JustMarkets Review

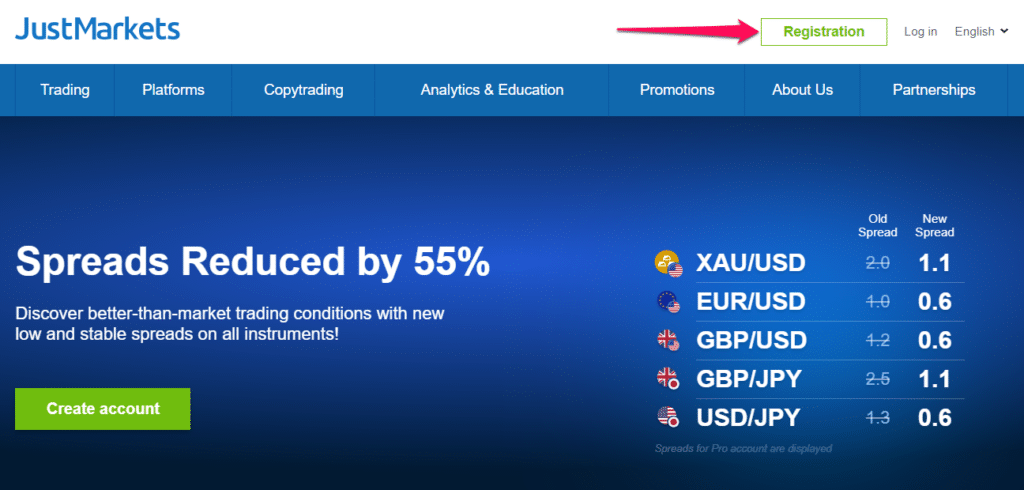

JustMarkets offers trading conditions that are better than average market prices. JustMarkets offers Ghanaians a 55% spread reduction and powerful trading platforms. Ghanaians can participate in spot trading as well as copy trading with JustMarkets.

- Lesche Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 1 (13 GHS)

Regulators

FSA, CySEC, FSCA, FSC

Trading Desk

MT4, MT5, MT4/5 WebTrader, mobile (iOS & Android)

Crypto

Yes

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

In this extensive analysis, we look at the path of JustMarkets, a brokerage founded in 2012. JustMarkets is committed to offering a variety of trading conditions ideal for novice and experienced traders in Ghana.

Throughout its operations, JustMarkets has continuously shown a commitment to development by aiming to accommodate the different demands of its trading community.

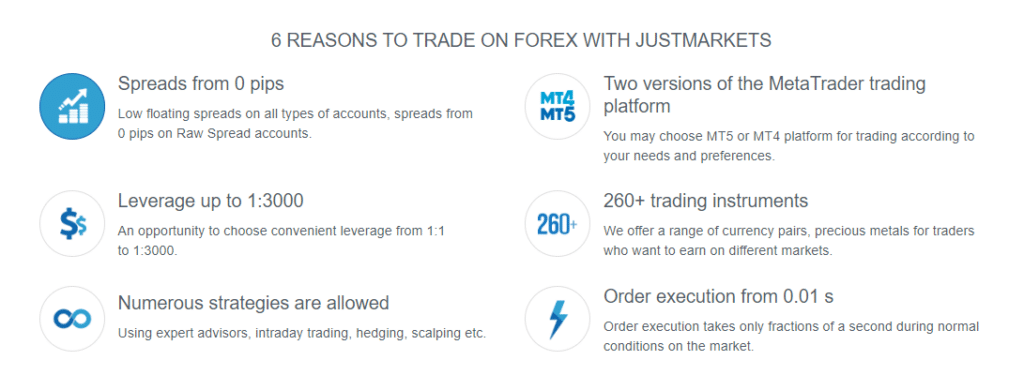

JustMarkets’ commitment to providing competitive trading conditions is evident in its availability of narrow spreads, beginning at 0.0 pips for certain accounts, and a high leverage option of up to 1:3000.

These advantages attract Ghanaian traders who want to optimize their trading potential with a little initial commitment.

Furthermore, JustMarkets has exhibited innovation in its trading platforms by providing the popular MetaTrader 4 and MetaTrader 5 platforms, recognized for their user-friendly interfaces and powerful capabilities.

These platforms provide access to a variety of trading assets, including currency pairings, indices, commodities, and cryptocurrency.

Throughout its existence, JustMarkets has been recognized for its exceptional customer service, receiving high ratings and positive user reviews.

The availability of multilingual support, along with a convenient mobile app, ensures that traders in Ghana can receive assistance whenever and wherever they need it.

In terms of financial assets, although JustMarkets offers a more limited range than some competitors, it provides a selection of well-suited instruments for those focusing on forex and certain CFDs.

While JustMarkets currently lacks a Tier-1 regulatory license, it operates under several jurisdictions, ensuring compliance with various international laws and regulations.

This oversight adds a layer of trust and reliability for traders, which is particularly important in the often unpredictable landscape of online trading.

Our initial thoughts on JustMarkets are that it is an excellent choice for Ghanaian traders seeking a reliable, well-regulated platform offering a range of trading instruments and competitive conditions.

In addition, from what we can see, JustMarkets’ ongoing efforts to enhance its services and adapt to client needs make it a compelling option for traders in Ghana and beyond.

How does JustMarkets’ customer support stand out?

JustMarkets offers 24/7 multilingual support, ensuring that traders can receive assistance anytime, which is a significant advantage over brokers with limited support hours.

What educational resources does JustMarkets offer that are unique?

JustMarkets provides comprehensive educational materials including webinars, forex articles, a glossary, and educational videos, which are more extensive than many competitors.

JustMarkets at a Glance

| 📊 Year Founded | 2012 |

| ⚖️ Regulation | FSA, CySEC, FSCA, FSC |

| 🏛 Ease of Use Rating | 4/5 |

| 💰 Bonuses | Yes, No-Deposit Bonus, 120% Deposit Bonus, Referral Bonus |

| 🌎 Support Hours | 24/7 |

| 📱 Trading Platforms | Trading Platforms MetaTrader 4, MetaTrader 5, JustMarkets App |

| 📈 Account Types | MT4 Standard Cent, MT4 Standard, MT4 Pro, MT4 Raw Spread, MT5 Standard, MT5 Pro, MT5 Raw Spread |

| 💰 Base Currencies | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 📊 Starting spread | From 0.0 pips |

| 📊 Leverage | 1:3000 |

| ✔️ Currency Pairs | Currency Pairs 61, Major, Minor, and Exotic Pairs |

| 💳 Minimum Deposit (GHS) | 135 GHS ($10) |

| 📉 Inactivity Fee | Yes, $5 monthly after 150 days of inactivity |

| 📱 Website Languages | English, Spanish, Portuguese, French, Russian, Indonesian, Malaysian, Chinese (Simplified and Traditional), Lao, Vietnamese, Thai, Turkish, and more |

| 💰 Fees and Commissions | Fees and Commissions Spreads from 0.0 pips, commissions from $6 |

| ✔️ Affiliate Program | Yes |

| 🔎 Banned countries | The United States, Japan, United Kingdom, EU, EEA, Belgium, and Spain |

| 📉 Scalping | Yes |

| 📈 Hedging | Yes |

| 💻 Tradable Assets | Indices, Energies, Forex, Metals, Cryptocurrencies, Shares, Futures |

| 👉 Open Account | 👉Open Account |

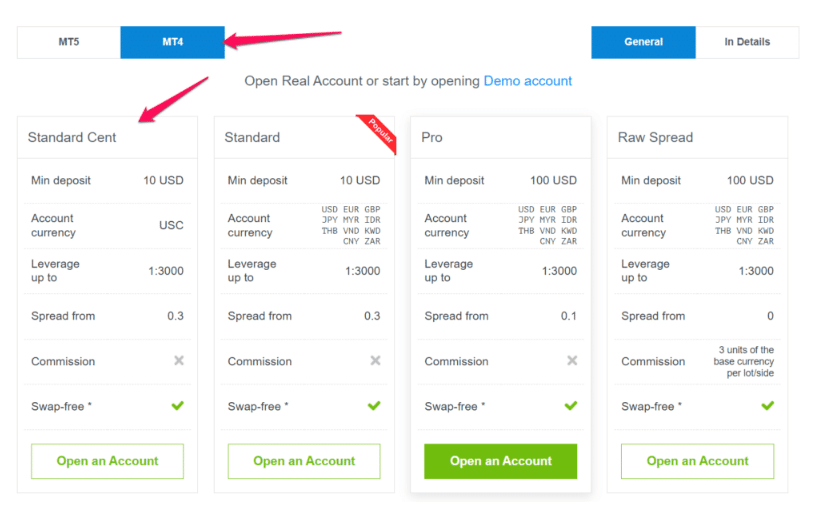

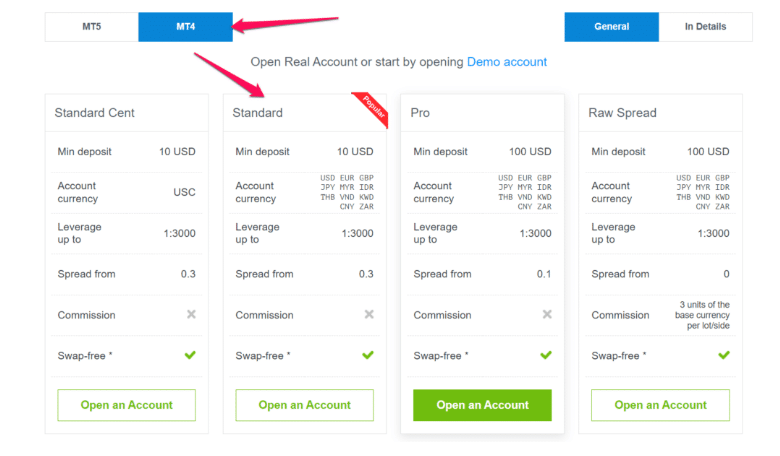

JustMarkets Account Types

While reviewing JustMarkets for Ghanaians, we first noticed the range of account types available, each suiting different types of traders according to their experience level.

We tested each account type through a demo, giving us first-hand exposure to JustMarkets’ competitive trading conditions. In the sections below, we give Ghanaians a breakdown of the main features of each account, followed by a discussion on each account and its benefits for traders.

| 💻 Live Account | 👉 Open Account | 📉 Minimum Dep. | 💻Platforms | 💸 Leverage |

| ➡️MT4 Standard Cent | 👉Open Account | 135 GHS | MetaTrader 4 | 1:3000 |

| ➡️MT4 Standard | 👉Open Account | 135 GHS | MetaTrader 4 | 1:3000 |

| ➡️MT4 Pro | 👉Open Account | 1,300 GHS | MetaTrader 4 | 1:3000 |

| ➡️MT4 Raw Spread | 👉Open Account | 1,300 GHS | MetaTrader 4 | 1:3000 |

| ➡️MT5 Standard | 👉Open Account | 135 GHS | MetaTrader 5 | 1:3000 |

| ➡️MT5 Pro | 👉Open Account | 1,300 GHS | MetaTrader 5 | 1:3000 |

| ➡️MT5 Raw Spread | 👉Open Account | 1,300 GHS | MetaTrader 5 | 1:3000 |

Demo Account

From what we could see during our testing, the JustMarkets demo account functions as an instructional platform that simulates real trading situations while posing no financial risk.

Furthermore, with a virtual fund of up to $5 million, traders can test various tactics for 30 days after signing up, giving them plenty of time to acquire confidence before moving on to live trading.

MT4 Standard Cent Account

With this account, novices and more experienced traders alike may test their methods in a safe setting before risking their money in a real-world trading environment. The following are the specifics of this account.

MT4 Standard Account

The MT4 Standard Account strikes a mix between use and features. Traders can access various trading products with a little initial payment and no commission fees.

According to our research, this account offers competitive spreads and leverage of up to 1:3000, making it ideal for people prioritizing risk control and cost-effectiveness.

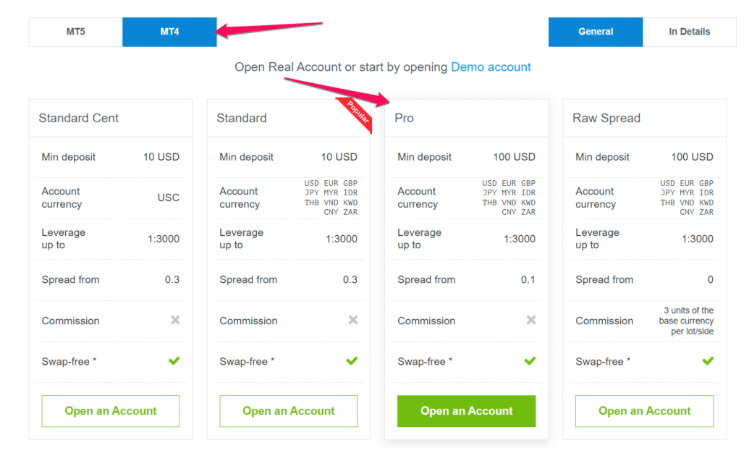

MT4 Pro Account

The MT4 Pro Account offers spreads as low as 0.1 pips for traders looking for a more professional edge. This account type has a greater minimum deposit, making it ideal for professional traders who want to fine-tune their tactics with precision.

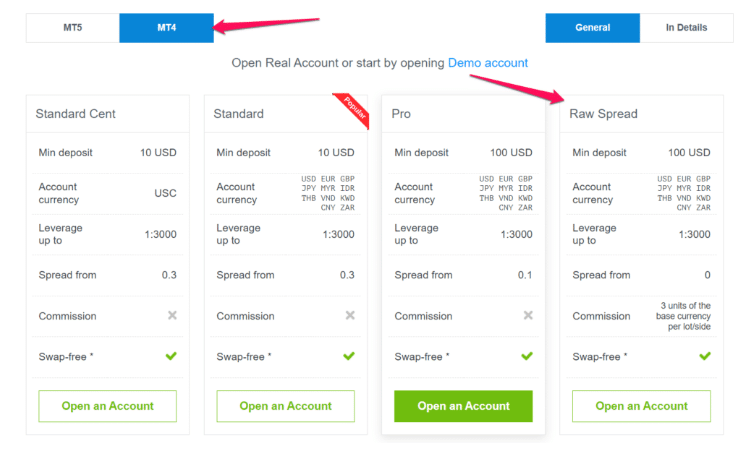

MT4 Raw Spread Account

The MT4 Raw Spread Account is ideal for scalpers and day traders because of its tight pricing and high leverage. With raw spreads starting at 0.0 pips and affordable commission costs, this account is suited for traders who value quickness and direct market access.

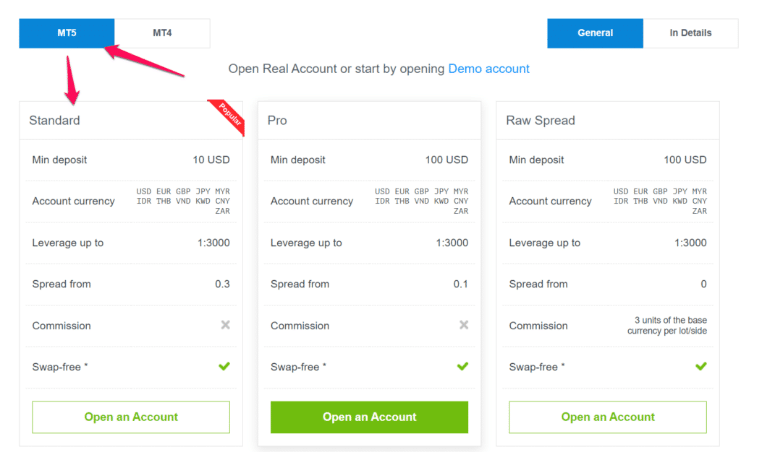

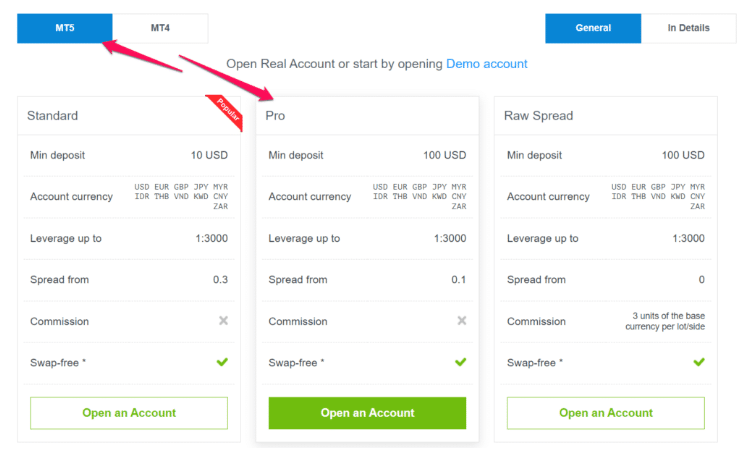

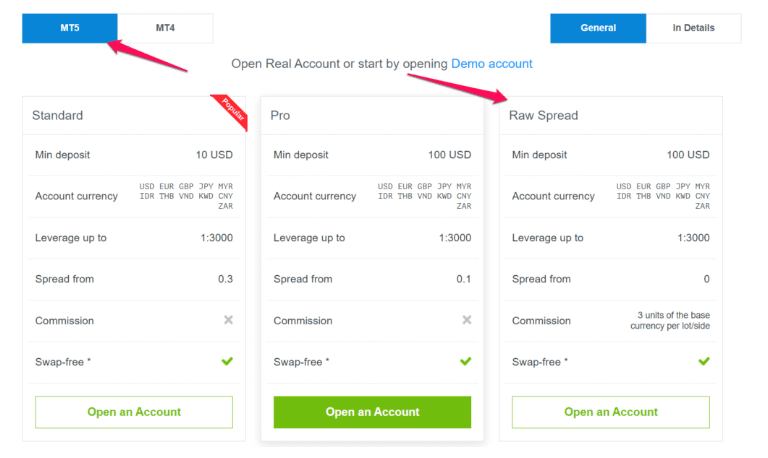

MT5 Standard Account

Transitioning to MT5 accounts, the first account we tested was the Standard Account. This account provides access to advanced trading features while requiring a minimal investment.

Furthermore, Ghanaians can take advantage of the increased features of the MT5 platform without worrying about commissions, broadening their trading possibilities.

MT5 Pro Account

For expert traders seeking sophistication, the MT5 Pro Account provides even tighter spreads and more complete analytical tools. This account type is designed for efficiency, allowing Ghanaians to execute trades precisely.

MT5 Raw Spread Account

The MT5 Raw Spread Account is intended for Ghanaians who value small price swings and fast trading. With clear commission structures and extensive analytical tools, this account type is ideal for scalpers hoping to profit from market volatility.

Islamic Account

JustMarkets provides an all-inclusive Islamic Account, which follows Sharia law by removing swap costs. This provision assures that Ghanaian Muslim traders can undertake ethical trading without jeopardizing their religious values.

Furthermore, we were pleased to notice that the swap-free function is accessible to all account types, reflecting JustMarkets’ dedication to diversity and cultural sensitivity.

What are the features of JustMarkets’ Pro account?

The JustMarkets Pro account offers spreads from 0.1 pips, leverage up to 1:3000, and a commission-free trading environment, ideal for experienced traders.

What is unique about JustMarkets’ Raw Spread account?

JustMarkets’ Raw Spread account features ultra-low spreads starting from 0.0 pips and a commission per trade, appealing to high-volume traders.

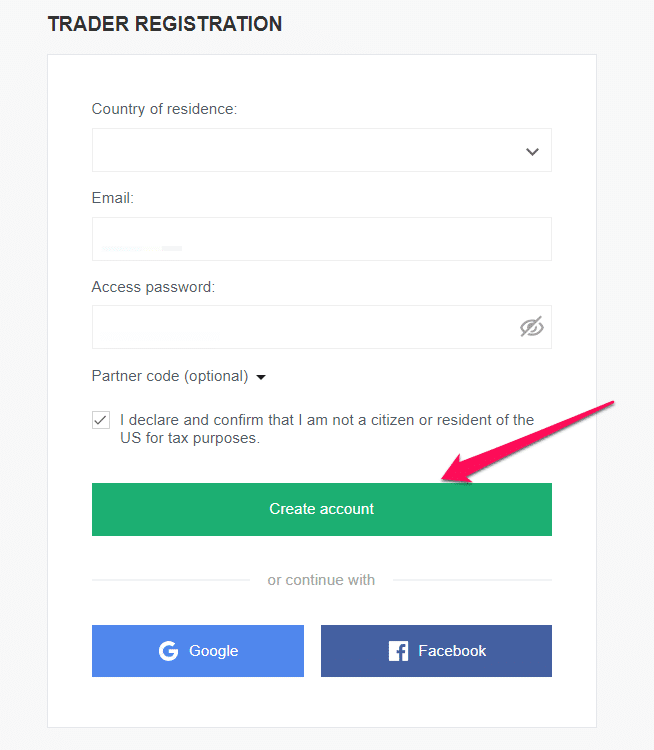

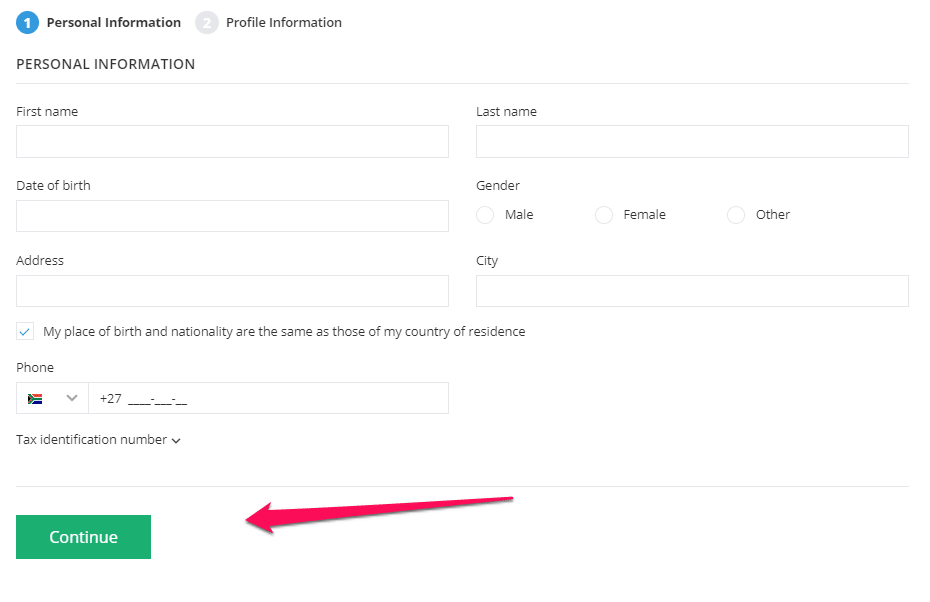

How To Open a JustMarkets Account step by step

JustMarkets boasts a fast and effortless account registration process that involves the following few steps:

Step 1: Find the “Register”

Find the “Register” option on JustMarkets’ official website—it’s normally in a prominent spot, like the upper right corner of the homepage.

Step 2: Fill in personal details

- When you start the registration process, you will asked to enter personal details like your full name according to your identity documents, a valid email address, and a phone number.

- After providing the necessary information, you can set up your trading dashboard or “Back Office” to manage your JustMarkets trading accounts, transactions, and more.

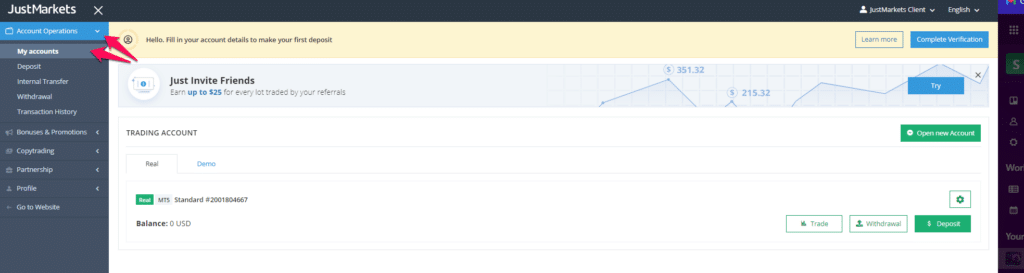

Step 3: “My accounts.”

- The next step is to create an account. You will find the “Account Operations” area in the Back Office, where you can choose “My accounts.”

- You can access the “Live” page and the “Trading account” section now and click the option to register an account from here.

- Choosing your ideal account is the next step in the process. There are a variety of accounts available, including Standard Cent, Pro, and Raw Spread, each with its own set of features, spreads, leverage, and instruments to choose from.

- Once you choose an account type, you can enter account-specific parameters, including the account currency (from options like USD, EUR, and GBP, among others) and leverage (if desired).

- You can indicate whether you require an Islamic account during the account formation procedure.

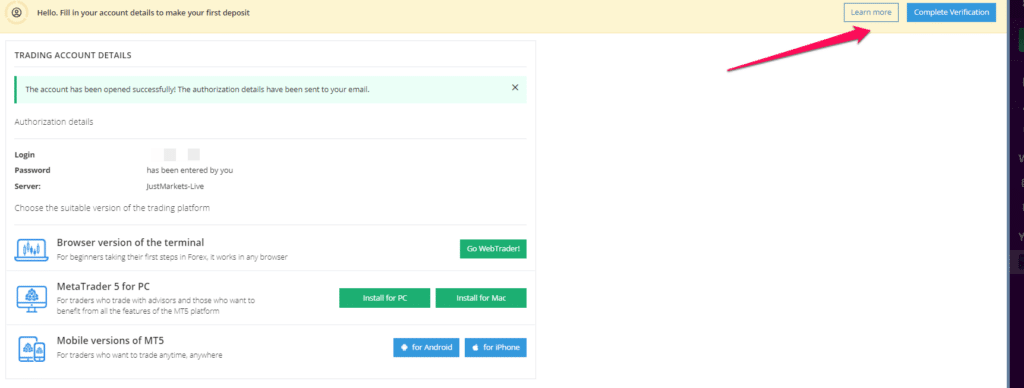

Step 4: Complete Verification

- Per international financial standards, the next step involves verifying your identity and residential address as part of the KYC policy. Here, you must upload a copy of your identity documents and proof of residence.

- After confirming your identity, you have a few options for funding your trading, including bank transfers and Internet payment systems. There is also an option to deposit in GHS using African Mobile Money solutions.

- Once your account has been funded, you can now begin trading with JustMarkets.

Is account verification required at JustMarkets?

Yes, account verification is required at JustMarkets, typically involving submitting proof of identity and address documents.

Can traders open multiple accounts with JustMarkets?

Yes, traders can open multiple accounts with JustMarkets, but they should adhere to any terms and conditions set by JustMarkets.

JustMarkets Deposit & Withdrawal Options

JustMarkets is a versatile broker that caters to Ghanaians by offering flexible deposit and withdrawal options and the benefit that traders can deposit and withdraw in GHS using African Mobile Money.

Here’s a snapshot of the deposit and withdrawal options followed by a step-by-step on how traders can manage their funds with JustMarkets.

| 💳 Payment Method | 🌎 Country | 💴Currencies Accepted | ⏱️Processing Time |

| 💰Credit/Debit Card | All | EUR, USD | 30 min – 2 hours |

| 💳Bank Transfer | Various | Bank Transfer Various AED, GHS, OMR, TRY, AUD, HKD, PHP, TTD, BBD, HRK, PKR, UGX, BGN, HUF, PLN, USD, BHD, ILS, QAR, ZAR, CAD, JPY, RON, ZMW, CHF, KES, SAR, CZK, MWK, SEK, DKK, MXN, SGD, EUR, NOK,THB, GBP, NZD, TND 1 – 6 banking days | 1 – 6 banking days |

| 💳 Skrill | All | EUR, USD | 5 min – 2 hours |

| 🪙 Neteller | All | EUR, USD, GBP, ZAR, CNY, MYR, JPY, AED, AUD, BRL, CAD, CHF, COP, INR, KRW, MXN, NGN, RUB, SGD, TWD | 5 min – 2 hours |

| 💸 Perfect Money | All | EUR, USD | 5 min – 2 hours |

| 🪙Sticpay | All | EUR, USD, JPY, KRW, CNY, PHP, AED, AUD, CAD, CHF, CLP, GBP, HKD, IDR, INR, MXN, MYR, NZD, RUB, SGD, THB, VND | 5 min – 2 hours |

| 💰AirTM | All | USD | 30 min – 2 hours |

| 🪙Bitcoin | All | BTC | 30 min – 2 hours |

| 💰Bitcoin Cash | All | BCH | 30 min – 2 hours |

| 🪙Ethereum | All | ETH | 30 min – 2 hours |

| 🪙USD Coin | All | USDC | 30 min – 2 hours |

| 💸Tether | All | USDT | 30 min – 2 hours |

| 💸BUSD | All | BUSD | 30 min – 2 hours |

| 💴Binance | All | BNB | 30 min – 2 hours |

| 🪙Dogecoin | All | DOGE | 30 min – 2 hours |

| 💴Litecoin | All | LTC | 30 min – 2 hours |

| 💳XRP | All | XRP | 30 min – 2 hours |

| 💸Malaysian Banks | Malaysian | MYR | 30 min – 2 hours |

| 💴Indonesian Banks | Indonesia | IDR | 30 min – 2 hours |

| 💸Thai Banks | Thailand | THB | 30 min – 2 hours |

| 💰Prompt Pay | Thailand | THB | 30 min |

| 💴Vietnamese Banks | Vietnam | VND | 30 min – 2 hours |

| 💳Philippines Banks | Philippines | PHP | 30 min – 2 hours |

| 💰African Local Cards/Transfer | Nigeria | NGN | 30 min |

| 💸Singaporean EFT Singapore SGD 30 min – 1 day | Singapore | SGD | 30 min – 1 day |

| 💰African local transfers | Nigeria | NGN | 30 min – 24 hours |

| 💳African Mobile Money | Uganda, Kenya, Rwanda, Ghana, Tanzania, and other West African Countries | UGX, KES, RWF, GHS, XAF, TZS | 30 min – 24 hours |

| 💴Skrill Medios de Pago en LatAm | Latin America | EUR, USD | 30 min |

| 💰Pay Retailers | All | USD | 1 day |

| 💳Boleto | Brazil | BRL | 1 day |

| 💴MoMo | Vietnam | VND | 30 min |

| 💸FasaPay | Indonesia | USD, IDR | 30 min – 3 hours |

JustMarkets Deposits

How to Deposit using Bank Wire Step by Step

➡️Access the JustMarkets Back Office.

➡️Go to the ‘Deposit’ area and choose ‘Bank Wire Transfer’.

➡️Enter the deposit amount in the specified currency.

➡️Obtain the specified banking information and initiate the wire transfer through your bank’s service.

➡️To confirm the deposit, upload proof of the bank wire transfer in your Back Office.

How to Deposit using Credit or Debit Card Step by Step

➡️Log in to the JustMarkets platform.

➡️Select ‘Deposit’ and then ‘Credit/Debit Card’ from the selections.

➡️Fill out your card details and deposit the amount.

➡️Confirm the information and submit it to complete the transaction.

How to Deposit using Cryptocurrency Step by Step

➡️Click ‘ Deposit ‘ in the JustMarkets Back Office and then your preferred cryptocurrency.

➡️A unique deposit address will be generated for each transaction; copy this or write it down.

➡️To make the deposit, use your cryptocurrency wallet and send it to the address provided.

How to Deposit using e-Wallets or Payment Gateways Step by Step

➡️Go to the ‘Deposit’ section of the JustMarkets Back Office.

➡️Choose your chosen e-wallet from the available alternatives.

➡️Enter the deposit amount and follow the prompts to complete the transaction through the e-wallet’s interface.

How to Deposit using African Mobile Money Step by Step

➡️Choose the Mobile Money option in JustMarkets’ deposit area.

➡️Enter the amount of GHS you want to deposit.

➡️Input your Mobile Money account information and confirm the transaction.

JustMarkets Withdrawals

How to Withdraw using Bank Wire Step by Step

➡️In the JustMarkets Back Office, navigate to the ‘Withdrawal’ area.

➡️Select ‘Bank Wire Transfer’ as your withdrawal option.

➡️Enter the amount and your banking information.

➡️Submit the request, and JustMarkets will send the funds to your bank account.

How to Withdraw using Credit or Debit Cards Step by Step

➡️Select ‘Withdrawal’ from your JustMarkets account section.

➡️Choose ‘Credit/Debit Card’ for the withdrawal.

➡️Enter the amount and then confirm your card information.

➡️Submit your request and wait for the funds to be credited to your card-linked bank account.

How to Withdraw using Cryptocurrency Step by Step

➡️Navigate to the ‘Withdrawal’ area of your JustMarkets account.

➡️Choose the cryptocurrency wallet option and select the cryptocurrency you want to withdraw.

➡️Enter the withdrawal amount and your crypto wallet address.

➡️Please review and submit your withdrawal request.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

➡️Navigate to the ‘Withdrawal’ section in the JustMarkets Back Office.

➡️Select your e-wallet or payment gateway from the alternatives.

➡️Specify the withdrawal amount and submit your e-wallet information.

➡️Please review and confirm the transaction.

How to Withdraw using African Mobile Money Step by Step

➡️In the withdrawal area, choose African Mobile Money.

➡️Enter your withdrawal amount in GHS.

➡️Provide your Mobile Money information and confirm the withdrawal request.

Can traders withdraw funds to a different payment method than the one used for deposit at JustMarkets?

No, you cannot. JustMarkets processes withdrawals back to the original deposit method according to AML policies.

Are there any restrictions on withdrawals at JustMarkets?

Yes, withdrawal restrictions at JustMarkets can include minimum amounts and verification requirements, which should be checked on the platform.

JustMarkets Trading Platforms and Software

JustMarkets makes it easy for traders to choose between platforms by offering certain account types linked to them.

JustMarkets’ trading conditions and unique features seamlessly integrate with these powerful platforms to give traders a unique and dynamic trading environment where they can thrive.

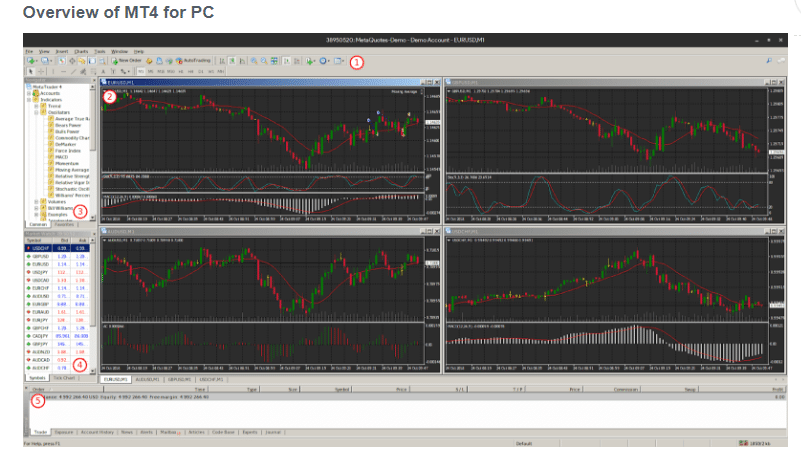

MetaTrader 4

Our experience with JustMarkets’ MetaTrader 4 platform revealed a robust and intuitive trading environment. Designed with Ghanaian traders in mind, MT4 on JustMarkets provides a diverse selection of trading pairs and instruments.

Combined with the broker’s competitive spreads, it ensures that trading is cost-effective. We discovered trades executed flawlessly, which is vital for strategies that demand swift market entry and exit.

Furthermore, the platform’s extensive customization options enabled us to tailor the interface to our preferences, thereby bolstering our analytical capabilities. By incorporating JustMarkets’ conditions, including high leverage, into MT4, we enhanced our trading capabilities significantly.

Overall, we can confidently say that traders in Ghana can look forward to a platform that performs efficiently and meets JustMarkets’ advantageous trading conditions.

MetaTrader 5

Upon examining MetaTrader 5, we quickly observed its significant improvements compared to its previous version. As seasoned reviewers of different trading platforms, we found MT5’s extra timeframes and analytical tools quite valuable.

The platform JustMarkets offers is well-suited to meet the intricate requirements of technical traders in Ghana. We found the depth of market visibility useful in gaining insights into the liquidity levels across various price points.

In addition, our testing of MT5 demonstrated strong compatibility with JustMarkets’ extensive range of instruments, including leverage options and market depth, covering forex and precious metals.

With the help of sophisticated charting and analysis tools, we gained a deeper understanding of market trends, which proved invaluable in making well-informed trading decisions.

Therefore, if you’re looking for a sophisticated and intuitive platform, JustMarkets’ MT5 offering is a great choice.

App

We also tried the JustMarkets App, which fits our fast-paced trading needs perfectly. The mobile interface is designed to be user-friendly and efficient, allowing for seamless trading.

As expert reviewers who’ve used various trading apps, we found the JustMarkets app incredibly useful in managing and executing trades on the go, with access to all trading instruments offered by JustMarkets.

The app effortlessly synced with our account preferences and settings on the desktop versions of MT4 and MT5 platforms, allowing us to seamlessly transition between devices without interrupting our trading activities.

Therefore, for traders in Ghana who prioritize mobility and functionality, JustMarkets’ mobile application is a fantastic tool.

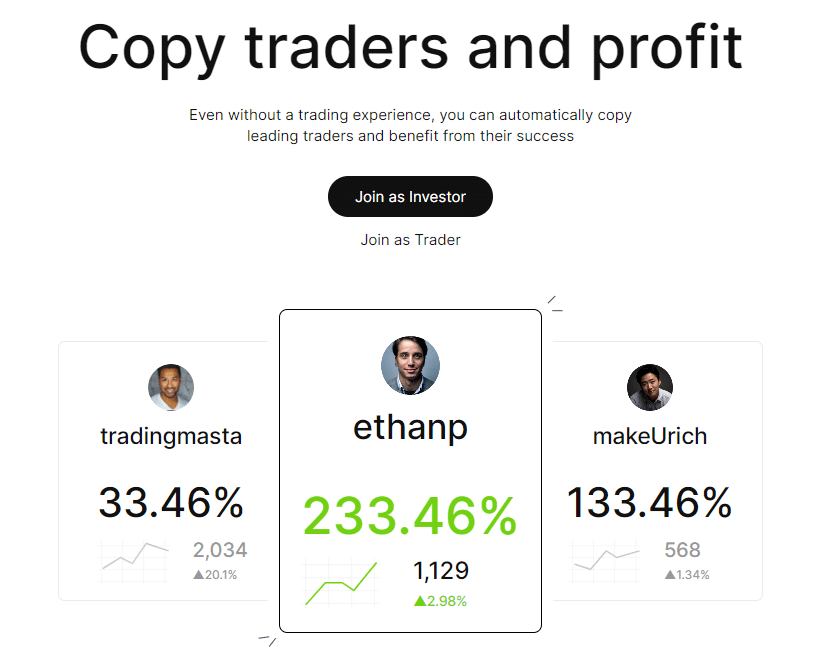

Copy Trading

Lastly, the Copy Trading platform offered by JustMarkets presents an enticing opportunity, particularly for novice traders or individuals seeking to broaden their trading approaches.

Our analysis revealed that it is a strategic approach to harness the knowledge of experienced traders. Operating on JustMarkets enables users to reap potential gains from market movements without conducting extensive analysis, similar to a quantitative analyst.

This feature is especially valuable in Ghana, where access to expert trading insights might be scarce. The Copy Trading platform seamlessly integrates with JustMarkets’ comprehensive service offering, ensuring that leverage and spread options remain consistent for all copied trades.

This service allows Ghanaians to enhance their trading skills by studying and emulating expert strategies.

What trading platforms does JustMarkets offer?

JustMarkets offers popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for a comprehensive trading experience.

Are there any unique features in JustMarkets’ trading platforms?

JustMarkets’ trading platforms include features like one-click trading, advanced charting tools, and various technical indicators.

Trading Instruments & Products

JustMarkets’ instruments allowed us to create a diversified portfolio, and we believe Ghanaians could do the same when they participate in trading the following markets and instruments:

➡️Share CFDs – JustMarkets allows Ghanaians to trade 165 share CFDs, allowing them to speculate on leading companies’ performance without owning actual shares, which could be extremely lucrative in terms of profitability.

➡️Cryptocurrency CFDs – JustMarkets offers Ghanaian traders 14 cryptocurrency pairs, providing a volatile and potentially lucrative market with leverage up to 1:3000, making it an ideal high-stakes environment.

➡️Forex – Ghanaian traders can engage in traditional currency trading with 65 forex pairings, leveraging up to 1:3000 with a small deposit, offering a risk-reward balance.

➡️Precious Metals – Ghanaian traders rely on trading seven metal instruments like gold and silver to hedge against inflation and currency volatility. Furthermore, JustMarkets offers leverage options of up to 1:3000 for speculation.

➡️Index CFDs – Ghanaian traders can profit from market performance using 11 global indices, leveraging leverage to magnify market changes’ influence on trader portfolios, presenting significant gains.

➡️Energy Commodities – JustMarkets facilitates trading energy commodities like oil and gas, allowing Ghanaians to profit from price fluctuations and periodic supply and demand shifts in global economies.

Are commodities available for trading on JustMarkets?

Yes, JustMarkets trades commodities such as gold, silver, and oil.

Can I trade shares with JustMarkets?

Yes, JustMarkets offers share trading, allowing traders to invest in the stock market.

Spreads and Fees

JustMarkets’ fees depend on the type of account being used and the market being traded. Overall, Ghanaians can expect competitive trading conditions. We’ve evaluated these trading conditions to give Ghanaians a breakdown of what they can expect to pay when they trade with JustMarkets.

Spreads

Spreads at JustMarkets are competitive and in line with industry standards for traders in Ghana. We discovered that spreads on Raw Spread accounts can be as low as 0.0 pips.

This level of tightness is highly advantageous for scalpers and high-volume traders. With Standard and Pro accounts, spreads begin at 0.3 and 0.1 pips, respectively.

These tight spreads cater to trading strategies like swing and position trading. With these spread conditions and high leverage, traders in Ghana can maximize their trading activities.

Commissions

With JustMarkets, the commission structures are designed to be transparent and straightforward.

For instance, on Raw Spread accounts, a standard commission of $3 per lot per side is considered reasonable within the industry.

Our research also showed that the Pro and Standard accounts do not charge commissions. Instead, the costs are incorporated into the spreads, allowing traders to easily calculate their expenses in advance.

Overall, we believe these clear commission rates provide traders with a clear understanding of the trade execution costs they can anticipate.

Overnight Fees

As with most forex and CFD brokers, keeping positions open overnight on JustMarkets will result in swap fees that can differ based on the instrument.

In our experience, these fees fall within the standard range for the industry. JustMarkets also provides Islamic accounts without swap fees, catering to traders with specific religious needs.

Deposit and Withdrawal Fees

An appealing aspect of JustMarkets is their lack of internal fees for deposits or withdrawals. However, Ghanaians should consider the possibility of incurring fees from payment processors or banks, particularly for currency conversions or international transfers.

Inactivity Fees

Our investigation revealed that JustMarkets does impose an inactivity fee. If an account remains inactive for an extended period (over 150 days), a monthly fee of $5 is charged.

This practice is common in the forex industry, and active traders won’t be affected. However, those taking a break from trading should be mindful to avoid the gradual erosion of their capital.

Currency Conversion Fees

For Ghanaian traders who fund their accounts in currencies other than the account’s base currency, there will be currency conversion fees applied by JustMarkets.

The fees are subject to market rates, and although JustMarkets does not impose additional charges, fluctuations in the currency market may impact the overall cost.

Are there fees for depositing or withdrawing funds with JustMarkets?

No, JustMarkets waives deposit and withdrawal fees, enhancing the trading experience by reducing additional costs.

Does JustMarkets offer any fee discounts or rebates?

Yes, JustMarkets offers cashback rebates, allowing traders to earn a rebate on their trading activity.

Leverage and Margin

Having conducted a comprehensive analysis of JustMarkets’ leverage and margin offerings for traders in Ghana, it is evident that the broker provides a flexible and dynamic range of leverage options that cater to traders with varying levels of experience and financial resources.

Furthermore, we also found that Ghanaian traders have the flexibility to choose leverage options that suit their risk appetite, ranging from conservative to active, letting them significantly enhance their trading capacity.

Traders with smaller investment amounts can expect JustMarkets to provide a maximum leverage of 1:3000, which decreases gradually as the trader’s equity increases.

For example, traders with equity ranging from $1,000 to $4,999 can access leverage up to 1:2000. Customers with an equity balance of $39,999 or higher can utilize leverage of up to 1:500.

We found that this structured approach can help traders avoid excessive risk, particularly during market volatility.

In addition, JustMarkets implements a prudent approach by modifying leverage when anticipating significant economic news, rollovers, weekends, and public holidays.

In our experience, this demonstrates their dedication to prioritizing the security of their client’s investments and efficiently handling risk. This is a common measure implemented to safeguard traders from the increased market volatility commonly seen during these periods.

Another factor is that implementing leverage structures showcases JustMarkets’ understanding of the potential for higher profits and increased risk.

Thus, the leverage parameters have been established to support traders in making informed decisions that align with their trading strategies and risk tolerance.

By viewing this comprehensive system, we can see that JustMarkets is dedicated to ensuring a stable and secure trading environment for its clients, emphasizing long-term sustainability.

In addition, this reflects a responsible approach to leverage management. It comforts traders, especially in dynamic financial markets, where leverage significantly impacts trading results.

Can Ghanaians increase their leverage limits on JustMarkets?

Yes, they can. Traders might be eligible to increase their leverage limits with JustMarkets depending on trading experience, account history, and adherence to risk management requirements.

Does JustMarkets provide margin call alerts?

Yes, JustMarkets sends margin call notifications to traders when their account equity approaches specified thresholds, asking them to modify their positions or deposit funds to adhere to margin obligations.

10 Best Forex Brokers in Ghana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Educational Resources

JustMarkets did not disappoint with the resources and tools available to new and experienced traders. Here’s what we found available on the JustMarkets website for Ghanaians:

➡️Forex Glossary – JustMarkets ensures that traders are well-informed about the trading world’s unique terminology to navigate confidently. The glossary provided by JustMarkets is a valuable resource for familiarizing oneself with trading terminology. This is especially beneficial when navigating through their wide range of product offerings.

➡️Online Training Webinars – The JustMarkets webinars provide live learning opportunities from experts, ensuring an interactive learning experience. This resource is especially useful for gaining insights into real-time market dynamics and learning how to utilize JustMarkets’ platform features effectively.

➡️Bookings for future webinars – Planning is crucial in trading, and JustMarkets offers traders the opportunity to secure spots in upcoming webinars. This assists Ghanaian traders in coordinating their learning schedule with their trading activities, guaranteeing they are adequately prepared to take advantage of market opportunities.

➡️Quick Start – JustMarkets provides a guide for beginners starting their trading journey. It’s created to assist traders in quickly setting up their accounts and getting started with trading, effortlessly navigating through the broker’s extensive features encompassing various account types and trading instruments.

➡️Forex Articles – The wide range of articles showcases JustMarkets’ dedication to providing continuous trader education. These writings offer valuable market insights, strategic discussions, and trading tips that can be utilized to maximize the trading conditions provided by JustMarkets.

➡️Educational Videos – These resources are designed for visual learners and cover a wide range of topics. Whether you’re new to Forex trading or an experienced trader, the videos provide valuable information on a range of topics. They are especially useful when incorporating JustMarkets’ leverage options and instrument variety into your trading strategies.

➡️Currencies – JustMarkets offers comprehensive resources on currency trading, providing valuable insights into the intricacies of different currency pairs available on the platform. This understanding is crucial for traders who want to maximize JustMarkets’ wide range of currency pairs, including major, minor, and exotic pairs, and the attractive leverage options they provide.

Can I access JustMarkets’ educational resources for free?

Most of JustMarkets’ educational resources are free to registered users, providing valuable learning opportunities.

Does JustMarkets provide webinars in different languages?

JustMarkets offers webinars in various languages, catering to a diverse global audience, but availability may vary.

JustMarkets Pros & Cons

| ✔️ Pros | ❌ Cons |

| JustMarkets offers copy trading solutions to Ghanaians There is no GHS-denominated account, resulting in currency conversion fees | There is no GHS-denominated account, resulting in currency conversion fees |

| Ghanaians can deposit and withdraw in GHS using African Mobile Solutions | Ghanaians can deposit and withdraw in GHS using African Mobile Solutions There are inactivity fees that apply to dormant accounts |

| JustMarkets offers a transparent and well-regulated trading environment in which traders can trade safely | Ghanaians have limited local deposit and withdrawal options |

| There are several educational tools and materials to help Ghanaians of all experience levels | There are several educational tools and materials to help Ghanaians of all experience levels JustMarkets is not regulated in Ghana by local authorities |

| JustMarkets has an impressive and flexible range of trading accounts | |

| Traders can register a Cent Account to trade live markets but with significantly less risk | |

| There is a demo account offered that Ghanaians can use to evaluate JustMarkets’ offer | |

| Traders can convert their live trading account into an Islamic Account that is exempted from overnight fees |

Our Recommendations on JustMarkets

While JustMarkets has a compelling offer, there are some areas where the broker can improve its offer, not only for Ghanaians but its global clientele:

- Asking traders for their feedback on features and services often and making changes based on those opinions can make trading easier.

- Mobile trading may be improved if the mobile interface includes the same detailed charting and personalized alerts as the desktop version.

- Simpler, faster, and more transparent withdrawals will satisfy customers. You must address withdrawal delay feedback to increase user confidence and satisfaction.

You might also like: AvaTrade Review

You might also like: IC Markets Review

You might also like: InstaForex Review

You might also like: Tickmill Review

You might also like: Exness Review

Conclusion

Our final thoughts are that JustMarkets is a strong trading platform in Ghana, offering competitive spreads, a wide range of financial instruments, and high-leverage options.

Furthermore, we liked that JustMarkets provides educational resources like Forex tutorials, webinars, and a glossary to help traders navigate the markets. Our evaluation of security indicated that JustMarkets adheres to international regulatory standards, ensuring trust and security.

However, some drawbacks include the lack of local regulation, which raises concerns about potential risks associated with high leverage. Furthermore, JustMarkets does not offer a GHS-denominated account and offers limited deposit and withdrawal options specifically for Ghanaians.

However, despite these concerns, the platform’s responsive customer service and user-friendly interface are praised by numerous customers.

In addition, despite occasional issues with withdrawals and account verification, JustMarkets is a reliable choice for traders seeking comprehensive trading capabilities and educational support.

However, we must urge traders to approach the platform with a balanced perspective, considering potential rewards and risks in online trading with JustMarkets.

Our Insight

After my detailed assessment, I found that JustMarkets trading is an easy start without a minimum deposit. They have low commissions and minimal spreads.JustMarkets has fast withdrawal of funds, and the ability to use any trading strategies.

Frequently Asked Questions

Is Just Markets available in Ghana?

Yes, JustMarkets accepts Ghanaian traders. Furthermore, JustMarkets provides African Mobile Money as a deposit and withdrawal option.

Is JustMarkets safe for Ghanaians?

Yes, JustMarkets is safe for Ghanaians. JustMarkets is regulated by several regulatory entities, including FSCA in South Africa, CySEC in Cyprus, FSA, and FSC.

Can I open an Islamic account in Ghana using JustMarkets?

Yes, JustMarkets provides swap-free Islamic accounts for Ghanaian traders.

What is Ghanaians’ minimum deposit on JustMarkets?

From 135 GHS. The minimum deposit amount varies based on the chosen account type and ranges from 135 to 1,300 GHS ($10 to $100).

Namibian Dollar Forex Trading Accounts

Namibian Dollar Forex Trading Accounts

Scam Forex Brokers in Ghana

Scam Forex Brokers in Ghana

JustMarkets User Comments and Reviews

JustMarkets has gained popularity since it was founded, with user reviews across the Internet. Here are a few that we’ve found while evaluating this broker: