Exness Review

Exness offers Ghanaian traders several GHS-denominated account options and the benefit that overnight fees are waived on instruments. Exness provides its partners with a lucrative revenue share affiliate program with commissions of up to 40%.

- Lesche Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawals

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

$10 / 119 GHS

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

While researching Exness’ suitability to Ghanaians, we found that Exness has gained popularity in Ghana due to its strong trading environment and low spreads on EUR/USD.

Since its inception in 2008, Exness has grown to over 700,000 customers worldwide. The company’s success is attributed to its focus on technology and international standards.

Exness offers a variety of financial instruments, including Forex, cryptocurrencies, stocks, and commodities, which is appealing to Ghanaian traders who want to diversify their portfolios.

While testing the broker, we found that Exness offers 24/7 support and a platform that supports multiple languages in Ghana, a country that mainly speaks English among Ewe, Nzema, Gonja, Dagaare, and Dangme, among others.

Exness supports a wide range of base currencies, including the Ghanaian Cedi (GHS), which reduces the need for currency conversion and saves Ghanaian traders money.

In our experience, Exness’ substantial monthly trading volume makes it stand out from other brokers and reflects the broker’s global popularity and strong market presence.

Another benefit of Exness is that it launched its trading platforms like the Exness Terminal and the Exness App, catering to Ghanaian investors who prefer to trade on the go.

Overall, Exness’s focus on educating and empowering traders is a significant advantage, as its extensive collection of educational resources helps both beginners and experienced traders make informed trading decisions based on analysis and strategy.

Is Exness regulated, and how does it keep traders safe?

Yes, Exness is regulated by numerous top-tier agencies, including CySEC and the FCA, which ensure stringent financial compliance and investor safety.

Does Exness provide multilingual customer assistance for Ghanaian traders?

Yes, Exness offers 24/7 multilingual customer service so Ghanaian traders can get help anytime they need it.

Exness at a Glance

| 📊 Year Founded | 2008 |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA |

| 🏛 Ease of Use Rating | 5/5 |

| 💰 Bonuses | No |

| 🌎 Support Hours | 24/7 |

| 📱 Trading Platforms | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness App |

| 📈 Account Types | Standard, Standard Cent, Raw Spread, Zero, Pro, Social Standard, Social Pro, Demo, Islamic |

| 💰 Base Currencies | USC, EUC, GBC, CHC, AUC, CAC, AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 📊 Starting spread | From 0.0 pips EUR |

| 📊 Leverage | Unlimited |

| ✔️ Currency Pairs | 100+ |

| 💳 Minimum Deposit (GHS) | 133 GHS ($10) – depends on payment system |

| 📉 Inactivity Fee | No |

| 📱 Website Languages | English, French, Indonesian, Portuguese, Spanish, Vietnamese, Arabic, Thai, Chinese (Simplified), Japanese, Korean, Urdu, Bengali, Hindi, etc. |

| 💰 Fees and Commissions | Spreads from 0.0 pips, commissions from $0.1 |

| ✔️ Affiliate Program | Yes |

| 🔎 Banned countries | USA, American Samoa, Baker Island, Guam, Howland Island, Kingman Reef, Marshall Islands, Northern Mariana Islands, Puerto Rico, Midway Islands, Wake Island, Palmyra Atoll, Jarvis Island, Johnston Atoll, Navassa Island, Martinique, US Virgin Islands, and the United States Minor Outlying Islands, Canada, Curaçao, Cuba, Sint Maarten, Falkland Islands, Uruguay, Australia, New Zealand, Vanuatu, North Korea, Malaysia, Singapore, Aland Islands, Andorra, Austria, Belarus, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Italy, Ireland, Kosovo, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Norway, Netherlands, Poland, Portugal, Romania, Russia, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, Vatican City, Seychelles, Sudan, South Sudan, Réunion, Iraq, Iran, Israel, Syria, Yemen, Palestinian Territory |

| 📉 Scalping | Yes |

| 📈 Hedging | Yes |

| 📉 Dedicated Ghana Account Manager? | No |

| 💻 Tradable Assets | Forex, Commodities, Stocks, Indices, Cryptocurrencies |

| 👉 Open Account | 👉 Click Here |

Regulation and Safety of Funds

Regulation in Ghana

Exness is not regulated by the Bank of Ghana (BoG). However, Exness’s global regulations are listed in the table below.

Exness Global Regulations

| 📱Registered Entity | 🌎Country of Registration | ✔️Registration Number | 🔎Regulatory Entity | 📊Tier | 💳License Number/Ref |

| Nymstar Limited | Seychelles | 8423606-1 | FSA | 3 | SD025 |

| Exness B.V. | Saint Maarten | 148698(0) | CBCS | 3 | 0003LSI |

| Exness VG Limited | British Virgin Islands | 2032226 | FSC BVI | 3 | SIBA/L/20/1133 |

| Tortelo Limited | Mauritius | 176967 | FSC | 3 | GB20025294 |

| Vlerizo (Pty) Ltd | South Africa | 51024 | FSCA | 2 | FSP 51024 |

| Exness (CY) Ltd | Cyprus | HE 293057 | CySEC | 2 | 178/12 |

| Exness (UK) Ltd | United Kingdom | 0886148 | FCA | 1 | FSR 730729 |

| Tadenex Limited | Kenya | – | CMA | 2 | 162 |

Exness Protection of Client Funds

| 🔎Security Measure | 📱Information |

| Segregated Accounts | Yes |

| Compensation Fund Member | Yes, Financial Commission |

| Compensation Amount | €20,000 per client |

| SSL Certificate | Yes |

| 2FA (Where Applicable) | Yes, Exness App |

| Privacy Policy in Place | Yes |

| Risk Warning Provided | Yes |

| Negative Balance Protection | Yes |

| Guaranteed Stop-Loss Orders | Yes, above 1.2 pips |

Which regulatory bodies monitor Exness’ operations in Ghana?

Exness is regulated by several international authorities like FSC, FSCA, FCA, CMA, etc, assuring a high level of safety and transparency for Ghanaian traders despite a lack of local regulation in the country.

How does Exness secure the funds of its Ghanaian clients?

According to our analysis, Exness protects customer funds by segregating them from corporate funds and employing top-tier institutions for this.

Awards and Recognition

According to our research, Exness has won several awards for superior services and products. Here are the most recent awards that this broker has secured:

- In 2024, Exness was named the “Most Trusted Broker” in MEA during the iFX EXPO held in Dubai.

- Exness received the “Best IB/Affiliate Programme MEA” award in 2024 during the iFX Expo in Dubai.

- During SiGMA/AGS Asia in 2023, Exness received the “Affiliate Program of the Year,” with the awards held in Manila, Philippines.

- In 2023, Exness was awarded “Global Broker of the Year” during the Forex Traders Summit held in Dubai.

- During the Forex Trading Summit in Dubai in 2023, Exness was awarded the “Most Innovative Broker of the Year.”

