IC Markets Review

Overall, IC Markets is considered low risk, with an overall Trust Score of 86 out of 100. IC Markets is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). IC Markets offers three retail trading accounts: a cTrader Account, a Raw Spread Account, and a Standard Account.

- Lesche Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

2390 GHS or $200

Regulators

ASIC, CySEC, FSA, SCB

Trading Desk

MetaTrader 4

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

IC Markets, a leading provider of forex and CFD trading solutions, is headquartered in Australia and is regulated by several financial authorities, including ASIC, CySEC, the FSA, and the SCB.

IC Markets offers a comprehensive suite of trading solutions designed to meet a variety of trading needs to a diverse clientele that includes novice traders, active day traders, and scalpers.

IC Markets’ commitment to providing higher liquidity and low-latency connections is one of its distinguishing features, ensuring traders can access optimal pricing conditions.

This pricing level was previously available only to high-net-worth individuals and investment banks but is now available to all IC Markets clients.

To accommodate different trading styles and preferences, the company also provides a variety of trading platforms, including MT4, MT5, IC Social, Signal Start, ZuluTrade, and cTrader. These platforms are well-known for their user-friendly interfaces and advanced trading tools, which improve the trading experience.

IC Markets accepts clients from Ghana and offers specialized account types, such as demo and Islamic accounts, to meet various trading needs and ethical concerns.

The pricing structure of IC Markets is one of its most competitive features. The firm offers an average spread as low as 0.0 pips, with a round-turn commission of $6 or $7, depending on the account type.

Traders can also take advantage of a maximum leverage ratio of up to 1:500, which provides ample opportunities for potentially higher returns, albeit at a higher risk.

Overall, IC Markets aims to provide a superior trading environment by combining innovative platforms, competitive pricing, and strong regulatory frameworks.

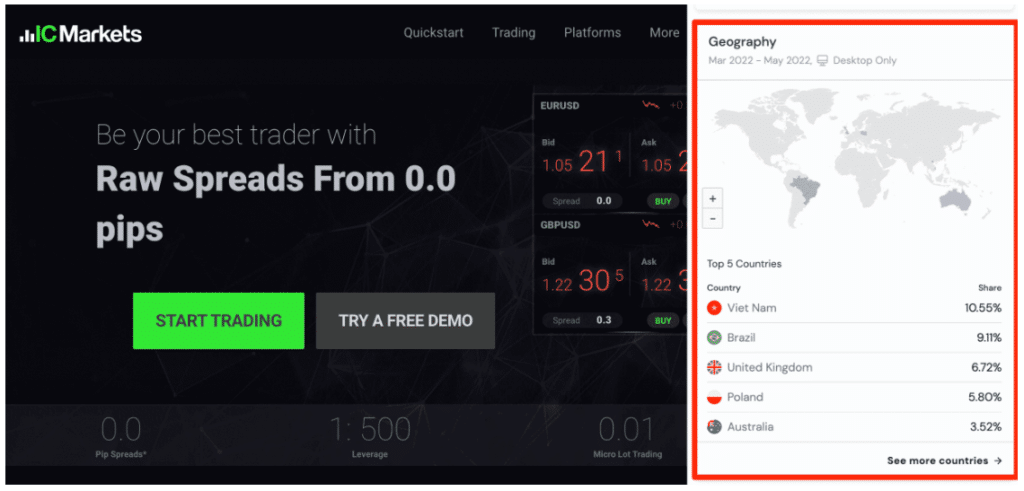

Distribution of Traders

Currently has the largest market share in these countries:

➡️ Vietnam – 11.7%

➡️ Brazil – 8.9%

➡️ United Kingdom – 6.5%

➡️ Poland – 5.6%

➡️ Australia – 3.9%

Popularity among Ghanaian traders

IC Markets is among the Top 20 Forex and CFD brokers for Ghanaian traders.

IC Markets At a Glance

| 🏛 Headquartered | Sydney, Australia |

| 🌎 Global Offices | Australia |

| 🏛 Local Market Regulators in Ghana | Bank of Ghana (BoG) |

| 💳 Foreign Direct Investment in Ghana | 524.3 million USD (2021) |

| 💰 Foreign Exchange Reserves in Ghana | 5.3 million USD (June 2024) |

| ✔️ Local office in Accra? | No |

| 👨⚖️ Governor of SEC in Ghana | Daniel Ogbarmey Tetteh (Director-General) |

| ✔️ Accepts Ghanaian traders? | Yes |

| 📊 Year Founded | 2007 |

| 📞 Ghana Office Contact Number | None |

| 📱 Social Media Platforms | Facebook |

| ⚖️ Regulation | ASIC, CySEC, FSA, SCB |

| 1️⃣ Tier-1 Licenses | Australian Securities and Investments Commission (ASIC) |

| 2️⃣ Tier-2 Licenses | Cyprus Securities and Exchange Commission (CySEC) |

| 3️⃣ Tier-3 Licenses | Financial Services Authority (FSA) Securities Commission of the Bahamas (SCB) |

| 🪪 License Number | Seychelles – SD018 Australia – AFSL 335692 Cyprus – 362/18 Bahamas – SIA-F214 |

| ⚖️ Regulation | No |

| ✔️ Regional Restrictions | United States, Canada, Iran, Yemen, and OFAC countries |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | Yes |

| 💻 Liquidity Providers | 25 |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | From 0.0 pips |

| 📉 Minimum Commission per Trade | From $3 to $3.5 |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a GHS Account? | No |

| 📉 Dedicated Ghana Account Manager? | No |

| 📈 Maximum Leverage | 1:500 |

| 📊 Leverage Restrictions for Ghana? | No |

| 💳 Minimum Deposit (GHS) | 2 390 Ghanaian Cedi or an equivalent to $200 |

| ✔️ GHS Deposits Allowed? | No |

| 📊 Active Ghana Trader Stats | Unknown |

| 👥 Active Ghanaian -based IC Markets customers | Unknown |

| 🔁 Ghana Daily Forex Turnover | Unknown, global OTC foreign exchange turnover reached $7.5 trillion in April 2022 |

| 💰 Deposit and Withdrawal Options | Credit Card Debit Card PayPal Neteller Neteller VIP Skrill UnionPay Bank Wire Transfer Bpay FasaPay Broker to Broker POLi Thai Internet Banking Vietnamese Internet Banking Rapidpay Klarna |

| 💻 Minimum Withdrawal Time | Instant |

| ⏰ Maximum Estimated Withdrawal Time | Up to 14 business days |

| 💳 Instant Deposits and Instant Withdrawals? | Instant Deposits |

| 🏛 Segregated Accounts with Ghanaian Banks? | Yes, on PayPal, Neteller, and Skrill |

| 📱 Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader IC Social Signal Start ZuluTrade |

| 💻 Tradable Assets | Forex Commodities Indices Bonds Cryptocurrencies Stocks Futures |

| ✔️ Offers USD/GHS currency pair? | No |

| 📊 USD/GHS Average Spread | None |

| ✅ Offers Ghana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Spanish, Russian, Thai, Malay, Vietnamese, Italian, Portuguese, and several others |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Ghana-based customer support? | Yes |

| 💸 Bonuses and Promotions for Ghanaian? | No |

| 📚 Education for Ghanaian beginner traders | Yes |

| 📱 Proprietary trading software | Yes, App |

| 🤝 Most Successful Trader in Ghana | Louis Boah |

| ✔️ Is IC Markets a safe broker for Ghana Traders? | Yes |

| 🎖 Rating for IC Markets Ghana | 9/10 |

| 🥇 Trust score for IC Markets Ghana | 86% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Ghana

The Bank of Ghana (BoG) does not currently regulate IC Markets. However, IC Markets’ global regulations are listed in the table below.

Global Regulations

| Registered Entity | Country of Registration | Registration Number | Regulatory Entity | Tier | License Number/Ref |

| Raw Trading Ltd | Seychelles | – | FCA | 3 | SD018 |

| International Capital Markets Pty Ltd. | Australia | CAN 123 289 109 | ASIC | 1 | AFSL 335692 |

| IC Markets EU Ltd | Cyprus | – | FSCA | 2 | 362/18 |

| IC Markets Ltd | Bahamas | 76823 C | SCB | 3 | SIA-F214 |

Client Fund Security and Safety Features

| Security Measure | Information |

| Segregated Accounts | Yes |

| Compensation Fund Member | No, in-house insurance |

| Compensation Amount | $1 million |

| SSL Certificate | No |

| 2FA (Where Applicable) | No |

| Privacy Policy in Place | Yes |

| Risk Warning Provided | Yes |

| Negative Balance Protection | Yes |

| Guaranteed Stop-Loss Orders | No |

Security while Trading

IC Markets prioritizes security, making it a trustworthy option for Ghanaian traders. Multiple financial authorities monitor IC Markets’ operations.

These regulatory bodies are well-known for their stringent standards, which ensure that IC Markets follows best practices in operational integrity, financial reporting, and client fund protection.

The segregation of client funds is one of the key security features provided by IC Markets. This means that trader funds are kept in separate bank accounts from the company’s operational funds, adding an extra layer of security. Client funds would be protected in case of IC Markets’ insolvency.

Furthermore, IC Markets uses advanced encryption technologies to protect its clients’ data and financial transactions. This includes using Secure Sockets Layer (SSL) encryption for data transmission, which ensures that sensitive information is transmitted securely over the web.

Furthermore, two-factor authentication (2FA) is frequently used to add an extra layer of security to the login process.

For Ghanaian investors concerned about the safety of their investments, IC Markets’ multi-jurisdictional regulatory status provides an additional layer of assurance.

This global regulatory recognition strengthens IC Markets’ credibility and provides traders with multiple dispute resolution options, should the need arise.

Are there any additional security features like two-factor authentication?

Yes, the broker provides two-factor authentication to increase account security.

Are my personal details safe with IC Markets?

Yes, the broker follows stringent data protection regulations to safeguard your personal information.

Awards and Recognition

For its exceptional execution speeds and trading flexibility on the MT5 platform, IC Markets has received numerous industry awards over the years, including Best Forex MT5 Broker 2020 (FX Scouts).

With over a decade of responsible behavior and rigorous regulatory scrutiny from some of the world’s strictest authorities, IC Markets is a safe broker to trade with.

What awards and recognition has IC Markets received in the financial industry?

They have earned numerous awards and recognitions in the financial industry, highlighting its commitment to excellence and client satisfaction. These awards often include recognition for Best Forex Broker, Best CFD Broker, and Best Trading Conditions from prestigious organizations and publications. IC Markets has been acknowledged for its trading platforms, customer service, and competitive pricing.

Do these awards and recognitions indicate the quality of there services?

Yes, the awards and recognitions received are indicative of the high quality of services the broker provides.

Account Types and Features

IC Markets provides retail investors with the option to choose from three various accounts, each of which comes with a distinctive set of features and trading conditions that are tailored to a specific type of trader.

➡️ cTrader Account

➡️ Raw Spread Account

➡️ Standard Account

| 🔎 Live Account | 💳 Minimum Deposit | 📈 Average Spread | 📉 Commissions | 📊 Average Trading Cost |

| cTrader Account | 2390 GHS or $200 | 0.0 pips | $3 or $6 per side | 6.02 USD |

| Raw Spread Account | 2390 GHS or $200 | 0.0 pips | $3 or $7 per side | 7.02 USD |

| Standard Account | 2390 GHS or $200 | 0.6 pips | None | 6.30 USD |

Live Trading Accounts

cTrader Account

The cTrader Raw Spread Account is designed specifically for day traders, scalpers, and expert advisor users. This account type operates on the cTrader platform, offering rapid order execution and deep liquidity.

Extremely low spreads, averaging just 0.1 pips for the EUR/USD pair, are one of its most notable characteristics. IC Markets’ aggregated pricing, sourced from up to 25 institutional-grade providers, ensures competitive and transparent pricing for traders using this account.

| Account Feature | Value |

| 💸 Bonuses and Promotions for Ghanaian? | No |

| 📊 Minimum Deposit | 2 390 GHS ($200) |

| 🔧 Minimum Account Balance | None |

| 💵 Average spreads | 0.0 pips |

| 💻 Maximum Leverage Ratio | 1:500 |

| 📈 Is a Demo Account offered? | Yes |

| 📉 Commission charges | $3 per side and $6 per round turn |

| 🔄 Trading Platform | cTrader |

| 📱 Swap-Free Islamic Account Option | Yes |

Raw Spread Account

Raw Spread Accounts are also available on the MetaTrader 4 and MetaTrader 5 trading platforms. Like the cTrader Raw Spread Account, it is ideal for day traders, scalpers, and expert advisors.

This account also offers low spreads, with an average of 0.1 pips for EUR/USD and a modest commission rate of $3.50 per lot per side. MetaTrader 4 and 5 servers are in the Equinix NY4 data centre in New York, which reduces latency and improves trading efficiency.

| Account Feature | Value |

| 💸 Bonuses and Promotions for Ghanaian? | No |

| 📊 Minimum Deposit | 2 390 GHS ($200) |

| 🔧 Minimum Account Balance | None |

| 💵 Average spreads | 0.0 pips |

| 💻 Maximum Leverage Ratio | 1:500 |

| 📈 Is a Demo Account offered? | Yes |

| 📉 Commission charges | $3 per side and $7 per round turn |

| 🔄 Trading Platform | MetaTrader 4 and 5 |

| 📱 Swap-Free Islamic Account Option | Yes |

Standard Account

The Standard Account is excellent for traders who prefer a commission-free trading environment. Although the spreads begin at one pip, slightly higher than the Raw Spread Accounts, no commissions are charged.

This account type is compatible with the MetaTrader 4 and 5 platforms and provides access to IC Markets’ extensive selection of trading instruments and competitive pricing.

| Account Feature | Value |

| 💸 Bonuses and Promotions for Ghanaian? | No |

| 📊 Minimum Deposit | 2 390 GHS ($200) |

| 🔧 Minimum Account Balance | None |

| 💵 Average spreads | 0.6 pips |

| 💻 Maximum Leverage Ratio | 1:500 |

| 📈 Is a Demo Account offered? | Yes |

| 📉 Commission charges | None |

| 🔄 Trading Platform | MetaTrader 4 and 5 |

| 📱 Swap-Free Islamic Account Option | Yes |

Demo Account

IC Markets provides a comprehensive demo account that allows traders to practice and become acquainted with the platform’s features in a risk-free environment.

One of the most notable features of this demo account is its unlimited duration, which allows traders to hone their skills and strategies without regard for time constraints. Opening a demo account is free and requires no real money deposits, making it accessible to traders of all skill levels.

The demo account gives you access to the same trading instruments and markets as the live accounts and simulates trading conditions realistically. Traders can use the demo account on various platforms, including MetaTrader 4, MetaTrader 5, and cTrader, depending on their preferences.

Furthermore, Ghanaian traders can practice trading with substantial amounts of capital with a virtual balance of up to $5,000,000, further enhancing the learning experience.

Account settings are highly customizable, allowing traders to tailor features to their specific trading styles and preferences. Furthermore, the demo account gives traders real-time market data, allowing them to analyze price movements and test their strategies in a simulated trading environment.

In addition to hands-on experience, IC Markets provides various educational resources, such as tutorials and webinars, to help traders improve their trading skills.

Islamic Account

IC Markets offers Islamic accounts, also known as swap-free accounts, to traders who cannot engage in interest-based financial activities due to religious convictions. These accounts are designed to make halal trading easier by removing the payment or receipt of interest.

The swap-free feature is available on the cTrader, Raw Spread and Standard account types on the MetaTrader 4, MetaTrader 5, and cTrader trading platforms.

Islamic accounts at IC Markets are outfitted with cutting-edge trading infrastructure and quick execution speeds, giving traders a market advantage. These accounts provide access to over 90 trading instruments, leverage up to 1:500, and spreads as low as 0.0 pips.

Unlike traditional accounts that use swaps, Islamic accounts do not have any additional costs in the form of interest. However, certain exotic currency pairs and Brent, Natural Gas, and WTI may be subject to a nominal overnight financing charge.

Except for these instruments, one distinguishing feature of IC Markets’ Islamic accounts is the absence of swaps or interest payments on trades involving currencies, metals, and indices.

However, a small financing charge may be applied to trades open for more than one day.

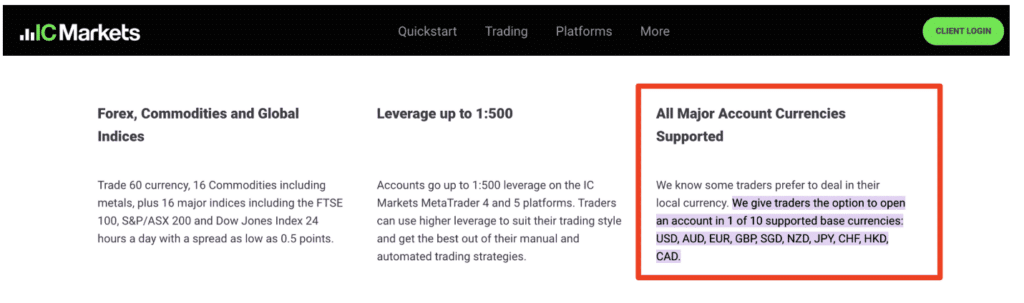

Base Account Currencies

The base account currencies available to Ghanaians include the following:

- USD

- JPY

- AUD

- GBP

- CAD

- SGD

- NZD

- EUR

Basic Order Types

- Market Order – A market order can be either a buy or a sell order that executes at the current market price. This is the current price displayed on your price chart. If you place a market order, you will be immediately entered at the best available price.

- Market orders are most effective when a trading opportunity requires prompt action. Click buy/sell at market to enter the trade immediately.

- Stop Order – A stop order can be either a buy or sell stop, depending on whether you wish to purchase above or below the market.

- This is useful for trading breakouts or trend continuation strategies when you want the market to continue moving in the same direction.

- Limit Order – Alternatively, if you believe the price will reverse when it reaches a certain price, you can place a limit order.

- Limit orders can be either buy or sell limits, depending on the market’s direction before your anticipated reversal.

- A sell limit is used to sell above the market, while a buy limit is used to purchase below the market.

Is scalping allowed in IC Markets accounts?

Yes, scalping is permitted, and the broker’s low spreads and quick execution make it a good choice for scalpers due to its fast execution and low spreads.

Can I have multiple trading accounts with IC Markets?

Yes, IC Markets permits traders to have multiple trading accounts that can be accessed and managed with a single login.

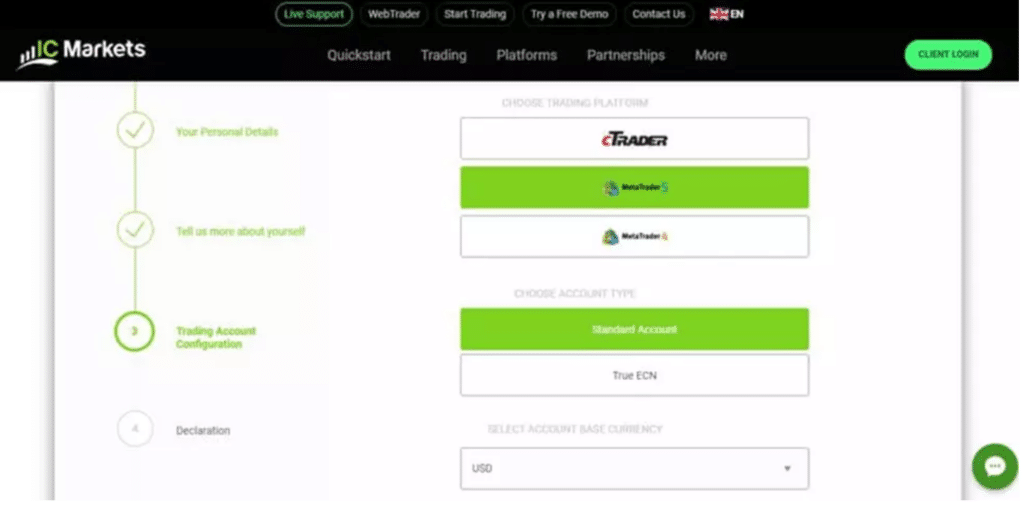

How to open an account with IC Markets

To open an account with IC Markets, Ghanaians can follow these steps:

Step.1 Select a user account

Make sure you have chosen the appropriate type of brokerage account for you before providing any of your personal information.

In this ICMarkets Account Opening Guide, we’ll look at the important steps involved in opening an account and identifying what to expect. To open a standard account, you’ll need to have at least one form of a photo ID and a document verifying Proof of Residence. Your documents must contain your full name and date of birth. You may open an IC Markets demo account at first and after that, you can also create an IC Markets live account for live trading.

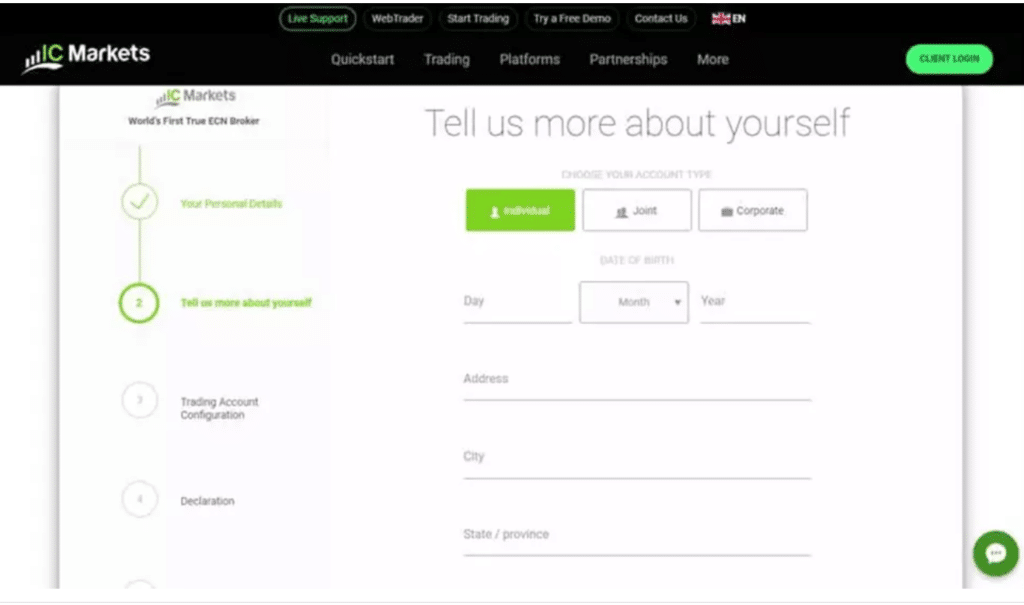

Step.2 Include personal data

The next step is to complete the questionnaire for basic information. You will be required to give information such as your name, birthdate, residence, nationality, place of employment, and other details. The broker you selected will determine how difficult this stage will be. Along with answering security questions to confirm that you have the proper authorization to trade, you will also be asked about your trading history.

Step.3 Add money to your account

You can start trading as soon as your account has been verified and opened. Transfer the required amount to your broker account, or any amount if none is required, and then start trading.

IC Markets Vs HF Markets Vs FP Markets – Broker Comparison

| 🥇 IC Markets | 🥈 HF Markets | 🥉 FP Markets | |

| ⚖️ Regulation | ASIC, CySEC, FSA, SCB | FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions | ASIC, CySEC |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • cTrader | • MetaTrader 4 • MetaTrader 5 • HF App | • MetaTrader 4 • MetaTrader 5 • Myfxbook AutoTrade • FP Markets App |

| 💰 Withdrawal Fee | No | No | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1 195 GHS / $ 200 | 0 GHS / $ 0 | 1 200 GHS / $100 |

| 📊 Leverage | 1:500 | 1:1000 | 1:500 |

| 📊 Spread | From 0.0 pips | From 0.0 pips | From 0.0 pips |

| 💰 Commissions | From $3 to $3.5 | $3 to $4 | From US$3 |

| ✴️ Margin Call/Stop-Out | 100%/50% | • 40%/10% • 50%/20% | 100%/50% |

| 💻 Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | cTrader Account Raw Spread Account Standard Account | CENT Account ZERO Account PREMIUM Account PRO Account | MT4/5 Standard Account MT4/5 Raw Account MT4/5 Islamic Standard Account Islamic Raw Account |

| ⚖️ BoG Regulation | No | No | No |

| 💳 GHS Deposits | No | No | No |

| 📊 Ghana Cedi Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 3 | 4 | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited | 60 lots | 50 lots |

| 💰 Minimum Withdrawal Time | Instant | 10 Minutes | Instant |

| 📊 Maximum Estimated Withdrawal Time | Up to 14 business days | 10 business days | Up to 5 working days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes, on PayPal, Neteller, and Skrill | No | Yes, Sticpay wallet withdrawals |

IC Markets Trading Platforms

offers Ghanaian traders a choice between these trading platforms:

- MetaTrader 4

- MetaTrader 5

- cTrader

- IC Social

- Signal Start

- ZuluTrade

MetaTrader 4

IC Markets offers its clients access to the renowned MetaTrader 4 platform, a globally recognized trading platform primarily used by forex traders.

MT4 has evolved from a basic trading tool into a global community where technological innovations meet traders’ needs, thanks to its user-friendly interface, rich feature set, and automated trading capabilities.

Furthermore, IC Markets collaborates with various technology providers to provide an enhanced version of the MetaTrader 4 platform to improve its clients’ trading experience.

MetaTrader 5

MetaTrader 5 is the advanced successor to MetaTrader 4, boasting new features and improved performance. The platform expands trading capabilities to include a broader range of financial instruments, such as stocks, futures, options, and forex and CFDs.

MT5 includes a more advanced and customizable interface, enhanced charting tools, and an integrated economic calendar. MT5, like its predecessor, supports automated trading via Expert Advisors (EAs) and provides a comprehensive set of technical indicators and drawing tools.

cTrader

Professional traders prefer cTrader because of its advanced trading capabilities and simple user interface. The platform provides access to deep liquidity, tight spreads, and fast execution speeds, making it an ideal choice for scalpers and high-volume traders.

cTrader includes advanced charting features, many technical indicators, and the ability to create and back-test custom indicators and trading systems. It also allows for automated trading via cBots, which work similarly to EAs in MT4 and MT5.

IC Social

IC Social is a proprietary social trading app developed by IC Markets that allows traders to copy the trades of successful traders or become signal providers themselves. The platform provides real-time performance metrics and is mobile-friendly, making social trading convenient and accessible.

Signal Start

Signal Start is another platform that facilitates automated trading, which allows traders to copy signals from various providers. It seamlessly integrates with IC Markets’ trading conditions, providing traders with low spreads and high liquidity while using the service.

ZuluTrade

ZuluTrade is a social trading platform that brings traders and signal providers together, allowing users to follow and copy trading strategies. It has advanced risk management and customization capabilities.

The integration of IC Markets with ZuluTrade ensures that traders benefit from competitive trading conditions, such as low spreads and high liquidity.

Which trading platforms does IC Markets offer?

MetaTrader 4, MetaTrader 5, cTrader, IC Social, Signal Start, and ZuluTrade are available from IC Markets.

Can I use multiple platforms with a single IC Markets account?

Yes, you can use multiple platforms, but certain features may be platform-specific.

Range of Markets

Ghanaian traders can expect the following range of markets:

- Forex

- Commodities

- Indices

- Bonds

- Cryptocurrencies

- Stocks

- Futures

Financial Instruments and Leverage offered

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 64 | 1:500 |

| ➡️ Precious Metals | 22 | 1:100 |

| ➡️ ETFs | 25 | 1:200 |

| ➡️ Stocks | 1,600 | 1:20 |

| ➡️ Cryptocurrency | 18 | 1:5 |

| ➡️ Futures | 4 | 1:200 |

| ➡️ Bonds | 11 | 1:200 |

Can I trade commodities with IC Markets?

Yes, commodities such as gold, oil, and natural gas can be traded.

Can I trade options with IC Markets?

No, the broker does not currently offer options trading.

Broker Comparison for Range of Markets

| 🥇 IC Markets | 🥈 HF Markets | 🥉 FP Markets | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | Yes |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | No |

Trading and Non-Trading Fees

Spreads

IC Markets offers variable spreads, and fees vary depending on the type of account used, the financial instrument being traded, and the market conditions on the day the transaction is executed.

The following is a list of the typical spreads that investors should expect to see when trading EUR/USD:

- cTrader Account – 0.0 pips

- Raw Spread Account – 0.0 pips

- Standard Account – 0.6 pips

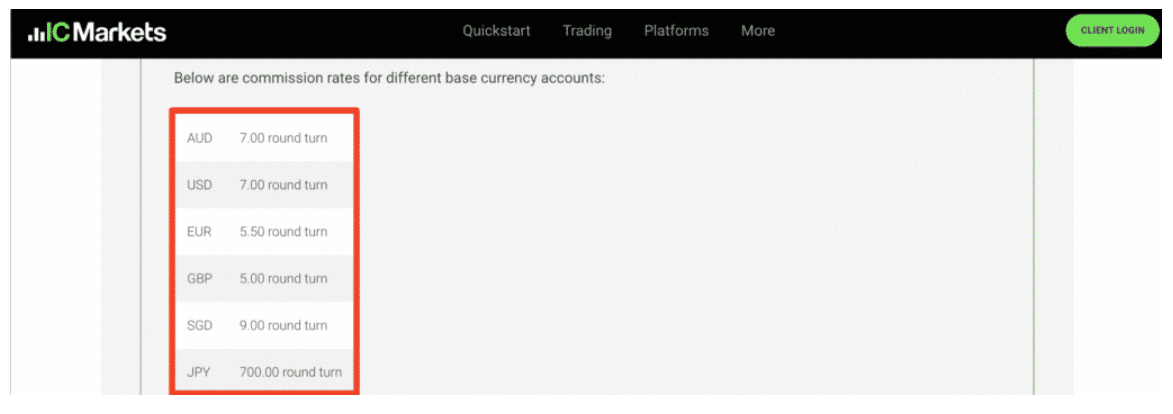

Commissions

Clients with zero-spread accounts must pay commissions to cover IC Markets’ fee for facilitating the transaction. The fees that IC Markets will charge retail traders for live trading accounts are as follows:

- cTrader Account – $3 per side and $6 per round turn

- Raw Spread Account – $3.5 per side and $7 per round turn

IC Markets charges commissions on Islamic accounts to compensate for the lack of overnight fees. These fees, deducted from the account balance, can range from $5 to $80.

Overnight Fees, Rollovers, or Swaps

In derivatives trading, the interest that is added to or withdrawn from trade to keep it open overnight is referred to as a swap rate or rollover. The variations in the interest rates that apply overnight between two currencies are considered when determining whether a currency pair is long or short.

Traders need to be aware that swaps will be applied to their positions if they hold on to them until the next forex trading day. There is the possibility that certain financial instruments could have swap rates that are negative on both sides of the deal.

A swap rate or rollover is the interest added to or subtracted from a deal overnight to keep it open in derivatives trading. Changes in overnight interest rates between two currencies are considered when determining whether a currency pair is long or short.

Swaps will be implemented if positions are held until the next forex trading day. As a result, some financial instruments may have negative swap rates on both sides of the transaction.

The value of a swap is determined in points, and the trading platform immediately converts these points to the account’s base currency.

Deposit and Withdrawal Fees

IC Markets does not charge deposit or withdrawal fees.

Inactivity Fees

IC Markets does not charge inactivity fees.

Currency Conversion Fees

Ghanaian traders who deposit or withdraw in GHS could face currency conversion fees.

Are commissions charged on IC Markets trades?

Raw Spread accounts are charged commissions, whereas Standard accounts are not.

Are there fees for using IC Markets trading platforms?

No additional fees are associated with IC Markets’ trading platforms.

Deposits and Withdrawals

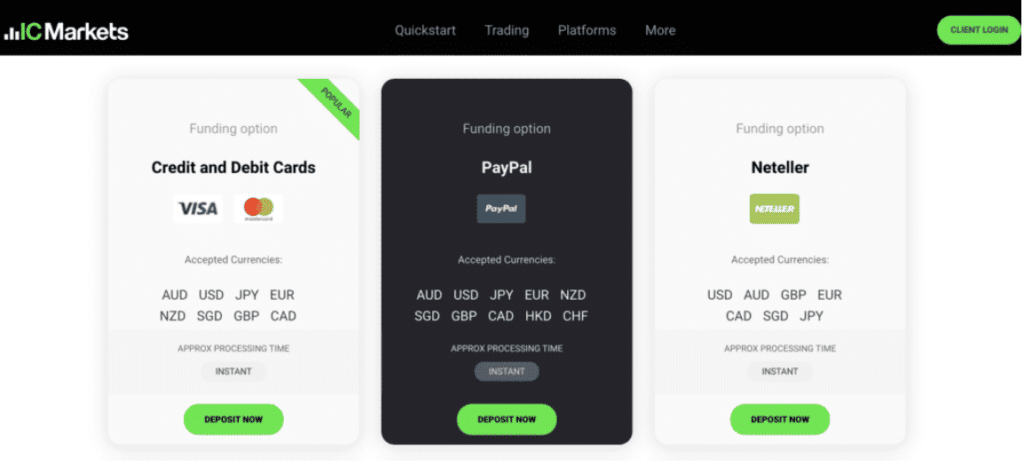

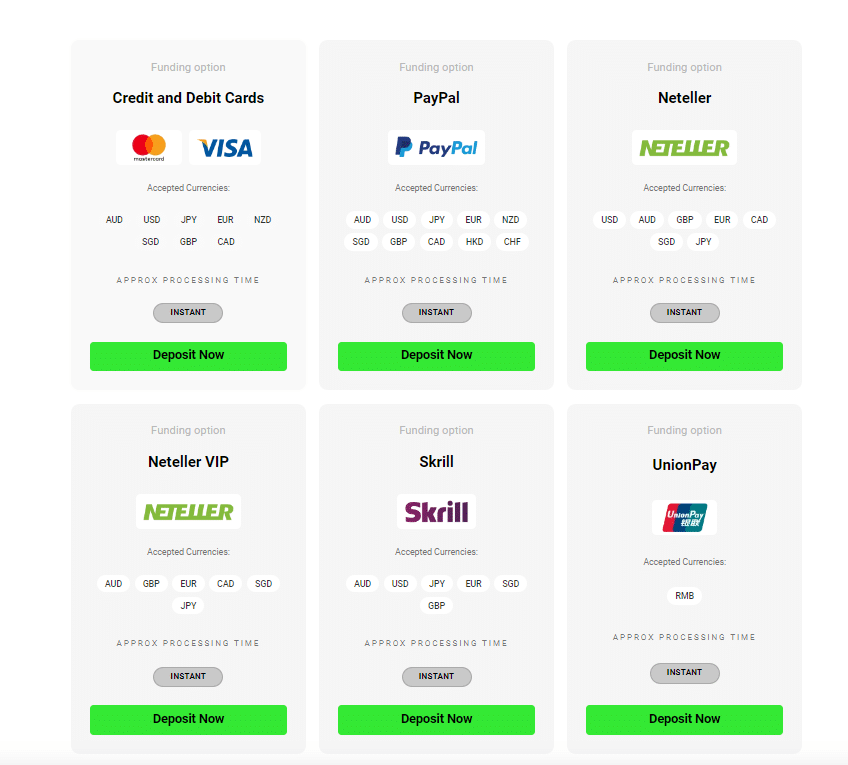

Ghanaian traders the following deposit and withdrawal methods:

- Credit Card

- Debit Card

- PayPal

- Neteller

- Neteller VIP

- Skrill

- UnionPay

- Bank Wire Transfer

- Bpay

- FasaPay

- Broker to Broker

- POLi

- Thai Internet Banking

- Vietnamese Internet Banking

- Rapidpay

- Klarna

Broker Comparison: Deposit and Withdrawals

| 🥇 IC Markets | 🥈 HF Markets | 🥉 FP Markets | |

| Minimum Withdrawal Time | Instant | 10 Minutes | Instant |

| Maximum Estimated Withdrawal Time | Up to 14 business days | 10 business days | Up to 5 Days |

| Instant Deposits and Instant Withdrawals? | Yes, on PayPal, Neteller, and Skrill | No | Yes, Sticpay wallet withdrawals |

Deposit Currencies, Deposit and Withdrawal Processing Time

| 💳 Payment Method | ⏰ Deposit Processing | ⏱️ Withdrawal Processing |

| 💰 Bank Wire Transfer | 2 to 5 working days | Up to 14 days |

| 💳 Credit/Debit Card | Instant | 3 to 5 working days |

| 🪙 PayPal | Instant | Instant |

| 💸 Neteller VIP | Instant | Instant |

| 💴 Neteller | Instant | Instant |

| 🪙 UnionPay | Instant | Instant |

| 💳 Bpay | 12 to 48 hours | 2 to 3 working days |

| 💰 FasaPay | Instant | 3 to 5 working days |

| 💳 Broker to Broker | 2 to 5 working days | 3 to 5 working days |

| 🪙 POLi | Instant | 2 to 3 working days |

| 💸 Thai Internet Banking | 15 to 30 minutes | One business Day |

What is the minimum deposit requirement for IC Markets?

The minimum deposit requirement for IC Markets is $200 or the equivalent in another currency.

Is account verification required for withdrawals?

Yes, account verification is required before withdrawal.

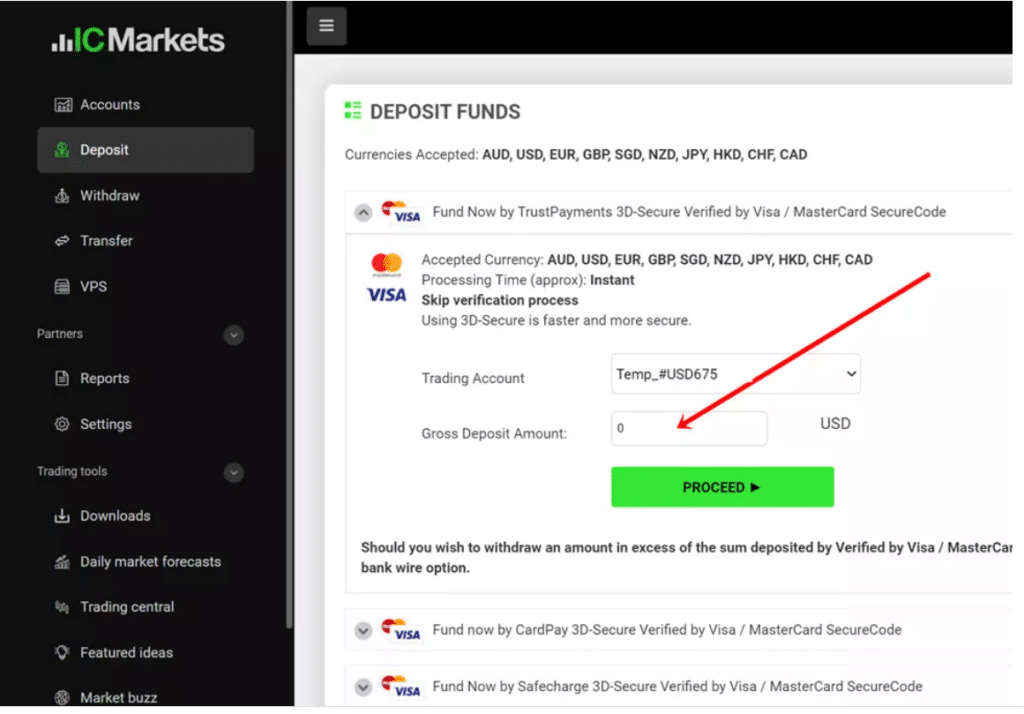

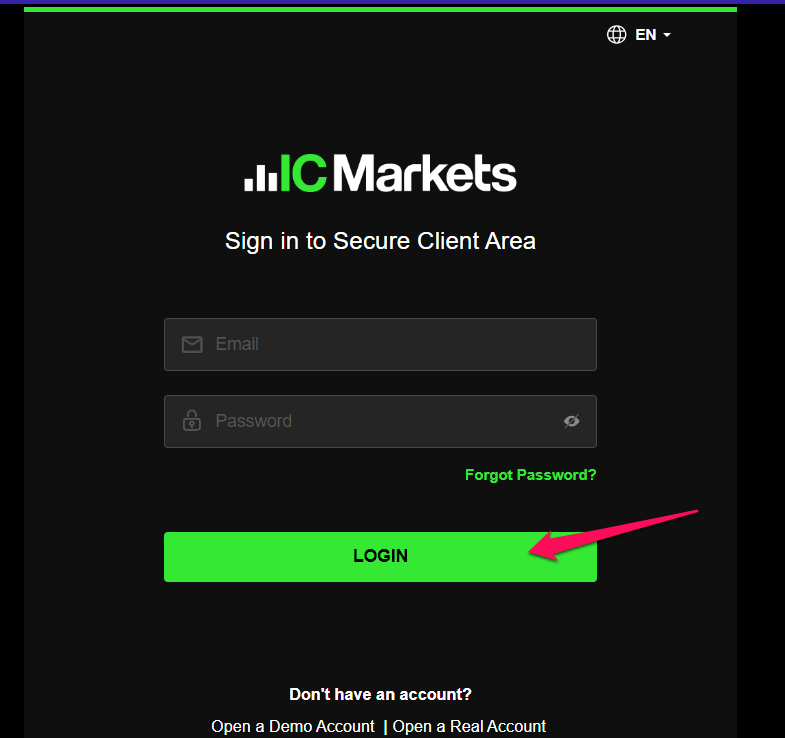

How to Deposit Funds

To deposit funds to an account with IC Markets, Ghanaian traders can follow these steps:

Step 1: Log In

Log in into your personal Secure Client Area

Step 2. Make a Deposit

- Once logged in, look for and select the “Deposit” button. This action will provide you with various funding options for your trading account.

- Choose the best funding method for you from the list of options. Credit/Debit Card, Bank Wire Transfers, or Online Payment Services such as PayPal, Neteller, or Skrill are all options.

Step 3. Deposit Methods

- Enter the deposit amount into your trading account. Make sure to follow the specific instructions for your chosen funding method.

- To complete your deposit, carefully follow the instructions. When the process is finished, the deposited funds will be immediately available in your trading account, allowing you to start trading immediately.

Step 4. Review your transaction

Depending on the method you chose, it might take a couple of days for your deposit to show up on your brokerage account. When it happens, the brokers usually send you an email to confirm the receipt of the deposit.

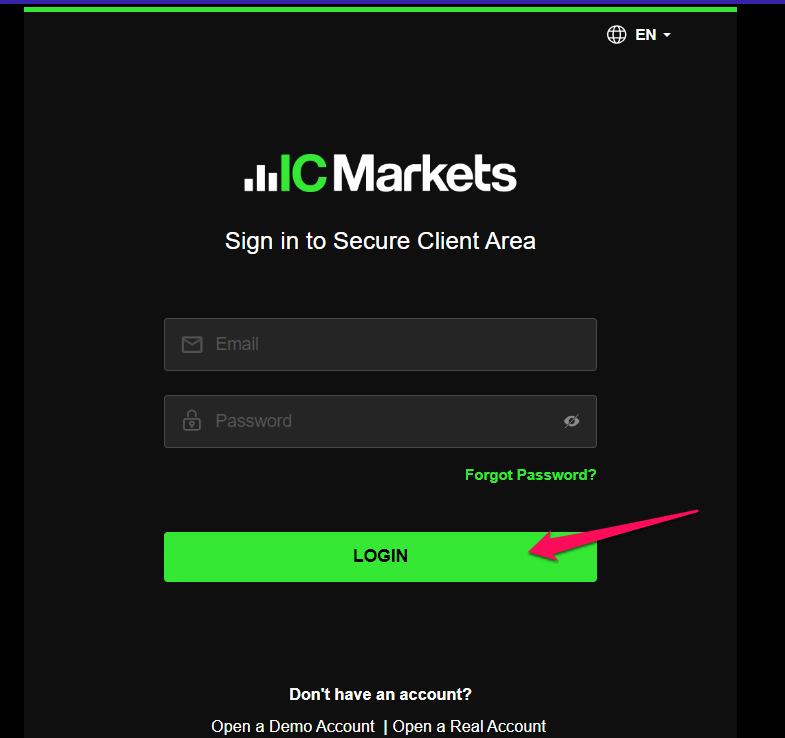

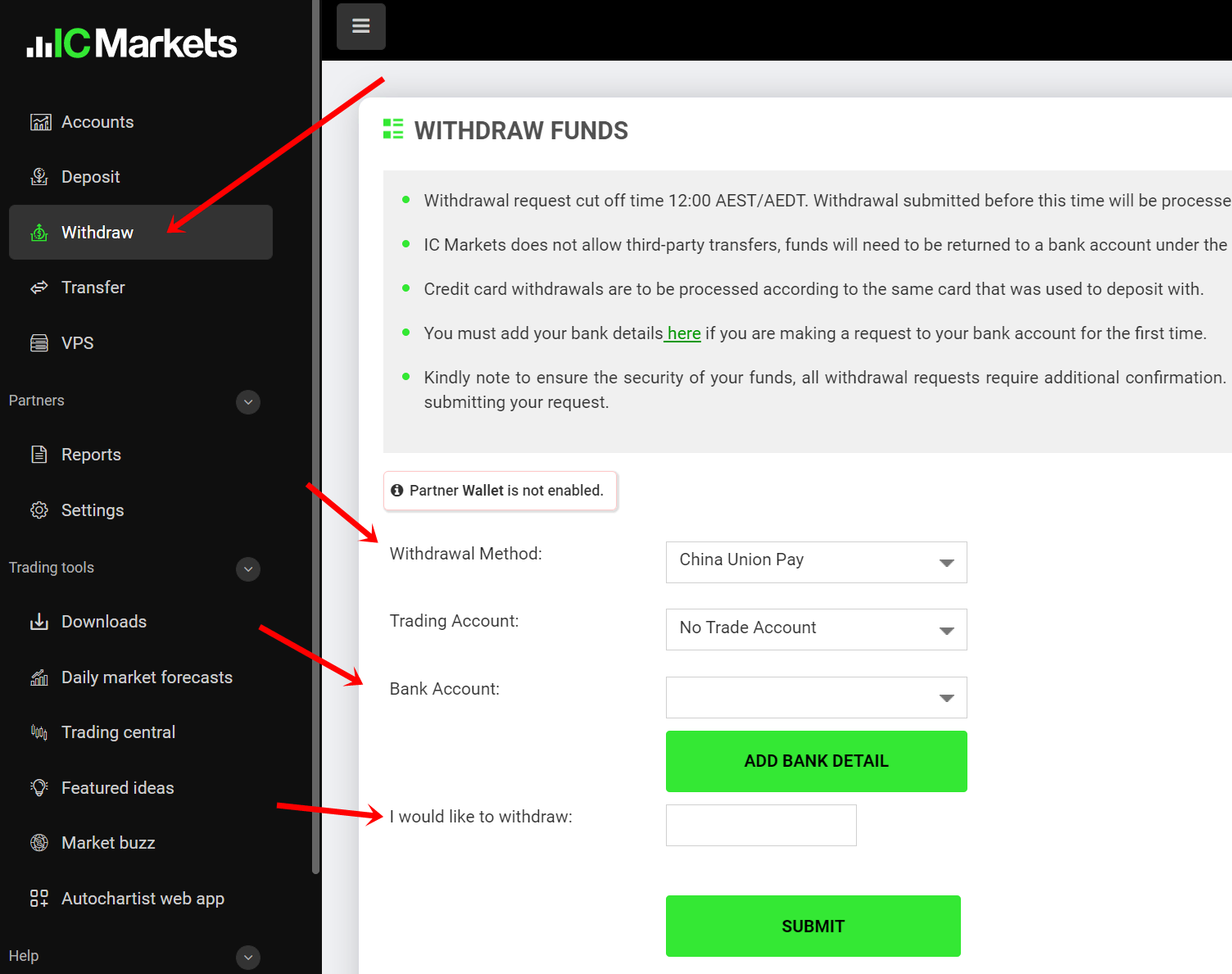

Fund Withdrawal Process

To withdraw funds from an account with IC Markets, Ghanaian traders can follow these steps:

Traders must file a withdrawal request to remove funds from their IC Markets account. This request may be in the trader’s Client Area and consists of a completed online form. Once finished, traders can submit a withdrawal request before noon AEST/AEDT, which means the withdrawal can be handled the same business day.

Step 1: Log in

Log in to your IC Markets trading account by entering your login credentials.

Step 2: ‘Withdraw Funds’

- Check the availability of funds in your account before submitting an IC Markets withdrawal request.

- Submit a withdrawal request from the client area by clicking on the ‘Withdraw Funds’ option.

- Enter the withdrawal amount from your IC Markets trading account. The broker does not specify any minimum withdrawal amount, which means you can take out any amount from your IC Markets online trading account.

- Select the mode of payment that you used to deposit funds into your trading account and submit your withdrawal request.

Following these steps, you can withdraw funds from your IC Markets trading account without any trouble. You can select any payment method to deposit or withdraw funds from your online trading account.

However, you should note that you can withdraw funds only into that payment method that you used to make the deposit. It means that if you used your credit card to deposit funds into your IC Markets trading account, you could request to withdraw funds through the same credit card.

The same holds for all the other payment options. If you use wire transfers to deposit funds, you can request IC Markets withdrawal through the same payment method.

Education and Research

Education

offers the following Educational Materials to Ghanaian traders:

- Trading Knowledge

- Advantages of Forex

- Advantages of CFDs

- Video Tutorials

- Web TV

- Webinars

- Podcasts

- Getting Started – which contains 10 lessons

Research and Trading Tool Comparison

| 🥇IC Markets | 🥈 HF Markets | 🥉 FP Markets | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | Yes | Yes | Yes |

| ➡️ AutoChartist | Yes | Yes | Yes |

| ➡️ Trading View | No | No | No |

| ➡️ Trading Central | No | No | No |

| ➡️ Market Analysis | Yes | Yes | No |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

IC Markets also offers Ghanaian traders the following additional Research and Trading Tools:

- Economic Calendar

- Market Analysis Blog

- Forex Calculators

- Forex Glossary

Does IC Markets provide real-time market updates?

Yes, traders can access market data in real-time.

Is there a glossary for trading terms with IC Markets?

Yes, a glossary is available to assist traders in comprehending important trading terms.

10 Best Forex Brokers in Ghana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

IC Markets has no active bonus offers or promotions for Ghanaian traders.

How to open an Affiliate Account

To register an Affiliate Account, Ghanaian traders can follow these steps:

- Visit the website of IC Markets Partners.

- Click the “Join our Partner Program” or “Apply” button to begin the application process.

- Fill out the application form with your personal and contact information.

- As specified during the application process, submit any required documents for verification, such as identification or proof of address.

- Following the review and approval of your application, you will be assigned a unique partner ID and a campaign link.

- To refer clients to IC Markets, promote your partner link through your website, blog, or social media platforms.

- Earn commissions or bonuses for each client who registers via your partner link, opens a separate trading account, and begins trading with IC Markets.

Affiliate Program Features

The IC Markets Affiliate Program offers a robust suite of features to enable partners to generate passive income through client referrals.

With a straightforward application process and a competitive commission structure that allows earnings of up to 50%, the program is designed for substantial earning potential. Affiliates are equipped with various marketing tools and real-time reporting capabilities to optimize their promotional efforts.

They also benefit from IC Markets’ deep liquidity and competitive spreads, enhancing the trading experience for their referrals. The program offers dedicated support, unlimited referral opportunities, and multiple pay-out options, making it a comprehensive and flexible partnership opportunity.

How transparent is the IC Markets affiliate commission structure?

The commission structure is competitive and transparent, offering up to 50% of the revenue generated by clients referred.

What marketing tools are available to IC Markets affiliates?

There are banners, landing pages, and tracking links available to affiliates.

Customer Support

IC Markets provides customers with a dedicated support team that is available through live chat, email, and phone around the clock. Support through live chat and the phone is available to assist with all frequent questions and problems.

Email is the sole method that may be used to communicate with inquiries that are aimed at departments, such as the department of accounts. In addition, the frequently asked questions (FAQ) part of IC Markets is comprehensive and provides answers that are related to the most common concerns.

| Customer Support | IC Market’s Customer Support |

| ⏰ Operating Hours | 24/7 |

| Yes | |

| 🗣 Support Languages | Portuguese, English, Vietnamese, Chinese |

| 🗯 Live Chat | Yes |

| ☎️ Telephonic Support | Yes |

Corporate Social Responsibility

There is currently no information on IC Markets’ CSR initiatives or projects.

Our Verdict

Our in-depth examination of IC Markets revealed that it is a robust platform that caters to a broad range of traders, from beginners to experts. IC Markets’ varied account offerings, including Raw Spread, Standard, and even Islamic accounts, offer flexibility and options typically lacking in the industry.

The tiered rebate structure of the Raw Trader Plus program is especially attractive to high-volume traders, as it provides a tangible means of reducing trading expenses.

MetaTrader 4, MetaTrader 5, and cTrader, the available trading platforms, are all industry standards renowned for their dependability and various features.

Social trading platforms such as IC Social and ZuluTrade diversify the trading experience by enabling traders to follow or become signal providers. Furthermore, we were impressed by the VPS solutions, which allow traders to execute automated strategies with optimal connectivity.

Additionally, IC Markets excels in its customer service. The prompt response times and the availability of customer support via multiple channels, including WhatsApp, demonstrate a commitment to customer satisfaction.

Furthermore, the educational resources and trading signals provide a well-rounded environment for novice and seasoned traders.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IC Markets is multi-regulated and has an impressive track record as a CFD and forex broker | CFDs have high financing rates |

| IC Markets’ order execution ensures that trades are executed in under 40ms | There are functionality limitations on MetaTrader |

| There are advanced trading tools available | IC Markets might not be ideal for traders with long-term strategies |

| IC Markets offers a safe and transparent trading environment | |

| There are several educational resources available on the platform | |

| There are over 2,000 financial instruments that can be traded | |

| Ghanaian traders can expect flexible account types | |

| IC Markets offers the best social trading support through several platforms |

You might also like: AvaTrade Review

You might also like: InstaForex Review

You might also like: Tickmill Review

You might also like: Exness Review

You might also like: HFM Review

Conclusion

Our Review Methodology

For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker.

Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements.

Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Now it is your turn to participate:

- Do you have any prior experience with IC Markets?

- What was the determining factor in your decision to engage with IC Markets?

- Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

- Have you experienced issues with IC Markets, such as difficulty withdrawing funds, inability to verify regulations, unresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

What types of trading accounts does IC Markets offer?

IC Markets offers the cTrader Raw Spread Account, the Raw Spread Account, and the Standard Account.

Does IC Markets have Nasdaq 100?

Yes, IC Markets offers Nasdaq 100 along with several other popular indices.

What is the maximum leverage offered by IC Markets?

The maximum leverage is 1:500 with IC Markets.

What is the minimum deposit for IC Markets?

A $200 minimum deposit is required to begin trading with IC Markets.

How long does it take to withdraw from IC Markets?

Withdrawals can be instant, depending on the payment method, or it could take up to 14 days if traders use bank wire transfers.

Does IC Markets charge for withdrawals and deposits?

No, IC Markets does not charge withdrawal or deposit fees.

How fast are trades executed on IC Markets?

IC Markets processes trades in less than 40 milliseconds.

Does IC Markets have VIX 75?

Yes, IC Markets offers the Volatility 75.

Is IC Markets Safe or a Scam?

IC Markets is a safe and transparent broker with multiple licenses and regulations.

Is IC Markets regulated?

Yes, ASIC, CySEC, FSA, and SCB regulate IC Markets.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all Ghanaian investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

.

Namibian Dollar Forex Trading Accounts

Namibian Dollar Forex Trading Accounts

Scam Forex Brokers in Ghana

Scam Forex Brokers in Ghana