trader you follow earns a commission on your transactions. This platform is ideal for those who want to tap into the expertise of a trading community.

Are there any restrictions on who can use AvaTrade’s platforms?

The platforms of AvaTrade are generally available to all traders, but some restrictions may apply depending on jurisdiction.

Can I use custom indicators on AvaTrade’s platforms?

Yes, custom indicators are typically used on platforms such as MetaTrader 4, which AvaTrade provides.

Trading App

Ghanaian traders can expect the following range of markets:

- Forex

- Stocks

- Commodities

- Cryptocurrencies

- Treasuries

- Bonds

- Indices

- Exchange-traded funds (ETFs)

- Options

- Contracts for Difference (CFDs)

- Precious Metals

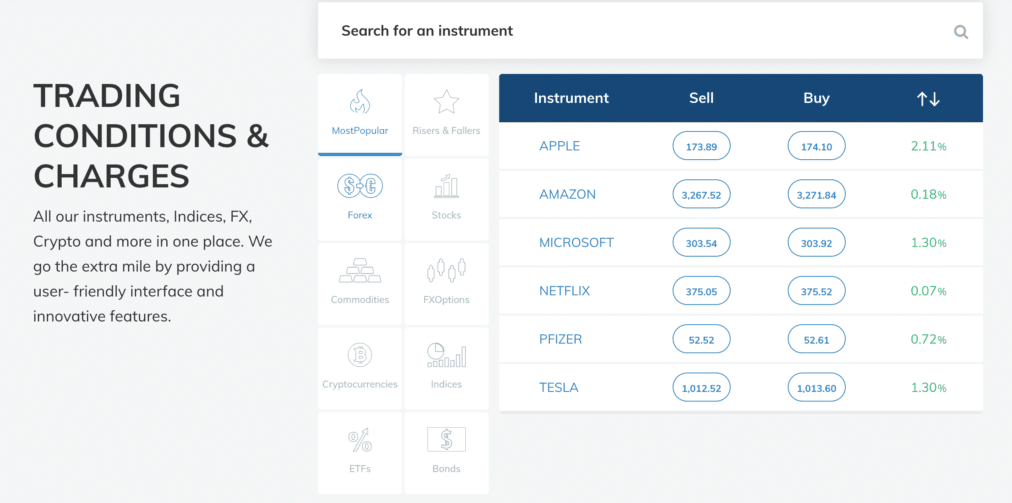

Financial Instruments and Leverage offered

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 55 | 1:400 |

| ➡️ Precious Metals | 5 | 1:200 |

| ➡️ ETFs | 59 | 1:20 |

| ➡️ Indices | 33 | 1:200 |

| ➡️ Stocks | 625 | 1:10 |

| ➡️ Cryptocurrency | 20 | 1:25 |

| ➡️ Options | 53 | 1:100 |

| ➡️ Energies | 5 | 1:200 |

| ➡️ Bonds | 2 | 1:20 |

| ➡️ FXOptions | 24 | 1:100 |

Does AvaTrade offer trading on indices?

Yes, clients can trade US, European, and Asian indices.

What financial instruments are available for trading with AvaTrade?

The broker provides various financial instruments, such as leveraged CFDs, forex, and spread betting.

Broker Comparison for a Range of Markets

| 🥇 AvaTrade | 🥈 NAGA | 🥉 Plus500 | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | Yes | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | Yes |

| ➡️️ Options | Yes | No | Yes |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | No | No |

Trading and Non-Trading Fees

Spreads

AvaTrade maintains transparency by applying fixed spreads that contain markup to account for broker costs linked with facilitating trades. As an exclusive Market Maker broker, AvaTrade carries out all orders via its own execution techniques.

To grant clients entry to the interbank market, AvaTrade accumulates substantial positions from multiple liquidity providers and presents them to traders. Traders in Ghana should anticipate having standard spreads falling within specific ranges:

- EUR/USD – 0.9 pips

- Stocks – 0.13%

- Crude Oil – 0.029 pips

- FXOptions – 0.9 pips

- Cryptocurrency – From 0.02 pips on BTC/USD

- Indices – From 0.03 pips

- ETFs – 0.13%

- Bonds – From 0.03 pips Over Market

Commissions

Traders in Ghana can experience commission-free trading with AvaTrade, which offers premium fixed spreads instead of separate commission fees. This provides transparent and all-inclusive trading without additional costs for traders.