Exness Account Types

| 💻 Live Account | 👉 Open Account | 📉 Minimum Dep. | 💻Platforms | 💸 Leverage |

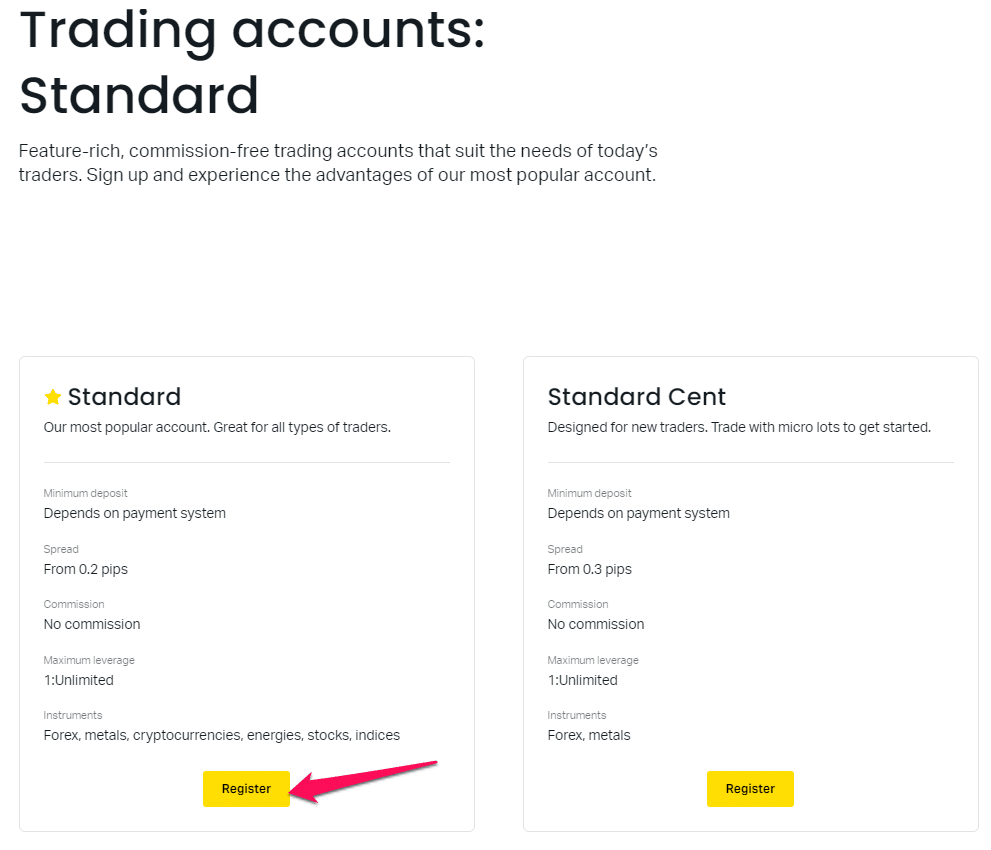

| ➡️Standard | 👉 Click Here | 133 GHS | All | Unlimited |

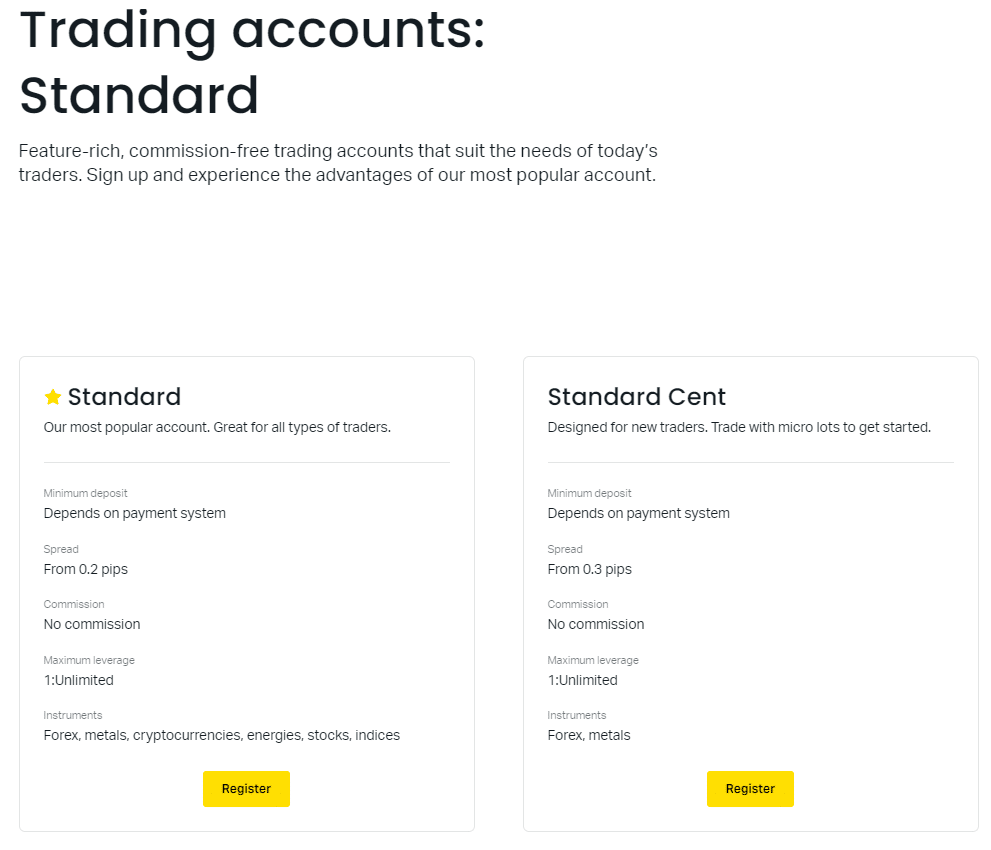

| ➡️Standard Cent | 👉 Click Here | 133 GHS | All | Unlimited |

| ➡️Raw Spread | 👉 Click Here | 6,700 GHS | All | Unlimited |

| ➡️Zero | 👉 Click Here | 6,700 GHS | All | Unlimited |

| ➡️Pro | 👉 Click Here | 6,700 GHS | All | Unlimited |

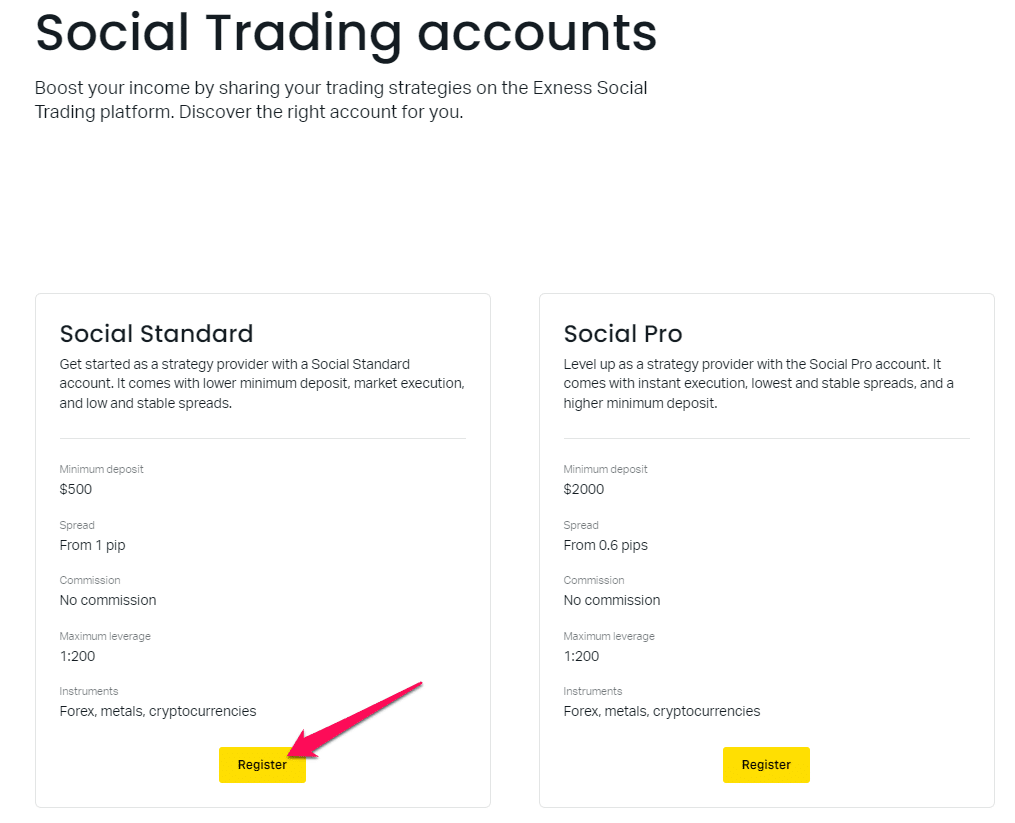

| ➡️Social Standard | 👉 Click Here | 6,700 GHS | All | 1:200 |

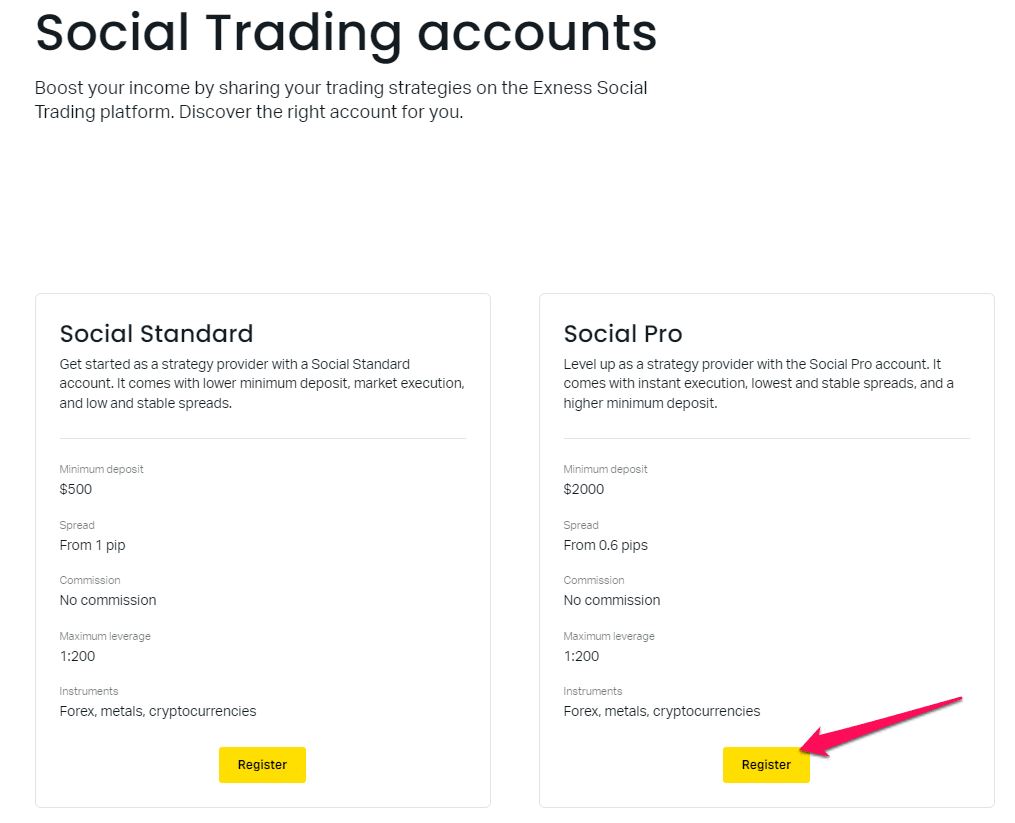

| ➡️Social Pro | 👉 Click Here | 27,000 GHS | All | 1:200 |

Our comprehensive analysis found that Exness is one of the best options for Ghanaians who want trading solutions and accounts denominated in GHS. In the sections below, we delve into the account types that Ghanaians have at their disposal and what traders can expect.

Demo Account

Ghanaian traders can learn more about trading with minimal risk using the Demo Account. We view this as the perfect teaching tool, allowing them to practice various approaches without money.

Ghanaians can register a demo account across live accounts to test each account’s features in a simulated environment. We found the process to sign up and start using the demo account exceedingly easy, with account approval within minutes.

Islamic Account

Exness caters to all traders with its flexible account types, including Muslim traders in Ghana who follow Sharia law. These traders can convert a live account into a Swap-Free option, exempting them from overnight fees.

Furthermore, Exness offers swap-free trading on most financial instruments, meaning Muslim traders can keep positions open on more instruments than what Exness’ competitors offer.

Social Standard Account

The Social Standard Account, ideal for Ghana’s growing social trading network, offers traders a cost-free, commission-free trading strategy with a low starting spread of 1 pip.

Its maximum leverage is 1:200, making it ideal for socially-driven trading. We also found its flexibility and swap-free option alluring, making it an excellent choice for traders seeking to connect and learn from one another.

Social Pro Account

The Social Pro Account in Ghana offers narrower spreads and no commission costs, making it an ideal platform for advanced social trading.

However, this account requires a minimum deposit of $2,000, which shows that it’s designed for serious traders.

Furthermore, leverage is limited at 1:200, and the platform offers market execution choices and immediate execution across different instruments, promoting active involvement and swift decision-making.

Standard Account

The Exness Standard Account aims to balance simplicity and functionality, offering convenient trading of various commodities, cryptocurrencies, energy, stocks, and indices with spreads as low as 0.2 pips and no commission costs.

Its unlimited leverage allows Ghanaians to unlock their full market potential, and it features quick market execution and a swap-free option for traders of different tastes.

Standard Cent Account

The Exness Standard Cent Account is an affordable entry point for novice traders, offering spreads as low as 0.3 pips and no fees.

We also found that this account allows trading in micro-lots up to 200 lots, allowing for exploration and growth at one’s own pace. It offers the same market execution and limitless leverage as the Standard Account.

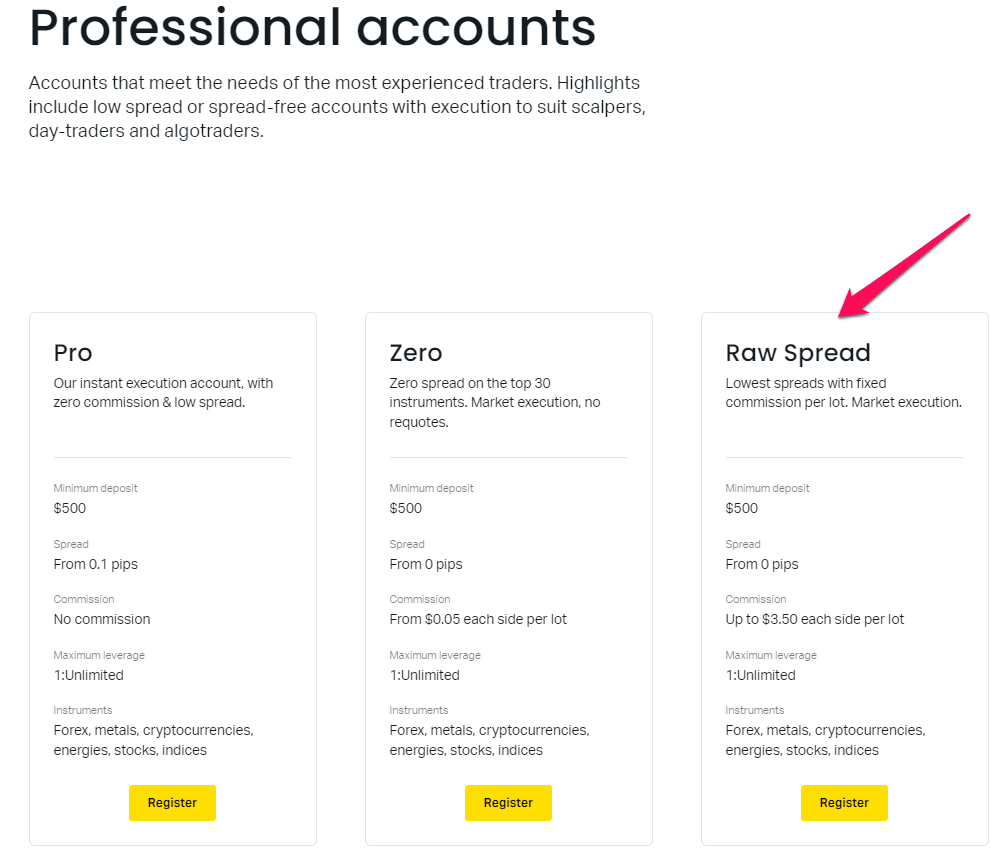

Raw Spread Account

The Exness Raw Spread Account is a great option for traders who want to keep their trading costs low.

Furthermore, the Raw Spread Account is perfect for Ghanaians who value accuracy in their methods, as it offers spreads as low as 0 pips and a moderate charge of up to $3.5 per side for every lot.

With its limitless leverage and market execution, this account is perfect for active traders who trade a wide range of financial instruments.

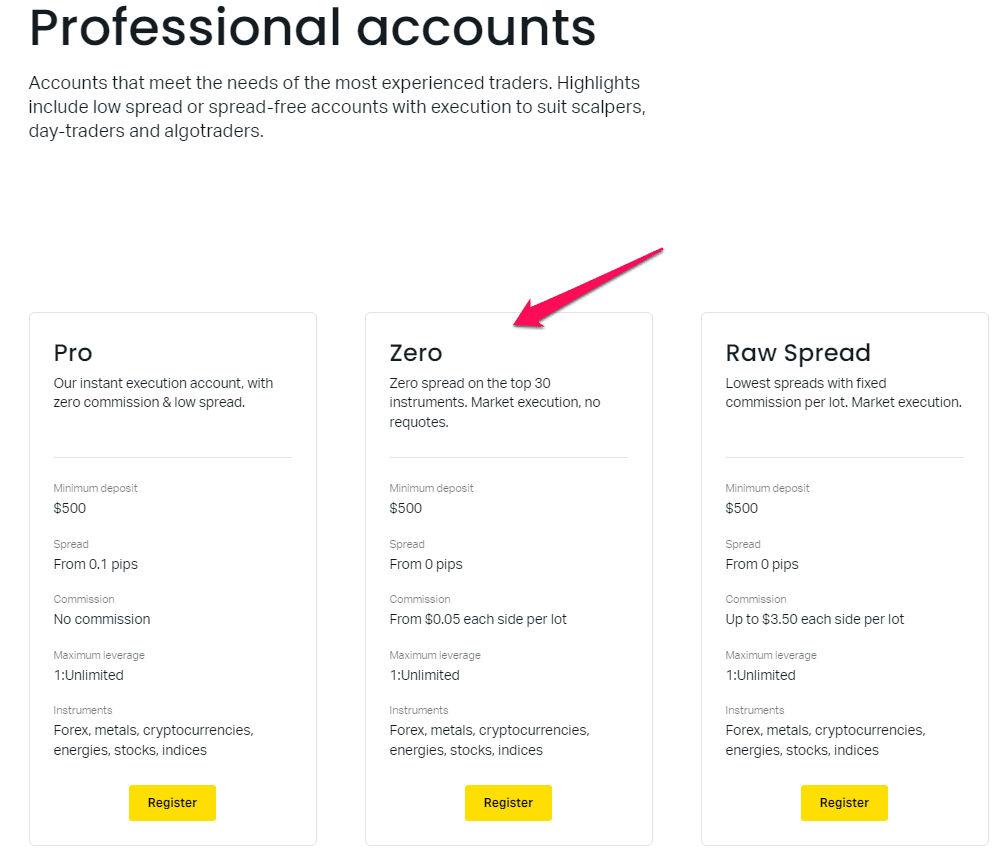

Zero Account

The Exness Zero Account is a suitable option for high-frequency Ghanaian traders who want to boost their profit potential while also trying to minimize spread expenses.

The Zero Account offers a low fee of $0.1 per side per lot and no spread expenses on key currency pairings, providing limitless leverage and market execution similar to other Exness accounts.

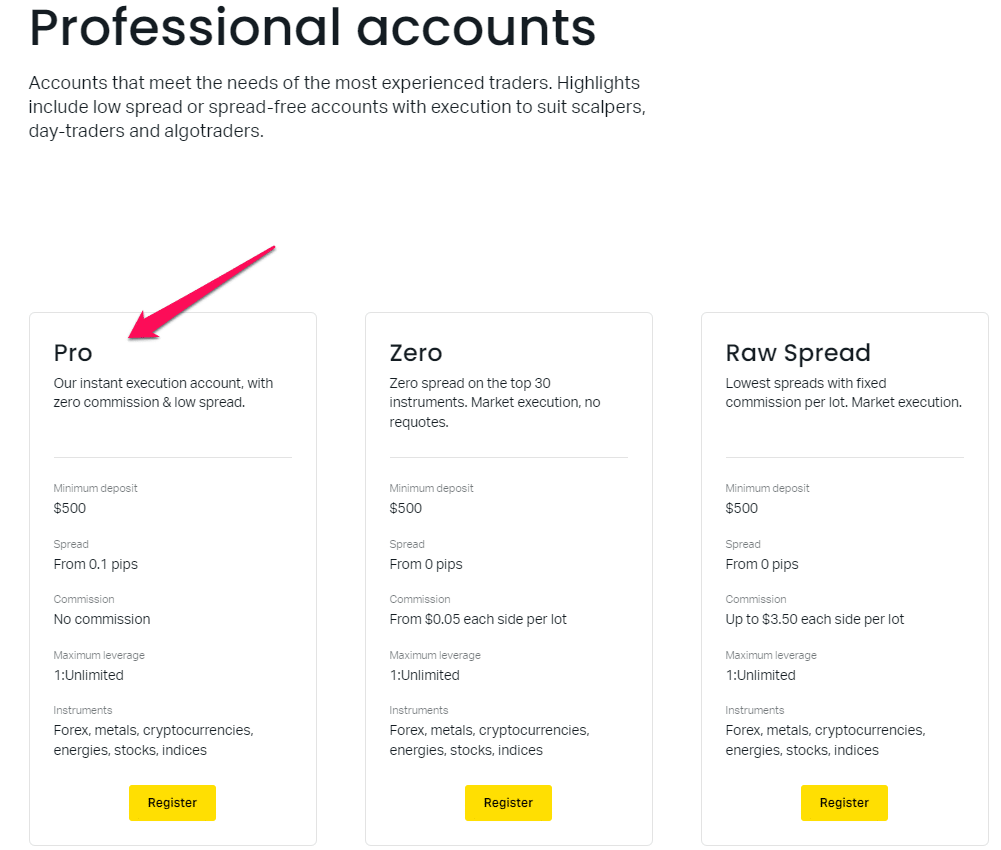

Pro Account

The Pro Account is ideal for complex trading methods and experts seeking fast execution and a variety of instruments.

In addition, the Pro Account charges Ghanaians spreads as low as 0.1 pips and no commission costs, allowing instant trading of cryptocurrencies, metals, energy, equities, and indices with limitless leverage.

Which Exness account type is the best for high-frequency traders in Ghana?

Exness’ Pro account type is excellent for high-frequency traders in Ghana, with minimal spreads and quick execution rates to maximize trading efficiency.

Can Ghanaian traders easily switch between Exness account types?

Yes, Ghanaian traders can quickly switch between account types on Exness using their client interface, allowing flexibility to meet changing trading demands.

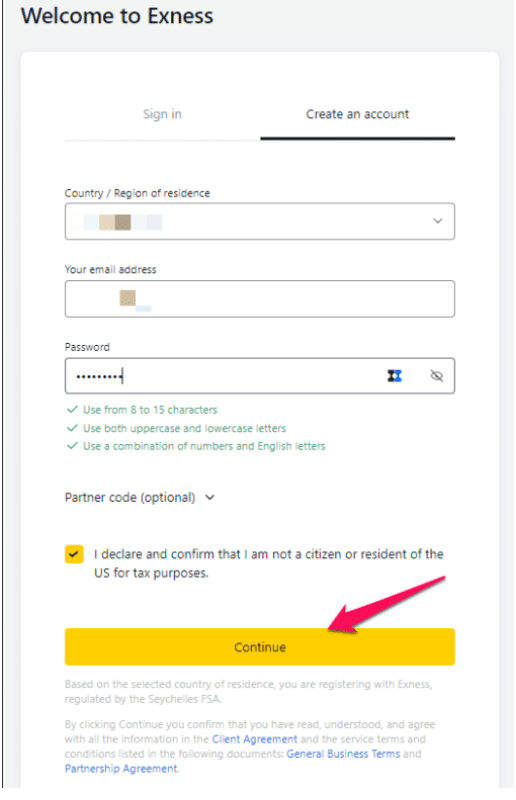

How To Open an Exness Account – step by step

To register an account with Exness, follow these steps:

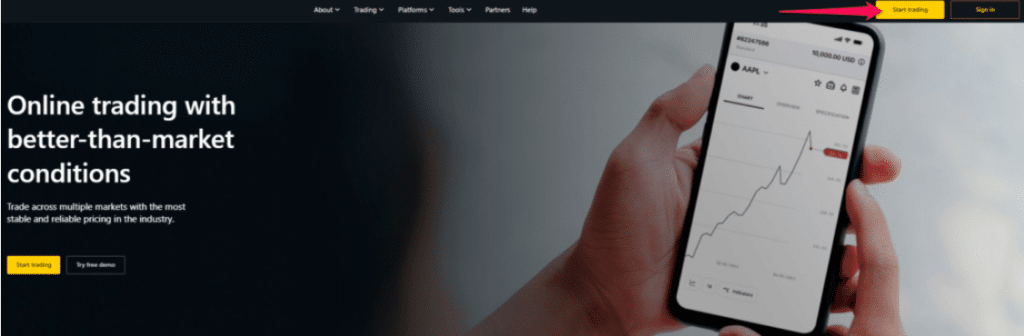

Step 1. Visit the Website

Start by going to the home page and clicking on Start Trading. The website will take you to the Registration page, where you will be required to provide your General and Personal Information.

Step 2. Create an Account

Start by going to the home page and filling out the information in the New Account Section.

After you have filled out the necessary information, you must choose the kind of trading account with which you want to register by clicking on Open New Real Account and then choosing the trading account type. Enter your email address. Create a password for your account following the guidelines shown.

Enter a partner code (optional), which will link your account to a partner in the Partnership program.

Tick the box declaring you are not a citizen or resident of the US, if this applies to you.

Click Continue once you have provided all the required information.

Congratulations, you have successfully registered a new Account and will be taken to your new Personal Area.

Please keep in mind that it may take up to 24 hours to validate the papers. Once your account has been authenticated, you will get an email confirming your registration.

Are there specific documents Ghanaians need to upload when opening an Exness account?

Yes, Ghanaian traders must upload a legitimate form of identity, such as a passport or national ID card, during the account verification procedure at Exness. Additionally, they must prove their residential address using a utility bill or credit card statement.

Are there any expenses to register an Exness trading account in Ghana?

No, Exness does not charge fees for creating a trading account in Ghana, ensuring a simple registration procedure for Ghanaian traders.

Broker Comparison

| 🥇 Exness | 🥈 FXCM | 🥉 Vantage Markets | |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA | FCA, ASIC, CySEC, FSCA | CIMA, VFSC, FSCA, ASIC |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • Exness App • Exness Terminal | • Trading Station • MetaTrader 4 • NinjaTrader • ZuluTrade • Capitalise AI • TradingView Pro • QuantConnect • MotiveWave • AgenaTrader • Sierra Chart • SeerTrading • NeuroShell Trader | • MetaTrader 4 • MetaTrader 5 • ProTrader • Vantage App • Vantage Social trading • ZuluTrade • Myfxbook AutoTrade • DupliTrade |

| 💰 Withdrawal Fee | No | Yes, bank wire | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | From 134 GHS ($10) | 673 GHS ($50) | 673 GHS ($50) |

| 📊 Leverage | Unlimited | • 1:30 (FCA) • 1:400 (Others) | 1:500 |

| 📊 Spread | Variable, from 0.0 pips | From 0.2 pips EUR/USD | From 0.0 pips |

| 💰 Commissions | From $0.1 per side per lot | Only the spread is charged | From $3 |

| ✴️ Margin Call/Stop-Out | 60%/0% | 100%/50% | 80%/50% |

| 💻 Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | Yes | No | No |

| 📈 Account Types | Standard Account Standard Cent Account Raw Spread Account Zero Account Pro Account | Active Trader Professional Trader | PRO ECN |

| ⚖️ BoG Regulation | No | No | No |

| 💳 GHS Deposits | Yes | No | No |

| 📊 Ghana Cedi Account | Yes | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 5 | 1 | 3 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited | 50 million per trade on Forex | 100 lots |

| 💰 Minimum Withdrawal Time | 24 hours | Instant | Instant |

| 📊 Maximum Estimated Withdrawal Time | 3 days | Up to 2 working days | 3 – 5 working days |

| 💸 Instant Deposits and Instant Withdrawals? | No | Yes | Yes |

Exness Deposit & Withdrawal Options

| 💳 Payment Method | 🌎 Country | 💴Currencies Accepted | ⏱️Processing Time |

| 💰Bank Cards | All | Various | Instant – 24 hours |

| 🪙 Skrill | All | Various | Instant – 24 hours |

| 💳 Neteller | All | Various | Instant – 24 hours |

| 🪙 Perfect Money | All | Various | 30 minutes – 24 hours |

| 💸 SticPay | All | Multi-currency | Instant – 30 minutes |

| 🪙Cryptocurrency | All | USDT TRC20, USDC ERC20, USDT ERC20 | Instant – 1 day |

| 💰BinancePay | All | Multi-currency | Instant – 30 minutes |

We had to create a profile on Exness to access the deposit and withdrawal options that Ghanaians have at their disposal, and while this was inconvenient, the process was quick. Below, we discuss how Ghanaians can easily deposit and withdraw funds from their Exness Account.

However, traders must note that the availability of deposit and withdrawal methods can differ. The processing times aren’t always accurate and can differ depending on when the transactions are placed, how many transactions are being processed by Exness, etc.

Deposits

How to Deposit using Bank Wire Step by Step

➡️Go to the Exness website, enter your Exness login details, and go to the “Finance” tab. From there, choose the “Deposit” option.

➡️Select “Bank Wire Transfer” from the list of available deposit methods.

➡️If prompted, choose GHS as the deposit currency and choose your account.

➡️Enter the amount you wish to deposit and then follow the on-screen instructions to obtain your Exness bank information.

➡️To ensure seamless wire transfer processing, please use Exness’s details and include the reference number to ensure the funds are correctly allocated to your account.

How to Deposit using Credit or Debit Card Step by Step

➡️Once you’re in your Exness Personal Area, navigate to the ‘Finance’ area and make a deposit.

➡️To deposit with a credit or debit card, select that option.

➡️Enter your card details and select GHS as your deposit currency if available.

➡️To authorize the transaction and complete the deposit, follow any extra security verification steps required by your credit card provider or bank.

How to Deposit using Cryptocurrency Step by Step

➡️After logging in, click “Deposit” in the “Finance” section of your Exness Personal Area.

➡️Choose the cryptocurrency you prefer.

➡️Choose your trading account.

➡️Send your crypto from your external wallet to the address provided by Exness.

➡️Finish the transfer and wait for the deposit confirmation, which is often done on the same day.

How to Deposit using e-Wallets or Payment Gateways Step by Step

➡️To make a deposit, go to your Exness Personal Area and click on the “Finance” page.

➡️Choose your preferred e-wallet or payment channel like Skrill, Neteller, or Perfect Money.

➡️Choose your trading account and, if available, use GHS as your transaction currency.

➡️To confirm the deposit, enter the amount you want to deposit (ensure it is equal to or more than the minimum required) and then follow the on-screen prompts to access your electronic wallet.

Withdrawals

How to Withdraw using Bank Wire Step by Step

➡️In the ‘Finance’ area of your Exness Personal Area, find “Withdrawal” and click on it.

➡️Please choose “Bank Wire Transfer” as the withdrawal method.

➡️To withdraw, choose the trading account and GHS as your withdrawal currency if this is available.

➡️Ensure all the information is correct before submitting your withdrawal request; this includes the account holder’s name, the bank’s name, and the SWIFT code.

How to Withdraw using Credit or Debit Cards Step by Step

➡️Navigate to the ‘Finance’ section of your Exness account and select ‘Withdraw.’

➡️Select “Credit/Debit Card” as your withdrawal method.

➡️Choose the account from which to withdraw and choose GHS as your withdrawal currency, if possible.

➡️Provide your withdrawal amount, verify the card information, and finish any further security steps your card issuer might require.

How to Withdraw using Cryptocurrency Step by Step

➡️To initiate a withdrawal, go to the “Finance” area of your Exness Personal Area after logging in.

➡️Choose the account from which you want to withdraw funds and the currency you want to withdraw.

➡️Enter your withdrawal amount and confirm the transaction.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

➡️Log in, go to your profile, and choose the “Finance” tab.

➡️Select your e-wallet or payment gateway, such as Skrill, Neteller, or Perfect Money.

➡️Select the trading account and currency (GHS if offered), input the withdrawal amount, and proceed with the on-screen guidance to complete the transfer to your e-wallet.

What deposit methods are accessible to Ghanaian traders on Exness?

Depending on what Exness’ system shows them, Ghanaian traders can deposit using bank wire transfers, credit/debit cards, e-wallets like Skrill and Neteller, and local payment alternatives.

How long does it take for deposits to be reflected in a Ghanaian trader’s Exness account?

Deposits made by Ghanaian traders on Exness often appear in their trading accounts immediately or within a few minutes, providing quick access to funds for trading.

Exness Trading Platforms and Software

While testing Exness’ platforms, we saw a perfect balance between Exness’ proprietary software and third-party platforms like MetaTrader 4 and 5, allowing traders to choose their favorite one.

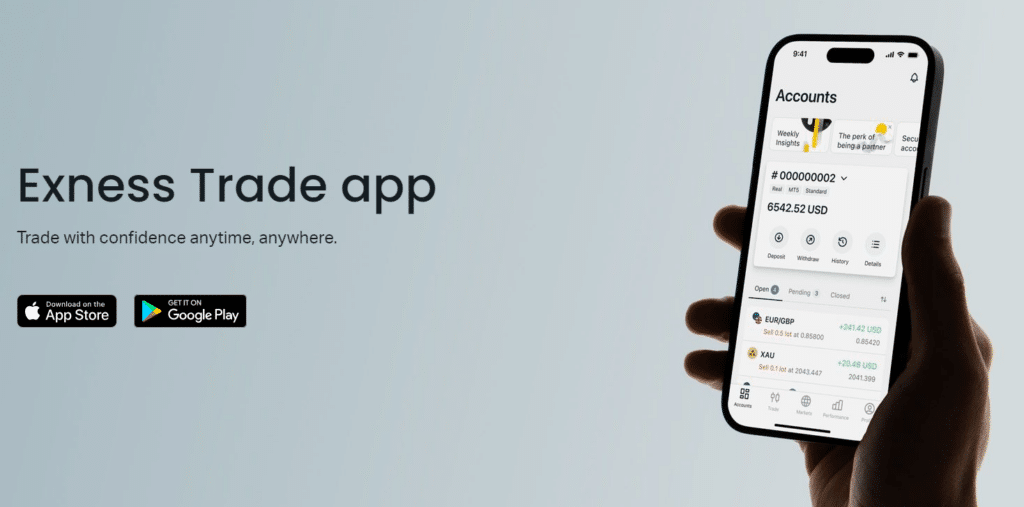

Trader App

When we tested the Exness Trader App, we first noticed that it is a user-friendly platform designed for Ghanaian traders.

It is an innovative trading bridge that offers several trading options, including over 100 currency pairs, stocks, and cryptocurrencies.

We could easily navigate the app and appreciated its reliability and non-existing lag. Furthermore, it integrates seamlessly with Exness’s trading conditions, enhancing the trading experience.

The app also allows for managing multiple accounts, providing flexibility and convenience. Overall, the Exness Trader App is a well-crafted platform that combines functionality with user-friendliness, making it a valuable tool for traders in Ghana.

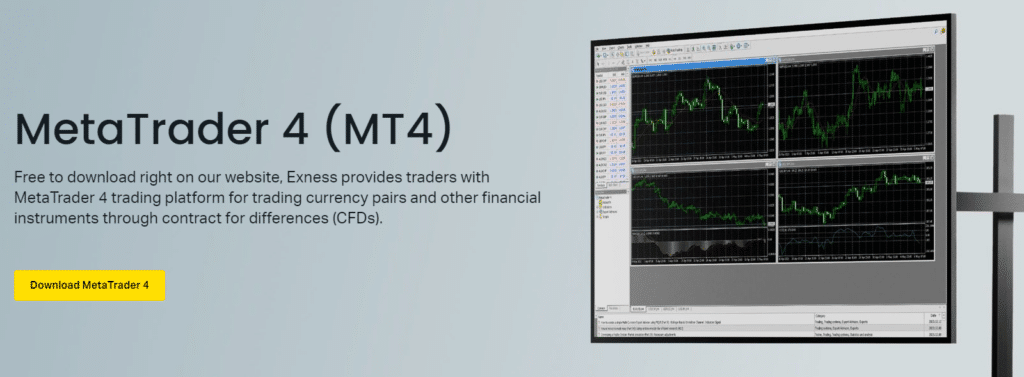

MetaTrader 4

Next, we tested MetaTrader 4 using Exness’ demo account and we can conclude that it is an excellent choice for traders due to its compatibility with Exness’s trading conditions.

Exness’s tight spreads and unlimited leverage complement MT4’s robust environment, allowing it to handle high trade volumes and cater to various investment sizes.

Furthermore, the one-click trading feature and rapid execution speeds enable swift market entry and exit, making it crucial for traders in fast-paced markets.

MetaTrader 5

We also tested Exness’ MT5 using the demo account and found that it offers an advanced trading environment that complements its diverse financial instruments.

Exness’ MT5 has comprehensive analysis tools that let Ghanaians explore complex trade setups, aligning with Exness’s offerings of stocks, indices, and energies.

Furthermore, MT5’s support for multi-asset trading and competitive spreads make it an ideal choice for portfolio diversification.

Finally, we believe that experienced Ghanaian traders will appreciate the platform’s depth of market features and transparency regarding commissions and other trading fees.

Web Terminal

The Exness Web Terminal is a user-friendly platform, and we discovered that it offers the unique attribute of eliminating barriers for new traders by requiring no downloads or installations.

The sleek design offers seamless functionality, providing a comparable experience to downloadable platforms and making it ideal for trading in dynamic markets.

The web terminal’s compatibility with Exness’s trading conditions ensures Ghanaians have access to the same competitive environment as traditional platforms.

Does Exness provide a mobile trading app for Ghanaian traders?

Yes, Exness has a mobile trading app accessible for both iOS and Android devices, allowing Ghanaian traders to trade on the move and manage their accounts from their phones or tablets.

Can Ghanaian traders customize their trading interfaces on Exness platforms?

Yes, Exness’ MetaTrader platforms include considerable customization possibilities, allowing Ghanaian traders to tailor their trading interface, charts, and technical indicators to their liking.

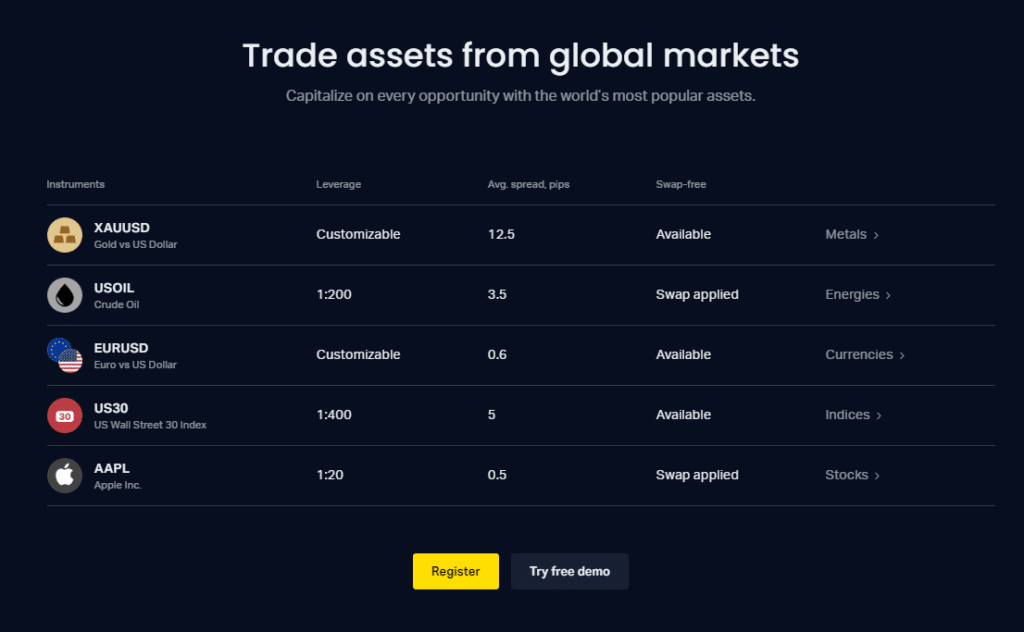

Trading Instruments & Products

We found that Exness focuses on providing Ghanaians access to CFD and Forex trading by offering several markets, including these:

➡️Precious Metals – Ghanaian traders can access 15 precious metals, including gold and silver, as hedges against inflation and market volatility, making them a reliable investment option.

➡️Energies – Exness has three energy commodities, including oil and gas, that Ghanaians can trade using Exness’ platforms or the MetaTrader Suite. These instruments are crucial to the global economy and potentially influenced by geopolitical events, offering various trade opportunities.

➡️Cryptocurrencies – Exness is embracing the growing interest in digital assets by offering trading on 11 cryptocurrency pairings, allowing Ghanaian traders to capitalize on this new asset class’s volatility and growth potential.

➡️Indices – Exness provides Ghanaian traders with 11 key indexes, including the US30, US50, and USTEC, allowing them to monitor market trends and gauge sector or economy performance.

➡️Forex – Ghanaians can choose from over 100 forex pairs that can be traded across all trading accounts and platforms, offering ample trading opportunities in a dynamic, volatile market.

➡️Stocks – Ghanaians can easily participate in trading global shares like Netflix, Apple, Amazon, and others through Exness.

What financial products can Ghanaian investors trade on Exness?

Exness allows Ghanaian traders to trade various financial items, including foreign currency pairings, commodities, cryptocurrencies, stocks, and indices.

Does Exness provide leverage for trading financial products to Ghanaian traders?

Yes, Exness offers Ghanaian traders leverage while trading financial products, letting them amplify their trading positions and perhaps improve their earnings.

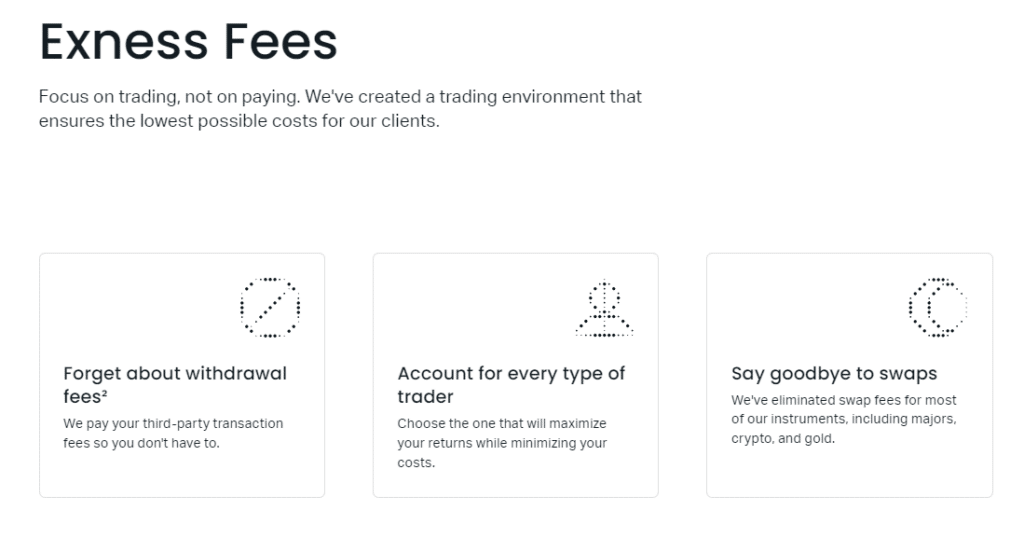

Spreads and Fees

We could easily view Exness’ spreads, fees, and other costs when we visited the official website. Each fee is detailed under the relevant markets, and there is a section under the “Trading” tab called “Fees,” making it convenient to access.

Exness Spreads and Fees

We could easily view Exness’ spreads, fees, and other costs when we visited the official website. Each fee is detailed under the relevant markets, and there is a section under the “Trading” tab called “Fees,” making it convenient to access.

Spreads

Our extensive evaluation of Exness reveals that the broker offers a competitive trading environment for Ghanaian traders, with spreads starting from 0.0 pips on EUR/USD for specific account types.

These tight spreads remain consistent across major currency pairs, demonstrating Exness’s commitment to cost-effective trading.

Furthermore, the spread value is influenced by the range of account types, catering to traders of all experience levels. Exness’s spread model complements different trading instruments, allowing traders to optimize their strategies without incurring excessive costs.

Commissions

We appreciate that Exness offers a transparent fee structure that aligns with industry standards. Commissions start from $0.1 per lot on the Zero account.

This fee is competitive, especially considering the precise trading with raw spreads from 0 pips. Some accounts have higher commissions, but minimal spreads balance them.

The Pro account offers professional trading conditions with zero commission, making it attractive to Ghanaian traders seeking an edge in the markets.

Overnight Fees

Exness charges swap fees for overnight positions, a common practice in the industry. It differentiates itself by providing detailed information on long and short swap fees for each instrument, allowing traders to plan effectively.

Despite potential changes based on market conditions, Exness’s transparency ensures traders are always aware of the costs of holding overnight positions.

Deposit and Withdrawal Fees

Exness offers a zero-fee policy for all Ghanaian traders, eliminating deposit and withdrawal fees. This policy applies to all payment methods, enhancing the cost-effectiveness of trading. However, traders should know potential fees from payment providers or financial institutions.

Inactivity Fees

Exness does not charge fees on dormant accounts, benefiting traders who may not trade consistently. This policy ensures that the trader’s equity remains intact during non-trading periods, highlighting Exness’s trader-friendly policies.

Currency Conversion Fees

Lastly, we also examined Exness’ currency conversion fees. Exness charges currency conversion fees for any currency conversion resulting from funding or trading in a different currency than the account’s base currency.

This practice is standard across the industry, and Exness maintains transparency. Ghanaian traders can mitigate these fees by selecting GHS as their base, deposit, and withdrawal currency.

However, should there be any discrepancy between trading currencies and those in which traders deposit and withdraw funds, Exness executes conversions at current market rates.

What are the typical spreads that Exness charges Ghanaian traders?

Exness charges Ghanaian traders attractive spreads starting at 0.0 pips on key currency pairs, assuring cost-effective trading conditions.

Does Exness provide discounts or promotions on spreads for Ghanaian traders?

Yes, Exness periodically offers promotional campaigns like forex cashback rebates that provide Ghanaian traders spread reductions, adding value to their trading activity.

Leverage and Margin

Exness offers traders unlimited leverage according to their account equity, a powerful tool for conservative and aggressive traders.

However, when evaluating the trading conditions relating to leverage and margin, we found that Exness also imposes margin requirements to protect traders, which can change depending on market conditions.

The platform’s margin call policy, which starts at 60%, provides a safety net for underfunded positions. In case of a stop-out, the platform automatically closes positions, preventing negative balances.

Exness’s leverage and margin policies address the inherent volatility in forex and CFD trading, providing Ghanaian traders with efficient capital tools while promoting a disciplined approach to risk management.

What leverage levels does Exness give Ghanaian traders?

Exness provides variable leverage levels for Ghanaian traders, ranging from 1:2 to 1:Unlimited, allowing them to adjust their trading approach to their risk tolerance and market conditions.

Can Ghanaian traders change their leverage after creating an account with Exness?

Yes, Ghanaian traders can alter their leverage levels at any time via the Exness Client Portal, allowing them to respond to changing market circumstances or risk choices.

10 Best Forex Brokers in Ghana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Educational Resources

While Exness does not have an educational section on the official website, a quick web search under “Exness Education” gave us a few resources, including the following:

- Webinars – Exness’s webinars, led by industry experts, offer real-time learning on market trends and trading strategies. The interactive nature allows traders to ask questions and receive immediate clarification, especially in volatile markets like Ghana.

- Educational Videos – Exness offers educational videos for visual learners, covering platform tutorials and trading strategies. These videos cater to beginners and experienced traders, making trading knowledge accessible to both beginners and experts.

- Exness Academy – The Exness Academy offers a comprehensive educational program for Ghanaian traders, focusing on risk management and market analysis techniques. The academy offers a structured learning path, starting with beginner courses and progressing to advanced techniques. Its unique approach ensures traders in Ghana understand trading principles tailored to their local market dynamics.

- Blog and Articles – Exness’s blog provides extensive trading content and advanced technical insights, benefiting Ghanaian traders. The blog’s market analysis aids in informed decision-making, aligning with the need for contextual understanding in Ghana’s trading environment, and serves as a valuable resource for traders.

Does Exness provide instructional resources in English for Ghanaian traders?

Yes, Exness offers teaching materials primarily in English to meet the linguistic needs of Ghanaian traders, assuring accessibility and ease of comprehension.

Does Exness have demo accounts where Ghanaian traders can practice trading?

Yes, Exness offers demo accounts with virtual funds, allowing Ghanaian traders to practice applying the information learned from educational materials in a risk-free trading environment before trading with real funds.

Bonuses and Promotions

Exness does not currently offer any active bonuses or promotions to retail traders. However, according to the Exness website, two specialized partnership opportunities exist for anyone who wants to make money through referrals.

The Exness affiliate program allows Ghanaian partners to earn money on each new client they introduce to Exness.

In contrast, according to our research, the Exness platform allows partners to offer cashback rebates to customers they refer, a feature highly appreciated in the Ghanaian market.

Moreover, partners can return up to 100% of their commissions as rebates, and Exness’ Personal Area allows partners to create, accept, or reject rebates, simplifying the payment process.

We also found that partners can arrange rebate payments daily, weekly, or monthly and receive them automatically or manually, with manual payments providing greater control.

However, Ghanaians must note that rebates do not apply to Social_Standard or Social_Pro accounts, ensuring the system is effectively used within the right account structures increasing its influence on the Ghanaian forex trading community.

What bonuses does Exness provide to new traders in Ghana?

Exness does not currently provide any unique bonuses to Ghanaian traders.

Are there any continuous promotions for Exness traders in Ghana?

No, Exness does not indicate any continuous promotions on its website.

How to Register an Affiliate Account with Exness Step-by-Step

The process involved with signing up as an affiliate with Exness is straightforward, involving these steps:

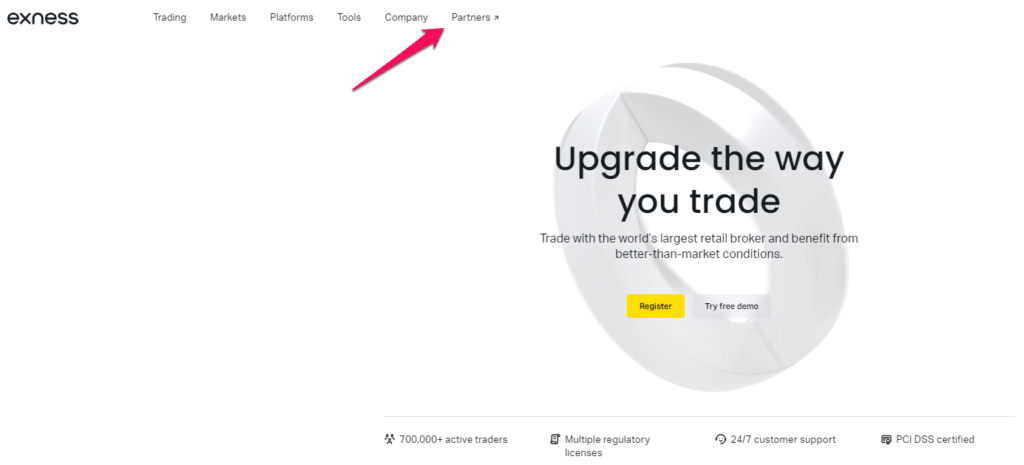

Step 1: Click on “Partners”

To learn more about affiliate options, visit the Exness homepage and look for the “Partners” item in the main menu.

Review the details and benefits of the Introducing Broker and Affiliate Program to see which best meets your needs.

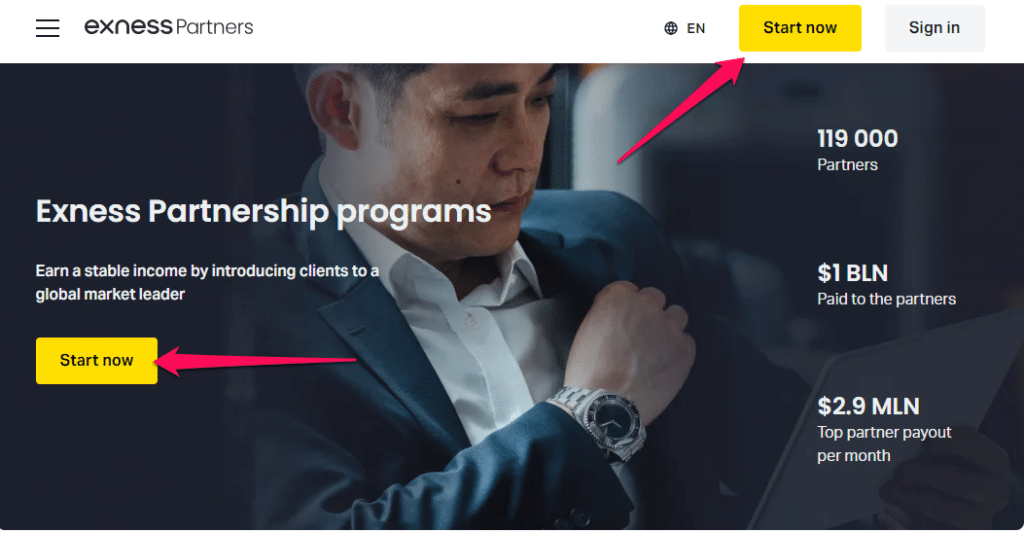

Step 2: Click on “Start Now”

If you already know what you prefer, click the “Start Now” banner at the top of the Partners page to begin the registration process.

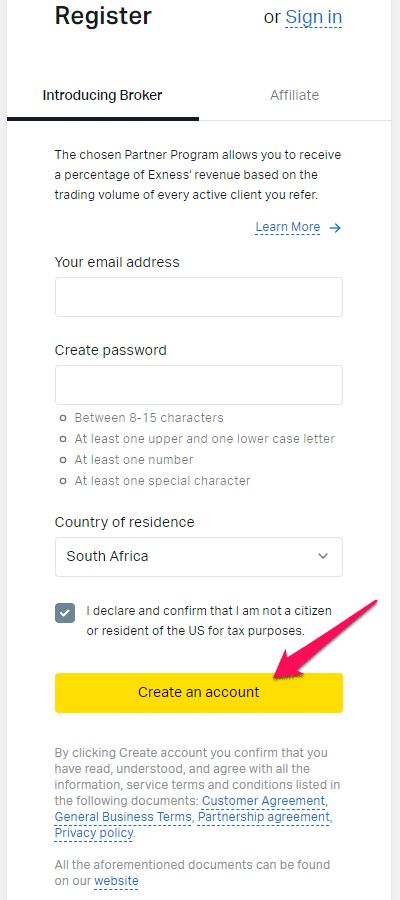

Step 3: Complete the Registration form

To set up your affiliate account, complete the registration form with accurate information such as your name, contact information, and any needed financial information.

Submit the form and wait for a confirmation email from Exness with additional information on how to fully activate your account and begin earning commissions.

Exness Affiliate Programs

In Ghana, where financial markets are quickly growing, the Exness Affiliate Program appears to be an appealing possibility for individuals to earn a consistent income by bringing new clients to a globally known broker.

Firstly, the Introducing Broker (IB) program pays partners up to 40% of the money produced by each active trader they refer to, which is a significant incentive, particularly for those with strong ties in the local trading community.

Furthermore, the Affiliate Program is quite competitive, giving commissions of up to $1,850 per customer, depending on the client’s region, selected platform, and deposit amount.

Overall, as per our comprehensive review, Exness has established itself as a dependable broker in 150 countries, providing services in 19 languages and 24/7 client assistance in 15 languages.

This vast global presence inspires trust in Ghanaian partners looking to market a broker with a strong international reputation.

How can I join the Exness Affiliate Program?

Ghanaians can register for the Exness Affiliate Program using the website’s Exness Partners portal.

What commission structure does Exness provide to its affiliates in Ghana?

Exness pays up to 40% of the revenue from referred clients’ trading activity to its Ghanaian affiliates.

Exness Customer Support

| Customer Support | Exness Customer Support |

| ⏰ Operating Hours | 24/7 |

| [email protected] | |

| 🗣 Support Languages | Multilingual |

| 🗯 Live Chat | Yes |

| ☎️ Telephonic Support | Yes |

| ✔️The overall quality of Exness Support | 5/5 |

Social Responsibility

Exness has a detailed CSR section that we could investigate in great detail. Based on our findings, Exness has established a robust Corporate Social Responsibility (CSR) framework, emphasizing ethical behavior and a commitment to societal improvement.

Exness’ comprehensive website outlines a multi-faceted strategy centered on education, environmental responsibility, and disaster relief. Exness provides resources and scholarships to schools, recognizing the importance of education in long-term social transformation.

Furthermore, we found that Exness closely collaborates with NGOs to reduce its negative impact on the environment, using innovative solutions like drones to detect forest fires.

Exness also allocates significant resources to global disasters and forest fires, demonstrating its commitment to disaster relief and humanitarian needs.

In our experience with this flexible, reputable broker, we found that Exness has consistently demonstrated its commitment to community involvement through global projects, such as environmental clean-ups, animal assistance, and educational resources for indigenous populations.

Exness Pros & Cons

| ✔️ Pros | ❌ Cons |

| Exness offers scalpers the perfect spread list, with spreads from 0.0 pips EUR/USD | Exness does not have a physical presence or regulations in Ghana |

| Exness caters to beginners in Ghana by providing a demo account and educational materials | Ghanaians might face currency conversion fees when they deposit and withdraw funds |

| There is a diversified portfolio of markets that can be traded, including 100+ forex pairs | The spreads on commission-free accounts can widen significantly |

| Exness is well-regulated in several regions and has a good reputation as a CFD and forex broker | |

| Exness offers dedicated social trading accounts to Ghanaians | |

| There is a balance between proprietary and third-party platforms | |

| Ghanaians can choose GHS-denominated accounts | |

| There are commission-free and swap-free options available |

Exness User Comments and Reviews

- “I’m extremely pleased with Exness, and I’ve been using it for some time. It is refreshing that there are no hidden costs and tight spreads. However, that unlimited leverage can be both a blessing and a curse, so be careful with it.”

- “I like Exness because of how versatile it is across all of my accounts. Although the fast withdrawals are incredibly handy, it’s a bit disappointing that there aren’t many deposit/withdrawal options. Overall, though, it’s a good platform.”

Our Recommendations on Exness

While Exness offers an ideal trading environment and trading options for Ghanaians, we can provide some recommendations on how it can cater better to Ghanaians, including the following:

- Offering more localized customer support in Ghana.

- Streamlining transactions in GHS by ensuring that deposit and withdrawal methods can be made in local currency, saving traders on currency conversion fees.

- Pursuing regulatory approval in Ghana.

You might also like: AvaTrade Review

You might also like: IC Markets Review

You might also like: InstaForex Review

You might also like: Tickmill Review

You might also like: Exness Review

Conclusion

According to our findings, Exness is an extremely reputable Forex and CFD broker for traders in Ghana. As part of its offer, Exness charges competitive spreads and offers a variety of trading options.

Some accounts allow for unlimited leverage, albeit with increased risk. Although not regulated locally in Ghana, Exness adheres to international security standards, providing trust and assurance for investors.

We found that Exness’ insurance coverage from the Financial Commission adds another layer of protection. However, the absence of local regulation in Ghana could raise concerns for some traders.

Furthermore, in our experience, the diverse range of account types can make choosing the ideal one difficult. Therefore, we advise Ghanaians to use a demo account to assess each account type to find the best fit.

Despite some concerns, we consider Exness a suitable option for Ghanaians who want a global presence, good reputation, competitive trading conditions, and a secure trading environment.

Our Insight

After my detailed assessment, I found that Exness offers a user-friendly trading platform, competitive spreads, and low commissions, making it a great choice for traders of all levels of experience. The Exness Partnership program is a stable way of gaining income.

Frequently Asked Questions

Does Exness provide any educational materials exclusively for Ghanaian traders?

No, Exness’ educational materials are not Ghana-specific but serve a global clientele.

Are there minimum income criteria for opening an Exness account?

No, Exness does not have income requirements. Instead, Exness’ payment systems have minimum investment amounts.

How long does becoming certified on Exness as a Ghanaian resident take?

Verification timeframes vary. However, Exness strives for efficiency. If you want to speed up the verification process, ensure your ID and Proof of Residence copies are legible.

Can I trade Ghanaian assets like the Ghana Stock Exchange Index on Exness?

No, you cannot. Exness focuses largely on the worldwide FX and CFD markets.

Does Exness offer any deposit bonuses to Ghanaian traders?

No, Exness does not have any active deposit bonuses geared towards Ghanaian or global clients.

Namibian Dollar Forex Trading Accounts

Namibian Dollar Forex Trading Accounts

Scam Forex Brokers in Ghana

Scam Forex Brokers in Ghana