- Fully Regulated

- Expertly Reviewed

- Secure & Trusted

- Transparent Fees

- Mobile Friendly

Find The Best Ghana Forex Broker For Your Trading Level.

NASDAQ forex Brokers

ECN Forex Brokers

Volitality 75 Forex Brokers

High Leverage Forex Brokers

Forex Trading Brokers in Ghana

We explore everything from A -Z how to become a skillful trader and who are the best forex brokers in Ghana for your style of trading.

For Ghanaian investors, forex trading can be a way to diversify.

Best Forex Brokers in Ghana

Forex Trading Basics

Forex Terminology

Currency Pairs

How to Start Trading in Ghana

Forex Trading Strategies

Forex Trading Platforms

Forex Charting

Forex Trading Risk Management

Pros and Cons of Forex Trading

Best Forex Brokers in Vietnam

Forex Trading Basics

Forex Terminology

Currency Pairs

How to Start Trading in Vietnam

Forex Trading Platforms

Forex Charting

Forex Trading Risk Management

Pros and Cons of Forex Trading

Top 10 Forex Brokers in Ghana

| 💵 Forex Broker | 👉 Open An Account | 💰 Min Deposit | 📊 Max Leverage | ⚖️ Regulation | ✔️ Accepts Ghanaians Traders |

| HFM | 👉Open Account | 57 GHS ($5) | 1:2000 | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA | Yes |

| InstaForex | 👉Open Account | 11.30 GHS ($1) | 1:1000 | BVI FSC, CySEC, FSA SVG, FCA | Yes |

| Exness | 👉Open Account | 114 GHS ($10) | 1: Unlimited | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA | Yes |

| Capital.com | 👉Open Account | 227 GHS ($20) | 1:100 | FCA, ASIC, CySEC, NBRB, FSA | Yes |

| FXTM | 👉Open Account | 114 GHS ($10) | 1:2000 | CySEC, FSCA, FCA, CMA, FSC | Yes |

| FXGT.com | 👉Open Account | 57 GHS ($5) | 1:1000 | FSCA, CySEC, VFSA, FSA | Yes |

| AvaTrade | 👉Open Account | 1,100 GHS ($100) | 1:30 (Retail) 1:400 (Pro) | BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC, CBI | Yes |

| Alpari | 👉Open Account | 57 GHS ($5) | 1:400 (Fixed) 1:1000 (Floating) | FSC | Yes |

| Trade Nation | 👉Open Account | 0 GHS ($0) | 1:200 | FCA, ASIC, FSCA, SCB | Yes |

| XM | 👉Open Account | 57 GHS ($5) | 1:1000 | FSCA, IFSC, ASIC, CySEC, DFSA | Yes |

10 Best Forex Brokers in Ghana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

In this comprehensive guide, you’ll learn all you need to know about being a great trader and which forex brokers in Ghana best suit your trading style. Ghanaian traders can easily start earning profits from the competitive, exciting environment of forex trading.

- For many Ghanaians, forex trading has become a popular online money-making prospect.

- Ghanaian students are increasingly interested in learning about forex trading and cryptocurrency.

- Ghana’s financial market provides a favorable atmosphere for forex trading as a successful side job.

- Forex trading has become more accessible to the common Ghanaian because of technological improvements.

- Forex trading is being investigated as a potential answer to the country’s rising unemployment.

- Ghanaian traders can only trade the Ghanaian Cedi (GHS) within the country with ICAP FX Global, ICAP Plc, Obsidian Achemer, Fenics MD, Emerging Africa, Ltd., and Cougar as brokers regulated by the Bank of Ghana.

How profitable is Forex trading for individuals and retail traders? How much do you need to start trading Forex in Ghana? Can you keep your full-time job while you trade Forex part-time? What are the significant risks involved with trading Forex in Ghana?

These are just a few questions that many Ghanaian traders may have as beginner forex traders. Explore our website to find the answers to these questions and more.

Foreign Exchange Trading is a legal activity in Ghana that is governed by the Bank of Ghana (BoG). While the Bank of Ghana does not officially regulate international forex brokers who provide CFD trading, regulators such as the FSCA, FCA, CySEC, and others protect Ghanaians.

We reveal the best brokers with verified regulations who offer their services locally in Ghana. Ghanaians can rest assured that these are trusted and legitimate brokers that garner a high trust score or rating.

Forex Trading Pros and Cons

| ✔️ Pros | ❌ Cons |

| Several brokers welcome Ghanaian traders | Ghanaian traders cannot trade GHS in international markets |

| Traders can access high leverage using forex brokers | Leverage can be extremely risky, and traders can lose their invested capital |

| There are several technologically advanced platforms for trading Forex and other instruments | Not all brokers will provide GHS-denominated accounts |

| There is high liquidity in the forex market | Market volatility can cause substantial losses |

| Ghanaian traders have access to hundreds of forex pairs that can be traded | |

| There are low minimum requirements for trading forex | |

| Traders can expect robust regulation when trading with brokers licensed by the FCA, FSCA, and other authorities |

Step-by-Step on How to Start Trading Forex in Ghana

- Step 1 – Learn about the Forex Market and Trading

- Step 2 – Familiarize Yourself with Forex Terms and Definitions

- Step 3 – Practice Using a Demo Account

- Step 4 – Learn About the Forex Trading Risks

- Step 5 – Develop a Forex Trading Strategy

- Step 6 – Practice and Improve Your Skills

- Step 7 – Transition to Live Trading

- Step 8 – Choose and Download A Trading Platform

- Step 9 – Fund Your Account and Begin Trading

Step 1 – Learn about the Forex Market and Trading

The first step for every aspiring Ghanaian trader is to learn the Forex market fundamentals. This includes understanding how the market works, the key currency pairs, and the factors influencing currency values.

Reading books, attending seminars, and taking online courses that provide insights into Forex trading is crucial. Understanding the historical context, the function of key financial institutions, and the global economic dynamics driving the market will lay a firm foundation.

Step 2 – Familiarize Yourself with Forex Terms and Definitions

Before you begin trading, you must learn the terminology used in the Forex market. Pip, lot, leverage, margin, and spread are fundamental and often used terms.

By becoming acquainted with these words, you will be better able to analyze market data, read trading charts, and make sound decisions.

Step 3 – Practice Using a Demo Account

Before trading with real funds, you should familiarize yourself with the process through practice using a demo account. Most brokers offer these accounts, allowing traders to simulate trades without utilizing their money.

By doing so, you are afforded the chance to become acquainted with the intricacies of the trading platform and comprehend market fluctuations while perfecting trade execution techniques – all this can be achieved without any financial risk involved on your part.

Step 4 – Learn About the Forex Trading Risks

Forex trading, like any other type of investing, carries dangers. Understanding these risks, including leverage, interest rate, and country risks, is critical. If they know these dangers, traders can make more educated judgments and devise methods to reduce potential losses.

Step 5 – Develop a Forex Trading Strategy

A well-defined trading strategy is essential for Forex’s success. This includes selecting entry and exit positions, placing stop-loss orders, and deciding how much to stake in each trade.

Whether you use technical analysis, fundamental analysis, or a combination, having a defined strategy can help guide your trading decisions.

Step 6 – Practice and Improve Your Skills

The key to mastering Forex trading is consistent practice. Regularly trading on your demo account allows you to fine-tune your tactics, learn from your failures, and gain confidence in your trading selections.

It is also good to stay current on global economic events and trends, as these can impact currency values.

Step 7 – Transition to Live Trading

After gaining confidence in your trading abilities and devising a solid strategy, the time has come to venture into actual trading. Commence with a modest investment amount and progressively scale it up as you accumulate valuable experience.

Furthermore, remember the importance of exercising patience while refraining from letting emotions sway your decision-making process when selecting trades.

Step 8 – Choose and Download A Trading Platform

Selecting the optimal trading platform for a seamless trading journey is crucial. Numerous brokers offer platforms like MetaTrader 4 and MetaTrader 5.

Ensure the chosen platform possesses user-friendly attributes, offers analytical tools, and provides real-time data. After making your decision, download it and familiarize yourself with its functionalities.

Step 9 – Fund Your Account and Begin Trading

After setting up your trading platform, the subsequent task involves depositing funds into your account. Many brokers offer funding options like bank transfers, credit cards, and online payment systems.

Trading can commence once you have successfully funded your account. It is important to trade responsibly by adhering to a strategy and adapting it according to market conditions and personal experience

4 Best Currency Pairs for Beginner Ghanaian Traders to Trade

USD/JPY (United States Dollar/Japanese Yen)

- Stability and Predictability. The USD/JPY is a significant currency pair well-known for its liquidity and stability. This pair provides a somewhat predictable trading environment for beginners.

- Economic Indicators: The United States and Japan are significant economies with regular economic updates, making it easier for newcomers to understand and monitor market movements.

British Pound/Japanese Yen (GBP/JPY)

- Dynamic Range: This pair is recognized for its volatility but also provides a greater trading range, making it ideal for beginners learning about market dynamics.

- Economic links: Based on economic data releases, the UK-Japan economic links present significant business prospects.

EUR/GBP (European Union/British Pound)

- European Proximity: Because the Eurozone and the United Kingdom are geographically and economically close, this duo provides insights into regional economic patterns.

- Brexit’s Aftereffects: Brexit discussions and consequences continue to present trading opportunities depending on political events.

AUD/USD (Australian Dollar/United States Dollar)

- Commodity-Driven: Because the Australian economy primarily relies on commodity exports, this pair is sensitive to commodity prices, particularly metals.

- Time Zone Advantage: The Australian market opens before other major markets, providing early clues of future market swings.

4 Best Currency Pairs for Professional Ghanaian Traders to Trade

New Zealand Dollar/Japanese Yen (NZD/JPY)

- Agriculture vs Technology: Which is Better? With agriculture driving New Zealand’s economy and technology driving Japan’s, this pair offers unique trade dynamics.

- Risk Sentiment: Professionals can evaluate global risk sentiment by watching this pair, as the NZD is seen as a riskier currency than the safe-haven JPY.

USD/CAD (United States Dollar/Canadian Dollar)

- Oil Price Influence: Because of Canada’s considerable oil exports, oil prices significantly influence this pair.

- Economic Data: Professionals can use economic data from both countries to make informed trading judgments.

EUR/AUD (European Union/Australian Dollar)

- Economic Diversification: This combination symbolizes two extremely different economies, allowing experts to capitalize on various economic indices.

- Interest Rate Differences: The interest rate differential between the Eurozone and Australia can present lucrative opportunities.

GBP/CHF (British Pound/Swiss Franc)

- Financial Hubs: Because the UK and Switzerland are global financial hubs, this pair is sensitive to worldwide financial news.

- Safe-Haven vs Volatility: The Swiss franc is regarded as a safe-haven currency, whereas the pound sterling can be turbulent, providing professionals with stability and opportunity.

9 Best Forex No-Deposit Brokers in Ghana

| 🏅No-Deposit Broker | 👉 Open Account | 💻 Trading Platform | 💰 Demo Account ? | 🎁Bonus Amount | 🎉Trading Accounts Offered |

| Admirals | 👉Open Account | MetaTrader 4 MetaTrader 5 Admirals Mobile App | Yes | 100 USD | Trade.MT4 Zero.MT4 Trade.MT5 Invest.MT5 Zero.MT5 |

| Tickmill | 👉 Open Account | MetaTrader 4 MetaTrader 5 | Yes | 30 USD | Classic Pro VIP |

| ForexChief | 👉Open Account | MetaTrader 4 MetaTrader 5 | Yes | 100 USD | MT4.DirectFX MT4.Classic+ Pamm-MT4.DirectFX Pamm.MT4.Classic+ Cent-MT4.DirectFX Cent-MT4.Classic MT5.DirectFX MT5.Classic+ Pamm-MT5.DirectFX Pamm.MT5.Classic+ Cent-MT5.DirectFX Cent-MT5.Classic |

| XM | 👉 Open Account | MetaTrader 4 MetaTrader 5 XM Mobile App | Yes | 30 USD | Micro Standard XM Ultra-Low Shares |

| Windsor Brokers | 👉 Open Account | MetaTrader 4 Windsor Brokers App | Yes | 30 USD | MT4 Zero MT4 Prime VIP ZERO |

| SuperForex | 👉Open Account | MetaTrader 4 SuperForex App | Yes | 88 USD | Standard Swap-Free No Spread Micro Cent Profi STP Crypto ECN Standard ECN Standard Mini ECN Swap-Free ECN Swap-Free Mini ECN Crypto |

| InstaForex | 👉Open Account | MetaTrader 4 MetaTrader 5 WebIFX InstaForex Multi-Terminal InstaForex WebTrader InstaTick Trader InstaForex MobileTrader | Yes | 1,000 USD | Insta.Standard Insta.Eurica Cent.Standard Cent.Eurica |

| FreshForex | 👉Open Account | MetaTrader 4 MetaTrader 5 | Yes | 99 USD | Classic Market Pro ECN |

| JustMarkets | 👉Open Account | MetaTrader 4 MetaTrader 5 JustMarkets App | Yes | 30 USD | Standard Pro Raw Spread |

Forex Trading – Stock Trading – Cryptocurrency Trading Compared

| 📈Forex Trading | 📉Stock Trading | 💰Crypto Trading | |

| ⏰Market Hours | 24/5 | 9 am – 3 pm (GMT+3) Monday to Friday | 24/7 |

| 🚀Trading Speed | Instant | Slow | Instant |

| ✅How is it traded? | OTC | Exchanges | OTC/Exchanges |

| 🔁Price Fluctuation | Fast | Slow | Fast |

| ✔️Min. Trade Size | 0.01 lots | 1 share or fractions | 1 lot or fractions |

| ✴️Volatility | High | Low | High |

| 📈Liquidity | Very High | Blue Chip Stocks are the most liquid | Only major Crypto, e.g. BTC, ETH, LTC, DOGE, etc. |

| 💻Trading Volume | High | High | Medium |

| ⚖️Regulation | $6.6 Trillion | 7,369,200 | $500 Billion+ |

| 📚Investment Horizon | Short, Medium, and Long-Term | Medium and Long-Term | Short, Medium, and Long-Term |

| 📉Average Leverage Ratios | 1:100 – 1:3000+ | <1:100 | <1:10 |

| ✔️ Susceptibility to Macroeconomic Factors | Yes Rarely as turbulent as Crypto | Yes Economic Performance | Yes Consumer Behaviour Supply and Demand |

2 Most Successful Forex Traders in Ghana

Louis Boah

Louis Boah is a great example of how hard work and commitment can lead to enormous success in the Forex trading market. Louis experienced numerous problems as a child growing up in a large, traditional family in rural Ghana.

On the other hand, his determination prompted him to investigate the world of Forex trading. He earned more than $136 thousand from an $8000 investment after accumulating significant knowledge and experience.

Today, he is the proud owner of FXGold Trading Limited, a brokerage firm incorporated in St Vincent and the Grenadines. This company is a market leader in its home country and has a large African presence.

Aside from his success in Forex trading, Louis is a philanthropist who supports local communities, particularly kids, through numerous programs.

Uche Paragon

Uche Paragon, originally from Nigeria, is another success story in Ghana’s Forex trading industry. He began his financial career with an interest in traditional banking but quickly discovered the potential of Forex trading.

He founded his brokerage firm in Nigeria after thorough research and experience. He recognized Ghana’s potential and expanded his business there, considerably impacting the local Forex market.

Furthermore, Uche Paragon is now regarded as one of Ghana’s best Forex traders, and his contributions to the country’s financial sector are enormous.

Secrets to the success of these Professional Traders

Both Louis Boah and Uche Paragon highlighted the significance of constant learning. They spent a significant amount of time investigating and comprehending the complexities of the Forex market before plunging in.

- Building strong networks and relationships in the sector was critical to their success. Uche Paragon’s entry into Ghana demonstrates the value of networking and knowing market dynamics.

- Both traders are committed to giving back to their communities. Louis Boah has helped local communities through his humanitarian endeavors, and Uche Paragon’s growth in Ghana has created countless opportunities for the people.

- Understanding and managing risks is one of the most important parts of their success. They were aware of the potential losses and put a strategy in place to limit them.

- Successful Forex trading does not rely solely on random trades. It necessitates a well-thought-out plan, an awareness of market trends, and the ability to make informed decisions.

How to Choose a Forex Broker in Ghana

Choosing the correct Forex broker is critical for Ghanaian traders in ensuring a good overall trading experience. Therefore, Ghanaian traders must examine the following points and their broker’s offer to determine the broker’s suitability.

Regulation and Authorization

To navigate the forex marketplace responsibly, you must first grasp and obey its regulatory requirements.

Regulatory agencies guarantee that brokers follow ethical trading procedures, safeguard their clients, and provide a safer trading environment overall. Ghanaian traders must consider the following:

- Check Local Regulation: Confirm that the broker is regulated by Ghanaian authorities, especially if traders are trading GHS locally.

- International Regulation: If the broker operates globally, investigate the rules in those countries.

Trading and Non-Trading Fees

Understanding a broker’s cost structure is a step toward maximizing profits for every trader. Traders must consider the following:

- Spreads are the price differences between purchasing and selling.

- Some brokers charge a commission fee for trading.

- Check for any hidden fees, particularly on withdrawals or inactivity.

Range of Markets

Diversifying investments frequently results in a more balanced portfolio. Thus, having access to many marketplaces is a big benefit, allowing traders to profit from various economic sectors and global events. Therefore, Ghanaians must consider the following:

- Multiple Currency Pairs: Not only major currency pairs but also minor and exotic currencies relevant to Ghana.

- Other Assets: Commodities, indexes, and stocks are examples of other assets.

Customer Support

The Forex market might create unanticipated difficulties. A prompt and skilled customer support team might mean the difference between quickly addressing an issue and dealing with protracted frustration. Therefore, Ghanaian traders must evaluate the following:

- Local Support: Having support personnel knowledgeable about local circumstances and peculiarities can be advantageous.

- Accessibility is ensured by availability by phone, email, live chat, and even social media.

- Because the Forex market is open 24 hours a day, having 24/7 support can be extremely beneficial.

Accounts and Features

Each trader has a distinct approach, risk tolerance, and plan. Brokers that provide a variety of account kinds and features can adapt to this diversity, delivering customized experiences for each trader. Therefore, traders must consider the following:

- Accounts of various sizes are available, ranging from Cent and Micro accounts for novices to VIP accounts for pros.

- Features must include leverage options, margin calls, and risk management tools for Ghanaian traders.

Trade Execution and Overall Execution Policy

Even a few seconds can make a major difference in the fast-paced world of Forex. Brokers must execute trades on time and at the expected prices. Furthermore, Ghanaian traders must also consider the following:

- Slippage: Check the broker’s slippage to ensure deals are performed at the desired prices.

- Policy Clarity: The broker’s trade execution policy should be transparent and easily understood.

Client Security and Fund Safety

The safety of their cash is one of the most pressing worries for traders. Brokers should prioritize this by providing clear precautions and safeguards. Therefore, Ghanaian traders must consider the following:

- Segregated Accounts: Ensure the broker separates customer funds from the company’s operational funds.

- Insurance: Some brokers provide insurance on client funds, which adds an extra degree of security.

Education and Research

The forex market is always changing, and traders must keep up. Therefore, when evaluating a broker, Ghanaian traders must consider the following:

- Seminars and webcasts: These, tailored to the Ghanaian market, can provide insights on local and worldwide trends.

- Research Instruments: Analysis, charts, and reports can help traders make more informed decisions.

Trading Platform

The trading platform serves as the intermediary between a trader and the market. Ghanaian traders must ensure their broker has the following:

- User-Friendly Interface: A platform that is simple to use and comprehend.

- Technical tools: This includes indicators and charting tools, essential for analysis.

- Mobile Trading: Given the growing use of smartphones in Ghana, a mobile trading alternative is advantageous.

Awards and Recognition

Awards attest to a broker’s superiority, service quality, and unique features. They provide traders with external validation of the broker’s industry standing. Therefore, Ghanaians must do the following:

- Examine Relevant Awards: Those focusing on the African or Ghanaian markets.

- Consider credibility: Make certain that the awards are from respectable organizations.

Online Reviews

- Peer reviews are frequently the most candid sources of information about a broker’s performance and client satisfaction. They act as a mirror, reflecting fellow traders’ real-world experiences. Therefore, Ghanaians must consult the following:

- Local Forums: Ghanaian trading communities may provide feedback based on their own experiences.

- Global Platforms: Several reputable review websites can provide a more comprehensive view of a broker and their offer.

- Local Forums: Ghanaian trading communities may provide feedback based on their own experiences.

Deposit and Withdrawal Options and Speed

Traders need liquidity and easy access to capital. Efficient deposit and withdrawal systems speed up the trading process and build trust in the broker’s operating efficiency. Ghanaian traders should check for the following:

- Flexible payment methods should be available for bank transfers, credit cards, and popular Ghanaian internet payment platforms.

- Reliable deposit/withdrawals: Rapid deposit and withdrawal processes are critical.

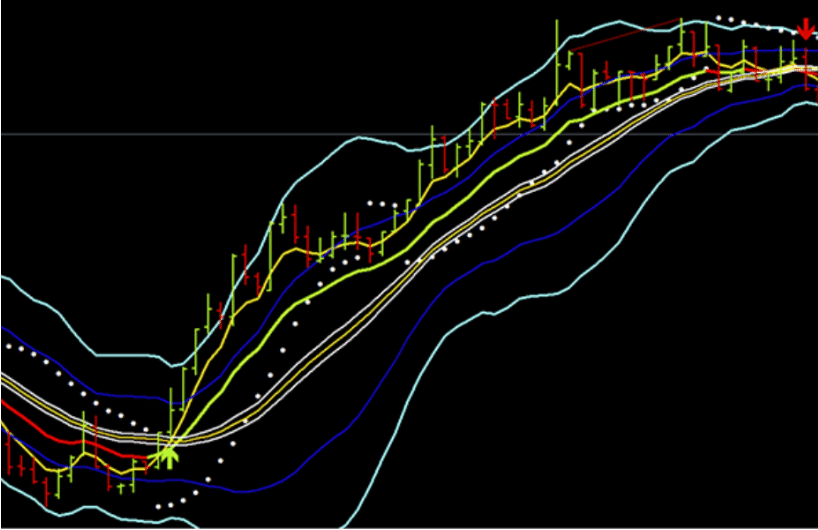

Understanding Forex Charting

Forex charting is a must-have tool for traders since it provides visual insight into the price fluctuations of currency pairings over time.

Mastering the art of reading and understanding these charts can be the key to making smart trading decisions for Ghanaian traders. This guide is geared exclusively toward the Ghanaian trading community and digs deep into Forex charting.

What is Forex Charting?

Forex charting is the use of graphical representations to demonstrate how the price of a specific currency pair has changed over a given timeframe. These charts show a snapshot of market activity, allowing traders to study trends, discover patterns, and estimate future price changes.

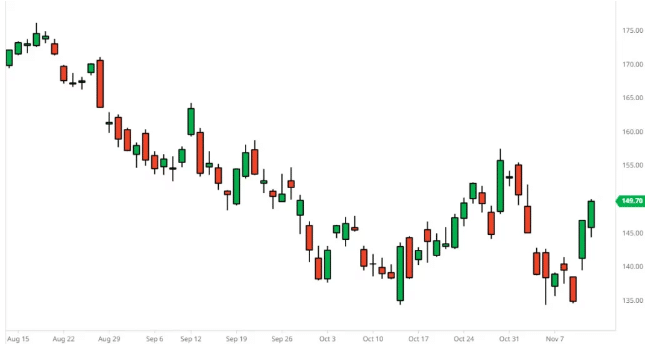

Types of Forex Charts

There are three primary types of charts used in Forex trading, and we will define each and provide an example.

Line Charts

A line chart connects closing prices over a certain timeframe in its most basic form. Furthermore, it depicts the overall price movement of a currency pair.

Bar Charts

Bar charts, which are more detailed than line charts, show the opening, closing, high, and low prices for a specific timeframe. Each “bar” represents the price movement range for a certain timeframe.

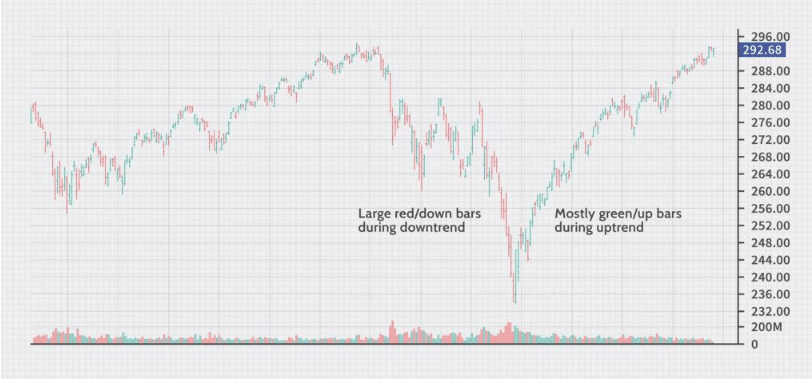

Candlestick Charts

Candlestick charts originated in Japan and are the most popular among Forex traders. They show the open, close, high, and low prices like bar charts do, but they employ colored “candles” to show whether prices rose or declined throughout the period.

Key Elements on a Forex Chart

- Timeframes: Charts can depict periods ranging from minutes (M1, M5) to hours (H1, H4) to days (D1) and even months (M1). The timeframe a trader chooses is determined by their strategy and trading style.

- Price Axis: The vertical axis displays the currency pair’s price.

- Time Axis: The horizontal axis shows the timeframe under consideration.

- Indicators and Oscillators are mathematical computations based on price, volume, or open interest that aid traders in forecasting future price fluctuations. Moving averages, Bollinger Bands, and the Relative Strength Index (RSI) are popular examples.

Reading Candlestick Patterns

Candlestick patterns can reveal important information about probable market reversals or continuations:

- Bullish Engulfing: A probable rising surge following a decline.

- Bearish Engulfing: Indicates a likely negative swing following an advance.

- Doji: This represents market hesitation, as the opening and closing prices are nearly identical.

Importance of Support and Resistance

In Forex charting, support, and resistance levels are critical concepts to understand:

- Support: A price level at which a currency pair is likely to attract purchasing interest, preventing the price from falling below it.

- Resistance: A price level where selling interest tends to prevent the price from climbing above it.

Furthermore, finding these levels can assist Ghanaian traders in making strategic entry and exit decisions.

Using Charting Tools and Software

Forex charting software and platforms are widely accessible. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are prominent platforms that provide various tools, indicators, and timeframes for both novices and pros.

Effective Risk Management for Ghanaian Forex Traders

Risk management is essential to successful forex trading, as it ensures that traders secure their capital and minimize potential losses.

Understanding and implementing effective risk management strategies is essential for Ghanaian traders traversing the volatile forex market. Here is a comprehensive guide to the topic.

Stay Emotionally Disciplined

Fear and greed can substantially influence business decisions. Regardless of market volatility, Ghanaian traders should cultivate emotional discipline to remain objective and adhere to their trading plan.

Only Risk What You Can Afford to Lose

In forex trading, the golden rule is never to risk more than you can afford to lose. Therefore, Ghanaian traders should allocate between 1% and 3% of their trading capital to each transaction. This strategy assures that even a string of losses will not significantly impact the total capital.

Use Leverage Wisely

Leverage enables traders to control a larger position with less capital. While it can increase profits, it can also increase losses. Ghanaian traders should employ leverage with caution, recognizing the inherent risks and ensuring they have sufficient margin to cover potential losses.

Continuous Education and Market Analysis

The foreign exchange market is dynamic and influenced by geopolitical and economic factors. Ghanaian traders should keep up with global news, economic calendars, and market analyses.

A thorough market understanding enables traders to anticipate its movements and modify their strategies accordingly.

Understanding the Importance of Risk Management

Risk management identifies, evaluates, and mitigates prospective trading losses. Without proper risk management, traders can rapidly exhaust their capital, making it difficult to recuperate from substantial losses.

Understanding the significance of risk management can mean the difference between long-term success and failure for Ghanaian traders, particularly those new to the forex market.

Diversify Your Trades

Diversification refers to spreading transactions across different currency pairs and market conditions. This strategy helps Ghanaian traders mitigate the potential adverse impact that a single poorly performing trade may have, as they avoid putting all their eggs in one basket.

Review and Learn from Past Trades

Regularly reviewing past transactions enables traders to determine what was successful and what was not. By analyzing successful and unsuccessful trades, Ghanaian traders can refine their strategies, avoid making the same mistakes, and enhance their trading abilities.

Have a Clear Trading Plan

A trader’s objectives, risk tolerance, evaluation criteria, and trading strategy are outlined in their trading plan. Traders in Ghana should have a well-defined plan and adhere to it, making decisions based on logic and analysis rather than emotion.

Setting Stop-Loss and Take-Profit Orders

- Stop-Loss Order: An order placed with a broker to acquire or sell a security at a predetermined price. It assists traders in limiting their losses.

- Take-Profit Order: This order enables traders to set a predetermined profit level at which the transaction will automatically close, securing gains.

Best Forex Strategies for Ghanaian Traders Revealed

Forex trading strategies act as road maps for traders, guiding their decision-making processes based on market conditions, risk tolerance, and trading objectives.

Understanding and adopting these tactics can help Ghanaian traders achieve consistent profitability. Here are five major techniques designed specifically for the Ghanaian trading environment:

Breakout Strategy

Overview

Breakouts occur when the price rises above or below a resistance or support level. When the price breaks through these obstacles, the breakout strategy enters a trade, anticipating a sustained advance in that direction.

Application for Ghanaians

Monitoring international news and events, such as geopolitical tensions or important economic developments, can provide lucrative breakout possibilities.

Trend Following Strategy

Overview

This approach entails detecting and trading in the direction of the current market trend. Moving averages and the MACD, among other technical indicators, aid in determining market direction.

Application for Ghanaians

Following the trend can offer a more predictable strategy, especially for those new to trading, given the importance of global economic factors on major currency pairs like EUR/USD or GBP/JPY.

Swing Trading Strategy

Overview

Swing trading entails maintaining positions for a few days to a few weeks to profit from short- to medium-term price trends. It uses a combination of technical and fundamental analysis to forecast potential price fluctuations.

Application for Ghanaians

Given the region’s economic and political trends, swing trading can be especially beneficial when anticipating market reactions to key regional events.

Carry Trade Strategy

Overview

The carry trade strategy is borrowing funds in a low-interest-rate currency, such as the JPY, and investing them in a higher-interest-rate currency, such as the AUD, to profit from the interest rate differential.

Application for Ghanaians

With varied interest rates across major nations, Ghanaian traders can investigate carry trade opportunities, particularly when trading pairs such as AUD/JPY.

Scalping Strategy

Overview

Scalping is a short-term trading method that seeks to capitalize on tiny price changes. It necessitates quick decision-making, with traders frequently holding positions for only a few minutes.

Application for Ghanaians

Scalping can be a useful strategy for Ghanaian traders due to the inherent volatility of key currency pairs such as EUR/JPY or AUD/USD. However, it necessitates a deep understanding of the market and a trading platform designed for speedy transactions.

Spot, Forwards, and Futures in Forex Trading

Spot Market

The Forex Spot Market is widely used for exchanging currency among organizations, businesses, and individuals.

The spot market has become even more popular due to advancements in information and communication technology (ICTs), allowing for electronic trading on a large scale. This has led to an increase in forex brokers and opened up currency trading to a wider audience.

When people discuss forex trading nowadays, they typically refer to the spot market. In this market, currencies are bought and sold at their current value.

Various factors influence these prices, such as supply and demand dynamics, prevailing interest rates, economic performance indicators of countries involved, attitudes towards local or international political situations affecting those currencies, plus speculative activity involving particular currencies relative to others.

The spot market’s transaction process is when two parties agree upon a price before carrying out bilateral transactions, where multiple cash-based exchanges of different currencies occur during settlement.

However, Ghanaians must note that although assumed instantaneous by many participants; it often takes around two days for settlements of most spot transactions to occur

Forwards and Futures Markets

A forward contract is a private agreement between two OTC market players to acquire a currency at a predetermined future date and price. A futures contract is a conventional agreement between two market players to exchange currencies at a specified price and date in the future.

Futures contracts are exchanged on exchanges rather than over the counter. Forwards trading takes place between two parties that have agreed on the parameters of their agreement.

Futures contracts with a defined amount and settlement date can be bought and sold on public commodities exchanges such as the Chicago Mercantile Exchange (CME).

Both contracts are legally binding and usually paid in cash at the underlying exchange when they expire, but they can sometimes be bought and sold before they expire. Currency forwards and futures markets may help currency traders reduce risk.

Large multinational corporations typically use these markets to hedge against anticipated currency changes. However, traders also engage.

An Introduction to Forex Brokers

Forex trading is becoming more popular in Ghana, reflecting a larger trend of greater financial knowledge and searching for alternative investment alternatives in the West African country.

In this context, a Forex broker is a conduit for Ghanaian traders to access the worldwide currency markets.

These brokers provide platforms, tools, and services targeted to Ghanaian traders’ specific trading demands and cultural considerations. Given the variations in financial rules, infrastructure, and market familiarity, Ghanaian traders must select brokers who understand their special needs.

What is the Role of a Forex Broker?

A Forex broker provides several important functions for a Ghanaian trader:

- Education and Resources: Because the Forex market may be unfamiliar to some Ghanaians, several brokers offer instructional materials, webinars, and seminars to help traders better understand the market.

- Local Customer Support: Given cultural and linguistic differences, having customer service that knows local issues and can effectively engage with Ghanaian traders is critical.

- Access to International Markets: Most Ghanaians lack direct access to international Forex markets. Forex brokers provide platforms for traders to buy and sell foreign currencies.

- Leverage: Forex firms offer leverage, which allows Ghanaian traders to trade with more money than they invested. While this can increase earnings, it also increases losses, so traders must know the risks.

- Facilitating Deposits and Withdrawals: Forex brokers catering to Ghanaian traders frequently offer a variety of payment methods, such as local bank transfers, mobile money choices such as MTN Mobile Money, and other payment platforms that Ghanaians are familiar with.

How do Forex Brokers Make Money?

- Spreads are the price differences between buying and selling a currency pair. Ghanaian traders will note that they may purchase a currency at one price and sell it cheaper. This disparity, known as the spread, is one method brokers profit.

- Some brokers charge a commission fee for each deal executed. This is increasingly frequent with ECN (Electronic Communication Network) brokers, who offer tighter spreads but charge a commission.

- If a position is left open overnight, a fee or interest rate known as the swap rate may be levied. Brokers may be able to profit from this.

- Brokers may offer premium services, tools, or educational resources that traders can pay for.

- Some brokers charge fees for accounts that have been inactive for a certain amount of time.

Ask and Bid Price in Forex Trading

The ask and bid prices serve as the foundation for Forex trading. Understanding this pricing is critical because it governs how deals are opened and closed.

What is the Ask Price?

The asking price, sometimes called the “offer” price, is the price at which the market (or your broker) will sell a specific currency pair to you. Thus, you, the trader, can buy the base currency at this price.

Furthermore, the asking price is essential as it gives the trader an understanding of the price they must pay to purchase a currency pair.

What is the Bid Price?

The bid price is when the market (or your broker) purchases a specific currency pair from you. Consequently, at this price, you can sell the base currency.

Knowing the bid price is crucial for traders as it indicates the price they will receive when they want to sell a currency pair.

Spread and Pips in Forex Trading

The concepts of spread and pips are closely tied to the ask and bid values in Forex trading, offering a deeper understanding of costs and movements within the Forex market.

Understanding the Spread

The spread differs between a currency pair’s ask and bid prices. It shows the broker’s profit margin (without commissions), although it is affected by several factors such as liquidity, volatility, and market demand.

The spread is a direct expense to traders. A wider spread usually translates into higher trading costs. Traders frequently seek brokers with reduced spreads to cut their trading costs.

Furthermore, a low spread can substantially impact profitability, especially in high-frequency trading, where positions are opened and closed quickly.

Deciphering Pips

A pip is an abbreviation for “percentage in point.” It denotes the smallest price movement a currency pair can make per market standard. Because most major currency pairs are priced to four decimal places, the smallest change is 0.0001, or one basis point.

Pips play an important role in trading since they allow traders to track the price movement of currency pairings. For instance, if EUR/USD moves from 1.1050 to 1.1055, it moves by 5 pips.

Pip value is determined by three factors: the currency pair being exchanged, the magnitude of the trade, and the exchange rate. Knowing the pip value is critical for risk management since traders can determine the magnitude of prospective losses or gains.

An Introduction to Day Trading

What is Day Trading?

Buying and selling financial instruments inside a single trading day is known as day trading. By the conclusion of the day, the trader has closed all positions, guaranteeing that no positions are left open overnight.

How Day Trading Works

- Research & Planning: Day traders often begin their day by monitoring news, evaluating charts, and spotting potential trade opportunities.

- Quick Decisions: Due to the brief period of trades, choices are frequently made fast based on real-time data and pre-set methods.

- Risk Management: Setting stop-loss and take-profit levels is critical for managing potential losses.

How Ghanaians Can Start Using Day Trading

- Educate Yourself: Learn the fundamentals of Forex, as well as charts and indicators.

- Choose a Reliable Forex Broker: Check that they have a stable trading platform, cheap spreads, and responsive customer service.

- Practice on a Demo Account: Before trading with real money, use a demo account to gain hands-on experience.

- Stay Updated: Follow financial news regularly, especially events that impact the Forex market, such as central bank decisions or important economic indices.

An Introduction to Swing Trading

What is Swing Trading?

Swing trading involves traders aiming to seize price swings or movements within a timeframe that may vary from a few days up to several weeks.

How Swing Trading Works

- Identify Trends: Swing traders use technical analysis, chart patterns, and sometimes fundamental analysis to forecast market movements.

- Entry & Exit Points: To control their deals, traders define unambiguous entry, stop-loss, and take-profit points.

- Longer Holding Period: Swing traders hold positions open for several days or weeks, unlike day traders.

How Ghanaians Can Start Using Swing Trading:

- Gain Knowledge: Learn the fundamentals of trend lines, support, and resistance levels, and prominent indicators such as Moving Averages and the RSI.

- Start Small: To minimize information overload, start with a couple of currency pairings or assets.

- Use Tools: Use charting tools and software platforms that enable technical analysis.

- Stay Patient: Swing trading necessitates patience as you wait for the market to move.

An Introduction to Scalping in Forex Trading

What is Scalping?

Scalping is a trading method in which traders make several little trades throughout the trading day to profit from small price movements.

How Scalping Works

- High Frequency: Scalpers often trade throughout the day, with each deal lasting only a few minutes or even seconds.

- Small Profits Accumulate: While each trade may result in a small profit, these can add up over time.

- Use of Leverage: Scalping frequently entails using high leverage ratios to enhance rewards, which raises risk.

How Ghanaians Can Start Using Scalping:

- Robust Trading Platform: Scalpers require a fast and dependable trading platform, as even tiny delays can negatively influence profitability.

- Start with Major Pairs: Because of their strong liquidity and low spreads, prominent currency pairings such as EUR/USD or GBP/USD are popular scalping targets.

- Stay Informed: Keep up with current events because unforeseen occurrences can trigger volatility, affecting scalping methods.

- Continuous Learning: Scalping necessitates ongoing market adaption. Review and improve your strategy regularly.

What are Base and Quote Currencies?

In a currency pair, the base currency is the starting point and symbolizes your intended purchase or sale. To illustrate this, in the EUR/USD pairing, EUR would be considered as the base currency. It indicates the amount of quote currency required to acquire one unit of the base currency.

On the other hand, there is the currency known as the quote or counter currency. It holds the second position within a pair and determines how much of our base currency (EUR, in this case) is needed to buy one unit.

Considering the previous EUR/USD example pairing, USD is an indicator for the counter (currency).

How it Works in Trades

A Ghanaian trader would buy the currency pair if they predicted the value of the base currency would grow relative to the quoted currency. They will sell the pair if they believe the base currency’s value will fall to the quoted currency.

Practical Implications for Ghanaians

Consider the following scenario: a Ghanaian trader is examining the EUR/USD pair currently trading at 1.2000. This means that one Euro (the base currency) is worth 1.2000 US dollars (the quote currency).

If the trader feels the Euro will strengthen versus the US Dollar, they will purchase the pair. If the Euro falls in value and the pair falls to 1.1900, the trader will lose money if they close their bet.

10 Best Forex Brokers in Ghana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

The Importance of Market Sentiment in Forex Trading

Market sentiment, often termed as the mood or attitude of investors towards a particular market or asset, plays a pivotal role in Forex trading. It’s the collective psychological state of traders, which can be bullish (expecting prices to rise) or bearish (expecting prices to fall).

Sources of Market Sentiment

- Economic Indicators: Market mood can be influenced by data releases such as employment figures, GDP growth, or interest rate decisions. Positive data can boost confidence, while bad data can diminish it.

- Global Events: Political events, natural disasters, and substantial policy changes can all impact trader sentiment globally.

- Market speculative trading can occur due to rumors or anticipated future occurrences, impacting market mood before real data is available.

The Role of Sentiment Analysis

Sentiment analysis entails assessing the market’s general sentiment. Tools such as the Commitment of Traders (COT) report and sentiment indicators on trading platforms can provide valuable information. These tools show how many traders are long or short on a currency pair.

Implications for Ghanaians

Understanding market sentiment is critical for Ghanaians because it provides a macro view of global currency developments. For example, there is frequently a flight to “safe-haven” currencies such as the US dollar or the Swiss franc during times of global uncertainty.

If a major incident occurs in Europe and opinion becomes negative against the Euro, a Ghanaian trader equipped with this information can make more informed selections on Euro-related pairs.

Using Sentiment in Trading Strategies

While constantly following most traders can be tempting, the best profitable deals often come from going against popular opinion. If every trader is positive on a currency, it can be overbought, and a reversal is likely.

Ghanaians should blend sentiment analysis with technical and fundamental investigations to develop a thorough trading strategy.

The Importance of Market Sentiment in Forex Trading

Market sentiment, often termed as the mood or attitude of investors towards a particular market or asset, plays a pivotal role in Forex trading. It’s the collective psychological state of traders, which can be bullish (expecting prices to rise) or bearish (expecting prices to fall).

Sources of Market Sentiment

- Economic Indicators: Market mood can be influenced by data releases such as employment figures, GDP growth, or interest rate decisions. Positive data can boost confidence, while bad data can diminish it.

- Global Events: Political events, natural disasters, and substantial policy changes can all impact trader sentiment globally.

- Market speculative trading can occur due to rumors or anticipated future occurrences, impacting market mood before real data is available.

The Role of Sentiment Analysis

Sentiment analysis entails assessing the market’s general sentiment. Tools such as the Commitment of Traders (COT) report and sentiment indicators on trading platforms can provide valuable information. These tools show how many traders are long or short on a currency pair.

Implications for Ghanaians

Understanding market sentiment is critical for Ghanaians because it provides a macro view of global currency developments. For example, there is frequently a flight to “safe-haven” currencies such as the US dollar or the Swiss franc during times of global uncertainty.

If a major incident occurs in Europe and opinion becomes negative against the Euro, a Ghanaian trader equipped with this information can make more informed selections on Euro-related pairs.

Using Sentiment in Trading Strategies

While constantly following most traders can be tempting, the best profitable deals often come from going against popular opinion. If every trader is positive on a currency, it can be overbought, and a reversal is likely.

Ghanaians should blend sentiment analysis with technical and fundamental investigations to develop a thorough trading strategy.

The Effects of Leverage in Forex Trading

Positive Effects of Leverage

- Diversification: Because just a fraction of the trade value must be deposited, traders can diversify their trades across several instruments.

- When a trade goes in a trader’s favor, leverage can greatly increase the profit. Due to the enlarged position size, a modest price movement in the right direction can result in substantial returns.

- With little money, a trader can still participate in larger deals otherwise out of reach.

Negative Effects of Leverage

- Margin calls are sent by brokers when the market moves against a leveraged position, and the trader’s account equity falls below the required margin level. This indicates that the trader must deposit more funds or shut down positions to meet the margin requirement.

- Just as possible profits are amplified, so are potential losses. A minor negative movement can result in significant losses, possibly exceeding the initial investment.

- Because traders can start large positions with little capital, they may be enticed to take on excessive trades or risk, potentially leading to overexposure.

Ways Ghanaians Can Mitigate the Risks of Leverage

- Do not invest money that you cannot afford to lose. Also, retain enough funds in your trading account to avoid closing positions prematurely owing to margin calls.

- You can limit potential losses by selecting a specified price at which your trade will automatically close if the market swings against you.

- Review your trades frequently. Recognize patterns in your victories and defeats and adapt your methods accordingly.

- Stay up to speed with market news and events. Global events, economic indicators, or central bank policies can influence currency values. Being prepared enables better position management.

- Learn about leverage and its implications. This entails understanding margin requirements and how much leverage is excessive for your risk tolerance.

- Due to the increased impacts of leverage, it is critical to monitor open positions regularly to respond quickly to adverse market moves.

- It is best to start with modest leverage levels and progressively increase them as you gain experience and confidence.

- While diversification cannot completely remove risk, spreading your funds over multiple trades helps lessen the impact of a losing position.

5 Best Forex Brokers in Ghana with Free VPS Hosting

Exness

Exness presents a unique VPS hosting service designed just for Ghanaian traders. This service, located near MT servers, ensures fast and secure trading experiences worldwide.

Ghanaian traders can conduct trading smoothly even with inconsistent internet connectivity by using Exness’ VPS. Notably, this VPS improves Expert Advisor (EA) performance, ensuring smooth EA operations and faster trade execution independent of internet reliability.

Interested Ghanaian traders must meet certain requirements, including keeping a free margin of at least $100 and depositing at least $500, and can be reached via email or live chat.

Furthermore, Ghanaians can use Exness’ dependable and effective VPS hosting for uninterrupted trading, allowing you to concentrate on refining methods.

RoboForex

RoboForex’s VPS server is always active despite variable internet access. It is always available from any location and runs independently of the state of your computer.

Free VPS is provided for clients with trading accounts that exceed $300 (excluding bonuses), with a minimum of 3 standard lots traded.

Alternatively, the VPS service can be had for $5 per month. Fulfilling equity and transaction volume requirements ensures continuous service, subject to certain constraints.

OANDA

OANDA’s VPS partners provide a robust and dynamic trading environment. OANDA’s partner VPS services ensure low latency and increased stability for the best trading performance.

- BeeksFX, a well-known forex VPS service, has data facilities in New York and London. Its fully managed VPS has one of the lowest latency rates in retail Forex, ensuring accurate transaction entry and exit. It offers ongoing plan implementation through dependable performance, allowing for diligent monitoring and adjustments to market situations.

- Liquidity Connect, a prominent IaaS technology supplier, provides outsourced infrastructure services to the Global Financial Markets. Their primary goal is to maintain low latency for uninterrupted operations.

TMGM

TMGM offers dependable VPS servers that ensure regular access to forex markets. The advantages include free VPS offerings based on trading requirements, which can accommodate up to three MT4 platforms at the same time.

Furthermore, TMGM’s trade servers offer quick and consistent market access with a latency of under 1 ms. ForexVPS.net’s guarantee of 100% uptime and 24/7 assistance adds to the comfort of mind.

Vantage Markets

Vantage Markets provides a VPS service for dedicated Forex traders wanting uninterrupted MetaTrader 4 functioning. This external server connection reduces the possibility of downtime due to technical concerns.

It needs a minimum deposit of $1,000, selection of a VPS provider, VPS activation, and monthly trades totaling $1 million for a potential VPS return of up to $50, making it especially helpful for Expert Advisor (Forex trading robots) customers.

MetaTrader 4 VS MetaTrader 5

| 📊Trading Instruments | 📈Mainly Forex. Limited CFDs and future | 📉Forex, stocks, futures, options, CFDs, and commodities |

| ⏰Timeframes | 9 timeframes | 21 timeframes |

| 🌎Economic Calendar | Not built-in | Built-in, covering international events |

| ✔️Order Types | 4 (Buy, Sell, Buy Stop, Sell Stop) | 6 (additional Buy Stop Limit and Sell Stop Limit) |

| 📈Hedging | Allows hedging (multiple positions in the same asset) | Limited depending on the broker (often uses the netting system) |

| 📱Technical Indicators | 30 built-in indicators | 38 built-in indicators |

| ✴️Graphical Objects | 31 graphical objects | 44 graphical objects |

| 🔁Strategy Tester | Single-threaded | Multi-threaded, multi-currency, real ticks |

| 🔎EAs and Scripting | MQL4 language | MQL5 language (more advanced and faster) |

| 📉Depth of Market | No | Yes, provides insights into market liquidity |

| 🛑Alerts | Basic alerts | More types of alerts and notifications |

| ✔️Economic News | Basic | Advanced with more news items |

| 👥Communication with Broker | Not integrated | Built-in chat to communicate with broker representatives |

| 🏛 Marketplace | Yes, with a range of tools & indicators | Bigger marketplace with more indicators, robots, and other tools |

| 🎉Popularity in Ghana | Widely accepted by Ghanaian Forex brokers due to its simplicity and focus on Forex | Growing in acceptance, especially for traders diversifying beyond Forex |

Best Forex Brokers in Ghana

Best MetaTrader 4 / MT4 Forex Broker

Overall Rating

- 4.8/5

Min Deposit

USD 50 (672 GHS)

Regulators

FCA

Trading Desk

MT4, NinjaTrader, Trading Station

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best MT4 forex broker in Ghana. FXCM is an NDD broker that provides MetaTrader 4 and additional platforms. Orders are completed in less than 31 milliseconds by FXCM’s trade execution system.

Best MetaTrader 5 / MT5 Forex Broker

Min Deposit

56,75 GHS or $5

Regulators

IFSC, CySec, ASIC, FCA

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XM is the best MetaTrader 5 forex broker in Ghana. XM offers MT5 on multiple devices to facilitate account integration.

In addition, negative balance protection is applied to all retail trading accounts, and XM does not restrict the trading strategies that Ghanaian traders employ.

Best Forex Broker for beginners

Min Deposit

USD 1 (13 GHS)

Regulators

IFSC

Trading Desk

MT4

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, SuperForex is the best forex broker for beginners in Ghana. SuperForex allows Ghanaians to open an account with a minimum deposit of $1 (11.30 GHS). SuperForex offers leverage of up to 1:1000 and applies a negative balance to all retail trading accounts.

Best Low Minimum Deposit Forex Broker

Overall Rating

- 4.8/5

Min Deposit

USD 5 (67 GHS)

Regulators

IFSC, FSCA, ASIC, CySEC

Trading Desk

MT4, MT5

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FBS is the best Low Minimum Deposit Forex Broker in Ghana. FBS has a low minimum deposit requirement of 11.30 GHS ($1) and employs ECN and STP order execution. FBS offers Ghanaians access to FBS Trader, MT4, and MT5 to participate in trading CFDs.

Best ECN Forex Broker

Min Deposit

1 135 GHS or $100

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Tickmill is the best ECN forex broker in Ghana. Tickmill’s ECN model ensures traders expect 0.0 pips on major instruments such as EUR/USD. Furthermore, Tickmill sources the deepest liquidity from the best banks and providers worldwide.

Best Islamic / Swap-Free Forex Broker

Min Deposit

USD 1 (13 GHS)

Regulators

FSA, CySEC, FSCA, FSC

Trading Desk

MT4, MT5, MT4/5 WebTrader, mobile (iOS & Android)

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, JustMarkets is the best Islamic / Swap-Free forex broker in Ghana. JustMarkets provides over 170 tradable instruments for trading. MetaTrader 4 and 5 are available to Muslim traders with the JustMarkets Islamic Account.

Best Forex Trading App

Min Deposit

USD 0 / 0 GHS

Regulators

FSCA, CySEC, DFSA, FSA, CMA

Trading Desk

MT4, MT5, HFM Platform (Android & IOS)

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, HFM is the best forex trading app in Ghana. The HFM app allows Ghanaians to monitor their account, trading positions, and various other useful functions. Traders can also stay updated with market news, and deposit and withdraw funds.

Best Forex Rebates Broker

Overall Rating

- 4.5/5

Min Deposit

USD 50 (672 GHS)

Regulators

FSCA

Trading Desk

MT4, Proprietary platform

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IronFX is the Best Forex Rebates Broker in xxx. Ghanaians can earn up to $8.25 on the Standard, Premium, VIP, No-Commission, and Absolute Zero Accounts when they trade EUR/USD. Alternatively, Ghanaians can earn up to $100 per 50 lots traded on Forex.

Best GHS Account Forex Broker in Ghana

Min Deposit

$10 / 119 GHS

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best GHS Account forex broker in Ghana. Exness is one of the only international brokers with a GHS-denominated account. Ghanaian traders can register a GHS Standard, Raw Spread, Zero, and Pro Account on MT4 and MT5 with Exness.

Best Lowest Spread Forex Broker

Min Deposit

2390 GHS or $200

Regulators

ASIC, CySEC, FSA, SCB

Trading Desk

MetaTrader 4

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IC Markets is the best lowest spread forex broker in Ghana. IC Markets is a multi-currency broker with sophisticated social and copy trading features. With IC Markets, Ghanaians can anticipate zero-pip spreads and free VPS hosting.

Best Nasdaq 100 Forex Broker

Min Deposit

USD 0 (0 GHS)

Regulators

CySEC, FSC

Trading Desk

MT4, Trade Nation Platform

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Trade Nation is the best Nasdaq 100 forex broker in Ghana. Ghanaians can trade Nasdaq and other Index CFDs on the spot and in futures markets. Ghanaians can anticipate US Tech spreads beginning at 0.8 pips and margin requirements between 0.5% and 5%.

Best Volatility 75 / VIX 75 Forex Broker

Min Deposit

2987 GHS or $250

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Ghana’s best Volatility 75 / VIX 75 forex broker. Among the more than 19,000 financial instruments offered by IG is VIX. When trading the Volatility 75 Index, Ghanaian traders can also anticipate having access to potent trading tools that will assist them in refining their trading strategies.

Best NDD Forex Broker

Overall Rating

- 4.7/5

Min Deposit

USD 50 (672 GHS)

Regulators

CySEC

Trading Desk

MT4, MT5

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, LiteFinance is the best NDD forex broker in Ghana. LiteFinance is an NDD broker that uses ECN trade execution to provide Ghanaians with the best possible pricing, with spreads from 0.0 pips on EUR/USD.

Best STP Forex Broker

Min Deposit

1 135,04 GHS or $100

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best STP forex broker in Ghana. AvaTrade is a versatile STP broker that provides Ghanaians access to over 1,250 financial instruments. AvaTrade, Currenex and other liquidity providers are responsible for some of the finest prices Ghanaians can anticipate.

Best Sign-up Bonus Broker in Ghana

Min Deposit

USD 1 (13 GHS)

Regulators

CySEC, FSC

Trading Desk

MetaTrader 4

MetaTrader 5

MultiTerminal

WebTrader

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, InstaForex is the best sign-up bonus broker in Ghana. InstaForex offers Ghanaians a $1,000 no-deposit bonus and welcome incentive.

Traders can use this no-deposit benefit to investigate the ForexCopy system, test the commission-free trading accounts, and select from various tradable instruments.

Frequently Asked Questions

What are the best Forex brokers available in Ghana?

The best forex brokers in Ghana include Exness, HFM, Alpari, FXTM, InstaForex, FGXT.com, XM, AvaTrade, and others.

Is Forex trading legal in Ghana?

Yes, Forex trading is permitted in Ghana. However, Ghanaian traders must use registered brokers to ensure transparency and security.

How do I start Forex trading in Ghana?

To start Forex trading in Ghana, look for a reputable broker, open a trading account, deposit funds, and begin trading on their platform.

Are there local Forex trading communities in Ghana?

Yes, there are several online and offline Forex trading forums in Ghana where traders discuss methods, share ideas, and learn from one another.

Do I need a large capital to start Forex trading in Ghana?

No, you do not. However, while many brokers provide accounts with low initial deposits, starting with a reasonable amount of cash provides more flexibility and risk management alternatives.

What are the popular currency pairs traded by Ghanaians?

While many Ghanaian traders concentrate on large pairs such as EUR/USD or GBP/USD, developing market currency pairs can also be popular.

Are there Forex trading seminars in Ghana?

Yes, there are. Forex trading seminars, workshops, and training sessions are held in Ghana regularly to educate traders and enthusiasts.

Can I practice Forex trading without real money?

Yes, you can. Most brokers provide demo accounts where traders can practice trading with virtual money, allowing them to learn about the platform and tactics without risking their money.

What risks are involved in Forex trading for Ghanaians?

Risks associated with forex trading include market volatility, leverage-related hazards, and the potential loss of invested funds.

Are profits from Forex trading taxable in Ghana?

Yes, forex profits are taxable in Ghana. Both realized, and unrealized exchange gains are considered taxable income under Act 896.

Namibian Dollar Forex Trading Accounts

Namibian Dollar Forex Trading Accounts

Scam Forex Brokers in Ghana

Scam Forex Brokers in Ghana