Additionally, the simplicity of AvaTrade’s fixed spreads enables easy focus on strategic trades rather than worrying about extra expenses.

Overall, by offering competitive pricing options through its premium fixed spread model, AvaTrade aims to provide cost-effective solutions for successful trader experiences, specifically within Ghana’s market.

Overnight Fees, Rollovers, or Swaps

The expenses linked to overnight trading differ based on numerous factors. These include whether Ghanaian traders hold a long or short position, the size of their trade, the type of financial instrument traded and prevailing market conditions when keeping it open.

To calculate such charges at AvaTrade, they multiply the entire worth of an active position by its corresponding interest rate for that night. Some of AvaTrade’s typical overnight fees are as follows and are subject to change:

- EUR/USD – a short swap of -0.000% and a long swap of -0.0091%

- Stocks (Apple) – a short swap of -0.0032% and a long swap of -0.0301%

- Gold – a short swap of -0.0006% and a long swap of -0.0259%

- Silver – a short swap of -0.0006% and a long swap of -0.0259%

- FXOptions (EUR/USD) – a short swap of -0.00926% and a long swap of -0.0000%

- US TECH 100 – a short swap of -0.0006% and a long swap of -0.0259%

- Cryptocurrency (BTC/USD) – a short swap of -0.0333% and a long swap of -0.0610%

- VIX ETN ETF – a short swap of -0.0032% and a long swap of -0.0301%

Deposit and Withdrawal Fees

AvaTrade does not levy any deposit or withdrawal fees for the broker’s offered methods of depositing and withdrawing.

Inactivity Fees

If a trading account with AvaTrade has been inactive for three consecutive months, a fee will be applied. An inactivity fee of $50 per month will be charged if no trades have occurred within that period to ensure the account remains active and efficient on the platform.

Therefore, Ghanaian traders should note that this charge could increase to $100 after 12 continuous months, which encourages frequent activity while ensuring optimal performance levels are maintained.

Currency Conversion Fees

Traders need to be aware of currency conversion fees. Depositing funds in GHS, an unaccepted deposit or base account currency, may result in such fees being applied when converting deposited funds into the designated account currency.

Therefore, Ghanaian traders must consider this and potential charges when making deposits.

What is the structure of AvaTrade’s charges?

The brokers spread structure is transparent, with fees built into the spread.

What is the starting spread for AvaTrade?

Spread and commission fees start at $100, with spreads starting at 0.6 pips (Pro Account on EUR/USD).

Deposits and Withdrawals

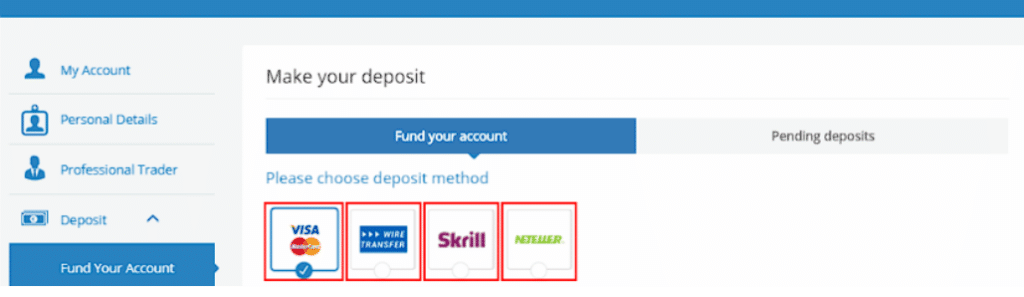

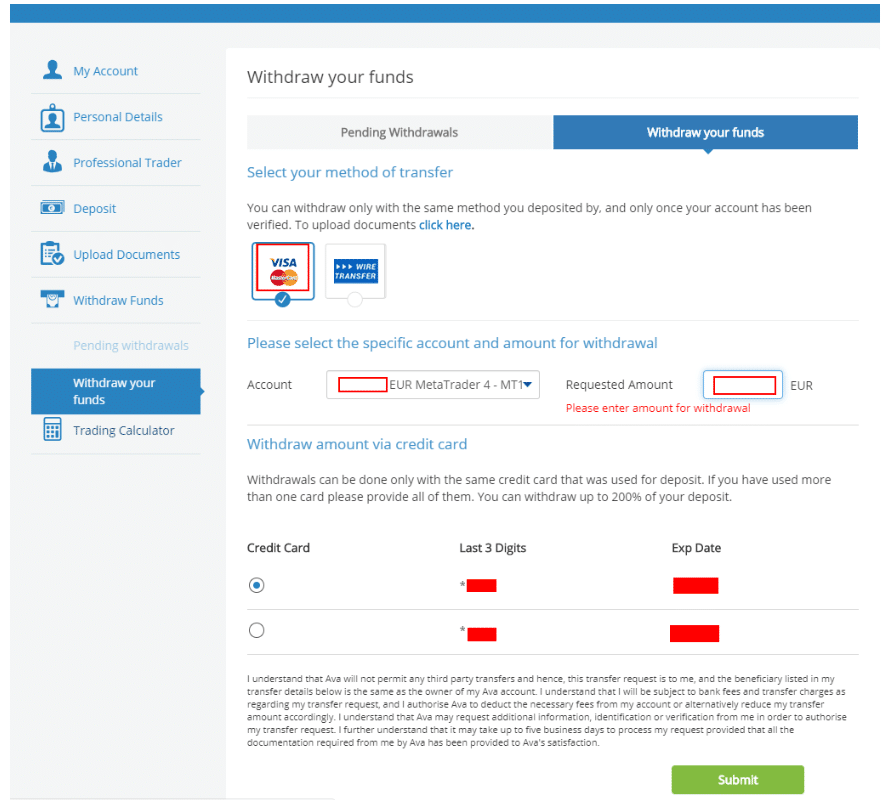

AvaTrade offers the following deposit and withdrawal methods:

- Bank Wire Transfer

- Credit/Debit Card

- PayPal

- WebMoney

- Neteller

- Skrill

Broker Comparison: Deposit and Withdrawals

| 🥇 AvaTrade | 🥈 NAGA | 🥉 Plus500 | |

| Minimum Withdrawal Time | 24 to 48 Hours | Instant | 1 business day |

| Maximum Estimated Withdrawal Time | Up to 10 days | Up to 5 working days | Up to 7 working days |

| Instant Deposits and Instant Withdrawals? | No | Yes | No |

Payment Method and Processing Times on Deposits and Withdrawals

| 💳 Payment Method | ⏰ Deposit Processing | ⏱️ Withdrawal Processing |

| 💰 Bank Wire Transfer | Up to 10 days | Up to 10 days |

| 💳 Credit/Debit Card | 24 – 48 Hours | 24 – 48 Hours |

| 🪙 PayPal | 24 – 48 Hours | 24 – 48 Hours |

| 💸 WebMoney | 24 – 48 Hours | 24 – 48 Hours |

| 💴 Neteller | 24 – 48 Hours | 24 – 48 Hours |

| 🪙 Skrill | 24 – 48 Hours | 24 – 48 Hours |

How do I withdraw funds from AvaTrade?

Log into your trading account, navigate to the withdrawal section, and follow the instructions.

How do I deposit into my AvaTrade account?

You can fund your trading account with a credit card, wire transfer, or various e-payment methods.

How to Deposit Funds step by step

To deposit funds to an account with AvaTrade, Ghanaian traders can follow these steps:

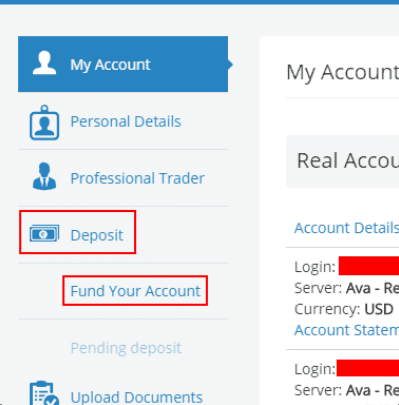

Step 1 -Locate the deposit option on your Avatrade dashboard.

On the account, the trader can click on ‘Deposit’ and select their preferred deposit method.

Step 2 – Click on Fund your account option.

Once you have selected to fund your account you can now select your preferred method.

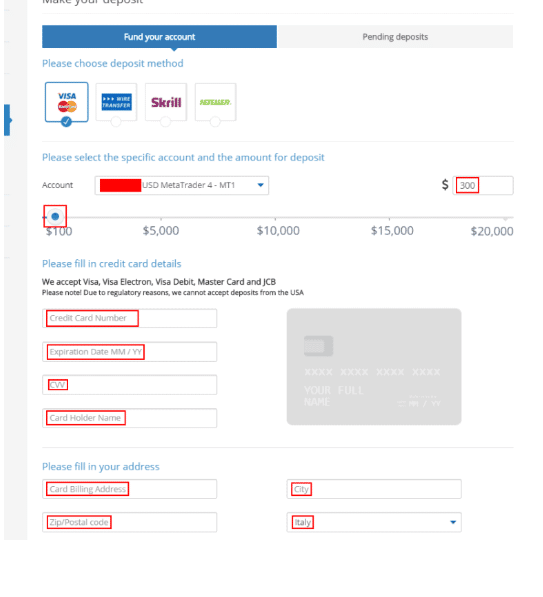

Step 3 – Enter the amount you wish to deposit.

Add the payment method details into the fields.

Step 4 – Click on ‘Deposit‘

How do I deposit to AvaTrade via wire transfer?

Log into your MyAccount area and select the ‘Deposit’ tab on the left side to deposit via wire transfer.

Are there any fees for depositing with AvaTrade?

Deposits are generally free of charge, but it is prudent to check for any additional fees.

Fund Withdrawal Process

To withdraw funds from an account with AvaTrade, Ghanaian traders can follow these steps:

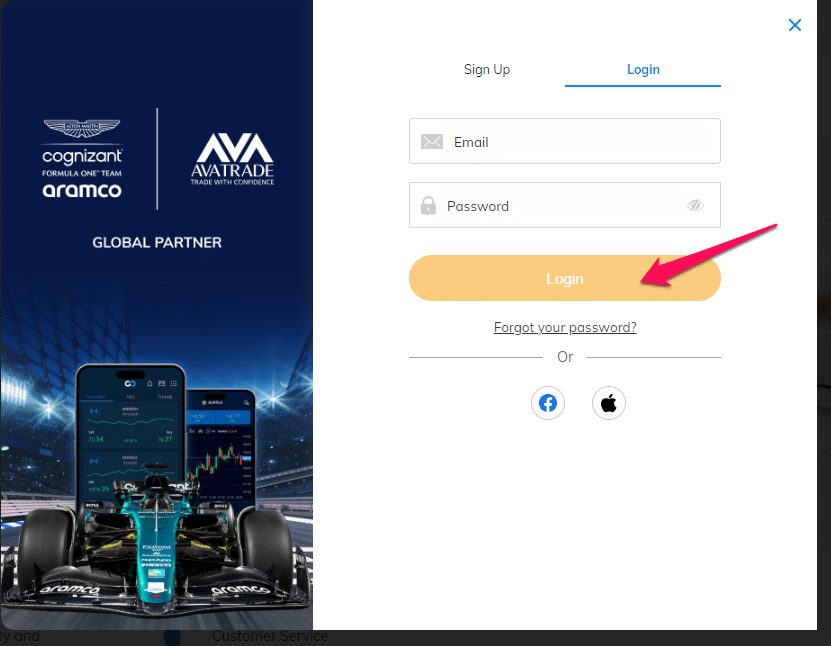

Step 1: Log in

Log into your trading account with your email address and password.

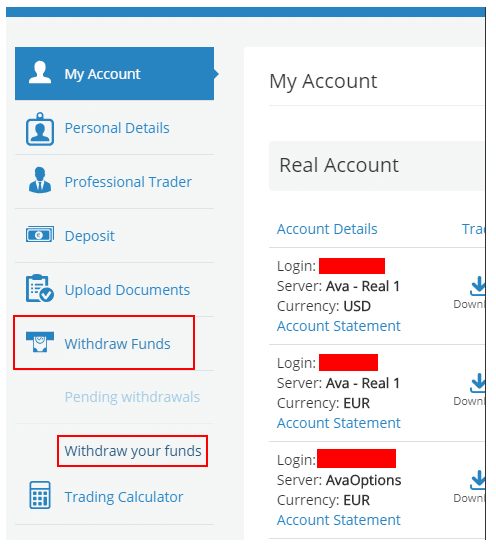

Step 2: withdrawal section

Once logged in, go to the withdrawal section.

Step 3:

Fill out an online withdrawal form through your account.

Your withdrawal will be processed within the next 24 business hours.

Are there any withdrawal fees imposed?

AvaTrade generally does not charge fees for withdrawals. However, some payment processors or banks may impose transaction fees on their end for processing the withdrawal. These fees are usually outside of AvaTrade’s control and are determined by the financial institution handling the transaction.

How long does it take for the withdrawn funds to reach my account?

The processing time for fund withdrawals from AvaTrade can vary depending on several factors. AvaTrade typically processes withdrawal requests within one to two business days.

Education and Research

Education

Offers the following Educational Materials to Ghanaian traders:

- Educational Videos

- Trading guides

- Trading Rules

- Market Terms

- Order Types

- Trading Strategies

- Trading Ideas

- Trader’s Blog

- A demo account with virtual funds

- Educational Articles

Research and Trading Tool Comparison

| 🥇 AvaTrade | 🥈 NAGA | 🥉 Plus500 | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | No | No | No |

| ➡️ AutoChartist | No | No | No |

| ➡️ Trading View | No | Yes | No |

| ➡️ Trading Central | Yes | No | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

AvaTrade also offers Ghanaian traders the following additional Research and Trading Tools:

- Technical Analysis Indicators

- Economic Indicators

- Economic calendar

- Trading Strategies

- AvaProtect Risk Management

- Trading Central

- Trading Calculators

- Earnings Releases

- Fundamental Analysis

- Technical Analysis

What educational resources does AvaTrade offer?

The broker offers a Trading Academy with eBooks, Webinars, Articles, Video Lessons, and more.

What advanced trading strategies are covered by AvaTrade?

The broker specializes in advanced strategies such as position trading, which necessitate extensive research and analysis.

10 Best Forex Brokers in Ghana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

AvaTrade offers Ghanaian traders the following bonuses and promotions:

- Referral bonus

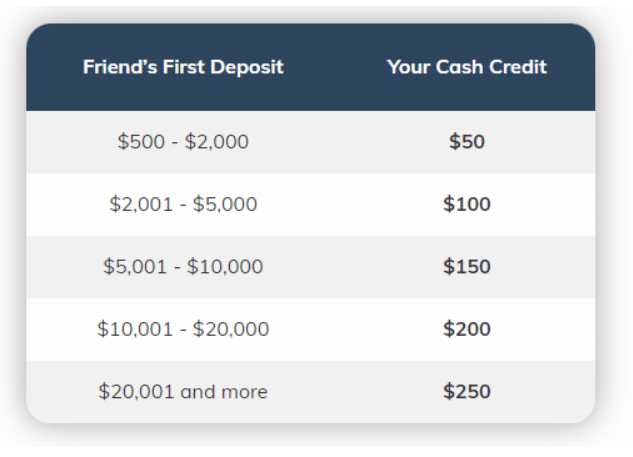

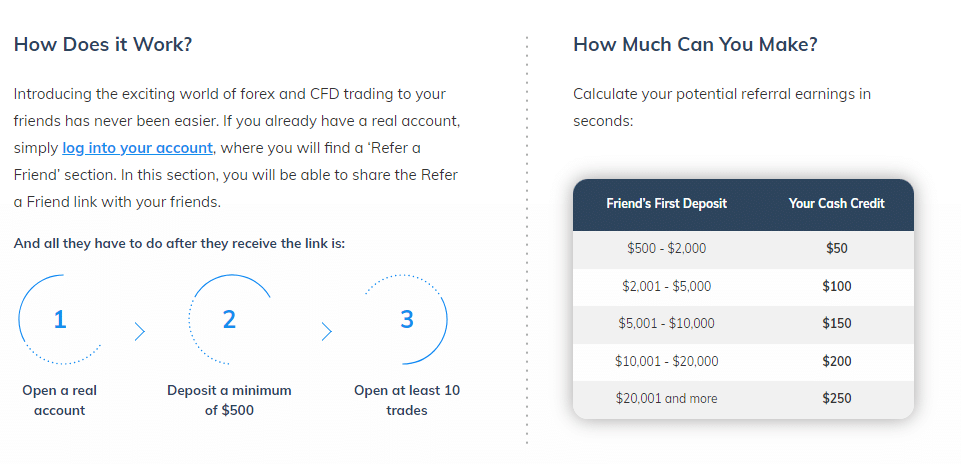

AvaTrade offers a referral bonus program that allows Ghanaian traders to earn rewards by referring their friends to the platform. The referral bonus allows earning up to $250 for each friend who makes a deposit and trades. Here is a summary of the AvaTrade referral bonus:

- Participating in the referral program can earn a referral fee for each friend you refer to AvaTrade.

- The referral bonus can range from $250 to $500, depending on the specific terms and conditions during the referral.

- AvaTrade will automatically deposit the referral fee into your trading account once your referred friend fulfils the requirements.

- To be eligible for the referral bonus, your referred friend must open an account, deposit funds, and engage in trading activities on the AvaTrade platform.

- AvaTrade provides a unique referral link or code to share with your friends to track referrals. This link or code facilitates the tracking of referrals and ensures you receive the appropriate referral bonus.

- There is no limit to the number of friends you can refer to AvaTrade, allowing you to earn multiple referral bonuses.

- Because the terms and conditions of the referral bonus program are subject to change, it is essential to check the AvaTrade website or contact customer support for the most up-to-date information.

Does AvaTrade offer bonuses?

Yes, AvaTrade occasionally offers welcome bonus promotions to new clients.

How are AvaTrade’s bonus prices calculated?

AvaTrade’s bonus prices are calculated using specific terms and conditions.

How to open an Affiliate Account with AvaTrade

To register an Affiliate Account, Ghanaian traders can follow these steps:

Navigate to the AvaTrade website and navigate to the “Partners” tab on the main menu of the homepage.

Next, complete the 3-step registration and application as per the website instructions.

Affiliate Program Features

You gain access to a comprehensive suite of features designed to optimize your affiliate experience and maximize your earning potential upon joining AvaTrade’s Affiliate Program. Here are the key characteristics:

- AvaTrade provides affiliates with personalized tracking links, allowing them to monitor the success of their referrals with precision. This ensures that all referrals are properly attributed, ensuring the affiliate is appropriately recognized and compensated for their efforts.

- Affiliates can access high-quality marketing materials, such as banners, landing pages, and promotional assets. These assets are designed to promote the AvaTrade brand and attract new customers effectively.

- The affiliate dashboard includes sophisticated reporting and analytics instruments. These tools enable affiliates to evaluate the efficacy of their marketing strategies, monitor referral activity, and gain insights for refining their marketing efforts for improved results.

- AvaTrade provides a variety of payment methods to accommodate the preferences of affiliates. Affiliates can select their preferred payment method, including bank transfers, checks, and digital payment platforms such as PayPal and Skrill.

- AvaTrade maintains a dedicated affiliate support team in recognition of the importance of prompt and responsive service. This team is always available to address questions or concerns, ensuring a smooth and fruitful collaboration.

What are the key features of the AvaTrade Affiliate Program?

CPA, White Label, and IB commission structures are available through the program.

What financial markets can I earn commissions from with AvaTrade?

Affiliates can earn commissions in a variety of financial markets.

Customer Support

AvaTrade provides exceptional customer service, particularly when compared to other brokers. AvaTrade’s live chat representatives are timely, friendly, and helpful, offering relevant information to inquiries.

| ☎️ Telephone/WhatApp | https://www.avatrade.com/about-avatrade/contact-us |

| 🗺️ Website URL | https://www.avatrade.com/ |

| [email protected] | |

| 📙 FAQ’s | www.avatrade.com/?s=FAQ |

| 🎓 Customer Service | https://www.avatrade.com/about-avatrade/contact-us |

| 📍 GDPR compliant T&Cs | https://www.avatrade.com/about-avatrade/legal-documentation |

Our Verdict

AvaTrade is a well-rounded and trustworthy trading platform that caters to traders of all experience levels based on our in-depth review and hands-on experience with the platform.

The robust features of the trading platform, such as its trading signals, VPS service, and cashback/rebate program, provide a comprehensive trading environment that improves both profitability and user experience.

It is commendable that AvaTrade is committed to corporate social responsibility, with initiatives in sustainability, diversity, and community support that are consistent with ethical business practices. This adds a layer of trust and is consistent with the values of socially responsible traders.

Customer service is responsive and knowledgeable, providing timely assistance essential in a fast-paced business environment.

However, it is important to note that different users have had different customer service experiences, indicating that consistency may be improved.

The platform’s trading signals, supported by a partnership with Trading Central, provide accurate and trustworthy insights. This is a significant benefit for traders who wish to make informed decisions without devoting hours to market analysis.

The cashback/rebate program is an additional feature, allowing traders to reduce costs and increase profitability. The program’s adaptability permits it to accommodate a variety of trading volumes and account types, making it accessible to many traders.

You might also like: InstaForex Review

You might also like: Tickmill Review

You might also like: IC Markets Review

You might also like: Exness Review

You might also like: BDSwiss Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Regulated by five Tier-1 regulators, which instils confidence and guarantees that traders are dealing with a legitimate broker | Fixed spreads that are marked-up |

| There are over 1,250 financial instruments that can be traded | There is a limited choice between account types |

| There are transparent trading and non-trading fees | There are limits on leverage for retail traders |

| AvaTrade guarantees trading fund protection | There is an inactivity fee charged |

| There are no commissions charged on any trades | There is no GHC-denominated account for Ghana traders and there are no local deposit and withdrawal options or deposit currencies GHC |

| AvaTrade offers a selection of trading platforms that can be used | Currency conversion fees may apply for deposits/withdrawals made in GHC |

| Trading strategies are not limited | |

| There are no fees charged on deposits or withdrawals |

Conclusion

Now it is your turn to participate:

Regardless, please share your thoughts in the comments below

Frequently Asked Questions

What trading tools are available to AvaTrade clients?

Both the economic calendar and earnings release calendar provided by AvaTrade can assist traders in planning their trades more effectively.

What is the verification process, and what documentation is required for AvaTrade?

When opening a trading account with AvaTrade, you must provide a clear, coloured copy of a valid government-issued ID, such as a passport, driver’s license, or identification card. You must present a utility bill to verify your address or residence.

What is the withdrawal process at AvaTrade?

To withdraw funds from your AvaTrade account, you must ensure that your account has been confirmed and verified.

How long does it take to withdraw from AvaTrade?

AvaTrade withdrawals can take a few hours or days, depending on the payment method.

Does AvaTrade have VIX 75?

Yes, AvaTrade is one of the best brokers for the VIX 75.

What is AvaTrade’s minimum deposit?

AvaTrade requires a minimum deposit of $100.

Is AvaTrade regulated?

AvaTrade is regulated, yes. The CBI, BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, and IIROC govern it.

Does AvaTrade have Nasdaq 100?

Yes, AvaTrade provides Nasdaq 100 shares and US TECH 100 CFDs.

Is AvaTrade Safe or a Scam?

AvaTrade is deemed secure. Multiple jurisdictions regulate it, which increases its safety and dependability.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all Ghanaian investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Namibian Dollar Forex Trading Accounts

Namibian Dollar Forex Trading Accounts

Scam Forex Brokers in Ghana

Scam Forex Brokers in Ghana

Corporate Social Responsibility

AvaTrade is a reputable online trading platform that provides its clients with a wide range of financial services.

As evidenced by its various initiatives to make a positive impact, AvaTrade strongly emphasizes social responsibility and ethical conduct. The following are key aspects of AvaTrade’s commitment to corporate social responsibility: